Wheat Seed Market Share, Size, Trends, Industry Analysis Report

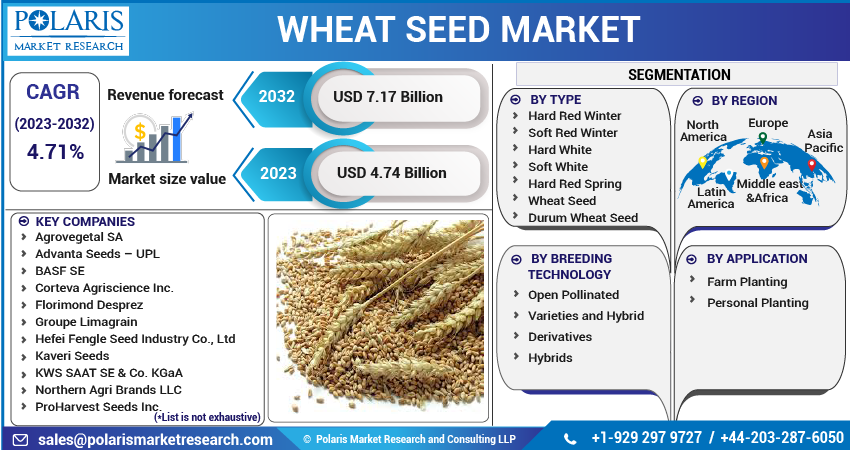

By Type (Hard Red Winter, Soft Red Winter, Hard White, Soft White, Hard Red Spring Wheat Seed, and Durum Wheat Seed); By Breeding Technology; By Application; By Region; Segment Forecast, 2023- 2032

- Published Date:Jul-2023

- Pages: 118

- Format: PDF

- Report ID: PM3481

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

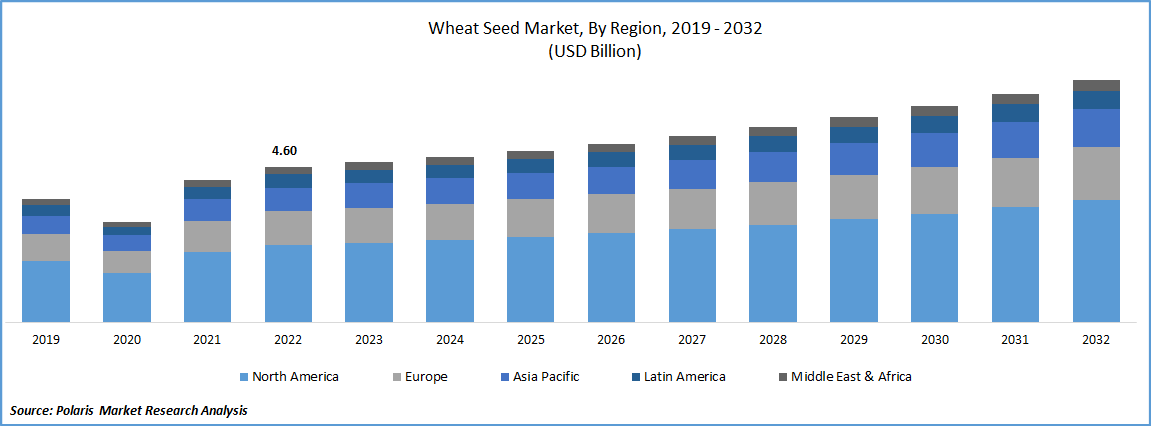

The global wheat seed market was valued at USD 4.60 billion in 2022 and is expected to grow at a CAGR of 4.71% during the forecast period. The industry is being driven by several important factors, including the increased demand for food caused by an expanding worldwide population, ongoing technological improvements in the creation of new seed varieties, and supportive governmental programmes. Other factors influencing the market include the biotechnology and agriculture sectors' rapid expansion, the rise in demand for wheat varieties high in protein, high research and development (R&D) efforts, and the convenience of product accessibility across online and offline retail channels.

To Understand More About this Research: Request a Free Sample Report

One of the most significant and necessary crops that are easily grown worldwide is wheat seeds. It is mostly made via government seed programmes that are significantly subsidised. Wheat seed, a crucial part of the production of wheat, is distinguished by a tough outer coating known as the seed coat and includes wheat kernels inside. The most common form of wheat seed is a kernel, like those found in corn, oats, grain, rice and rye. They are low in fat and a source of complex carbohydrates. Cereals, bread, pasta, crackers, and many more culinary products can all be made from wheat seeds.

Wheat plants assist in reducing soil erosion and improving soil quality, hence wheat seed is essential for soil conservation. Utilising wheat seed has several benefits since it can be cultivated in a range of temperatures and soil conditions, making it a good crop for many areas. Wheat seed is a preferred option among farmers due to its popularity and ease of maintenance. A rich source of starch, vitamins, protein, carbs, and other necessary nutrients, the wheat seed is also very nourishing. As a result, a wide range of items, including bread, pasta, and cereal, are made using a lot of wheat seed.

The boost in wheat seed market value can be attributed to several factors, including a greater emphasis of product manufacturers on product innovations, the development and broadening of the consumer agriculture industry, particularly in emerging economies. In addition, the market is benefiting from consumers' growing preference for goods made from wheat, such as whole-grain items. Additionally, there are many advances in agricultural techniques as a result of the growing worries about how changes in weather patterns would affect crop growth and output, which is enhancing the outlook for the market.

COVID-19, which was formally dubbed a pandemic in March 2020, has spread globally over the first half of 2020. Covid-19 had a serious negative influence on people's life and means of subsistence as well as on the economy and society as a whole. The vast majority of country governments and their health departments made efforts to stop the pandemic by limiting mobility and promoting social distancing. The supply of seed, the particularly certified seed of new and improved kinds and farmers' timely access to it, as well as seed-related products sold at what is known as local, traditional, and informal markets, have all been badly impacted by the crisis.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

Favourable government actions that promote the agricultural sector and provide farmers with advantages for seed purchases have contributed to the market's profitable expansion. As part of its plan to increase agricultural output and farmer income, the government established a special INR 5 Bn budget to micro-irrigate more land. Fund is set under the NABARD, which provides funding to the states on a cheaper rate of interest to promote the micro-irrigation, covering around 10 Mn hectares.

Further, an enormous increase in the demand for organic food crops is another factor driving the industry. The NDA Governance introduced the Paramparagat Krishi Vikas Yojana (PKVY) in 2015 as a programme to support organic farming across the nation. The plan suggests farmers organise into groups or clusters and switch to organic agricultural practices across a sizable portion of the nation. Through this scheme, in 2019, 10,000 clusters were formed converting around 5 lakh acres of agricultural land to organic cultivation.

The government also has decided to pay for certification fees and support organic farming by utilising conventional means. The government paid each farmer who signs up for the programme INR 20,000 per acre over three years. Therefore, various government programmes launched as well as the continued focus on development are driving the growth of the market over the forecast period.

Report Segmentation

The market is primarily segmented based on type, breeding technology, application, and region.

|

By Type |

By Breeding Technology |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

The hybrids segment is expected to witness the fastest growth during forecast period

The hybrid segment is growing at the fastest pace due to its various benefits for the development of crops. The arrival of the hybrid wheat, which combines advantageous qualities from two parent plants, comes after adverse weather reduced grain harvests and the Ukraine crisis hampered supply to insatiable importers, driving prices to record highs this spring. When compared to traditional wheat, hybrid wheat can offer more consistent outcomes across fields and may even produce higher yields in less-than-ideal soil conditions. There are a few hybrids already in existence, and businesses are creating new hybrids with drought tolerance and disease resistance, so it is anticipated that the number will rise in the future.

Soft White Winter accounted for the largest market share in 2022

Winter wheat is a variety of wheat that is sown in the autumn and harvested in the spring. The plants stop growing over the winter and start again in the spring. Since winter wheat is firmer than other varieties, it is the best wheat to grow in colder climates. In February 2022, Limagrain Cereal Seeds (LCS) announced the development of five new hard red winter wheat varieties and five CoAXium soft white winter wheat varieties, all with PNW-adapted pedigrees. Beginning with this growing season, farmers will have a wider range of options to protect their fields from grassy weeds. Winter wheat comes in two different varieties: bread wheat and pastry wheat. Because it contains more protein and gluten than regular wheat, bread wheat is ideal for generating yeast slices of bread. Because pastry wheat contains less protein and gluten, it is excellent for baked items like pies and pastries.

The demand in Asia-Pacific is expected to witness significant growth during 2022

Many nations in the region, including Argentina, Australia, China, and India, produce wheat. This region is still developing. As economies grow quickly, there is a rise in demand for numerous home goods. Spring wheat seeds are employed in both food and pharmaceutical goods. A less expensive substitute for various cosmetic and personal care items is spring wheat seeds. Asia-Pacific is the region with the largest market for spring wheat seeds due to the variety of industrial uses, expanding population, and rising demand. The demand for processed food items is anticipated to be driven by expanding consumer disposable income levels in emerging markets like China and India, which would positively affect industry expansion. The government in the region are taking various agricultural initiatives to support farming.

The fourth-largest producer of wheat in the world is the United States. Due to a rise in price and a rise in worldwide demand, wheat planting has expanded. The greatest producer of wheat in Europe, Ukraine experienced the quickest growth as a result of the adoption of hybrid seeds, which increased grain exports to Africa. The development of enhanced open-pollinated seed varieties that are insect-resistant and made available to growers so they can cultivate larger yields at lower costs than hybrid seeds is anticipated to raise the revenue of growers. Since wheat is a staple food in many nations, there will likely be an increase in demand for it. Additionally, there will likely be more high-yielding varieties available, and private companies will likely spend more time researching stress- and disease-resistant varieties.

Competitive Insight

Some of the major players operating in the global market include Agrovegetal, Advanta Seeds, BASF SE, Corteva Agriscience, Florimond Desprez, Groupe Limagrain, Hefei Fengle Seed, Kaveri Seeds, KWS SAAT, Northern Agri Brands, ProHarvest Seeds, RAGT Semences, Syngenta, and Seed Co.

Recent Developments

- In June 2021, Ideltis is BASF's newest brand name for hybrid wheat seeds. It shows how committed the corporation is to transforming wheat for long-term prosperity through creative hybridization. To progress one of the most significant crops in the world, BASF's hybrid wheat is designed to give farmers higher and more reliable performance in yield and quality.

Wheat Seed Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 4.74 billion |

|

Revenue Forecast in 2032 |

USD 7.17 billion |

|

CAGR |

4.71% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments Covered |

By Type, By Breeding Technology, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Agrovegetal SA, Advanta Seeds – UPL, BASF SE, Corteva Agriscience Inc., Florimond Desprez,. Groupe Limagrain, Hefei Fengle Seed Industry Co., Ltd, Kaveri Seeds, KWS SAAT SE & Co. KGaA, Northern Agri Brands LLC, ProHarvest Seeds Inc., RAGT Semences UK, Syngenta AG, and Seed Co Limited |

FAQ's

The wheat seed market report covering key segments are type, breeding technology, application, and region.

Wheat Seed Market Size Worth $7.17 Billion By 2032.

The global wheat seed market is expected to grow at a CAGR of 4.71% during the forecast period.

Asia-Pacific is leading the global market.

key driving factors in wheat seed market are government also has decided to pay for certification fees and support organic farming.