Window Lift Motors Market Size, Share, Trends, Industry Analysis Report

: By Vehicle Type (Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles), Voltage, Position, Type, Sales Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 115

- Format: PDF

- Report ID: PM5122

- Base Year: 2023

- Historical Data: 2019-2022

Window Lift Motors Market Overview

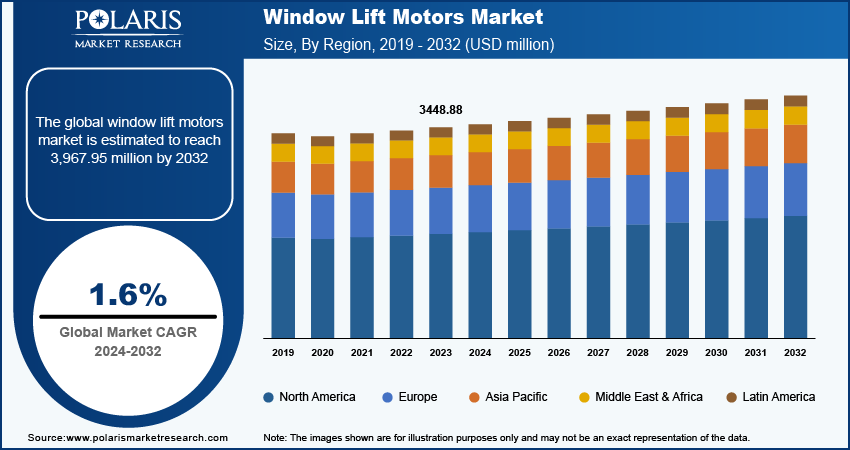

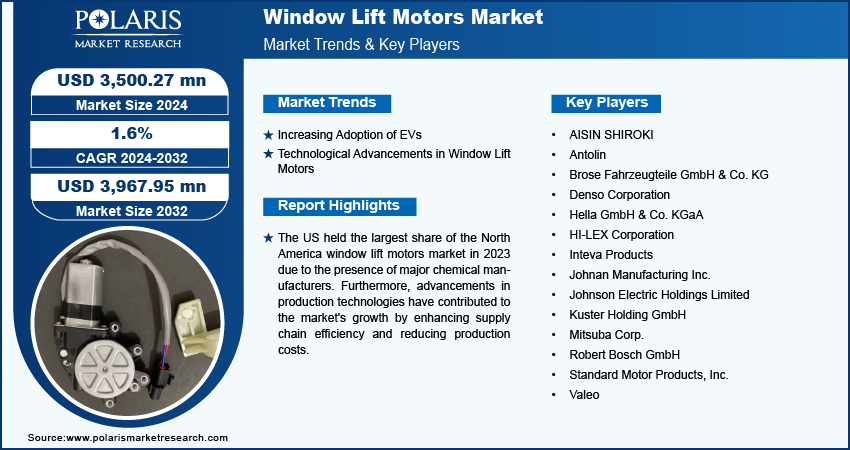

The global window lift motors market size was valued at USD 3,448.88 million in 2023. The market is projected to grow from USD 3,500.27 million in 2024 to USD 3,967.95 million by 2032, exhibiting a CAGR of 1.6% during 2024–2032.

Window lift motors, also known as power window motors, are electric motors that control the movement of car windows. These motors are part of the vehicle's power window system, allowing windows to be raised or lowered automatically with the push of a button rather than using manual cranks. Nowadays, consumers expect higher levels of comfort in vehicles. Additionally, rising disposable incomes in regions such as Asia Pacific and Latin America are allowing more consumers to afford vehicles with advanced features. As a result, the demand for vehicles equipped with window lift motors is increasing, which is contributing to the market growth.

To Understand More About this Research: Request a Free Sample Report

The increasing urbanization is leading more people to use personal vehicles for commuting and transportation. Hence, higher vehicle ownership leads to an increased demand for window lift motors. Moreover, the aftermarket automotive sector is experiencing a significant increase in demand for vehicle customization, particularly in the area of power window system upgrades. There is a growing trend among consumers to retrofit older vehicles with window lift motors, which is driving market expansion.

Window Lift Motors Market Trends

Increasing Adoption of EVs

Electric vehicles (EVs) are designed with advanced electronic systems that prioritize energy efficiency, user convenience, and enhanced vehicle performance. Window lift motors ensure the smooth operation of power windows and also optimize the overall energy consumption of the vehicle. As a result, the demand for such innovative motor technologies is increasing as automakers strive to strike a balance between vehicle performance, energy efficiency, and the comfort features that consumers expect from modern EVs. According to the International Energy Agency, in 2023, electric car sales reached 14 million, in which China, the US, and Europe accounted for 95% of the total sales. Thus, the increasing adoption of EVs accelerates the demand for efficient, lightweight window lift motors.

Technological Advancements in Window Lift Motors

Innovations in motor technologies are playing a crucial role in the growth of the window lift motors market. The development of more energy-efficient and compact window lift motors has transformed the automotive industry by addressing the need for performance and sustainability. These advancements are particularly important in hybrid and electric vehicles, where reducing energy consumption is critical. The new generation of motors is designed to use less power while delivering the same or better performance, allowing automakers to enhance vehicle range and efficiency. Furthermore, compact designs save valuable space within the vehicle's door structure, allowing for more flexibility in vehicle design and manufacturing. Noise reduction is a key factor in the appeal of modern vehicles, especially luxury and electric models, and is further contributing to the growth of the window lift motors market.

Window Lift Motors Market Segment Insights

Window Lift Motors Market Breakdown, by Vehicle Type Insights

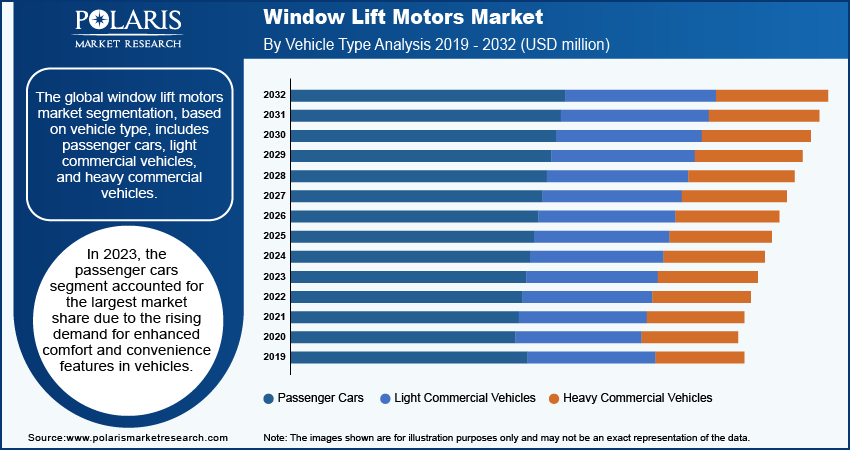

The global window lift motors market segmentation, based on vehicle type, includes passenger cars, light commercial vehicles, and heavy commercial vehicles. In 2023, the passenger cars segment accounted for the largest market share due to the rising demand for enhanced comfort and convenience features in vehicles. With the increasing consumer preference for automation in vehicle functionalities, window lift motors have become standard components in most passenger cars. The growing automotive industry, particularly in emerging economies, has fueled vehicle production, further driving the adoption of window lift motors. Additionally, the integration of advanced technologies such as power windows and smart glass in modern cars has amplified the demand for these motors, contributing to the segment's dominance in the market.

Window Lift Motors Market Breakdown, by Voltage Insights

The global window lift motors market segmentation, based on voltage, includes 12V and 24V. The 12V segment is expected to register a higher CAGR during the forecast period due to its widespread application in various automotive systems and its suitability for small to medium-sized vehicles. Additionally, the 12V configuration is widely favored in electric and hybrid vehicles, which are seeing rapid growth as the automotive industry shifts toward electrification. The increasing adoption of 12V systems in passenger and commercial vehicles, driven by the need for improved energy efficiency and performance, is propelling the window lift motors market growth for the 12V segment.

Regional Insights

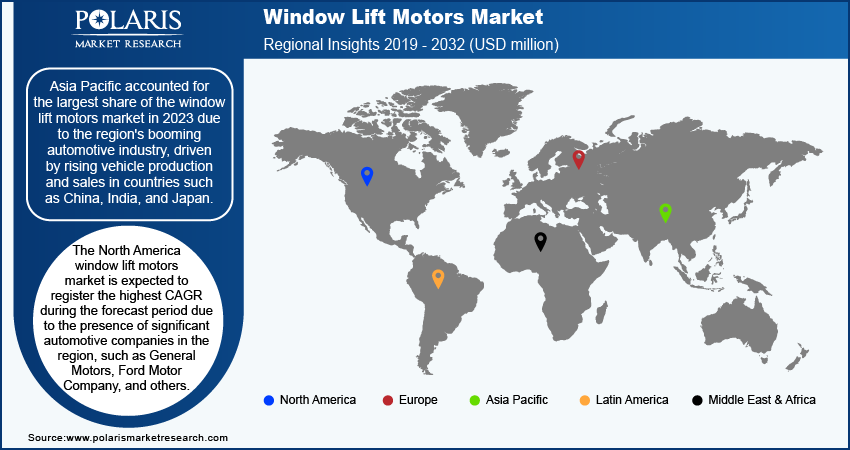

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific accounted for the largest share of the window lift motors market in 2023 due to the region's booming automotive industry, driven by rising vehicle production and sales in countries such as China, India, and Japan. Increasing urbanization, rising disposable incomes, and a growing middle-class population have led to higher demand for passenger vehicles, which, in turn, has fueled the need for window lift motors. Additionally, the rapid adoption of advanced vehicle technologies, including power windows and other comfort features, has accelerated market growth in the region.

China held the largest share of the Asia Pacific window lift motors market in 2023 due to their push toward electric vehicles (EVs) and rising advancements in automotive technology, which are driving the integration of power windows and automated systems in traditional and electric vehicles. Chinese automakers currently account for 21% of global passenger vehicle production. Moreover, the share is projected to increase to 33% by 2030. In 2022, they manufactured 62% of the world's electric vehicles (EVs) and were responsible for 77% of the production of EV batteries. Thus, the dominating presence of China in EV manufacturing has led to the adoption of window lift motors, thereby contributing to the market growth in the country.

The North America window lift motors market is expected to register the highest CAGR during the forecast period due to the presence of significant automotive industry players in the region, such as General Motors, Ford Motor Company, and others. These automakers are increasing their production in response to rising consumer demand for advanced vehicle features, including automated window systems, which are becoming standard in new models. Additionally, the ongoing shift toward electric vehicles is fueling the market growth, as EVs typically require high-performance window lift motors to support their advanced functionalities. Furthermore, the aftermarket segment is gaining momentum as the aging vehicle fleet necessitates the replacement of worn-out components, including window lift motors, contributing to the expansion of the window lift motors market in the region.

The US window lift motors market is expected to record the highest CAGR during the forecast period due to the significant investments in research and development by the US automotive industries, which are aimed at enhancing motor technology, improving efficiency, and incorporating smart features. For instance, in 2021, according to the Motor & Equipment Manufacturers Association, the total foreign direct investment in the US automotive industry reached USD 143.3 billion in 2019.

Window Lift Motors Market – Key Players & Competitive Insights

The competitive landscape of the window lift motors market is characterized by a mix of established automotive manufacturers and specialized component suppliers, all competing for market share amid evolving industry trends. Key players in the market include automotive giants such as Bosch, Denso Corporation, Valeo, and Magna International, which provide a wide range of window lift motors and related systems. These companies leverage their extensive R&D capabilities to innovate and improve the efficiency and reliability of their products, often integrating advanced technologies such as smart sensors and connectivity features.

Regional players and emerging companies are making significant strides in the market, focusing on niche segments or offering customized solutions to meet customer needs. The competitive landscape is further influenced by collaborations and partnerships between automotive manufacturers and component suppliers aimed at enhancing product offerings and expanding market reach. Price competition is a notable aspect of this landscape, as manufacturers strive to balance quality and cost-effectiveness. Moreover, the increasing shift toward electric vehicles is prompting many companies to invest in the development of lightweight and energy-efficient window lift motors that align with the sustainability goals of the automotive industry. Major market players are AISIN SHIROKI; Antolin; Brose Fahrzeugteile GmbH & Co. KG; Denso Corporation; Hella GmbH & Co. KGaA; HI-LEX Corporation; Inteva Products; Johnan Manufacturing Inc.; Johnson Electric Holdings Limited; Kuster Holding GmbH; Mitsuba Corp.; Robert Bosch GmbH; Standard Motor Products, Inc.; and Valeo.

DENSO Corporation is engaged in the sales and manufacturing of automotive parts worldwide. The company's product line includes a wide range of air-conditioning systems such as heat pump air-conditioning systems, thermal management heat pump systems, refrigerant products, air quality systems, personal heating and cooling devices, bus air-conditioning systems, heat exchangers, automotive freezers, and cooling products. Additionally, DENSO offers ventilation, heating, and air-conditioning units. In February 2024, Betterfrost partnered with DENSO and the Ontario Vehicle Innovation Network to enhance the range of electric vehicles (EVs).

Johnson Electric Holdings Limited is a global player engaged in the manufacturing and distribution of motion systems. The company's product line includes synchronous, shaded pole, and universal motors, headlamp, coolant and refrigerant valves, grill shutter actuators, HVAC, automotive switches and subsystems, eco blowers and fans, automotive cooling fan motors, factory and delivery bikes, automotive compact, industry compact DC motors, edrives, and automotive and industry EC motors.

Key Companies in Window Lift Motors Market

- AISIN SHIROKI

- Antolin

- Brose Fahrzeugteile GmbH & Co. KG

- Denso Corporation

- Hella GmbH & Co. KGaA

- HI-LEX Corporation

- Inteva Products

- Johnan Manufacturing Inc.

- Johnson Electric Holdings Limited

- Kuster Holding GmbH

- Mitsuba Corp.

- Robert Bosch GmbH

- Standard Motor Products, Inc.

- Valeo

Window Lift Motors Industry Developments

In February 2024, STMicroelectronics launched the AEK-MOT-WINH92 evaluation board for controlling DC motors in car window lifters.

In January 2024, Han Yale Ind. Co., Ltd. revealed its plans to unveil an innovative smart window lift motor and window regulator at the upcoming AAPEX event.

Window Lift Motors Market Segmentation

By Voltage Outlook (Revenue – USD million, 2019–2032)

- 12V

- 24V

By Vehicle Type Outlook (Revenue – USD million, 2019–2032)

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Position Outlook (Revenue – USD million, 2019–2032)

- Front Windows

- Rare Windows

By Type Outlook (Revenue – USD million, 2019–2032)

- Arm Type

- Single Rail Cable

- Double Rail Cable

By Sales Channel Outlook (Revenue – USD million, 2019–2032)

- OEM

- Aftermarket

By Regional Outlook (Revenue – USD million, 2019–2032)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Window Lift Motors Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 3,448.88 million |

|

Market Size Value in 2024 |

USD 3,500.27 million |

|

Revenue Forecast by 2032 |

USD 3,967.95 million |

|

CAGR |

1.6% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global window lift motors market size was valued at USD 3,448.88 million in 2023 and is projected to grow to USD 3,967.95 million by 2032.

The global market is projected to register a CAGR of 1.6% during the forecast period.

Asia Pacific accounted for the largest share of the global market in 2023 due to the region's booming automotive industry, driven by rising vehicle production and sales in countries such as China, India, and Japan.

A few key players in the market are AISIN SHIROKI, Antolin, Brose Fahrzeugteile GmbH & Co. KG, Denso Corporation, Hella GmbH & Co. KGaA, HI-LEX Corporation, Inteva Products, Johnan Manufacturing Inc., Johnson Electric Holdings Limited, Kuster Holding GmbH, Mitsuba Corp., Robert Bosch GmbH, Standard Motor Products, Inc., and Valeo.

The passenger cars segment dominated the market in 2023 due to the rising demand for enhanced comfort and convenience features in vehicles.

The 12V segment is expected to register a higher CAGR during the forecast period due to its widespread application in various automotive systems and its suitability for small to medium-sized vehicles.