Veterinary Pain Management Market Share, Size, Trends, Industry Analysis Report

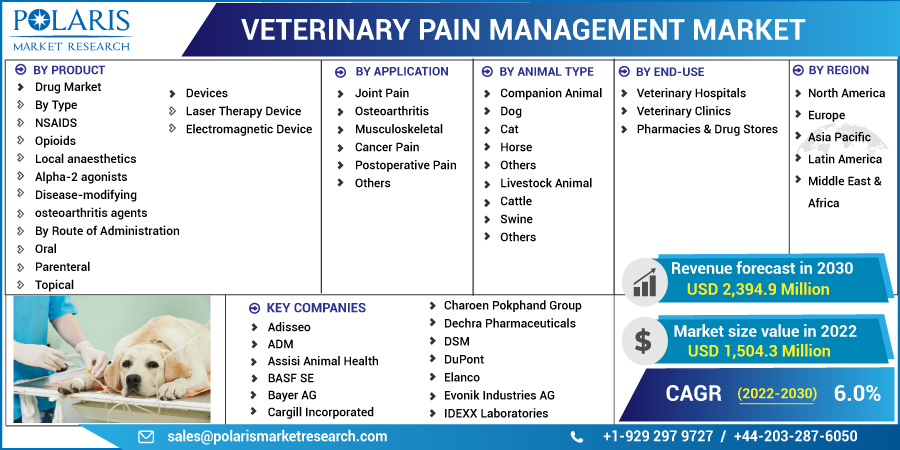

By Product; By Application; By Animal Type; By End-Use (Veterinary Hospitals, Veterinary Clinics, Pharmacies & Drug Stores) By Region; Segment Forecast, 2022 - 2030

- Published Date:Nov-2022

- Pages: 118

- Format: PDF

- Report ID: PM2846

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

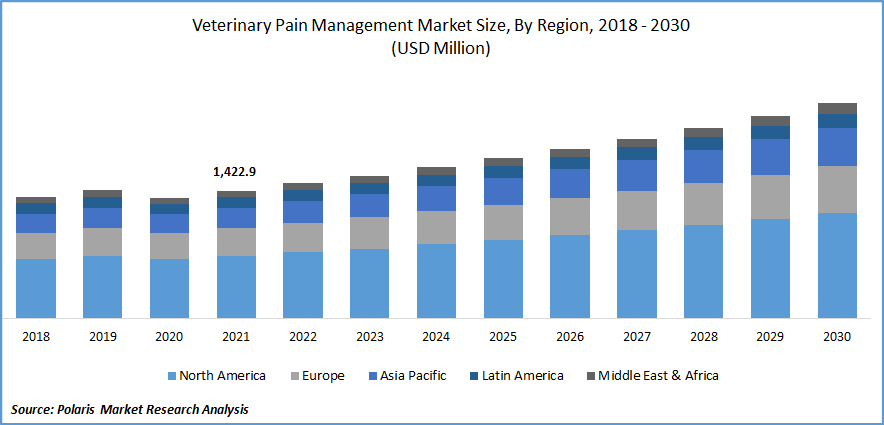

The veterinary pain management market was valued at USD 1,422.9 million in 2021 and is expected to grow at a CAGR of 6.0 % during the forecast period. The growth is anticipated to be accelerated by the upward trend in pet adoption and the rising awareness of improved pet care. Investments in technological improvements and innovation are predicted to generate growth prospects for key businesses in the future years.

Know more about this report: Request for sample pages

The practice of diagnosing, preventing, and treating pain in animals brought on by a range of causes, such as issues with their essential organs, physical injuries, abnormalities with their spines and central nervous systems, and surgical procedures, is referred to as veterinary pain management. Veterinary professionals must be able to identify and alleviate pain in a wide range of pet conditions if they are to practice pain control.

Numerous conditions, including arthritis, cancer, surgical procedures, and more, can cause animal pain. Animals' aggressive behavior, reduced or absent activity, and other behaviors can all be signs of pain. Performance can be impacted by pain in agricultural and companion animals. The treatment options include laser therapy, prescription drugs, therapeutic massages, complementary therapies, and rehabilitation programs.

Increased public-private funding for targeted research projects, an increase in the number of pets, an increase in the number of animal-related traffic accidents, and an increase in product innovations and development due to technological advancements worldwide will create lucrative opportunities for market participants during the forecast period.

Additionally, rising preventive care and treatment facilities for companion animals increased acceptance of unconventional and non-pharmaceutical treatment modalities, and rising per capita healthcare spending will all contribute to a future expansion of the market's growth rate.

The Covid-19 pandemic has severely impacted the market. The decline in medical device manufacturing has resulted in a negative impact on revenues. The market faced difficulties due to movement restrictions, facility closures, and disruptions in the supply chain. To preserve hygiene and lower the risk of contamination, pet parents are also urged to keep a safe distance from their animals. The livestock sector has also experienced the effect. The post-pandemic period, however, is anticipated to put the market back on track.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The rising prevalence of pet obesity is significantly stimulating the market for veterinary pain management. For instance, the percentage of osteoarthritis in dogs was founded to be 20% worldwide in June 2020, according to a Veterinary Practice News article. Similarly, the American Animal Health Association said in April 2021 that every year, 6 million dogs are diagnosed with cancer.

Increased efforts by governmental groups to promote animal health internationally are anticipated to fuel market expansion. For instance, in October 2020, the “FECAVA Basic Practices in Anesthesia and Analgesia" campaign was introduced by FECAVA. It was about a series of six ready-to-use, infographics/printable posters regarding animal anesthesia and pain management.

Report Segmentation

The market is primarily segmented based on product, application, animal type, end-use, and region.

|

By Product |

By Application |

By Animal Type |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Drug market to account for the largest market share in 2021

The drug market acquired the largest market revenue in 2021 due to the increased use of NSAIDs in treating animals. The NSAIDs sub-segment dominated the drug market segment as these are the most frequently used drugs to treat osteoarthritis-related pain and inflammation. Companies are developing new NSAIDs to reduce side effects and responses.

Moreover, due to strict regulations, opioids are anticipated to increase gradually during the forecast period. The FDA has tight regulations regarding the manufacture, storage, and sale of opioid medications, to reduce the abuse of opioids by pet owners for personal use. This aspect is anticipated to limit this segment's growth in the years to come.

Joint pain is supposed to account for a significant market share in 2021

Joint pain application is anticipated to acquire the largest market share in 2021 due to the growing number of pets, the prevalence of musculoskeletal disorders like osteoarthritis, and the rising number of overweight or obese animals.

The osteoarthritis sub-segment is the main reason driving this segment's growth due to the high-frequency condition, particularly in canine species. Nutraceuticals are recommended for mild OA pain whereas NSAIDs and coxibs are indicated for moderate to severe OA pain. Among the medications recommended for the condition are Galliprant, Rimadyl, Meloxicam, and Metacam.

Livestock animal type is anticipated to capture the largest market share in 2021

Livestock animal type is expected to witness a significant market share in 2021 due to the rising prevalence of chronic diseases, increased awareness among animal healthcare organizations, and high spending on animal healthcare in developing countries.

The visual signs of discomfort in livestock animals include lameness, accelerated breathing, increased vocalization, an expiratory grunt, and teeth grinding. NSAIDs, two adrenergic medications, and local anesthetics are the most often prescribed.

Moreover, the category of companion animals is anticipated to develop steadily over the duration of the forecast period due to rising ownership, awareness, and the need for effective animal care. Additionally, the prevalence of obesity and other chronic diseases like osteoarthritis and cancer is increasing, which is fueling the market.

Veterinary hospitals accounted for a significant market share in 2021

Veterinary hospitals acquired the most considerable market share during the forecast period due to the extensive range of diagnostic and therapeutic options offered in these verticals. Additionally, the need for outpatient facilities and the rise in the number of surgeries are significant growth drivers, accelerating the segment’s growth.

Moreover, veterinary clinics are anticipated to grow at the fastest CAGR during the forecast timeline as these facilities use cutting-edge technology. Mobile technologies for pet owners and effective information management systems are a couple of these facilities which drive the segment’s growth.

North America dominated the regional market

North America dominated the veterinary pain management regional market due to the growing number of pet owners and the necessity for high-quality animal care. Furthermore, the development is being further fueled by highly advanced and established animal healthcare facilities. In North America, veterinary prescriptions have become compulsory, which is supposed to raise the sales of prescription drugs over the projection period in this region.

Asia Pacific is supposed to showcase lucrative growth over the forecast timeline due to the rising trend of pet adoption and the region's developing economy. Additionally, the rising cases of animal diseases have increased the need for procedures, which is further boosting the expansion.

Competitive Insight

Some of the major players operating in the global market include Adisseo, ADM, Assisi Animal Health, BASF SE, Bayer AG, Boehringer Ingelheim International GmbH, Cargill Incorporated, Ceva, Charoen Pokphand Group, Dechra Pharmaceuticals, DSM, DuPont, Elanco, Evonik Industries AG, IDEXX Laboratories, Kemin Industries, Inc., Medtronic, Merck Sharp & Dohme Corp, Norbrook, Novusint, Nutreco, Sumitomo Chemical, Vetoquinol, Virbac, and Zoetis

Recent developments

In June 2022, Boehringer collaborated with Carthronix to pursue small-molecule therapeutics in canine oncology.

In January 2022, the first injection named Solensia (Frunevetmab injection) for controlling pain associated with osteoarthritis in cats was approved by the United States Food and Drug Administration.

Veterinary Pain Management Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 1,504.3 million |

|

Revenue forecast in 2030 |

USD 2,394.9 million |

|

CAGR |

6.0% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By Application, By Animal Type, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Adisseo, ADM, Assisi Animal Health, BASF SE, Bayer AG, Boehringer Ingelheim International GmbH, Cargill Incorporated, Ceva, Charoen Pokphand Group, Dechra Pharmaceuticals, DSM, DuPont, Elanco, Evonik Industries AG, IDEXX Laboratories, Kemin Industries, Inc., Medtronic, Merck Sharp & Dohme Corp, Norbrook, Novusint, Nutreco, Sumitomo Chemical, Vetoquinol, Virbac, and Zoetis |