Water Soluble Packaging Market Share, Size, Trends, Industry Analysis Report

By Material (Polymers, Fibers, Surfactants), By Product, By Solubility Type, By End-use, By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM3587

- Base Year: 2023

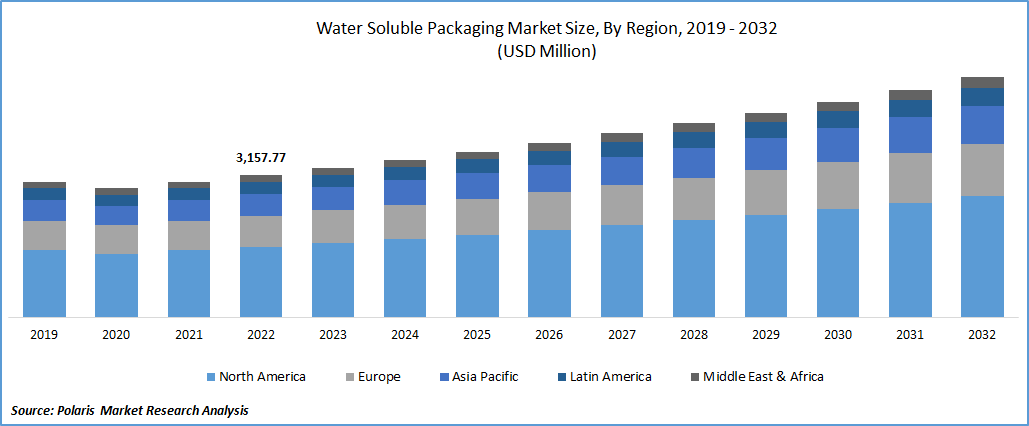

- Historical Data: 2019-2022

Report Outlook

The global water-soluble packaging market was valued at USD 3320.39 million in 2023 and is expected to grow at a CAGR of 5.40% during the forecast period. The market's growth is driven by the need for sustainable packaging solutions, consumer demand for convenience, and regulatory pressures to reduce plastic waste. As environmental concerns continue to grow, the adoption of water-soluble packaging is expected to increase further, providing a more sustainable option for packaging materials. One of the key advantages of water-soluble packaging is its convenience for consumers. The packaging can be easily dissolved in water, eliminating the need for separate disposal processes. This convenience aligns with the growing consumer preference for packaging that is easy to use and dispose of responsibly.

To Understand More About this Research: Request a Free Sample Report

Moreover, water-soluble packaging offers an eco-friendly solution as it does not contribute to pollution. Traditional packaging materials like plastic, glass, and metal can decompose for hundreds of years and often pollute landfills, oceans, and other natural habitats. In contrast, water-soluble packaging dissolves harmlessly in water, significantly reducing environmental impact.

The U.S. Environmental Protection Agency (EPA) and the Food and Drug Administration (FDA) have implemented regulations that impact the packaging industry and contribute to the growth of water-soluble packaging solutions. The EPA has established rules for the disposal of plastic waste to address the environmental concerns associated with plastic pollution. These regulations include guidelines for proper waste management, recycling, and reducing plastic waste. By promoting responsible disposal practices and encouraging the use of more sustainable alternatives, such as water-soluble packaging, the EPA's regulations create an impetus for businesses to adopt eco-friendly packaging options.

On the other hand, the FDA regulates the use of plastics in consumer goods, including packaging materials. The agency has established guidelines to ensure food safety and other products that meet plastics. These regulations often require extensive testing and compliance with specific standards for packaging materials. Water-soluble packaging materials that meet the FDA's requirements can provide a safe and compliant option for packaging various consumer goods.

The growing awareness among consumers regarding the benefits of water-soluble packaging has been a key driver for its adoption. As consumers become more conscious of the environmental impact of traditional packaging materials, they are actively seeking sustainable alternatives. This shift in consumer preferences has created a demand for water-soluble packaging solutions across various industries. The use of water-soluble packaging by Saie, a health and beauty brand, is an excellent example of this trend. Saie's adoption of water-soluble packaging showcases the increasing recognition of its environmental advantages. Using water-soluble packaging, Saie demonstrates its commitment to sustainability and aligns with the growing consumer demand for eco-friendly packaging options.

Industry Dynamics

Growth Drivers

Stringent government regulations on plastic bans have had a positive impact on the growth of the water-soluble packaging market. The draft of the EU regulation by the U.K. government, which aims to achieve zero plastic waste by 2042, is a significant example of such rules. The European Union and its member countries have been at the forefront of implementing strict regulations and targets to reduce plastic waste and promote sustainable packaging solutions. The proposed target of zero avoidable plastic waste by 2042 demonstrates a strong commitment to addressing the environmental issues associated with plastic pollution. Such regulations and targets create a sense of urgency and accountability among businesses, encouraging them to seek alternatives to traditional plastic packaging. Water-soluble packaging emerges as a viable solution that aligns with the sustainability objectives set by governments.

Report Segmentation

The market is primarily segmented based on material, product, solubility type, end-use, and region.

|

By Material |

By Product |

By Solubility Type |

By End-Use |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Polymers segment accounted for the largest market share in 2022

The polymer segment accounted for the largest market share in 2022. PVA is a popular material choice for such packaging due to its water solubility. PVA-based water-soluble packaging films possess good mechanical strength and barrier properties, making them suitable for various applications. They can effectively protect and contain a wide variety of product ingredients. This versatility makes PVA-based water-soluble packaging compatible with different sectors such as household, medical, agriculture, and personal care.

The fiber segment witnessed steady growth. It offers an eco-friendly alternative to conventional plastic packaging solutions, reducing the environmental impact. Natural fiber materials like wood pulp are biodegradable and renewable resources. Synthetic fibers derived from grains also provide a sustainable option, as they are often derived from renewable agricultural feedstocks.

Bags segment garnered largest share in 2022

The bags segment held the largest revenue share in 2022. Water-soluble bags find extensive adoption in the medical packaging sector, particularly for applications such as infected laundry bags. These bags offer a convenient and hygienic solution for containing contaminated or infectious materials, reducing the risk of cross-contamination, and promoting proper handling and disposal. Medical facilities, hospitals, and other healthcare settings often use water-soluble bags containing soiled linens, garments, or medical waste. The water-soluble property of these bags enables easy and safe disposal by simply dissolving them in water, eliminating the need for direct contact with potentially hazardous materials.

Hot water solubility segment garnered largest share in 2022

Hot water solubility segment held the largest revenue share in 2022. The advantages of hot water solubility go beyond eliminating plastic waste. It also offers benefits in various applications and industries. For instance, in the household sector, hot water-soluble packaging is used for products such as laundry detergents, dishwashing detergents, and cleaning agents. Consumers can conveniently dissolve the packaging in hot water, eliminating the need to handle and dispose of plastic bottles or pouches. It also beneficial in industries like hospitality, where single-use amenities such as shampoos, conditioners, and soaps can be packaged in water-soluble materials. Hotels and accommodations can provide guests with convenient packaging that dissolves in hot water, reducing waste and enhancing the overall guest experience.

North America dominated the global market in 2022

North America dominated the global market with a considerable market share. The increasing demand for water-soluble packaging solutions in the region can be attributed to various end-user industries, including household products, food and beverages, pharmaceuticals, and more. These industries recognize the benefits of water-soluble packagings, such as convenience, sustainability, and reduced environmental impact. As a result, they are adopting these solutions to meet consumer preferences and align with sustainability goals.

The stringent government regulations in North America also significantly drive the demand for water-soluble packaging. Federal, state, and local regulatory bodies have implemented measures to reduce plastic waste and promote sustainable packaging practices. These regulations create a favorable environment for adopting water-soluble packaging as businesses strive to comply with the requirements and address environmental concerns.

APAC registered a robust growth rate. The high demand for laundry detergents and personal care products in these countries drives the adoption of water-soluble packaging solutions. As consumers become more environmentally conscious, there is a growing preference for sustainable packaging options that reduce plastic waste and promote responsible consumption. Additionally, implementing plastic packaging bans in various countries within the Asia Pacific region is further fueling market growth. For example, in July 2022, the Indian government banned single-use plastics to combat plastic pollution and reduce the burden on landfills. Such regulatory measures create a favorable environment for adopting water-soluble packaging as an alternative to traditional plastic packaging.

Competitive Insight

Some of the major players operating in the global market include Kuraray, Lithey Inc., Mondi Group, SEKISUI CHEMICAL, Mitsubishi Chemical Corporation, Soltec Development, Soluble Technology, Aquapak Polymers, Rovi Packaging, AICELLO CORPORATION, Cortec Corporation, Acedag Ltd, Green Master Packaging, Solupak, EOS Plast, and Solubag.

Recent Developments

- In May 2022, Aquapak announced its partnership with Industrial Physics. This collaboration aims to support Aquapak in further advancing its Hydropol water-soluble sustainable packaging product range. Through a partnership with Physics Industrial, Aquapak can leverage the expertise and technologies of Industrial Physics to ensure the compliance, reliability, and consistent quality of its Hydropol product rang

Water Soluble Packaging Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3493.05 million |

|

Revenue forecast in 2032 |

USD 5,330.31 million |

|

CAGR |

5.40% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Material, By Product, By Solubility Type, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Kuraray, Lithey Inc., Mondi Group, SEKISUI CHEMICAL, Mitsubishi Chemical Corporation, Soltec Development, Soluble Technology, Aquapak Polymers, Rovi Packaging, AICELLO CORPORATION, Cortec Corporation, Acedag Ltd, Green Master Packaging, Solupak, EOS Plast, and Solubag. |

FAQ's

key companies in water-soluble packaging market are Kuraray, Lithey Inc., Mondi Group, SEKISUI CHEMICAL, Mitsubishi Chemical Corporation, Soltec Development.

The global water-soluble packaging market is expected to grow at a CAGR of 5.4% during the forecast period.

The water-soluble packaging market report covering key segments are material, product, solubility type, end-use, and region.

key driving factors in water-soluble packaging market are stringent government regulations on plastic bans.

The global water-soluble packaging market size is expected to reach USD 5,330.31 million by 2032.