Whiskey Market Share, Size, Trends, Industry Analysis Report

By Product (Malt, Wheat, Rye, Corn, and Others); By Type; By Quality; By Region; Segment Forecast, 2022 - 2030

- Published Date:Dec-2022

- Pages: 118

- Format: PDF

- Report ID: PM2915

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

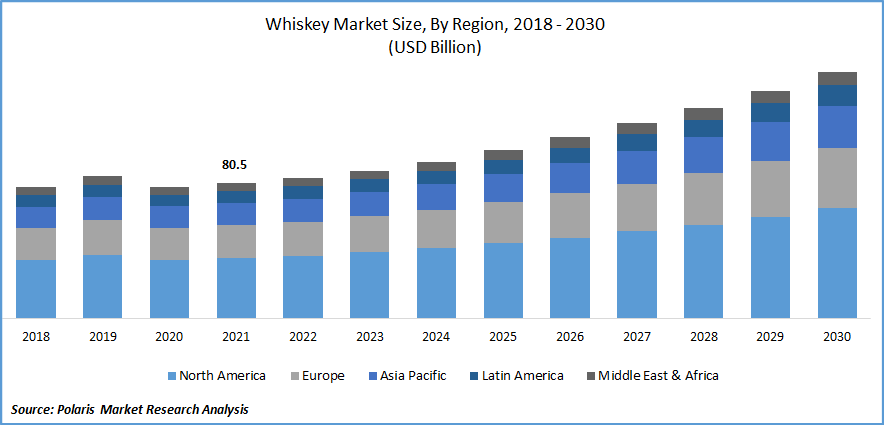

The global whiskey market was valued at USD 80.5 billion in 2021 and is expected to grow at a CAGR of 7.3% during the forecast period.

The rapid change in consumer lifestyles, growing spending capacity, and rising demand for whiskey products from the young generation are the major industry drivers. In addition, the extensive rise in the number of nightclubs, pubs, restaurants, and distilleries across the globe, are some of the crucial factors propelling the market growth. Furthermore, increasing demand for blended whiskey, owing to the large consumer base and high demand of super-premium drinks from developed nations such as the U.S., France, UK., and Canada, is further anticipated to fuel the industry growth.

Know more about this report: Request for sample pages

Changing consumer preferences toward premium products has made consumers to explore high-quality and unique alcoholic beverages, including whiskey, and wine, among others. The inclusion of many natural ingredients in alcoholic beverages enhances the product's functionality, due to which premium whiskey is gaining more popularity and is further projected to contribute positively to market growth. However, growing consumer awareness regarding various negative effects caused by whiskey on the human body and several government regulations and taxation policies on whiskey consumption worldwide are likely to hamper the growth of the global market over the study period.

The occurrence of the COVID-19 pandemic has substantially obstructed market demand. The emergence of the deadly virus has resulted in the closure of various hotels, restaurants, bars, and alcohol shops due to imposed lockdowns and high disruptions in the supply chain by many countries, including India, France, the United States, and Germany. Due to several restrictions, many large companies have seen a slight sales decline and profit margins. For instance, Pernod Ricard, a global whiskey provider, was a decline in their profit margins by around 20%, as per their annual filings.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The growing number of innovations in whiskey products, including various flavors and product quality, coupled with the easy affordability of the middle-class population around the globe, are some of the major factors anticipated to drive the global market demand. In the last few years, global manufacturers' investments in the research and development of whiskey products and increasing efforts to promote whiskey as a better source of protein with digestibility are likely to fuel the adoption of these products around the world.

Furthermore, the rapid growth in the retail sector and high development of various online retailing portals, which allows customers to make hassle-free purchases of whiskey products, along with the extensive rise in promotional activities conducted by key market companies to capture consumer’s attention, is further propelling the growth of the market.

Report Segmentation

The market is primarily segmented based on product, type, quality, and region.

|

By Product |

By Type |

By Quality |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Wheat Segment is Expected to Witness the Fastest Growth

The wheat segment is witnessing the fastest growth over the forecast period. The growth in this segment can be attributed to several features of wheat-based whiskey products, such as saporous products, lightness, and the availability of gentle sweetness in them. In addition, the spice factor in the wheat product is comparatively low as compared to a large number of secondary grains are also likely to fuel the demand and growth of the segment market in the coming years.

Moreover, the malt segment is likely to register significant growth over the anticipated period. The growth of the segment market can be attributed to the high consumption of malt whiskey in countries like China, South Korea, and Taiwan. Additionally, the market's growth is also fueled by the high exclusivity of several whiskey festivals and clubs coupled with the rising visibility in the specific type of on-trade venues.

Premium Segment Accounted for the Largest Market Share in 2021

The premium segment leads the global market in 2021 with a significant market share and is likely to retain its position throughout the forecast period. The segment is mainly driven by rising demand for conventional drinks, high consumer attention towards premium segment products, and the highest number of product offerings among whiskey producers worldwide. In addition, the growing club and pub-visiting population and preference for alcoholic beverages in genuine flavors have also been projected to augment the demand and growth for premium drinks significantly.

However, the high-end premium segment is expected to grow at the fastest growth rate over the study period because of the rising number of 5-star restaurants and high-end nightclubs, where people usually prefer quality ahead of price. Some specialized brands across the globe produce high-end premium whiskey with the help of distillery techniques and are fermented for over ten years. Additionally, the segment is likely to witness the fastest growth in European countries due to heavy investment in the region by many well-recognized global brands and high consumer demand for expensive products.

Scotch Whiskey Segment Held the Largest Market Revenue Share

In 2021, the scotch whiskey segment accounted for a substantial share owing to the high popularity of Scottish whiskey worldwide due to its taste, aroma, and texture. The intricacy & distinct flavor of such whiskey is well appreciated by millennials globally. The availability of scotch whiskey in both premium and the high-end premium segment has also fueled the adoption and usage in pubs, restaurants, and nightclubs to cater to the need of all types of consumers.

Furthermore, American whiskey is the second dominant of the market with a significant contribution to market share in 2021, which is majorly accelerated by growing consumption among the old age population in the United States and availability in five different types of categories with a distinctive price range. Moreover, American whiskey is also exported to various Asian and African countries, resulting in growth in production and competition among the brand in the country.

North America Region Dominated the Whiskey Market in 2021

The North American region dominated the global market in 2021 and is projected to maintain its dominance over the projected period. The regional market's growth is driven by an extensive rise in the number of premium whiskey manufacturers and reduced timelines for approval from federal and state regulatory control. In addition, premiumization trends and emerging trend of consumers towards the innovation in products and diversification of their product ranges has positively impacted regional growth. For instance, according to Distilled Spirits Council, in 2021, the revenue of the high-end premium segment rose by 37% and the super-premium segment by 136%.

Furthermore, the Asia Pacific region is emerging as the fastest-growing region because of increasing consumer spending power and the highly growing adoption of western culture among the young generation, especially in developing nations such as India, China, and Indonesia. Increasing efforts by industry players in the region to expand their business globally is also likely to create lucrative growth opportunities for market growth in the coming years. For instance, in August 2021, Beam Suntory announced the launch of its first Indian whiskey outside of India. With this launch, the company is showing its commitment and intention to expand its business in North India by launching five different premium spirits.

Competitive Insight

Key players in the market include Pernod Ricard, Red Brick Brewing, The Edrington, United Spirits, Accoloade Wines, Anchor Brewing, Beijing Red Star, Brown Forman, Bacardi, Beam Suntory, Asahi Group, Johnnie Walker, Diageo, Bass Brewery, Suntory Holding, and William Grant.

Recent Developments

In July 2021, Diageo Plc, announced that Johnnie Walker whiskey now would be available in paper bottles to address the environment issues related to other types of packaging like plastic among others. The company also opted to sell their products in plastic free bottles and likely to be available in wood-pulp material packaging.

In November 2021, Pernod Ricard, unveils about it’s the Chuan Malt Whiskey Distillery, in China. The company has unveiled its new distillery with an ambition to bring new products and better experience to its consumers and expected to contribute substantially to the growth of the economy.

Whiskey Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 83.28 billion |

|

Revenue forecast in 2030 |

USD 146.15 billion |

|

CAGR |

7.3% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Product, By Quality, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Pernod Ricard SA, Red Brick Brewing Company, The Edrington Group, United Spirits Ltd., Accoloade Wines, Anchor Brewing Company, Beijing Red Star Co., Brown Forman, Bacardi Ltd., Beam Suntory, Asahi Group Holding Ltd., Johnnie Walker, Diageo, Bass Brewery, Suntory Holding Ltd., and William Grant & Sons. |