Water Desalination Equipment Market Share, Size, Trends, Industry Analysis Report

By Technology; By Application (Municipal, Industrial, Others) By Source (Sea Water, Brackish Water, River Water, Others); By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 117

- Format: PDF

- Report ID: PM1986

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

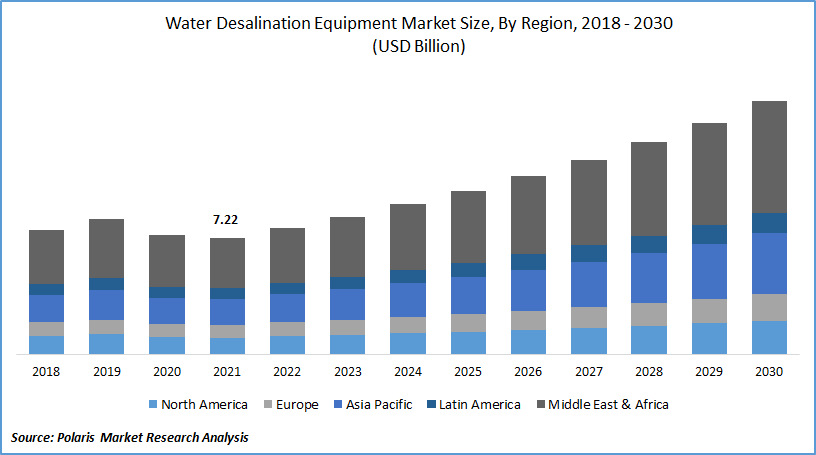

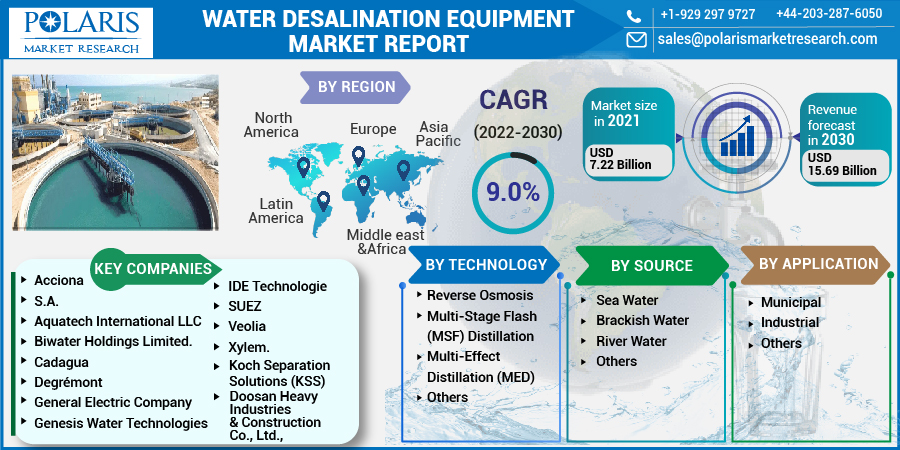

The global water desalination equipment market was valued at USD 7.22 billion in 2021 and is expected to grow at a CAGR of 9.0% during the forecast period. Speedy deletion of freshwater sources and increasing water scarcity are predicted to boost demand for H2O desalination equipment over the forecast period.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

The major industry players and manufacturers are investing heavily in R&D to improve efficiency and reduce energy consumption, boosting demand and supply for equipment worldwide. The growing trend of desalinated H2O replacing diminishing freshwater supplies is expected to provide sufficient growth prospects for the global water desalination equipment market.

Rapid development throughout the world has increased the need for freshwater. More than 14,800 Mgal of H2O is needed by businesses in the United States alone, and according to the World Bank, India's demand for H2O for industries is increasing by 4.2 % per year, with an anticipated 228 billion cubic meters of H2O required by 2025, up from 67 billion cubic meters in 1999. This growing demand will drive the worldwide equipment market forward in the upcoming years.

The introduction of innovative technologies in H2O detoxification is the worldwide equipment market's future. Companies are developing desalination plants driven by solar and wind energy. For example, in 2020, GivePower will construct containerized, solar-powered aqua desalination and purifying plants in Kenya and Haiti, using Tesla's power wall battery storage technology. GivePower's solar farm installations are just USD 500,000 and have a 20-year estimated lifespan.

COVID-19 pandemic is expected to slow down the growth of the global market due to the shortage of laborers and disruption in the supply chain of construction materials which is expected to hinder the construction of desalination plants during the lockdown imposed in many parts of the world.

Industry Dynamics

Growth Drivers

The global equipment market is driven by increasing population, scarcity of fresh aqua resources, abundant availability of sea aqua, and rapid industrialization during the forecast period. Increasing investment by governments to build mega desalination plants and advancements in technology such as the development of energy-efficient technologies is expected to further propel the global equipment market growth.

In partnership with private companies, governments across the globe are investing heavily to build mega desalination plants to fulfill the demands of the public and industry. For instance, in 2020, a USD 384 billion contract was given to Acciona and RTCC by Saline Water Conversion Corp. (SWCC) to construct the Shuqaiq 1 desalination plant in Saudi Arabia. Last year, India started creating four desalination plants in Gujarat along the Arabian Sea coast. These developments will augment the growth of the global market.

The industry players are launching new products, raising funds, and collaborating to develop new innovative technologies. For instance, the DOE introduced USD 9 billion challenges such as the "Solar Desalination Prize" in April 2020 to promote the systems that employ solar-thermal energy to generate clean H2O from highly saline H2O. Hydro Wind Energy, based in UAE, launched a device, Quench Sea, in March 2020. The device is used to desalinate sea aqua through reverse osmosis to generate fresh H2O, and the hand-held H2O desalination device is priced at just USD 30.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented based on technology, source, application and region.

|

By Technology |

By Source |

By Application |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Insight by Technology

The reverse osmosis segment dominated the market and generated the highest revenue, in 2021, because of its potential to treat various types of feed aqua, ease of processing, low cost of installation, and limited use of chemicals. The ability of the technology to consume less energy and increase efficiency are the key factors that drive the segment's growth.

The MSF distillation segment is expected to increase rapidly during the anticipated period. Increased Gain Output Ratio (GOR), lower maintenance and operational costs, and the ability to work with dual-purpose power plants are anticipated to boost technical acceptability, particularly in desalination applications.

Insight by Application

The municipal segment generated the highest revenue in 2021, owing to the increasing urban population and burgeoning megacities, driving the need for desalination equipment in the municipal sector. In addition, the decreasing cost of desalinated H2O and the rising cost of surface H2O in significant cities are expected to boost demand for the equipment.

The industrial segment is anticipated to grow at a high rate due to the speedy industrial development in emerging economies such as Thailand, India, and Malaysia, which have led to the increasing demand for the equipment. The growing global population has led to the development of industrial sectors such as food & beverage, oil & gas, pharmaceuticals, pulp & paper, and manufacturing. All these factors drive equipment market growth in the forecast period.

Geographic Overview

The Middle East & Africa equipment market is the most significant region for the global equipment market. The severe scarcity of fresh H2O and rainfall in the region is anticipated to create a need for the desalination equipment market over the projected period.

Countries such as Saudi Arabia have some of the giant desalination plants globally, and the governments in this region are investing heavily in desalination solutions. In addition, the growth in tourism, particularly in the Middle East region, and increasing per-capita consumption of H2O will further drive the equipment market growth.

Asia Pacific water desalination equipment market is expected to be the fastest region for the global market due to rapid industrialization, substantial growth in agriculture, and massive population in countries like China and India. These two countries are the world's largest populated countries and fastest-growing economies. This will increase the demand for freshwater, which will boost the equipment market's growth.

Competitive Insight

Major market players in the water desalination equipment market are investing hugely in R&D to develop innovative energy-efficient desalination solutions. Companies are also devising key strategies such as new product launches, collaborations, and acquisitions to expand their footprint in the global equipment market.

Some of the major players operating in the water desalination equipment market include Acciona, S.A., Aquatech International LLC, Biwater Holdings Limited., Cadagua, Degrémont, Doosan Heavy Industries & Construction Co., Ltd., General Electric Company, Genesis Water Technologies, Guangzhou KangYang Seawater Desalination Equipment Co., Ltd. (KYSEARO), IDE Technologies, Koch Separation Solutions (KSS), SUEZ, Veolia, Xylem.

Water Desalination Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 7.22 Billion |

|

Revenue forecast in 2030 |

USD 15.69 Billion |

|

CAGR |

9.0% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Technology, By, Source By, Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Acciona, S.A., Aquatech International LLC, Biwater Holdings Limited., Cadagua, Degrémont, Doosan Heavy Industries & Construction Co., Ltd., General Electric Company, Genesis Water Technologies, Guangzhou KangYang Seawater Desalination Equipment Co., Ltd. (KYSEARO), IDE Technologies, Koch Separation Solutions (KSS), SUEZ, Veolia, Xylem. |