Viral Vector Manufacturing Market Share, Size, Trends, Industry Analysis Report

By Vector Type; By Workflow; By Application; By End-Use; By Region; Segment Forecast, 2021 - 2028

- Published Date:Oct-2021

- Pages: 115

- Format: PDF

- Report ID: PM1991

- Base Year: 2020

- Historical Data: 2016-2019

Report Outlook

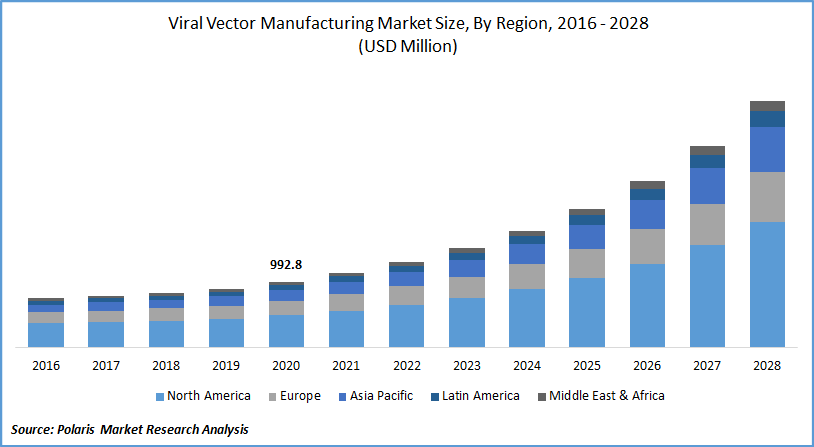

The global viral vector manufacturing market was valued at USD 992.8 million in 2020 and is expected to grow at a CAGR of 18.6% during the forecast period. The rising research base for innovative medicines has principally driven the industry for clinical applications, including clinical, preclinical, and regulatory studies.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The COVID-19 pandemic has generated a lucrative opportunity for market participants, specifically in the vaccine production industry. The increasing significance of stem cell technology and the growing focus on cell and gene therapies will further propel the viral vector manufacturing market growth over the coming years.

Research in gene and cell therapy has gained prominence in the past few decades. Many such therapies use viral strands to deliver the specific gene that is expected to mitigate the genetic disorders. Gene therapy provides the potential to cure various diseases that include heart disease, diabetes, hemophilia, cancer, cystic fibrosis, and AIDS.

The number of gene treatments in the pipeline is over 360 in the U.S. alone, and more than 75% of these new therapies are still in an early stage of research & development. This will help the market growth for viral vector production.

COVID-19 pandemic is expected to positively influence the market's growth for Viral vector manufacturing during the forecast period since these tracks are used in the R&D of COVID-19 vaccines. The adenoviral vector Ad5 is already being explored in the R&D of the COVID-19 vaccine, and this cost-effective approach has already been used for the production of the Ebola virus vaccine.

Industry Dynamics

Growth Drivers

The global market for Viral vector manufacturing is driven by factors such as the increased R&D in cell and gene therapy in recent years, along with the adoption of these paths in developing vaccines and oncolytic therapies. The rapid use of stem cells in disease modeling and the emergence of the COVID-19 pandemic are expected further to propel the market growth for Viral vector manufacturing during the forecast period.

Stem cell technology has seen rapid progress in recent years and induced pluripotent stem cell (iPSC) is the fastest growing stem cell segment with approximately 10% growth every year. The lentiviral segment is commonly utilized in the generation of iPSC.

Induced pluripotent cells (iPSC cells) are utilized in disease modeling and will help in the better understanding of the pathogenesis of various disorders such as congenital heart disease, premature aging, cancer, and other disorders. All these factors augment the upward growth of the global market for viral vector production.

Companies are involved in launching new viral platforms and are entering into collaborations, acquisitions, and funding in recent years. Thermo Fisher introduced Lentiviral Production System in May 2019, and this new system is cost-efficient and is expected to simplify researchers' workflow. IForge Biologics raised USD 40 million Series A financing in July 2020.

Know more about this report: request for sample pages

Report Segmentation

The market is primarily segmented on the basis of vector, workflow, application, end-use and region.

|

By Vector |

By Workflow |

By Application |

By End-use |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Vector Type

Adeno-associated virus (AAV) had the highest revenue share, in 2020, due to the increased employment in vaccine exploration for COVID-19. The proven non-pathogenicity data is one of the major elements driving the acceptance of this segment. In recent times, the usage of AAV has increased significantly across numerous therapeutic domains, resulting in surged adoption rate across the projection period.

The lentiviral is expected to witness a high growth rate during the forecast period. Induced Pluripotent Stem Cells (iPSC) have been successfully reprogrammed using these production paths. This has opened up possibilities for iPSC-based medicinal investigation.

Insight by End-Use

The research institute segment dominated the market and generated the highest revenue in 2020. The growing involvement of research institutions in gene and cell therapy study has led to increased revenue share for the segment. The emergence of the COVID-19 pandemic has shifted researchers' focus to develop a vaccine against the pandemic, leading to increased market demand for viral tracks.

In addition, the scientists are also engaged in the development of vaccines for Hepatitis B and HIV, leading to the growth of the segment. The biotechnology and pharmaceutical companies market segment is projected to have a strong growth rate due to increased investigation on gene and cell therapies for numerous life-threatening illnesses.

Geographic Overview

North America market for Viral vector manufacturing dominated the production market in 2020, owing to the adoption of modern technologies in medical investigation and the existence of prominent players for production in the region.

Countries like the U.S. are extensively involved in the study of gene and cell therapies. In the U.S. alone, there will be 362 gene therapies in 2020, which is 25% more than the previous year, and these therapies are in various stages of preclinical R&D. All these factors drive market growth for Viral vector manufacturing in the region.

Asia Pacific production market is expected to be the fastest-growing region for the global Viral vector manufacturing Market due to the increasing investment in a medical studies in countries such as China and India. Japan has the most favorable regulatory for stem cell study across the globe, and these factors will influence the market growth for viral vector production.

Competitive Insight

Some of the major players operating in the market for Viral vector manufacturing include Addgene, Inc., Advanced BioScience Laboratories, Inc. (ABL, Inc.), Aldevron, L.L.C., Audentes Therapeutics, Batavia Biosciences B.V., BioMarin Pharmaceutical, BioNTech IMFS GmbH, Biovion oy, BlueBird Bio, Catalent Inc., Cell and Gene Therapy Catapult, CEVEC Pharmaceuticals GmbH, Cobra Biologics Ltd., Creative Biogene, FUJIFILM Diosynth Biotechnologies U.S.A., Inc., General Electric Company (GE Healthcare), Genezen, Lonza, Merck KGaA, Miltenyi Biotec GmbH, Novasep Holding S.A.S, Orgenesis Biotech Israel Ltd (formerly ATVIO Biotech ltd.), RegenxBio, Inc., SIRION Biotech GmbH, Takara Bio., Thermo Fisher Scientific, VGXI, Inc., Vibalogics GmbH, Vigene Biosciences, Inc., Virovek Incorporation, VIVEbiotech S.L., Waisman Biomanufacturing, Wuxi AppTec Co., Ltd., YPOSKESI.

Viral vector manufacturing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 992.8 million |

|

Revenue forecast in 2028 |

USD 3,703.3 million |

|

CAGR |

18.6% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2028 |

|

Segments covered |

By Vector, By Workflow, By Application, By End-use, By Region |

|

Regional scope |

North America Europe Asia Pacific Latin America; Middle East & Africa |

|

Key companies |

Addgene, Inc., Advanced BioScience Laboratories, Inc. (ABL, Inc.), Aldevron, L.L.C., Audentes Therapeutics, Batavia Biosciences B.V., BioMarin Pharmaceutical, BioNTech IMFS GmbH, Biovion oy, BlueBird Bio, Catalent Inc., Cell and Gene Therapy Catapult, CEVEC Pharmaceuticals GmbH, Cobra Biologics Ltd., Creative Biogene, FUJIFILM Diosynth Biotechnologies U.S.A., Inc., General Electric Company (GE Healthcare), Genezen, Lonza, Merck KGaA, Miltenyi Biotec GmbH, Novasep Holding S.A.S, Orgenesis Biotech Israel Ltd (formerly ATVIO Biotech ltd.), RegenxBio, Inc., SIRION Biotech GmbH, Takara Bio., Thermo Fisher Scientific, VGXI, Inc., Vibalogics GmbH, Vigene Biosciences, Inc., Virovek Incorporation, VIVEbiotech S.L., Waisman Biomanufacturing, Wuxi AppTec Co., Ltd., YPOSKESI |