Vaccine Storage & Packaging Market Size, Share, Trends & Industry Analysis Report

By Function (Storage and Packaging), By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 128

- Format: PDF

- Report ID: PM1737

- Base Year: 2024

- Historical Data: 2020-2023

Overview

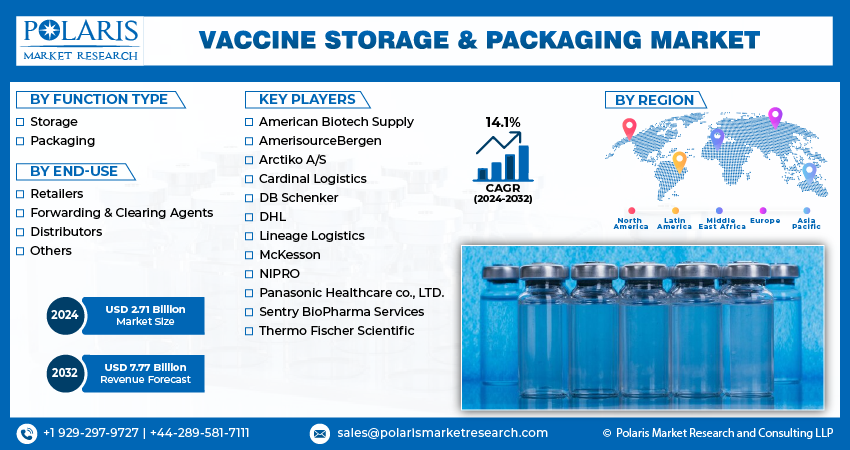

The global vaccine storage & packaging market was valued at USD 25.53 billion in 2024 and is expected to grow at a CAGR of 11.49% from 2025 to 2034. Key factors driving demand for vaccine storage & packaging include rising incidence of chronic diseases across the globe, increasing healthcare spending globally, and growing government venture into vaccination programs.

Key Insights

- The storage segment held the largest revenue share in 2024 due to rising global immunization programs and expanded vaccination drives for COVID-19.

- The distributors segment dominated the revenue share in 2024 due to their crucial role in bridging the gap between manufacturers and healthcare providers.

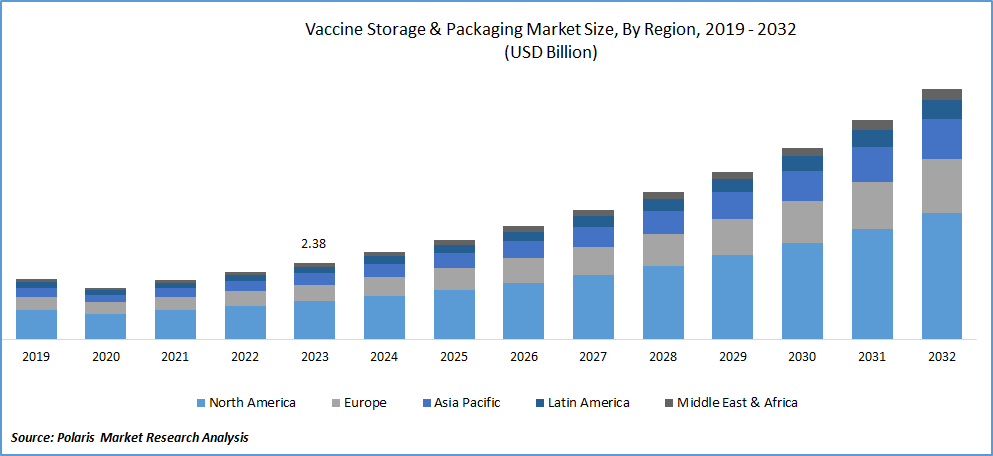

- North America vaccine storage & packaging market held 38.91% of global vaccine storage & packaging market share in 2024, owing to strong healthcare infrastructure and government initiatives.

- U.S. held the largest revenue share in the North America vaccine storage & packaging landscape in 2024, due to large-scale immunization programs.

- The industry in Europe is projected to grow at a rapid CAGR from 2025 to 2034, owing to high vaccination coverage and stringent regulatory requirements.

Industry Dynamics

- The growing government venture into vaccination programs is fueling the market growth by allocating substantial funding for research and development, procurement, and distribution of vaccines to ensure public health and safety.

- The increasing healthcare spending globally is propelling the demand for vaccine storage & packaging by enabling the procurement of larger vaccine quantities and the introduction of new vaccines.

- Advancement in material science is creating a lucrative market opportunity.

- The risk of vaccine potency loss due to temperature excursions outside the recommended storage ranges, may hamper the market growth.

AI Impact on Vaccine Storage & Packaging Market

- AI enhances precision in vaccine storage by enabling real-time temperature monitoring and predictive maintenance in cold-chain logistics.

- It optimizes packaging design through data-driven simulations for better thermal protection.

- AI-powered inventory systems improve shelf-life management and reduce waste via smart expiration tracking.

- Machine learning supports supply chain resilience by forecasting demand and identifying potential disruptions.

Market Statistics

- 2024 Market Size: USD 25.53 Billion

- 2034 Projected Market Size: USD 75.61 Billion

- CAGR (2025-2034): 11.49 %

- North America: Largest Market Share

Vaccine storage & packaging refer to the specialized processes and materials used to preserve the potency, safety, and efficacy of vaccines from the point of manufacture to administration. Proper storage typically involves maintaining vaccines within a strict temperature range, often between 2°C and 8°C, using refrigerated transport, cold boxes, and vaccine freezers as part of the "cold chain." Some vaccines, like certain mRNA-based ones, require ultra-cold storage at temperatures as low as -70°C. Packaging includes temperature-sensitive labels, insulated packaging, and tamper-evident vials to ensure integrity and prevent contamination. These measures are crucial because exposure to incorrect temperatures or physical damage can degrade vaccine components, rendering them ineffective.

Effective storage and packaging also support logistical efficiency, especially in remote or resource-limited areas, enabling timely immunization campaigns. In global health initiatives, reliable cold chain systems are essential for distributing vaccines against diseases like polio, measles, and COVID-19.

The demand for vaccine storage & packaging products is increasing due to the rising incidence of chronic diseases across the globe. World Health Organizations, in its report stated that noncommunicable diseases (NCDs) or chronic disorder killed at least 43 million people in 2021. This is driving governments and health organizations to expand immunization efforts to protect vulnerable populations from chronic diseases that can worsen their health. This expansion requires a steady and large-scale supply of vaccines, including those for influenza, pneumonia, and other infections. The increased volume and variety of vaccines in circulation is directly driving up the need for specialized storage solutions, such as ultra-low temperature freezers and smart refrigeration units, to maintain vaccine potency. Additionally, the demand for advanced packaging, like pre-filled syringes, multi-dose vials, and temperature-monitored containers are growing, as these ensure safe delivery and administration for the treatment of chronic disorder. The complexity of managing vaccines for chronic disease patients, who often require frequent or combination vaccinations, is further accelerating innovation in storage and packaging technologies. Thus, the rising burden of chronic diseases not only boosts vaccine production but also creates a robust market for efficient, reliable, and scalable storage and packaging solutions.

Drivers & Opportunities/Trends

Growing Government Venture into Vaccination Programs: The growing government venture into vaccination programs is fueling the global market. Governments worldwide such as the U.S. and India, is actively supporting associations and projects associated with vaccination, by allocating substantial funding for research and development, procurement, and distribution of vaccines to ensure public health and safety. This is leading to high adoption of vaccine storage & packaging to preserve the potency, safety, and efficacy of vaccines.

Increasing Healthcare Spending: Higher healthcare spending across the globe is enabling the procurement of larger vaccine quantities, the introduction of new vaccines, and the scaling up of vaccination campaigns. This surge in vaccine availability is directly increasing the need for reliable storage solutions, such as refrigerators, freezers, and cold chain logistics, to maintain vaccine efficacy and prevent spoilage. Health spending in the U.S. increased by 7.5% in 2023 to $4.9 trillion or $14,570 per capita. Additionally, greater investment in healthcare infrastructure is pushing for advanced packaging technologies, like temperature-controlled containers and single-dose vials that ensure safe transport and administration. Furthermore, public health emergencies and pandemic preparedness efforts, often funded by increased healthcare budgets, is accelerating the adoption of vaccine storage and packaging systems.

Segment Analysis

Function Analysis

Based on function, the segmentation includes storage and packaging. The storage segment held the largest revenue share in 2024 as governments, healthcare providers, and pharmaceutical companies invested heavily in reliable cold chain infrastructure. Rising global immunization programs, expanded vaccination drives for COVID-19, and the need to distribute temperature-sensitive biologics drove significant demand for advanced storage systems. Cold storage units, ultra-low freezers, and temperature-controlled warehouses became essential to maintain vaccine potency and reduce wastage. Countries also prioritized the development of centralized storage facilities and last-mile refrigeration solutions to strengthen immunization coverage, particularly in emerging nations. The expansion of global healthcare infrastructure, coupled with increasing awareness about the importance of maintaining optimal storage conditions, further strengthen the dominance of the segment.

The packaging segment is projected to grow at a rapid pace in the coming years, owing to the rising use of advanced packaging formats such as prefilled syringes, vials, and ampoules that ensure accurate dosing and reduce contamination risks. Manufacturers are increasingly adopting smart packaging technologies, including RFID tags and temperature indicators, to track vaccine integrity across supply chains. The push for sustainable materials and innovations in packaging that extend shelf life without compromising safety also boost segment growth. Moreover, the trend toward personalized vaccines and the increasing focus on patient-centric delivery formats is making packaging a critical segment.

End Use Analysis

In terms of end use, the segmentation includes retailers, forwarding & clearing agents, distributors, and others. The distributors segment dominated the revenue share in 2024 due to their crucial role in bridging the gap between manufacturers and healthcare providers. Distributors managed large-scale logistics networks, enabling efficient handling of vaccines that require stringent temperature control. The ability of distributors to maintain robust cold chain systems and provide real-time monitoring ensured that doses reached hospitals, clinics, and immunization centers in safe and effective condition. Governments and global health organizations relied on established distribution partners to scale up vaccination programs, particularly during pandemic-driven campaigns. The expansion of healthcare infrastructure in emerging economies and the growing complexity of biologics further strengthened the dominance of distributors, who invested in advanced storage facilities and digital tracking solutions to reduce wastage and improve delivery timelines.

The retailers segment is estimated to grow a rapid pace during the forecast period owing, to the increasing shift toward decentralized immunization services and patient-centric vaccine delivery. Pharmacies, drugstores, and retail clinics continue to expand their role in providing accessible vaccination points, especially in urban and semi-urban regions. Consumers prefer these outlets for their convenience, shorter wait times, and ease of access compared to traditional hospital settings. Retailers also adopt specialized refrigeration units and digital monitoring systems to ensure compliance with safety standards, which enhances their reliability as vaccine providers. The growing acceptance of pharmacies as primary healthcare touchpoints, coupled with rising partnerships between retail chains and pharmaceutical companies, is projected to further accelerate their importance in future immunization campaigns.

Regional Analysis

North America vaccine storage & packaging market held 38.91% of global vaccine storage & packaging market share in 2024. This dominance is attributed to strong healthcare infrastructure and government initiatives. The region emphasized temperature-controlled logistics due to the rise in mRNA-based and biologic vaccines requiring ultra-cold chain solutions. Public-private partnerships and investments in vaccine distribution networks further boosted the need for advanced packaging technologies. Regulatory standards from agencies such as the FDA ensured high safety and traceability, prompting manufacturers to adopt smart packaging with real-time monitoring capabilities.

U.S. Vaccine Storage & Packaging Market Insight

U.S. held the largest revenue share in the North America vaccine storage & packaging landscape in 2024, due to large-scale immunization programs, including routine childhood vaccinations and pandemic preparedness efforts. Federal funding through agencies such as the CDC and BARDA supported cold chain expansion and modernization. The prevalence of advanced healthcare facilities and research institutions accelerated the adoption of innovative packaging solutions such as tamper-evident vials and IoT-enabled cold boxes. Growing awareness of vaccine spoilage and supply chain inefficiencies also pushed stakeholders to invest in reliable, temperature-sensitive packaging solutions.

Asia Pacific Vaccine Storage & Packaging Market

The Asia Pacific market is projected to hold significant revenue share in 2034, driven by rising healthcare spending and increasing government focus on public health. For instance, in the total health expenditure of the India between FY15 and FY22, the share of government health expenditure has increased from 29.0 per cent to 48.0 per cent. Countries in the region are strengthening their cold chain infrastructure to support national vaccination campaigns, especially in rural and remote areas. The surge in vaccine production capacity, particularly in India and South Korea, is increasing the need for scalable and efficient packaging solutions. Additionally, collaborations with global health organizations such as WHO are promoting the adoption of cold chain equipment and temperature-stable packaging formats.

China Vaccine Storage & Packaging Market Overview

The demand for vaccine storage & packaging in China is being driven by strong government backing and strategic investments in biopharmaceutical manufacturing. The country prioritizes self-reliance in vaccine supply, leading to expanded production and distribution networks requiring robust cold chain logistics. Chinese regulators are tightening quality standards, encouraging manufacturers to implement smart labeling, anti-counterfeiting technologies, and insulated packaging. Urbanization and digital health integration are further driving innovation in tracking and maintaining vaccine integrity throughout the supply chain.

Europe Vaccine Storage & Packaging Market

The industry in Europe is projected to grow at a rapid CAGR from 2025 to 2034, owing to high vaccination coverage and stringent regulatory requirements. The EU’s focus on cross-border healthcare collaboration and pandemic resilience is leading to investments in harmonized cold chain systems. Countries in the region are adopting sustainable packaging materials and digital monitoring tools to meet environmental and safety standards. Additionally, research initiatives and public health programs are supporting the adoption of next-generation packaging solutions, including prefilled syringes and multi-dose vials.

Key Market Players & Competitive Report

The competitive landscape of vaccine storage and packaging is marked by innovation and strategic collaboration among key players such as Gerresheimer, SCHOTT Pharma, Corning, and Stevanato, who dominate in primary packaging with advanced glass and polymer vials. Companies like NIPRO and Piramal Glass strengthen supply chains with high-quality container manufacturing. Thermo Fisher Scientific and Sealed Air provide critical secondary packaging and cold-chain solutions, ensuring product integrity. B Medical Systems and Lineage, Inc. lead in temperature-controlled storage and logistics, vital for mRNA and ultra-cold chain vaccines. Amcor and Stévanato focus on sustainable, scalable packaging designs. With rising global vaccination demands, firms are investing in automation, tamper-evident technologies, and eco-friendly materials, fostering intense competition centered on reliability, scalability, and compliance with stringent regulatory standards across developed and emerging markets.

Major companies operating in the vaccine storage & packaging industry include Gerresheimer; SCHOTT Pharma AG & Co. KGaA; Sealed Air Corporation; Stevanato; B Medical Systems; Lineage, Inc.; NIPRO; Corning Incorporated; Piramal Glass; Amcor; and Thermo Fisher Scientific.

Key Companies:

- Amcor

- B Medical Systems

- Becton Dickinson

- Corning Incorporated

- Gerresheimer

- Lineage, Inc.

- NIPRO

- Piramal Glass

- SCHOTT Pharma AG & Co. KGaA

- Sealed Air Corporation

- SiO2 Materials Science

- Stevanato

- Thermo Fisher Scientific

Industry Developments

October 2021: Becton Dickinson announced an expansion of its injection production in the United States to ensure the safe and efficient operation of injection devices.

June 2020: SiO2 Materials Science, a U.S. advanced materials science corporation, signed a USD 143 million agreement with the federal government. These agreements aimed to support the development of advanced technology for packaging vaccines and biological pharmaceuticals. This initiative highlights the company's commitment to enhancing the packaging solutions for these critical medical products.

Vaccine Storage & Packaging Market Segmentation

By Function Outlook (Revenue, USD Billion, 2020–2034)

- Storage

- Storage Equipment

- Refrigerator

- Freezer

- Others

- Service

- Warehouse storage

- Transportation

- Storage Equipment

- Packaging

- Type

- Vaccine Bags

- Vials & Ampoules

- Bottles

- Corrugated Boxes

- Others

- Packaging Level

- Primary

- Secondary

- Tertiary

- Type

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Retailers

- Forwarding & Clearing Agents

- Distributors

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Vaccine Storage & Packaging Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 25.53 Billion |

|

Market size value in 2025 |

USD 28.41 Billion |

|

Revenue forecast in 2034 |

USD 75.61 billion |

|

CAGR |

11.49% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020- 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments covered |

|

|

Regional scope |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global market size was valued at USD 25.53 billion in 2024 and is projected to grow to USD 75.61 billion by 2034.

The global market is projected to register a CAGR of 11.49% during the forecast period.

North America dominated the market in 2024

A few of the key players in the market are Gerresheimer; SCHOTT Pharma AG & Co. KGaA; Sealed Air Corporation; Stevanato; B Medical Systems; Lineage, Inc.; NIPRO; Corning Incorporated; Piramal Glass; Amcor; and Thermo Fisher Scientific.

The storage segment dominated the market revenue share in 2024.

The retailers segment is projected to witness the fastest growth during the forecast period.