Waterborne Coatings Market Share, Size, Trends & Industry Analysis Report

By Resin Type (Acrylic, Polyester, Alkyd, Epoxy, Polyurethane, PTFE, PVDF, PVDC, Others); By Application Industry; By Region; Segment Forecast, 2025 - 2034

- Published Date:May-2025

- Pages: 153

- Format: PDF

- Report ID: PM1482

- Base Year: 2024

- Historical Data: 2020-2023

Waterborne Coatings Market Overview

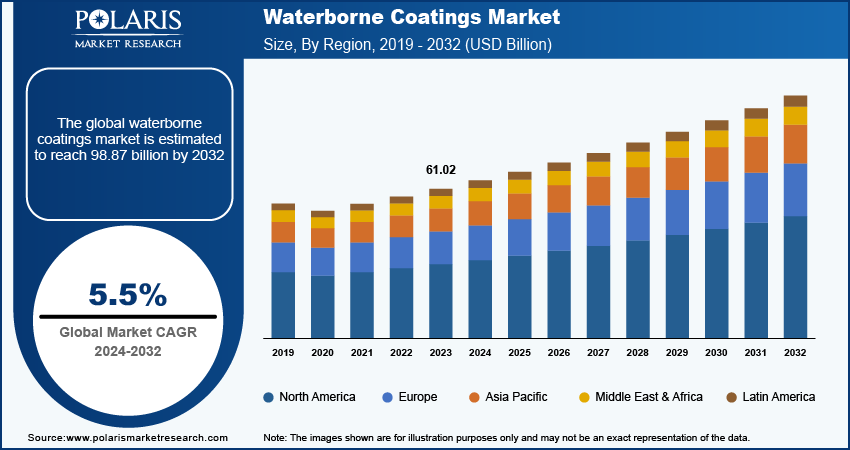

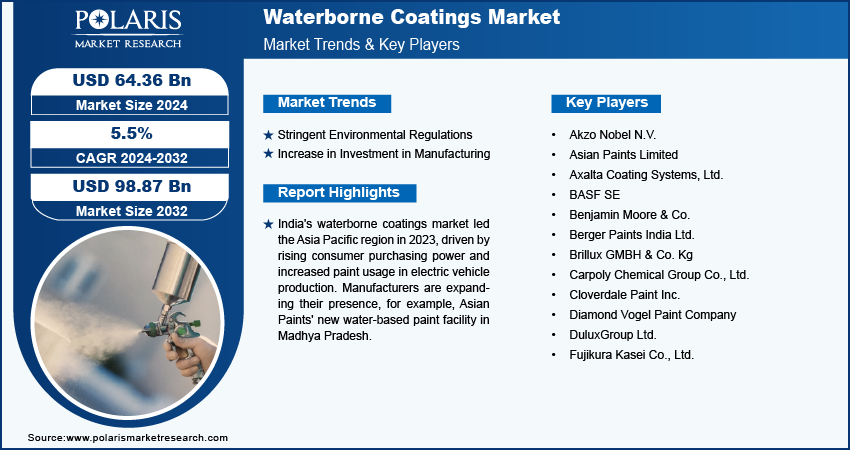

The global waterborne coatings market was valued at USD 93.7 billion in 2024 and is forecasted to grow at a CAGR of 6.10% from 2025 to 2034. Growth is supported by increasing environmental regulations and demand for low-VOC coatings.

The waterborne coatings market encompasses eco-friendly paint and coating solutions primarily composed of water as a solvent. These coatings are favored for their low volatile organic compounds (VOCs), making them safer for the environment and human health while providing effective surface protection. The increasing demand for coatings in the automotive industry, particularly in the electric vehicle (EV) segment, is driving the growth of the waterborne coating market. Government initiatives aimed at environmental protection, such as incentivizing the purchase of EVs and promoting sustainable manufacturing practices, are further propelling this growth.

Additionally, the ability of waterborne coatings to emit lower levels of volatile organic compounds (VOCs) is encouraging their adoption by original equipment manufacturers (OEMs) to ensure compliance with strict environmental regulations, thereby contributing to the overall growth.

To Understand More About this Research: Request a Free Sample Report

The increase in demand for waterborne coatings in metal industries is significantly driving the market growth. Waterborne coating offers unique properties such as exceptional durability, mechanical strength, and resistance to chemicals, corrosion, and abrasion. These characteristics enhance the longevity and aesthetic appeal of metal surfaces, making waterborne coatings an attractive choice for manufacturers. Leading companies are investing in advanced waterborne manufacturing technologies to create innovative waterproof and fire-resistant coatings, further expanding their application potential and solidifying their role in protecting metal products. Thus, an increase in demand for durable coatings is boosting the growth of waterborne coatings market growth.

Market Dynamics

Stringent Environmental Regulations

Stringent environmental regulations are a significant driving factor for the market. Manufacturers are increasingly shifting towards waterborne formulations as governments worldwide impose stricter guidelines to reduce volatile organic compounds (VOCs) and promote sustainable practices. These coatings comply with regulatory standards while offering enhanced safety and lower environmental impact. The push for greener alternatives in industries such as automotive, construction, and furniture further accelerates overall growth. Additionally, consumers' growing awareness of environmental issues fuels demand for eco-friendly products, reinforcing the transition towards waterborne coatings as a viable solution in a rapidly evolving regulatory landscape.

Increase in Investment in Manufacturing

Increased investment in manufacturing is expected to fuel the number of players in the waterborne coating market. As companies seek to enhance their product offerings and meet rising demand for eco-friendly solutions, they are allocating resources toward advanced production technologies and innovative formulations. This influx of investment not only supports the development but also drives competition among manufacturers, leading to the advancement in technology. Therefore, an increase in investment in manufacturing is expected to fuel the market growth.

Market Segment Insights

Market Breakdown by Resin Type Outlook

The global waterborne coatings market segmentation, based on resin type, includes acrylic, polyester, alkyd, epoxy, polyurethane, PTFE, PVDF, PVDC, and others. In 2024, the Alkyd segment dominated the market due to rise in application of alkyd-based coatings in architectural, residential, and commercial buildings. Additionally, the alkyd-based coatings are made with emulsion technology, which enables it to alter traditional solvents with water, promoting sustainability and safety associated with the final painting. In November 2023, a study showcased in the Journal of Coatings Technology and Research synthesized the potential of organosilane monomer such as corrosion resistance and the adhesive properties associated with the acrylic-modified water-reducible alkyd resin.

Market Breakdown by Application Industry Insights

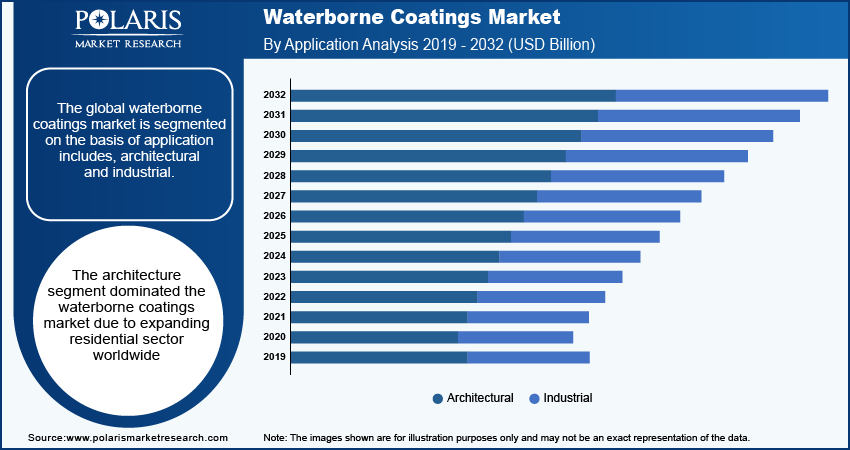

The global waterborne coatings market, based on application industry, is bifurcated into architectural and industrial. The architectural segment held a larger revenue share in 2024. The demand for waterborne coatings in this segment is driven by the rising emphasis on residential and commercial space remodeling and allied renovation activities. According to the National Association of Home Builders (NAHB) Remodelers survey in 2024, the demand for complete house remodeling is 50%, while window or door renewal is 22%. Further, the growing focus on reducing power consumption is expected to stimulate the adoption of these coatings, driven by their benefits such as faster drying and enhanced air quality.

Regional Insights

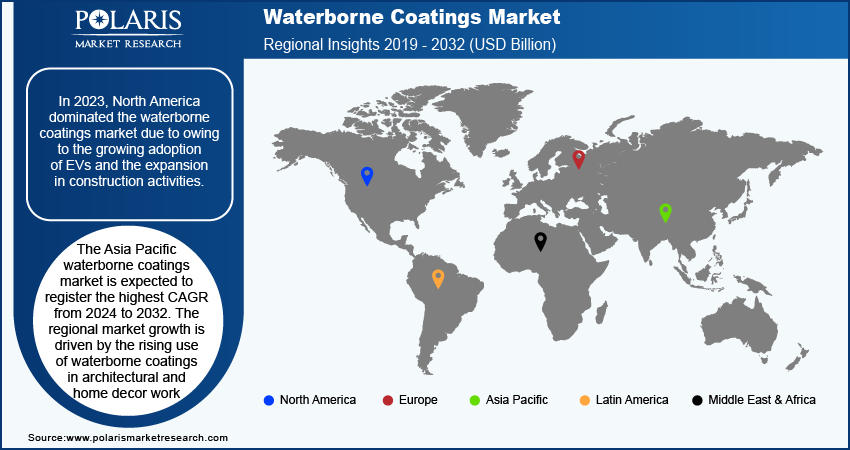

By region, the study provides insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominates the global waterborne coatings market, owing to the growing adoption of EVs and the expansion in construction activities.

The presence of key companies such as Axalta Coating Systems, Benjamin Moore, and Diamond Vogel Paint, focusing on providing advanced waterborne coatings, strengthens the market landscape in North America. The players are also focusing on various strategic initiatives such as acquisitions, mergers, and collaborations to strengthen their presence and serve better offerings in North America.

Europe waterborne coatings market accounted for the second-largest share due to stringent environmental regulations. Rising air pollution levels and increasing hazardous waste production are further driving the shift towards waterborne coatings, as these solutions offer lower volatile organic compounds (VOCs) and reduced environmental impact. Additionally, governments and industries are actively seeking sustainable practices to comply with regulations, which enhances the adoption across various applications in the region.

The Asia Pacific waterborne coatings market is expected to register the highest CAGR from 2025 to 2034. This growth is largely driven by the increasing use in architectural and home decor projects, fueled by a rising middle-income population and growing disposable incomes. The demand for eco-friendly and aesthetically appealing coatings is increasing as consumers invest more in home improvement and renovation. Additionally, increased disposable income is encouraging more architectural projects, further propelling the adoption in the region.

India waterborne coatings market held the largest share of the Asia Pacific in 2024. The growth in the country is driven by factors such as the rising purchasing power of consumers, growing use of paint in electric vehicle production, and increasing initiatives by manufacturers to expand their industrial presence in India. In January 2024, Asian Paints announced its strategy to introduced water-based paint production in Madhya Pradesh with a capacity of 400,000 kiloliters per year.

Key Players and Competitive Insights

Leading players are investing hugely in research and development to innovate new products and expand their product portfolio, which will assist them in acquiring a competitive share by enhancing accessibility to their products. Key participants in the waterborne coatings industry are adopting intensive strategies to enhance their global footprint. A few of the major developments are mergers and acquisitions, collaborations, and partnership agreements. They are working on developing affordable waterborne coatings to attain a larger chunk of the consumer base globally.

In the global waterborne coatings industry, producing locally is one of the main business tactics that is adopted by the major players to limit production costs and augment profits. The industry is significantly upgrading technologies with changing global conditions.

Akzo Nobel, Asian Paints, Axalta Coating Systems, BASF SE, Benjamin Moore, Berger Paints India, Brillux GMBH, Carpoly Chemical Group, Cloverdale Paint, Diamond Vogel Paint, DuluxGroup, and Fujikura Kasei Co are among the major players in the waterborne coating market.

BASF SE is a global chemical corporation with seven distinct business segments: chemicals, industrial solutions, materials, surface technologies, nutrition & care, agricultural solutions, and others. The chemical segment supplies petrochemicals and their intermediates. Advanced materials and their precursors for applications such as polyamides and isocyanates are available through the Materials section, inorganic basic products and specialties for the plastic and plastic processing industries. The industrial solutions sector deals with the development and sale of various ingredients and additives such as polymer dispersions, resins, electronic materials, pigments, light stabilizers, antioxidants, mineral processing, oilfield chemicals, and hydrometallurgical chemicals. On the other hand, Surface Technologies provides chemical solutions and automotive OEM services to the automotive and chemical sectors. This includes surface treatment, battery materials, refinishing coatings, catalysts, and base metal services. The Nutrition and Care sector provides ingredients for food and feed producers, pharmaceutical, detergent, cosmetics, and cleaner industries. Lastly, the Agricultural Solutions segment offers seeds and crop protection products, such as herbicides, fungicides, insecticides, seed treatment products, and biological crop protection products.

Arkema SA is a chemical company engaged in offering coating solutions, adhesives, and advanced materials. It provides coating resins, additives, adhesives, and polymers to aeronautics, sporting products, cosmetics, electrics, and automobile industries across the globe. In April 2024, Arkema widened its sustainable offering by introducing a range of products focused on circularity, decarbonization, and others at the American Coatings Show 2024 in Indiana to meet changing consumer interests.

Key Companies in Waterborne Coatings Market

- Akzo Nobel N.V.

- Asian Paints Limited

- Axalta Coating Systems, Ltd.

- BASF SE

- Benjamin Moore & Co.

- Berger Paints India Ltd.

- Brillux GMBH & Co. Kg

- Carpoly Chemical Group Co., Ltd.

- Cloverdale Paint Inc.

- Diamond Vogel Paint Company

- DuluxGroup Ltd.

- Fujikura Kasei Co., Ltd.

Waterborne Coatings Industry Developments

In February 2025: AkzoNobel launched RUBBOL WF 3350, a waterborne wood coating featuring 20% bio-based content. Developed by the Sikkens Wood Coatings business, the product combines sustainability with high performance, supporting a circular economy and eco-friendly building design.

August 2024: AkzoNobel, a chemical company, unveiled its plan to exhibit its new range of wood coating solutions at the International Woodworking Fair (IWF) 2024 in Atlanta. It includes Chemcraft’s acrylic systems and Selva Pro 2K polyurethane.

August 2023: Covestro completed the construction of its new manufacturing plant in Shanghai, China, to develop polyurethane dispersions. This is to meet the demand for sustainable coatings and adhesives in Asia Pacific, primarily for the automotive, packaging, furniture, and construction industries.

Waterborne Coatings Market Segmentation

By Resin Type Outlook

- Acrylic

- Polyester

- Alkyd

- Epoxy

- Polyurethane

- PTFE

- PVDF

- PVDC

- Others

By Application Industry Outlook

- Architectural

- Industrial

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Waterborne Coatings

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 93.7 Billion |

|

Market Size Value in 2025 |

USD 99.42 Billion |

|

Revenue Forecast by 2034 |

USD 169.3 Billion |

|

CAGR |

6.10% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global waterborne coatings market size was valued at USD 61.02 billion in 2023 and is projected to grow to USD 169.3 billion by 2034.

The global market is projected to register a CAGR of 6.10% during the forecast period.

North America accounted for the largest share of the global market in 2024.

Akzo Nobel N.V.; Asian Paints Limited; Axalta Coating Systems, Ltd.; BASF SE; Benjamin Moore & Co.; Berger Paints India Ltd.; Brillux GMBH & Co. Kg; Carpoly Chemical Group Co., Ltd.; Cloverdale Paint Inc.; Diamond Vogel Paint Company; DuluxGroup Ltd.; and Fujikura Kasei Co., Ltd. are among the key players in the market.

The alkyd segment dominated the market in 2024 due to rise in application of alkyd-based coatings in architectural, residential, and commercial buildings.

The architectural segment had a larger share of the global market in 2024 due to expanding residential sector worldwide.