Vacuum Contactor Market Size, Share, Trends, & Industry Analysis Report

By Configuration (Contactor and Contactor Fuse Combination), By Voltage Rating, By Application, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6084

- Base Year: 2024

- Historical Data: 2020-2023

Overview

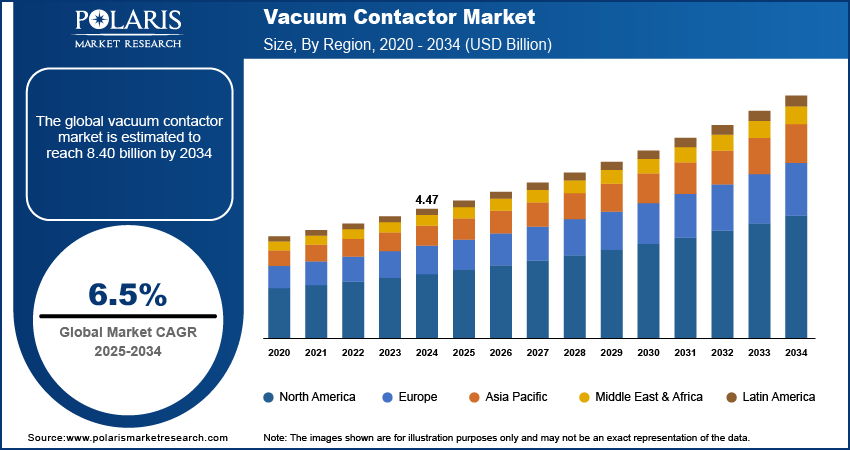

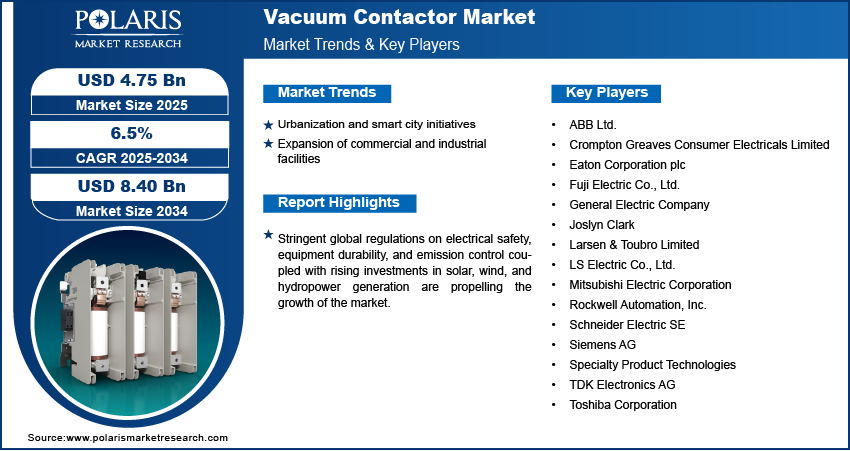

The global vacuum contactor market size was valued at USD 4.47 billion in 2024, growing at a CAGR of 6.5% from 2025–2034. Rapid urbanization and smart city initiatives coupled with expansion of commercial and industrial facilities are driving the growth of the market.

Key Insights

- The contactor segment accounted for largest market share in 2024.

- The capacitors segment is projected to grow at the fastest rate over the forecast period, due to the growing deployment of power factor correction systems to improve energy efficiency and reduce reactive power losses.

- The Asia Pacific vacuum contactor market accounted for largest share of the global market in 2024.

- China vacuum contactor market held largest regional share of the Asia Pacific market in 2024, driven by government-led smart grid initiatives and ongoing power infrastructure upgrades.

- The market in North America is projected to grow at a significant CAGR from 2025-2034. This growth is owing to the surge in modernization of aging electrical infrastructure in the US and Canada.

- The market in the US is expanding due the expansion of data centers, healthcare facilities, and commercial real estate projects.

Industry Dynamics

- Rapid urbanization and smart city initiatives are fueling demand for compact, safe, and reliable switching devices to support growing urban power loads and digitally connected infrastructure.

- Expansion of commercial and industrial facilities, in emerging economies, is boosting the adoption of medium-voltage vacuum contactors for efficient load management and system protection.

- Integration of IoT and smart diagnostics is emerging as a key opportunity, enabling real-time monitoring, predictive maintenance, and seamless integration with advanced grid and automation platforms.

- High initial cost of installation is restraining the market growth, in price-sensitive markets, where limited budget allocations delay upgrades or replacements.

Market Statistics

- 2024 Market Size: USD 4.47 billion

- 2034 Projected Market Size: USD 8.40 billion

- CAGR (2025-2034): 6.5%

- Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Vacuum contactors operate by interrupting electrical currents within sealed vacuum chambers, enabling arc-free switching that enhances equipment safety and lifespan. This results in preferred use across manufacturing facilities, utilities, and infrastructure projects where switching reliability and maintenance efficiency are required. The transition from air and oil-based contactors to vacuum-based alternatives is accelerating due to the performance benefits, offer under demanding operating conditions, such as frequent switching cycles and high short-circuit levels.

Stringent global regulations on electrical safety, equipment durability, and emission control are increasing the demand for vacuum-based systems. Government authorities and industry regulators are focusing on improving workplace safety and reducing environmental impact in power-intensive industries, thereby pushing the adoption of vacuum contactors. These systems offer superior insulation, zero gas emissions, and minimal arc-related hazards. This trend is propelling its adoption across utility networks, process industries, and commercial power distribution systems.

Rising investments in solar, wind, and hydropower generation are further contributing to the growth of the market. According to the IEA’s World Energy Investment report, capital investment in the global energy sector is expected to reach USD 3.3 trillion in 2025, reflecting a 2% increase in real terms compared to 2024. Renewable energy facilities require highly durable and efficient switching devices capable of managing voltage fluctuations and load balancing across substations and grid interconnections. Vacuum contactors are well-suited for such operations due to resistance to harsh environmental conditions and ability to ensure uninterrupted switching under varying power loads. Growing emphasis on clean power infrastructure in global energy strategies is driving increased demand for advanced vacuum switching equipment across utilities and grid modernization projects.

Drivers & Opportunities/Trends

Urbanization and Smart City Initiatives: Rapid urbanization coupled with large-scale smart city development, is fueling the need for resilient power distribution and automation systems. According to the United Nations, an additional 2.5 billion people are expected to live in urban areas by 2050 compared to the current population, reflecting the ongoing global trend of population movement from rural to urban regions. Urban infrastructure relies heavily on medium-voltage switchgear and control systems to maintain grid stability, in high-density areas with variable energy loads. Vacuum contactors are deployed in smart substations, transportation hubs, and commercial complexes to support automated switching, load control, and fault protection functions. The arc-free operation and low maintenance requirements make it well-suited for critical applications, thus fueling the market growth.

Expansion of Commercial and Industrial Facilities: The rising number of commercial buildings, data centers, and industrial plants is boosting the growth of medium-voltage contactors that withstand heavy-duty operations. As per International Energy Agency data, in 2023, Google, Microsoft, and Amazon investment in AI and data centers, reached about 0.5% of US GDP, highlighting the sharp rise in data center investments. In data centers and large commercial buildings, vacuum contactors are used for motor control, capacitor switching, and power distribution automation. This expansion in end-use infrastructure is accelerating the market growth for vacuum-based switching technologies globally.

Segmental Insights

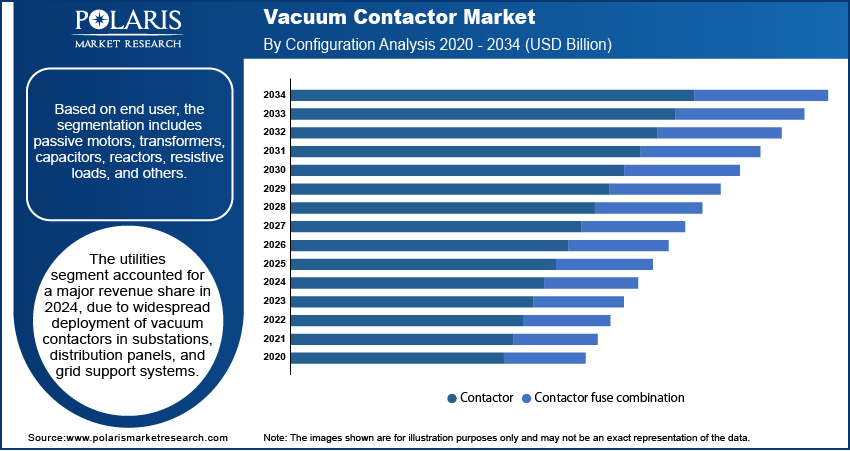

Configuration Analysis

Based on configuration, the segmentation includes contactor and contactor fuse combination. The contactor segment accounted for largest revenue share in 2024, driven by growing usage in medium-voltage motor starters, power distribution units, and capacitor bank switching systems. These configurations are favored in industrial, utility, and commercial environments due to the straightforward design, ease of integration, and efficient switching under normal and overload conditions. Manufacturers are enhancing traditional contactor designs with arc-extinguishing vacuum interrupters to improve reliability and reduce maintenance in repetitive switching operations.

The contactor fuse combination segment is expected to grow at the fastest rate during the forecast period, due to the ability to provide built-in overcurrent protection, simplifying panel layouts and reducing installation costs. The integrated fuse protection enhances equipment safety in high-fault current applications, such as transformer switching and power factor correction systems. Growing industry preference for compact, safe, and low-maintenance switching solutions is fueling demand for fused contactor assemblies across oil & gas, utilities, and commercial infrastructure sectors.

Voltage Rating Analysis

Based on voltage rating, the segmentation includes 1kV–5kV, 5.1kV–10kV, 10.1kV–15kV, and 15.1kV–24kV. The 1kV–5kV accounted for largest revenue share in 2024, driven by its widespread use in industrial motor control, commercial building automation, and light utility switching applications. These systems are suitable for low-to-medium power circuits and are commonly installed in air-handling units, HVAC systems, and water pumping stations where medium-voltage protection is required. Cost efficiency, compact design, and the growing demand for low-voltage industrial equipment continue to support this segment’s strong market share.

The 15.1kV–24kV segment is projected to register the highest CAGR over the forecast period. This growth is fueled by expanding investments in high-voltage infrastructure, in utility substations, renewable energy installations, and heavy industrial operations. These vacuum contactors are designed to manage high-load switching and protect mission-critical assets in harsh environments. Increasing deployment of wind farms and utility-scale solar plants, that operate at higher voltage levels, is further driving the adoption of contactors in this voltage category.

Application Analysis

Based on application, the segmentation includes motors, transformers, capacitors, reactors, resistive loads, and others. The motors accounted for largest revenue share in 2024, attributed to the extensive application in industrial motor control across mining, oil & gas, and process manufacturing facilities. Vacuum contactors are used in motor starters to provide rapid and safe switching for medium-voltage motors, in applications that involve high starting currents or frequent starts and stops. The ability to reduce arc energy and contact wear make vacuum contactors as a preferred alternative to air-break and oil-based contactors in medium-voltage motor circuits.

The capacitors segment is projected to grow at the fastest pace during the forecast period, due to the growing deployment of power factor correction systems to improve energy efficiency and reduce reactive power losses. Vacuum contactors are used to switch capacitor banks in substations and commercial power systems, ensuring precise control and preventing transient overvoltage. Rising efforts by utilities and large industrial users to optimize grid performance and reduce operational costs are increasing the adoption of contactors in capacitor switching applications.

End User Analysis

By end user, the market is segmented into utilities, industrial, oil & gas, commercial, mining, and others. The utilities segment held the largest share in 2024, due to widespread deployment of vacuum contactors in substations, distribution panels, and grid support systems. These components are used in automated switching systems to enhance grid stability, reduce arc-related faults, and minimize downtime in electrical networks. Growing investment in substation modernization and renewable grid integration is further supporting the strong demand for vacuum-based switching solutions among utility operators. For instance, in September 2023, TenneT, the transmission system operator for the Netherlands and Germany, signed approximately USD 2 billion framework contract with Siemens, Hitachi Energy, GE Grid, and Royal SMIT to upgrade and construct substations.

The commercial segment is anticipated to grow at the fastest CAGR during the forecast period. Rising construction of smart buildings, hospitals, and data centers is increasing demand for reliable and space-efficient electrical switching devices. Vacuum contactors are adopted in power management systems within these buildings to control HVAC motors, lighting panels, and energy storage units. Low maintenance and support for frequent switching cycles meet commercial user needs for uninterrupted operations and long-term energy reliability.

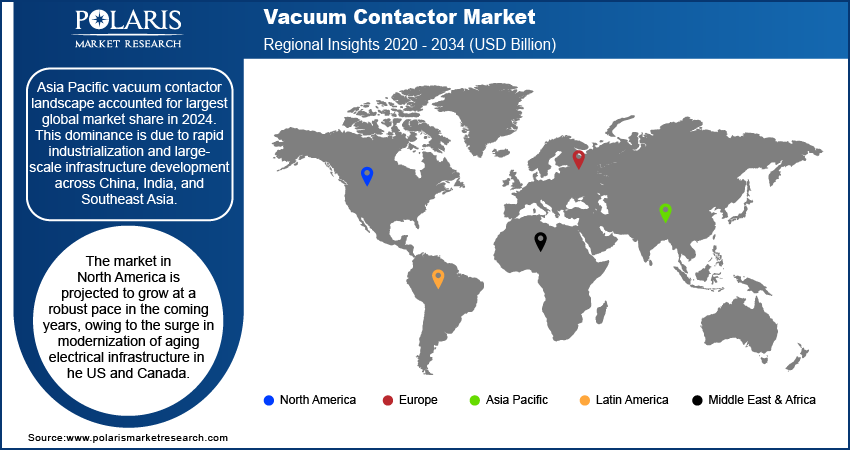

Regional Analysis

Asia Pacific vacuum contactor market accounted for largest share of global market in 2024. This dominance is due to rapid industrialization and large-scale infrastructure development across China, India, and Southeast Asia. Growing urban populations and rising demand for uninterrupted power supply are driving installations of medium-voltage contactors across commercial buildings, industrial parks, and transport networks. Additionally, ongoing investment in new power generation facilities and grid capacity expansion projects is increasing the need for vacuum-based switching equipment to manage rising energy loads. Industries in the region are gradually transitioning to compact, low-maintenance switching solutions that enhance equipment safety and operational efficiency in high-demand environments.

China Vacuum Contactor Market Insight

China held largest regional share in Asia Pacific vacuum contactor landscape in 2024, driven by government-led smart grid initiatives and ongoing power infrastructure upgrades. In June 2022, China released its 14th Five-Year Plan for renewable energy, setting a target for renewables to account for 33% of electricity generation by 2025, up from around 29% in 2021. National development plans are driving the deployment of digital substations and grid automation technologies that integrate advanced switching devices. These initiatives are enabling a wider rollout of vacuum contactors in urban distribution systems and rural electrification projects. Local utilities and industrial users are adopting these solutions to meet performance standards while reducing arc-related hazards and operational downtime.

North America Vacuum Contactor Market

The market in North America is projected to grow at a significant CAGR from 2025-2034. This growth is owing to the surge in modernization of aging electrical infrastructure in the US and Canada. Utilities and industrial facilities are upgrading outdated switching equipment with vacuum-based alternatives to enhance system reliability and ensure compliance with updated safety regulations. Vacuum contactors are gaining adoption in substations, motor control centers, and facility power systems due to their ability to minimize maintenance requirements and improve switching performance. Increasing emphasis on energy efficiency and equipment durability across critical infrastructure is further supporting market growth.

The US Vacuum Contactor Market Overview

The market in the US is expanding due the expansion of data centers, healthcare facilities, and commercial real estate projects. According to recent data from the Cloudscene platform, there are over 11,800 operational data centers globally, with the US accounting for 45% of global total. The US hosts 5,427 data centers, roughly ten times more than China and most countries in Europe. These high-load environments require consistent and reliable power control systems to maintain uptime and operational continuity. Vacuum contactors are integrated into electrical distribution frameworks across commercial and institutional buildings to handle repetitive switching cycles, protect equipment, and streamline energy usage. Also, the presence of major equipment manufacturers investing in product development tailored to the country’s safety and performance requirements, is further propelling the market growth.

Europe Vacuum Contactor Market

The vacuum contactor landscape in Europe is projected to hold a substantial share in 2034, due to the regional decarbonization efforts and a growing shift toward clean energy solutions. The deployment of wind farms, solar plants, and battery energy storage systems is increasing the demand for vacuum contactors that support high-voltage switching in renewable power grids. Utilities aiming to improve power quality and lower carbon emissions are increasingly turning to advanced switching systems that support sustainable infrastructure. Furthermore, the strong presence of industrial automation and Industry 4.0 integration across manufacturing hubs in Germany, France, and the Nordics is driving the need for intelligent, maintenance-free switching devices that meet with modern operational standards.

Key Players & Competitive Analysis Report

The vacuum contactor market is moderately competitive, with leading players focusing on expanding product portfolios, enhancing technological capabilities, and targeting high-growth application segments to strengthen their global footprint. Manufacturers are increasingly investing in the development of compact, energy-efficient, and high-performance vacuum contactors to meet rising demand across industrial automation, utilities, renewable energy, mining, and transportation sectors. These companies are leveraging smart grid trends and digital substation technologies to offer vacuum contactors integrated with advanced monitoring and control features. Strategic collaborations with OEMs, infrastructure developers, and energy companies are helping key players to optimize supply chains and offer application-specific solutions tailored for medium-voltage switching needs. Product innovations are aimed at improving arc-quenching capabilities, operational safety, and durability in harsh environments. Additionally, the push for sustainability and lower maintenance systems is driving the replacement of legacy switchgear with vacuum-based solutions in developed and emerging economies.

Major companies operating in the vacuum contactor market include ABB Ltd., Crompton Greaves Consumer Electricals Limited, Eaton Corporation plc, Fuji Electric Co., Ltd., General Electric Company, Joslyn Clark, Larsen & Toubro Limited, LS Electric Co., Ltd., Mitsubishi Electric Corporation, Rockwell Automation, Inc., Schneider Electric SE, Siemens AG, Specialty Product Technologies, TDK Electronics AG, and Toshiba Corporation.

Key Players

- ABB Ltd.

- Crompton Greaves Consumer Electricals Limited

- Eaton Corporation plc

- Fuji Electric Co., Ltd.

- General Electric Company

- Joslyn Clark

- Larsen & Toubro Limited

- LS Electric Co., Ltd.

- Mitsubishi Electric Corporation

- Rockwell Automation, Inc.

- Schneider Electric SE

- Siemens AG

- Specialty Product Technologies

- TDK Electronics AG

- Toshiba Corporation

Industry Developments

- July 2025: CNC Electric launched the new Axis7 Series, a range of vacuum contactors designed with smarter protection and control features. This latest series emphasizes enhanced monitoring, digital diagnostics, and support for predictive maintenance, aligning with current trends toward automation and real-time system health monitoring.

Vacuum Contactor Market Segmentation

By Configuration Outlook (Revenue, USD Billion, 2020–2034)

- Contactor

- Contactor fuse combination

By Voltage Rating Outlook (Revenue, USD Billion, 2020–2034)

- 1KV-5KV

- 5.1KV-10KV

- 10.1KV-15KV

- 15.1KV-24KV

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Motors

- Transformers

- Capacitors

- Reactors

- Resistive loads

- Other

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Utilities

- Industrial

- Oil & gas

- Commercial

- Mining

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Vacuum Contactor Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.47 Billion |

|

Market Size in 2025 |

USD 4.75 Billion |

|

Revenue Forecast by 2034 |

USD 8.40 Billion |

|

CAGR |

6.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 4.47 billion in 2024 and is projected to grow to USD 8.40 billion by 2034.

The global market is projected to register a CAGR of 6.5% during the forecast period.

Asia Pacific dominated the market in 2024.

A few of the key players in the market are ABB Ltd., Crompton Greaves Consumer Electricals Limited, Eaton Corporation plc, Fuji Electric Co., Ltd., General Electric Company, Joslyn Clark, Larsen & Toubro Limited, LS Electric Co., Ltd., Mitsubishi Electric Corporation, Rockwell Automation, Inc., Schneider Electric SE, Siemens AG, Specialty Product Technologies, TDK Electronics AG, and Toshiba Corporation.

The contactor segment dominated the market in 2024. This dominance is driven by growing usage in medium-voltage motor starters, power distribution units, and capacitor bank switching systems.

The capacitors segment is expected to witness the fastest growth during the forecast period, due to the growing deployment of power factor correction systems to improve energy efficiency and reduce reactive power losses.