Wi-Fi Chipset Market Size, Share, Trends, Industry Analysis Report

By Standard, By MIMO Configuration (MU-MIMO and SU-MIMO), By Application, By End-User, and By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6330

- Base Year: 2024

- Historical Data: 2020-2023

Overview

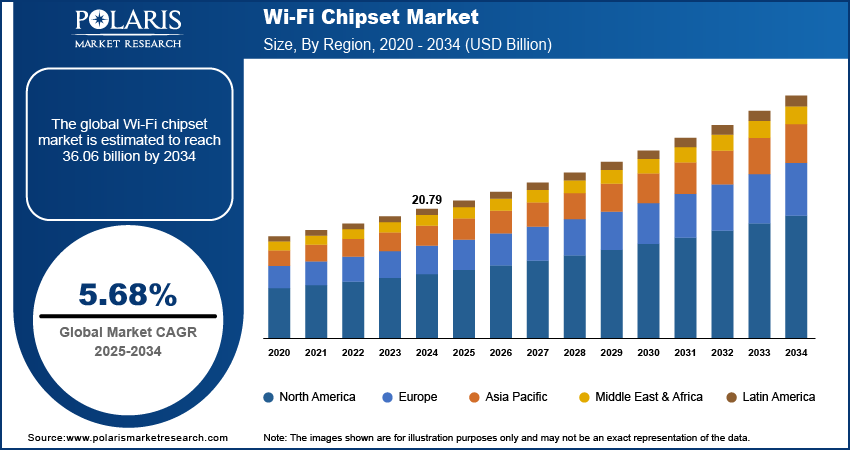

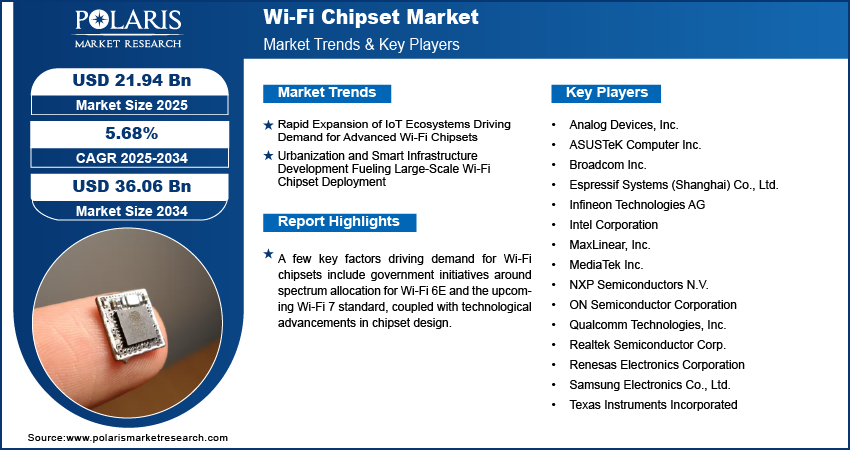

The global Wi-Fi chipset market size was valued at USD 20.79 billion in 2024, growing at a CAGR of 5.68% from 2025 to 2034. Key factors driving demand for Wi-Fi chipset include the rapid expansion of IoT ecosystems, coupled with urbanization and smart infrastructure development.

Key Insights

- The Wi-Fi 6 and 6E segment dominated the market share in 2024.

- The IoT devices segment is projected to grow at a rapid pace in the coming years, due to the rapid adoption of smart home systems, connected healthcare devices, and industrial IoT solutions.

- The Asia Pacific Wi-Fi chipset market dominated the global market share in 2024.

- India Wi-Fi chipset market is growing, due to the expanding digital infrastructure, smart city development, and increasing smartphone affordability.

- The market in North America is projected to grow at a fast pace from 2025-2034, attributed to the growing investments in aerospace and defense connectivity applications.

- The market in the U.S. is growing rapidly, attributed to the rapid adoption of smart home ecosystems, connected appliances, and entertainment devices

Industry Dynamics

- Rapid expansion of IoT ecosystems is driving demand for advanced Wi-Fi chipsets. Connected devices in healthcare, automotive, and industrial automation require seamless connectivity, high data throughput, and low latency to function effectively.

- Urbanization and smart infrastructure development are fueling large-scale Wi-Fi chipset deployment. Governments and enterprises are investing in smart cities, intelligent transportation, and digital public services that rely on high-performance wireless networks.

- Integration of AI-driven network optimization in Wi-Fi chipsets is creating new opportunities. These advancements enable intelligent traffic management, interference reduction, and predictive maintenance across enterprise and consumer applications.

- Rising chipset manufacturing costs are restraining the market growth. Complex design requirements, spectrum integration, and high R&D investments are elevating expenses, restricting adoption in cost-sensitive consumer electronics and IoT markets.

Market Statistics

- 2024 Market Size: USD 20.79 Billion

- 2034 Projected Market Size: USD 36.06 Billion

- CAGR (2025–2034): 5.68%

- Asia Pacific: Largest Market Share

AI Impact on Wi-Fi Chipset Market

- AI optimizes network traffic intelligently, dynamically allocating bandwidth to prevent congestion and ensure stable, high-speed connections for all devices.

- It enables predictive maintenance and self-healing, identifying and resolving potential Wi-Fi issues automatically before user’s experience disruptions.

- AI enhances security by analyzing network behavior in real-time to detect and quarantine unusual activity, like intrusions or attacks.

- It powers advanced location-based services, using Wi-Fi signals for precise indoor positioning and analytics in smart buildings and retail.

The Wi-Fi chipset market comprises advanced semiconductor solutions designed to deliver high-speed connectivity, seamless integration, and reliable performance across a wide spectrum of consumer and industrial applications. Widely utilized in smartphones, laptops, smart home devices, automotive systems, and industrial IoT, Wi-Fi chipsets enable robust wireless communication, efficient data transfer, and enhanced user experiences. Growing advancements in chipset architecture, multi-band support, and low-power designs are driving improvements in speed, latency, and energy efficiency, supporting the adoption of next-generation wireless standards. These chipsets provide secure connectivity, greater device compatibility, and optimized performance in high-density environments, contributing to enhanced digital infrastructure, expanding IoT ecosystems, and scalable smart technology deployments.

Government initiatives around spectrum allocation for Wi-Fi 6E and the upcoming Wi-Fi 7 standard are boosting the growth of the Wi-Fi chipset market. Regulatory authorities are actively expanding spectrum availability to improve connectivity, enhance network efficiency, and address the rising demand for high-speed internet across residential, enterprise, and industrial sectors. These developments are pushing chipset manufacturers to innovate solutions that support higher bandwidth, lower latency, and more reliable performance, driving broader adoption of next-generation Wi-Fi technologies across consumer electronics, automotive, and IoT ecosystems.

Technological advancements in chipset design, enabling faster, smarter, and more energy-efficient wireless communication, are further propelling market growth. For instance, in January 2025, Australian startup Morse Micro introduced a groundbreaking Wi-Fi HaLow microprocessor, recognized as the smallest, fastest, and lowest-power Wi-Fi chip with an extended range of up to 1 km. This innovation allows seamless machine-to-machine communication with exceptional energy efficiency, making it ideal for IoT applications such as smart agriculture, utilities monitoring, logistics, and industrial automation. These advancements highlight the growing role of Wi-Fi chipsets in powering robust IoT connectivity and expanding the scope of smart technology deployments worldwide.

Drivers & Opportunities

Rapid Expansion of IoT Ecosystems Driving Demand for Advanced Wi-Fi Chipsets: The accelerating adoption of Internet of Things (IoT) technology across smart homes, healthcare, industrial automation, and connected consumer electronics is fueling the demand for embedded Wi-Fi chipsets. These chipsets are crucial in enabling seamless connectivity, supporting applications ranging from wearable health devices and remote monitoring systems to smart appliances and industrial robotics. According to a recent report by GSMA, global IoT connections are projected to surpass 23 billion by 2025, compared to 15.1 billion in 2021. This surge in connected devices is driving the need for high-performance, low-power Wi-Fi chipsets capable of handling diverse data requirements while ensuring security, efficiency, and reliability. The rapid growth of IoT ecosystems is expanding the adoption of Wi-Fi chipsets, making them a crucial component in next-generation connectivity solutions.

Urbanization and Smart Infrastructure Development Fueling Large-Scale Wi-Fi Chipset Deployment: The rising global urbanization, coupled with growing smart cities, connected transportation networks, and public Wi-Fi infrastructure, is further propelling investments in advanced Wi-Fi chipsets. These chipsets are essential to enable high-speed, low-latency, and scalable connectivity across urban ecosystems that rely heavily on digital technologies for governance, transportation, and citizen services. According to the United Nations, global urbanization is expected to add nearly 2.5 billion people to cities by 2050, significantly increasing the demand for connected infrastructure. This accelerating shift toward smart urban infrastructure highlights the growing importance of chipset innovation in meeting the connectivity needs of rapidly urbanizing economies.

Segmental Insights

By Standard

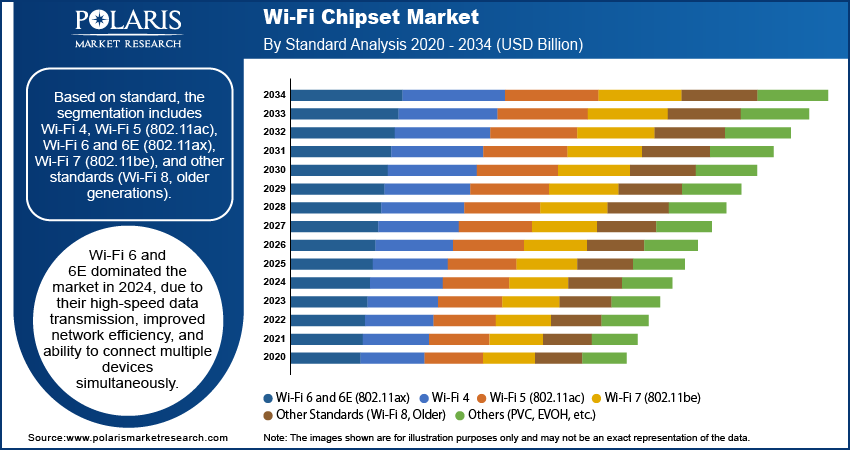

Based on standard, the Wi-Fi chipset market is segmented into Wi-Fi 4, Wi-Fi 5 (802.11ac), Wi-Fi 6 and 6E (802.11ax), Wi-Fi 7 (802.11be), and other standards (Wi-Fi 8, older generations). Wi-Fi 6 and 6E dominated the market in 2024, due to their high-speed data transmission, improved network efficiency, and ability to connect multiple devices simultaneously. These chipsets are widely adopted in consumer electronics, enterprise networking, and IoT ecosystems.

Wi-Fi 7 is expected to register the fastest growth during the forecast period, driven by its advanced features such as multi-link operation, higher throughput, and ultra-low latency that are crucial for immersive applications including AR/VR, cloud gaming, and next-generation industrial automation.

By MIMO Configuration

Based on MIMO configuration, the Wi-Fi chipset market is segmented into MU-MIMO and SU-MIMO. MU-MIMO accounted for the largest share in 2024, propelled by its capability to simultaneously transmit data to multiple devices, improving overall network efficiency and user experience. The technology delivers higher throughput, reduced latency, and enhanced spectrum utilization, making it essential for environments with high device density, such as enterprise networks, smart homes, and public Wi-Fi hotspots.

SU-MIMO is projected to witness steady growth during the forecast period, driven by its effectiveness in single-user scenarios where stable, high-speed connections are prioritized. SU-MIMO remains a preferred choice in applications requiring consistent performance for individual devices, including home networking, gaming, and streaming. Its lower implementation complexity and ability to deliver strong point-to-point connectivity make it an important option for consumer and enterprise markets seeking reliable wireless performance.

By Application

Based on application, the Wi-Fi chipset market is segmented into smartphones, tablets, desktops, laptops, Wi-Fi routers and broadband gateways, TVs, IoT devices, infotainment systems (automotive), and other device applications. The smartphones segment dominated in 2024, owing to the rising consumer preference for high-speed mobile connectivity, streaming services, and cloud-based applications. The integration of advanced Wi-Fi chipsets ensures faster downloads, reduced latency, and enhanced user experience.

IoT devices are projected to witness the fastest growth, supported by the rapid adoption of smart home systems, connected healthcare devices, and industrial IoT solutions. The increasing need for power-efficient chipsets capable of managing massive device-to-device communication is boosting their adoption across connected ecosystems.

By End-User

Based on end-user, the Wi-Fi chipset market is segmented into consumer electronics, telecommunication, healthcare, automotive, and other end-users. Consumer electronics accounted for the largest share in 2024, driven by surging adoption of smartphones, laptops, tablets, and smart home devices. The growing penetration of high-speed internet, increasing integration of Wi-Fi 6/6E technologies, and the shift toward connected living are accelerating the demand for advanced Wi-Fi chipsets in consumer applications.

The telecommunication sector is expected to witness substantial growth during the forecast period, driven by expanding 5G infrastructure, rising demand for fiber-to-the-home (FTTH) deployments, and the integration of Wi-Fi 7 technology into broadband gateways and access points. Wi-Fi chipsets are enabling telecom operators to enhance coverage, increase network capacity, and deliver seamless indoor and outdoor connectivity for businesses and households.

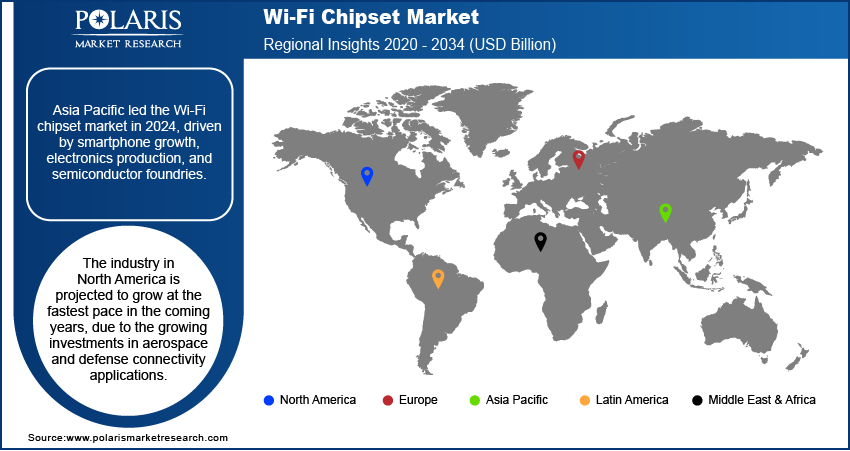

Regional Analysis

The Asia Pacific Wi-Fi chipset market accounted for the largest share in 2024, fueled by rapid smartphone penetration, high-volume consumer electronics production, and the strong presence of semiconductor foundries in countries such as China, South Korea, and Taiwan. Local OEMs are driving significant demand for low-cost chipsets in price-sensitive markets across Southeast Asia and India. The expanding 5G ecosystem, coupled with rising deployment of Wi-Fi 6 and 6E in broadband and enterprise applications, is accelerating growth across the region. Increasing focus on localized semiconductor manufacturing and government-backed digital infrastructure initiatives is further propelling the market growth.

India Wi-Fi Chipset Market Outlook

India is projected to record the fastest growth in the Asia Pacific, driven by expanding digital infrastructure, smart city development, and increasing smartphone affordability. According to the International Trade Administration (ITA) India Country Commercial Guide 2024 report, India’s digital economy is expected to approach about USD 1 trillion valuation in the coming years, fueled by widespread connectivity initiatives and improved network capacity. This strong growth is pushing chipset suppliers to expand partnerships with local manufacturers to meet the rising demand for affordable Wi-Fi solutions.

North America Wi-Fi Chipset Market Overview

North America is projected to grow at a fast pace from 2025–2034, attributed to the strong demand for enterprise-grade Wi-Fi solutions catering to hybrid and remote work models. Growing investments in aerospace and defense connectivity applications are further increasing the demand for advanced chipsets designed for mission-critical communications. The region benefits from the robust R&D capabilities of global chipset leaders and increasing adoption of Wi-Fi 6/6E-enabled routers and gateways.

U.S. Wi-Fi Chipset Market Insights

The U.S. dominates the North American market, owing to the rapid adoption of smart home ecosystems, connected appliances, and entertainment devices. Leading technology companies are accelerating the integration of Wi-Fi 7 in next-generation routers and consumer electronics to improve bandwidth efficiency. According to the Association for Smart Home Professionals, the U.S. smart home market was valued at nearly USD 29 billion in 2024. This expanding ecosystem is boosting the demand for high-performance chipsets across consumer and enterprise applications.

Europe Wi-Fi Chipset Market Trends

Europe is experiencing steady adoption of advanced Wi-Fi chipsets, driven by the rising demand for public Wi-Fi networks in airports, train stations, hotels, and tourism-centric economies. Industrial IoT and factory automation in Germany, France, and the Nordic countries are accelerating the deployment of high-performance Wi-Fi solutions. Supportive regulatory frameworks for smart city projects and emphasis on connected infrastructure are creating new opportunities for chipset vendors. Growing investments in automotive infotainment systems and connected vehicles across the EU are further driving market expansion.

Key Players & Competitive Analysis

The global Wi-Fi chipset market is highly competitive, with key players such as Analog Devices, Inc., ASUSTeK Computer Inc., and Broadcom Inc. spearheading innovation in wireless connectivity solutions. Analog Devices, Inc. focuses on integrating Wi-Fi chipsets with advanced IoT and industrial automation applications, enabling reliable connectivity across mission-critical environments. ASUSTeK Computer Inc. leverages its expertise in networking hardware and consumer devices to design high-performance Wi-Fi chipsets for routers, PCs, and smart devices. Broadcom Inc. maintains a strong presence through its cutting-edge Wi-Fi 6 and Wi-Fi 7 chipsets that deliver superior speed, efficiency, and network coverage for enterprise and consumer markets.

The market is witnessing the accelerating adoption of next-generation Wi-Fi technologies, including Wi-Fi 6E and Wi-Fi 7, driven by growing demand for faster connectivity, low latency, and higher device density. Companies are investing in chipsets that support multi-gigabit speeds, extended spectrum utilization, and improved energy efficiency to address the requirements of smartphones, laptops, smart home devices, and industrial IoT applications. Strategic collaborations with consumer electronics manufacturers, telecom operators, and cloud service providers are expanding market reach, while continuous R&D investments are advancing chipset capabilities in areas such as AI-powered connectivity optimization, integrated security, and compatibility with emerging wireless standards.

Prominent companies operating in the Wi-Fi chipset market include Analog Devices, Inc., ASUSTeK Computer Inc., Broadcom Inc., Espressif Systems (Shanghai) Co., Ltd., Infineon Technologies AG, Intel Corporation, MaxLinear, Inc., MediaTek Inc., NXP Semiconductors N.V., ON Semiconductor Corporation, Qualcomm Technologies, Inc., Realtek Semiconductor Corp., Renesas Electronics Corporation, Samsung Electronics Co., Ltd., and Texas Instruments Incorporated.

Key Players

- Analog Devices, Inc.

- ASUSTeK Computer Inc.

- Broadcom Inc.

- Espressif Systems (Shanghai) Co., Ltd.

- Infineon Technologies AG

- Intel Corporation

- MaxLinear, Inc.

- MediaTek Inc.

- NXP Semiconductors N.V.

- ON Semiconductor Corporation

- Qualcomm Technologies, Inc.

- Realtek Semiconductor Corp.

- Renesas Electronics Corporation

- Samsung Electronics Co., Ltd.

- Texas Instruments Incorporated

Wi-Fi Chipset Industry Developments

In April 2025, Synaptics expanded its Veros wireless portfolio with its first Wi-Fi 7 system-on-chip (SoC) lineup comprising the SYN4390 and SYN4384. These triple-combo SoCs integrate Wi-Fi 7, Bluetooth 6.0, and Zigbee/Thread connectivity, delivering up to 5.8 Gbps peak speed, ultra-low latency, and support for the Matter protocol.

In October 2024, Microchip Technology launched over 20 new Wi-Fi products tailored for industrial and commercial applications. The enhanced portfolio includes Wi-Fi microcontrollers (MCUs), network and link controllers, and plug-and-play modules, all designed for deployment in demanding environments featuring high thermal, noise, and signal-interference resilience, enhanced security via pre-provisioned cloud authentication, and simplified, developer-friendly integration.

Wi-Fi Chipset Market Segmentation

By Standard Outlook (Revenue, USD Billion, 2020–2034)

- Wi-Fi 4

- Wi-Fi 5 (802.11ac)

- Wi-Fi 6 and 6E (802.11ax)

- Wi-Fi 7 (802.11be)

- Other Standards (Wi-Fi 8, Older)

By MIMO Configuration Outlook (Revenue, USD Billion, 2020–2034)

- MU-MIMO

- SU-MIMO

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Smartphones

- Tablets

- Desktops

- Laptops

- Wi-Fi Router and Broadband Gateway

- TV

- Infotainment Systems

- Other Applications

By End-User Outlook (Revenue, USD Billion, 2020–2034)

- Consumer Electronics

- Telecommunication

- Healthcare

- Automotive

- Other End-Users

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Wi-Fi Chipset Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 20.79 Billion |

|

Market Size in 2025 |

USD 21.94 Billion |

|

Revenue Forecast by 2034 |

USD 36.06 Billion |

|

CAGR |

5.68% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 20.79 billion in 2024 and is projected to grow to USD 36.06 billion by 2034.

The global market is projected to register a CAGR of 5.68% during the forecast period.

Asia Pacific dominated the market in 2024.

A few of the key players in the market are Analog Devices, Inc., ASUSTeK Computer Inc., Broadcom Inc., Espressif Systems (Shanghai) Co., Ltd., Infineon Technologies AG, Intel Corporation, MaxLinear, Inc., MediaTek Inc., NXP Semiconductors N.V., ON Semiconductor Corporation, Qualcomm Technologies, Inc., Realtek Semiconductor Corp., Renesas Electronics Corporation, Samsung Electronics Co., Ltd., and Texas Instruments Incorporated.

The Wi-Fi 6 and 6E segment dominated the market revenue share in 2024, due to its high-speed data transmission, improved network efficiency, and ability to connect multiple devices simultaneously.

The SU-MIMO segment is projected to witness the fastest growth during the forecast period, driven by its effectiveness in single-user scenarios where stable, high-speed connections are prioritized.