Vodka Market Share, Size, Trends, Industry Analysis Report

By Type (Flavored, & Non-Flavored), By Distribution Channel; By Region; Segment Forecast, 2024-2032

- Published Date:Jan-2024

- Pages: 112

- Format: PDF

- Report ID: PM3472

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

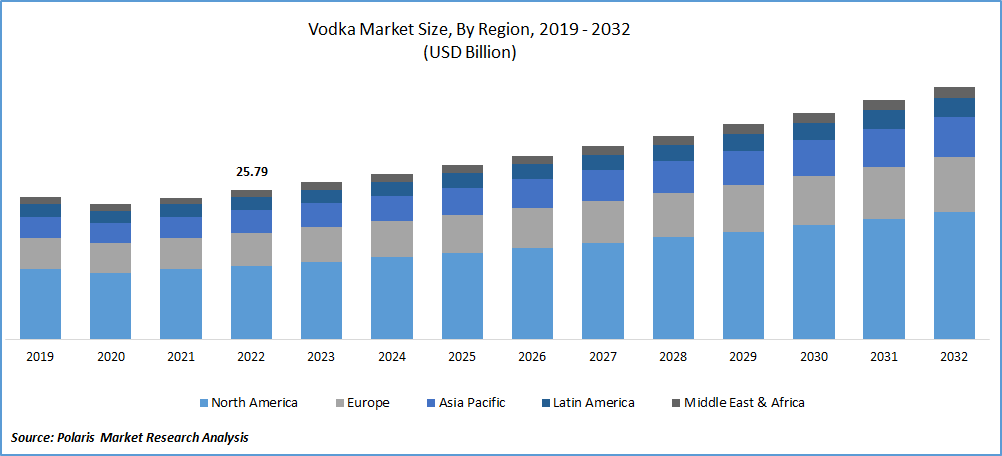

The global vodka market was valued at USD 27.13 billion in 2023 and is expected to grow at a CAGR of 5.40% during the forecast period. Key factors responsible for the market growth include the premiumization of vodka, owing to the surge in disposable income among middle and middle-income populations in Asian nations, changing consumer preferences, the presence of flavored vodka, effective marketing and promotion strategies, preferable choice among females, and the emergence of gluten-free and organic vodka.

To Understand More About this Research: Request a Free Sample Report

Flavored vodka has become very popular in recent years, with a wide range of flavors available to consumers. Some popular fruit flavors include lemon, lime, raspberry, strawberry, and peach. Other popular flavors include vanilla, caramel, chocolate, and coffee. Flavored vodka has become a popular choice for consumers looking for new and interesting flavor experiences, and it has also been embraced by bartenders and mixologists who use it as a base for creative cocktails.

The emergence of organic and gluten-free vodka products reflects the growing trend towards health and wellness. Organic vodka is made from organically grown grains free from synthetic pesticides and fertilizers, while gluten-free vodka is made from grains that do not contain gluten, such as corn, potato, or rice. Premium vodkas are often made from high-quality ingredients and are distilled using traditional methods, resulting in a smoother and more refined taste. These vodkas are also often packaged in elegant and eye-catching bottles, which add to their appeal. The premiumization trend has led to the introduction of a wide range of high-end vodka brands, and some of the major players in the vodka market have responded by introducing their premium lines.

The rise of cocktail culture has also led to the development of new bars and lounges dedicated to serving high-quality cocktails and the creation of cocktail festivals and competitions. A few notable cocktail bars & festivals include The Aviary (U.S.), Tales of the Cocktail (Festival in New Orleans), Dead Rabbit (U.S.), and London Cocktail Week (U.K.). These festivals celebrate the city's thriving cocktail culture with week-long events, tastings, and masterclasses programs. The festival attracts thousands of visitors annually and is a must-visit for anyone interested in cocktails.

Many vodka brands have established a strong presence on social media, using these platforms to showcase their products, interact with consumers, and promote their latest offerings. In line with this, Tito's Vodka is marketed as the "hand-crafted vodka" on the firm's official website and social media account. These brands also partner with social media influencers to promote their brand and increase product sales.

Industry Dynamics

Growth Drivers

Key players focus on introducing drinks with low or minimum alcohol content. Fruit-based vodka flavors are popular with consumers looking for refreshing and flavorful drinks, and they can be used in various cocktails and mixed drinks. By reducing the alcohol content, vodka brands can appeal to consumers who want to enjoy a drink without the negative health effects of excessive alcohol consumption. This trend also aligns with the growing demand for low-alcohol or non-alcoholic beverages, which a greater emphasis on health and wellness has driven.

The growth of e-commerce has certainly played a significant role in the increasing popularity of vodka sales. With the emergence of various direct-to-consumer (DTC) and other e-commerce channels, it has become easier for consumers to purchase vodka online, leading to the industry's growth. Players in the vodka industry have employed different DTC approaches to sell their products to consumers directly and legally. Some of these models include online marketplaces, where vendors can sell their products to consumers directly, and subscription-based models, where consumers can sign up for regular deliveries of their favorite vodka. Overall, the growth of e-commerce channels presents a significant opportunity for vodka producers and distributors to reach a wider audience and drive sales.

Report Segmentation

The market is primarily segmented based on type, distribution channel, and region.

|

By Type |

By Distribution Channel |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Non-Flavored segment accounted for the largest market share in 2022

Non-flavored segment garnered the largest revenue share and is expected to maintain its dominance over the study period. This is primarily because it is considered as gold as a standard process. Non-flavored vodkas are distilled multiple times to remove impurities and create a smooth, neutral base spirit. This allows the vodka to be mixed with other ingredients, such as fruit juices or syrups, without overpowering the overall flavor of the cocktail. Additionally, some brands may offer infused or flavored vodkas, which have gone through a secondary distillation process with added ingredients to create a specific taste or aroma.

The flavored segment is expected to grow robust over the study period. Flavored vodka has become increasingly popular among consumers, especially millennials, due to its versatility and ability to be mixed with a wide range of ingredients to create unique and exciting cocktails. As a result, many vodka producers have started expanding their product lines to include various flavored options, catering to this growing demand.

On-trade segment held the significant market share in 2022

The on-trade segment held the largest revenue share in 2022. Consumers increasingly seek convenient and easy-to-enjoy alcoholic beverages, and RTDs provide a quick and easy solution. Additionally, many hospitality venues have been upgrading their cocktail offerings to cater to the tastes of millennials, who tend to value unique and high-quality experiences. As a result, there has been an increased demand for high-quality vodka products and other premium spirits that can be used to create innovative and exciting cocktails.

The off-trade segment registered a substantial growth rate over the study period. Consumers are gradually shifting towards specialty outlets such as pubs, bars, & restaurants as they offer promotional offers and discounts, such as happy hour specials, which can make drinking more affordable for consumers. These promotions and discounts can also be a way for outlets to attract and retain customers, as consumers are often attracted to deals and special offers.

North America region dominated the global market in 2022

North America region dominated the global market in 2022. There has been a shift towards more premium and high-end vodka products as consumers are looking for ways to treat themselves at home. Overall, the pandemic has significantly impacted the vodka market in the region, and these changes in consumer habits and preferences are likely to continue in the coming years.

APAC registered a significant growth rate over the study period. As per the population estimates of the United Nations, the region comprises around 60% of millennials, and this proportion is expected to rise in the coming years. Moreover, the rise in the working women population, positive demographic dividend, and changing lifestyles are expected to increase the cocktail culture among South Asian nations, significantly contributing to the sale of vodka and low-alcohol beverages.

Competitive Insight

Some of the major players operating in the global market include Brown-Forman, Diageo, Pernod Ricard, Belvedere Vodka, Bacardi Limited, Constellation Brands, Proximo Spirits, Distell Limited, Stoli Group, and Iceberg Vodka.

Recent Developments

- In August 2022, Constellation brands introduced “Fresca Mixed”, a premium line of cocktails in 2 distinct varieties Spritz & Tequila Paloma.

- In April 2022, Stoli Group introduced its limited-edition brand originating from the “World’s Central Kitchen Ukrainian Relief.”

Vodka Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 28.56 billion |

|

Revenue forecast in 2032 |

USD 43.67 billion |

|

CAGR |

5.40 % from 2023– 2032 |

|

Base year |

2023 |

|

Historical data |

2019– 2022 |

|

Forecast period |

2024– 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Brown-Forman, Diageo, Pernod Ricard, Belvedere Vodka, Bacardi Limited, Constellation Brands, Proximo Spirits, Distell Limited, Stoli Group, and Iceberg Vodka |

Uncover the dynamics of the Vodka Market sector in 2024 with detailed statistics on market share, size, and revenue growth rate meticulously curated by Polaris Market Research Industry Reports. This all-encompassing analysis extends to a forward-looking market forecast until 2032, complemented by a perceptive historical overview. Immerse yourself in the profound insights offered by this industry analysis through a complimentary PDF download of the sample report.

FAQ's

The global vodka market size is expected to reach USD 43.67 billion by 2032.

Top market players in the Vodka Market Brown-Forman, Diageo, Pernod Ricard, Belvedere Vodka, Bacardi Limited, Constellation Brands.

North America contribute notably towards the global Vodka Market.

The global vodka market expected to grow at a CAGR of 5.4% during the forecast period.

The Vodka Market report covering key are railroad type, distribution channel, and region.