U.S. Ventilators Market Share, Size, Trends, Industry Analysis Report

By Product (Instruments/ Ventilator Machines, Accessories); By Interface (Invasive, Non-Invasive); By End-Use (Hospitals, Ambulatory Surgical Centers, Home Healthcare, Others); Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 117

- Format: PDF

- Report ID: PM3541

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

The U.S. ventilators market size and share was valued at USD 1045.36 million in 2023 and is expected to grow at a CAGR of 6.30% during the forecast period. The market for ventilators is experiencing high demand worldwide as these devices play a crucial role in providing supportive care for critically ill patients. Ventilators assist or take over breathing by delivering oxygen into the bloodstream to support vital organ function. As a result, the industry is expected to witness substantial growth in the upcoming years. Technological advancements such as hybrid respiratory solutions, helmet-based ventilation, wireless networking, 3D printing, and high-performance turbine-based ventilators are anticipated to contribute to the expansion of the market.

A ventilator is a type of medical apparatus that supports or recreates the process of breathing and helps the lungs work. As such, it’s also sometimes referred to as a vent or breathing machine. It can be a life-saving machine if someone develops a condition that makes it difficult or impossible to breathe on their own. Just like normal breathing, a ventilator provides oxygen to the lungs and removes carbon dioxide from them. Along with that, it provides pressure to keep the small air sacks in the lungs from collapsing.

Ventilators are mostly used in healthcare settings. Here, the physician or respiratory therapist controls the amount of oxygen that’s pushed into the lungs by the ventilator. There are various ways in which an individual can receive ventilator support. The common ventilator types available in the U.S. ventilators market include manual resuscitator bags, mechanical ventilators, face mask ventilators, and tracheostomy ventilators. Ventilators can be used to support breathing in several health conditions, such as asthma, brain injury, cardiac arrest, pneumonia, lung infection, and acute respiratory distress syndrome. Furthermore, it can also be used for people who undergo surgery.

To Understand More About this Research: Request a Free Sample Report

Multidisciplinary teams in healthcare facilities have numerous opportunities to advance the care of critically ill patients on ventilators due to technological advancements in microprocessor-controlled ventilation and innovative ventilator modes. Advanced ventilators are also ready for any situation and have numerous checks and balances in place. Monitors and sensors are included in the equipment for patient-specific parameters like air volume, air pressure, and flow speed and general variables like mechanical failure, air leakage, oxygen tanks, battery backups, power failure, and the remote control.

The outbreak of COVID-19 was the major factor that will drive the market. The increasing cases of COVID-19, respiratory diseases, and emerging technologies have resulted in the introduction of new ventilator products in the market. For instance, In April 2020, Philips increased the Philips Respironics E30 ventilator production by producing around 15,000 units every week to fulfill the increasing need due to the pandemic.

The U.S. ventilators market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

Industry Dynamics

Growth Drivers

High prevalence of respiratory diseases

According to the World Health Organization, respiratory diseases account for more than 12% of all disability-adjusted life-years (DALYs), a metric that evaluates the amount of productive and active life lost owing to a condition. Incidentally, these diseases are second only to cardiac diseases (including stroke). Among the top 30 causes of death, COPD is 3rd; the lower respiratory tract infection is 4th; tracheal, bronchial, and lung cancer is 6th; tuberculosis is 12th; and asthma is 28th. More than a Million individuals in the U.S. suffer from chronic or acute respiratory illnesses. Consequently, the market growth in the number of patients suffering from respiratory disorders is a major factor fostering the U.S. ventilators market.

High prevalence of COPD and asthma

Asthma and COPD are the most predominant respiratory disorders across the country. As per the WHO, in the U.S., a projected 16 million adults have COPD. Nevertheless, that may be an underestimate. There may be as many as 24 million adult Americans with COPD, according to the American Lung Association (ALA). The Midwest and Southeast states have the highest COPD rates.

The cost incurred by healthcare systems across the globe due to COPD is ~USD 50 billion annually and the U.S. has a remarkable share in it. A few of the major causes of COPD are prolonged exposure and indoor & outdoor air pollution, long-term asthma to tobacco smoke, and occupational fumes & dust. Other comorbid chronic conditions, including musculoskeletal impairment, cardiac disorders, and diabetes mellitus, are related to COPD. These conditions may also influence the health status of patients, as well as interfere with COPD management.

Report Segmentation

The market is primarily segmented based on product, interface, and end-use.

|

By Product |

By Interface |

By End-Use |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

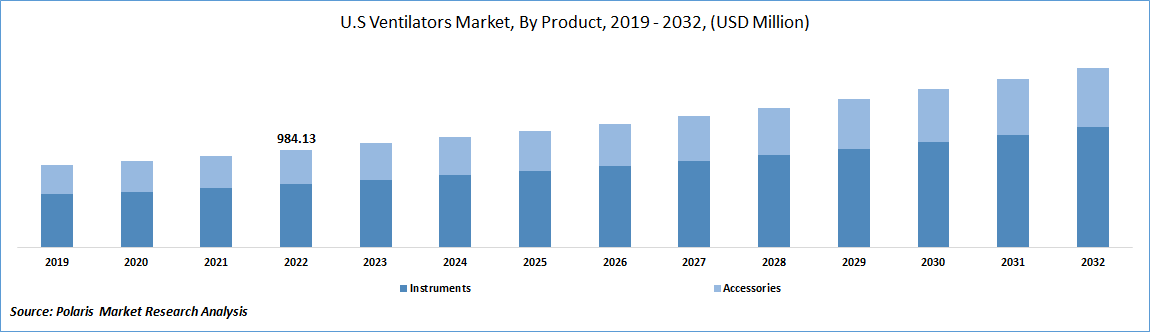

The instruments/ventilator machines segment generated the highest market revenue in 2022

The instruments/ventilator machines led market revenue in 2022, due to an increase in respiratory disease patients, an increase in the number of preterm births, and the COVID-19 pandemic's outbreak. ICU ventilators generated the highest revenue owing to the high demand for non-invasive ventilators and the rise in the patient population.

The rising rates of neonatal mortality are among the factors that are anticipated to support the market expansion of neonatal ventilators during the estimation period. Additionally, the rising number of preterm births with breathing circumstances is additionally assessed to drive the development of neonatal ventilators in the U.S. market. Moreover, the specialized movements in neonatal ventilators are additionally projected to pad the market development of neonatal ventilators. Instead, the increasing neonatal ventilator cost is likely to hamper the market growth.

Moreover, the rising awareness among healthcare professionals about neonatal ventilators will further provide opportunities for the neonatal ventilators market growth in the forecast period. However, the severe regulatory requirements might further encounter the growth of the neonatal ventilators market in the near future

Invasive interface segment dominated the revenue share in 2022

Invasive ventilators are specifically designed for critically ill patients suffering from respiratory failure, congestive cardiac failure, and for newborns. The Invasive ventilators segment is expected to grow at a rapid pace as these ventilators are convenient for patients, have fewer side effects, and faster recovery.

The hospital end-use segment generated the highest revenue in 2022

One of the major factors contributing to the surge in demand is an increase in hospital ICU admissions. The rising prevalence of chronic and respiratory disease is also an added factor to propel the growth of this segment. The Coronavirus pandemic has overburdened medical care services and increased the number of clinic admissions. Furthermore, the growing number of hospitals in developing nations is expected to augment the demand for ICU equipment in this market.

Competitive Insight

Some of the major players operating in the market are AccentCare, Inc., ADAPT Home Health Care, Amedisys, Byram Healthcare Centers, Inc., ELARA CARING, Lincare Holdings Inc., Apria, and Aerocare.

Recent Developments

- In April 2022, Amedisys acquired the home health services offered by AssistedCare at Home and AssistedCare of the Carolinas, which will continue to offer Intellectual & Developmental Disabilities (IDD) and Private Duty Nursing Services. Amedisys will now provide home health services in 15 locations across Texas, Oklahoma, and Ohio.

- In February 2021, AeroCare was acquired by AdaptHealth for a total consideration consisting of approximately $1.1bn in cash and 31 million shares of AdaptHealth stock.

U.S. Ventilators Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1106.95 million |

|

Revenue Forecast in 2032 |

USD 1,803.80 million |

|

CAGR |

6.30% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product, By interface, By End-Use, By Region |

|

Key Companies |

AccentCare, Inc., ADAPT Home Health Care, Amedisys, Byram Healthcare Centers, Inc., ELARA CARING, Lincare Holdings Inc., Apria and Aerocare. |

Gain profound insights into the 2024 U.S. ventilators market with meticulously compiled statistics on market share, size, and revenue growth rate by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into historical trends but also unfolds a roadmap with a market forecast extending to 2032. Immerse yourself in the comprehensive nature of this industry analysis through a complimentary PDF download of the sample report.

FAQ's

The U.S. ventilators market size is expected to reach USD 1,803.80 million by 2032.

Key players in the U.S. ventilators market are AccentCare, Inc., ADAPT Home Health Care, Amedisys, Byram Healthcare Centers, Inc., ELARA CARING.

key driving factors in U.S. ventilators market are Increasing in Prevalence of Respiratory Diseases.

The U.S. ventilators market is expected to grow at a CAGR of 6.25% during the forecast period.

The U.S. ventilators market report covering key segments are product, interface, and end-use.