Global Waste Recycling Services Market Share, Size, Trends, Industry Analysis Report

By Application (Municipal, Industrial, Others); By Product; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jul-2023

- Pages: 112

- Format: PDF

- Report ID: PM1985

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

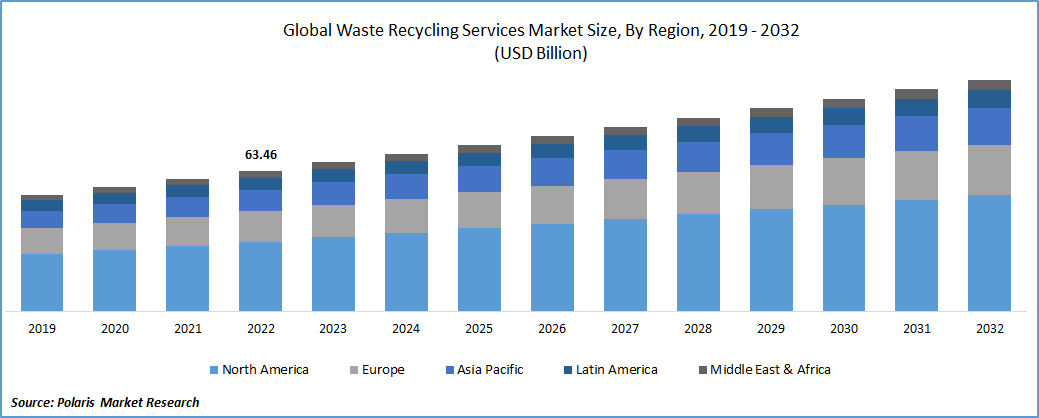

The global Waste Recycling Services market was valued at USD 63.46 billion in 2022 and is expected to grow at a CAGR of 5.00% during the forecast period. Managing and reducing the environmental impact of waste generated by individuals, businesses, and industries is crucial, and waste recycling services play a vital role in achieving this goal. These services involve collecting, sorting, processing, and reusing materials that would otherwise end up in landfills or incinerators. The primary objective of waste recycling services is to promote sustainability and resource conservation by diverting waste from disposal and facilitating the recovery of valuable materials.

To Understand More About this Research: Request a Free Sample Report

Recycling services typically involve collecting recyclable materials such as paper, plastics, glass, metals, and electronics through curbside pickup, drop-off centers, or commercial waste collection. Once collected, the materials undergo sorting and processing to separate them into different categories and prepare them for reprocessing. Sorting methods can include manual, mechanical, or advanced technologies like optical sorting systems. Depending on the material type, the sorted materials are then transformed into new products through processes like shredding, melting, or reconstitution.

Waste recycling services offer numerous environmental and economic benefits. Furthermore, recycling materials help conserve natural resources, reduce energy consumption, and minimize greenhouse gas emissions associated with the extraction and production of raw materials. Recycling also helps to mitigate pollution and reduce the demand for landfill space, thus prolonging the lifespan of existing landfills.

Industry Dynamics

Growth Drivers

Rising strict government policies and regulations towards waste management drive the market. Many countries have implemented waste management laws with targets for recycling and penalties for improper disposal. These regulations encourage individuals and businesses to adopt recycling practices and use recycling services to comply with the law.

Public engagement and participation in recycling initiatives drive demand for recycling services. Education and awareness campaigns about the benefits of recycling and the importance of proper waste segregation have increased public willingness to recycle. People are becoming more proactive in seeking recycling services and supporting organizations prioritizing sustainable waste management.

Report Segmentation

The market is primarily segmented based on form, Product, Manufacturing Process, End-Use and region.

|

By Product |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

The Paper & Paperboard segment is expected to witness the fastest growth

The Global Waste Recycling Services industry is expected to experience growth in the coming years, with the paper and paperboard segment being a major driver of this growth. The demand for recycled paper and paperboard is increasing as more companies are focusing on sustainability and eco-friendliness.

The paper and paperboard segment has been the largest end-user of recycled materials for many years. The growth of this segment can be attributed to the increasing demand for recycled paper and paperboard products. These products have several advantages, including lower costs, better quality, and reduced environmental impact. The demand for recycled paper and paperboard products has been increasing steadily, and this trend is expected to continue in the coming years.

The major factors driving the growth of the paper and paperboard segment is the increasing focus on sustainability. Companies are becoming more environmentally conscious and are looking for ways to reduce their environmental impact. Using recycled paper and paperboard is one way to achieve this goal. Recycled paper and paperboard products are made from wastepaper and cardboard, which reduces the need for virgin materials. This, in turn, reduces the impact of paper and paperboard production on the environment.

Another factor driving the growth of the paper and paperboard segment is the increasing availability of recycled materials. There has been a significant increase in the amount of wastepaper and cardboard that is being collected for recycling. This has led to an increase in the availability of recycled materials, which has made it easier and more cost-effective for companies to use recycled paper and paperboard in their products.

In addition, the development and use of new technology and advancements in the recycling process have also contributed to the growth of the paper and paperboard segment. New technologies are being developed that allow to produce high-quality recycled paper and paperboard products. These new technologies are more efficient and cost-effective, which makes them more attractive to companies looking to use recycled materials in their products.

Furthermore, the global trend towards sustainability and eco-friendliness is driving the growth of the paper and paperboard segment. Many countries and organizations are adopting policies and regulations that encourage the use of recycled materials. This has led to an increase in the demand for recycled paper and paperboard products, which has contributed to the growth of the industry.

The Municipal segment accounted for the largest market share over the forecast period

The Municipal segment is a significant contributor to the waste recycling services market, accounting for the largest market share over the forecast period. Municipal waste is the waste generated by households, commercial and institutional establishments, and other non-industrial sources. The increasing amount of municipal waste generated across the globe has led to a surge in demand for waste recycling services.

Several factors drive the growth of the municipal segment in the waste recycling services market. One of the major factors is the growing awareness of the benefits of recycling among governments and municipalities. Governments are implementing policies and regulations to encourage recycling and reduce the amount of waste sent to landfills. This has resulted in a surge in demand for waste recycling services, particularly for municipal waste.

Furthermore, the increasing urbanization and industrialization in developing countries have contributed to the growth of the municipal segment. As urbanization and industrialization increase, so does the amount of municipal waste generated, leading to higher demand for waste recycling services. Additionally, the rise of smart cities and the adoption of advanced waste management technologies have further driven the growth of the municipal segment.

The COVID-19 pandemic has further highlighted the importance of waste recycling services, particularly for municipal waste. The pandemic led to a surge in the amount of waste generated globally due to increased healthcare waste and the rise of online shopping. Municipalities and waste management companies have had to adapt quickly to the increased demand for waste recycling services.

The municipal segment has also been boosted by advancements in waste recycling technologies. The development of new recycling technologies and the use of automation and artificial intelligence have led to increased efficiency and reduced costs for waste recycling services. These technologies have also enabled the recovery of more materials from municipal waste, contributing to the growth of the municipal segment in the waste recycling services market.

The demand in North America is expected to witness significant growth

Waste recycling services are becoming increasingly important in North America, as more individuals and businesses recognize the benefits of reducing waste and preserving natural resources. The demand for these services in North America is expected to witness significant growth in the coming years, fueled by various factors.

One of the significant drivers behind the expected growth of waste recycling services is the rising awareness of environmental issues. More and more people are becoming conscious of the adverse impact of waste on the environment, and thus, are looking for ways to minimize their environmental footprint. Particularly, younger generations are increasingly concerned about environmental issues and are more likely to seek recycling services.

Another key factor contributing to the growth of waste recycling services in North America is government regulation. The government is becoming more involved in regulating waste management practices to protect public health and the environment. This has led to the introduction of various regulations promoting waste reduction and recycling, such as landfill bans, mandatory recycling programs, and extended producer responsibility laws.

Additionally, economic factors are driving the growth of waste recycling services in North America. As the cost of raw materials increases, businesses are recognizing the value of recycling to reduce costs and improve their bottom line. Therefore, there is an increased investment in recycling infrastructure and technology, and businesses are collaborating more with waste management companies.

The demand for waste recycling services in North America is expected to continue growing in the coming years. This presents both opportunities and challenges for waste management companies, who will need to invest in new technologies and infrastructure to meet the rising demand for their services. As companies explore new ways to recycle waste and create value from discarded materials, there will be opportunities for innovation and growth in the sector.

One potential growth area for waste recycling services in North America is electronic waste (e-waste) recycling. The rapid pace of technological innovation and the short lifespan of many electronic devices have resulted in e-waste becoming one of the fastest-growing waste streams globally. Recycling e-waste presents an opportunity for companies to recover valuable metals and other materials while reducing the environmental impact of discarded electronics.

Another potential growth area for waste recycling services in North America is organic waste recycling. Organic waste, including food waste and yard waste, is a significant contributor to greenhouse gas emissions and other environmental issues. Recycling organic waste can help reduce these emissions while producing valuable compost and other soil amendments that can be used to improve soil health and reduce the need for chemical fertilizers.

Competitive Insight

Some of the major players operating in the global market include Biffa plc, BioMedical Waste Solutions, LLC, Clean Harbors, Inc, Covanta Holding Corporation, Daiseki Co., Ltd, Eurokey Recycling, Ltd., FCC Environment Limited, Hitachi Zosen Corporation, Northstar Recycling, REMONDIS SE & Co. KG, Republic Services, Stericycle, SUEZ, Triple M Metal LP, Urbaser, Veolia Environnement S.A., Waste Connections, Waste Management, Inc.

Recent Developments

- In May 2022, Northstar Recycling Company, LLC acquired Complete Recycling, LLC. The purchase would allow the former to provide increased services to their current customers, while also improving the combined business' potential to serve additional consumers and partners via a more scaled platform.

- In September 2021, Eurokey Recycling invested about £15 million in a supermarket recycling line. This development is intended to retrieve and recycle flexible plastics and films from the supermarket and retail sectors.

- In June 2021, Triple M Metal LP acquired Peterborough Iron & Metal (PIM), in order to expand its international reach in Ontario.

- In March 2019, Veolia and Nestle entered a partnership for the development of a recycling program for plastic wastes.

- In February 2020, Suez signed an agreement with the Shanghai Chemical Industry Park to collect all the hazardous waste from the industrial park.

Global Waste Recycling Services Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 67.26 billion |

|

Revenue forecast in 2032 |

USD 104.34 billion |

|

CAGR |

5.00% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Product, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Biffa plc, BioMedical Waste Solutions, LLC, Clean Harbors, Inc, Covanta Holding Corporation, Daiseki Co., Ltd, Eurokey Recycling, Ltd., FCC Environment Limited, Hitachi Zosen Corporation, Northstar Recycling, REMONDIS SE & Co. KG, Republic Services, Stericycle, SUEZ, Triple M Metal LP, Urbaser, Veolia Environnement S.A., Waste Connections, Waste Management, Inc. |

FAQ's

The Waste Recycling Services Market report covering key are Product, Application and region.

Global Waste Recycling Services Market Size Worth $104.34 Billion By 2032.

The global Waste Recycling Services market expected to grow at a CAGR of 5.00% during the forecast period.

North America is leading the global market.

key driving factors in Waste Recycling Services Market are Concerns about waste management are growing.