Wireless Broadband in Public Safety Market Share, Size, Trends, Industry Analysis Report

By Offering (Hardware, Software, And Service); By System; By Application; By End-Use And By Region; Segment Forecast, 2024- 2032

- Published Date:May-2024

- Pages: 119

- Format: PDF

- Report ID: PM4911

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

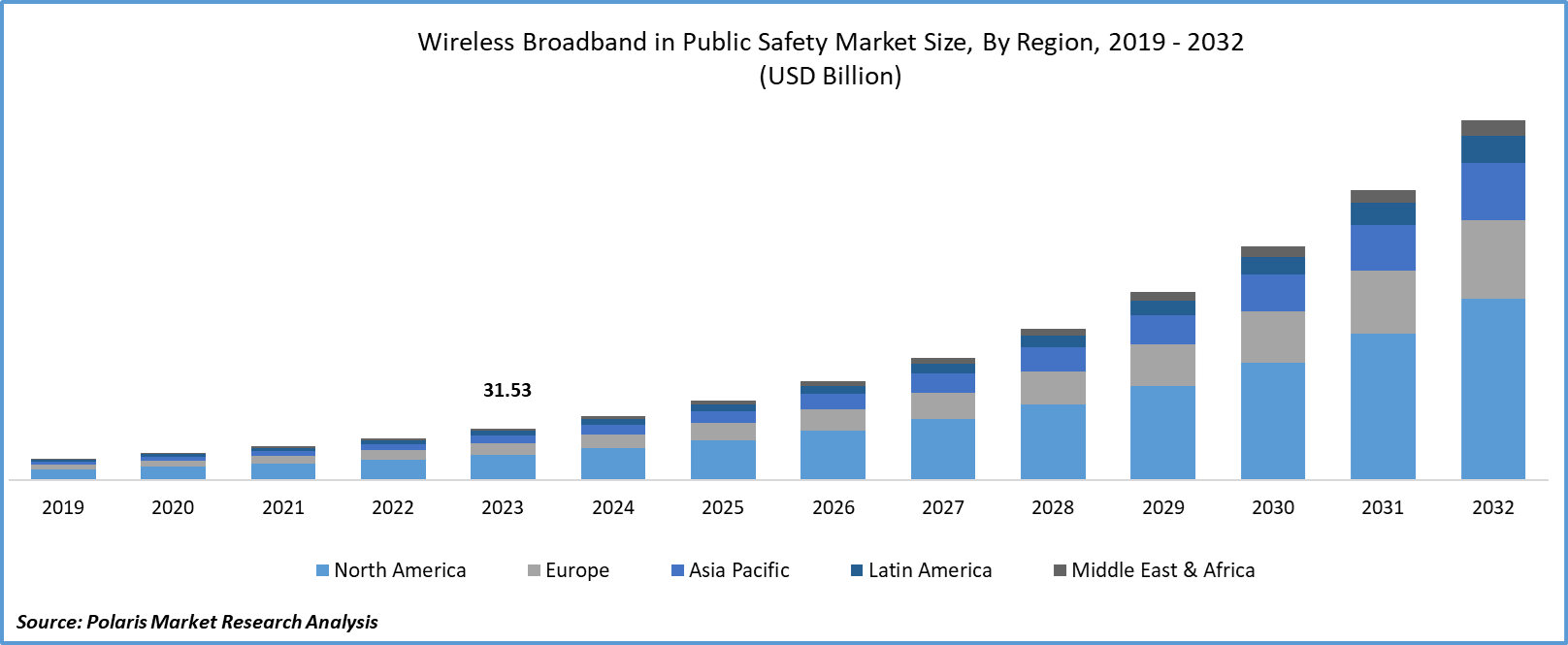

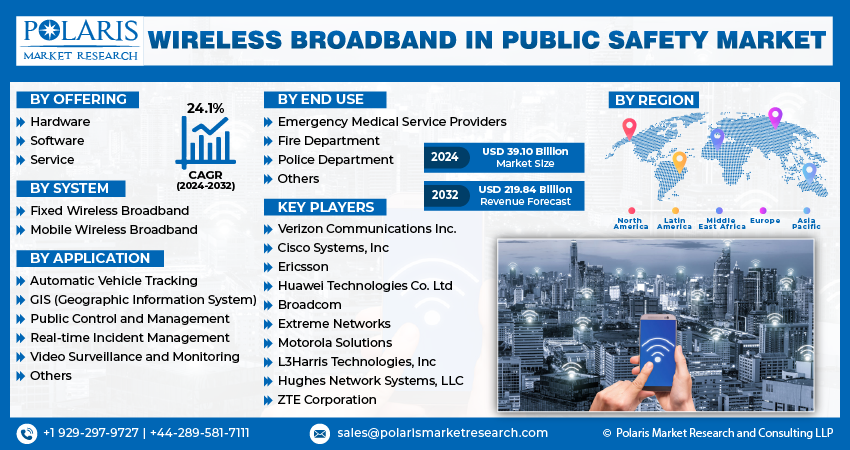

The wireless broadband in public safety market size was valued at USD 31.53 billion in 2023. The market is anticipated to grow from USD 39.10 billion in 2024 to USD 219.84 billion by 2032, exhibiting a CAGR of 24.1% during the forecast period.

Industry Trend

In public safety, wireless broadband is a cutting-edge communication solution aimed at enhancing the effectiveness and efficiency of public safety and emergency response organizations. This specialized technology enables first responders, law enforcement, and other emergency personnel to establish reliable connections and swiftly transmit data in the field.

The primary goal of wireless broadband in public safety is to establish a robust communication infrastructure capable of facilitating real-time information exchange during emergencies, including natural disasters, accidents, or threats to national security. Integrating various wireless communication standards like LTE (Long-Term Evolution) and forthcoming 5G networks, this technology ensures high data throughput and minimal latency.

To Understand More About this Research: Request a Free Sample Report

One of the key advantages of wireless broadband in public safety is the provision of prioritized and dedicated network access for public safety agencies, ensuring critical communications receive precedence during emergencies. This technology enables seamless transmission of data, voice, and video, supporting multimedia applications and enhancing responders' situational awareness, aiding in quick decision-making.

An escalating demand for real-time data and video underscores the importance of LTE and 5G networks, which offer superior bandwidth and lower latency compared to previous generations of wireless technology. Furthermore, public safety agencies are increasingly integrating their communication networks onto a unified platform, driven by the need for enhanced efficiency and interoperability. This convergence facilitates more effective collaboration between public safety organizations and facilitates data sharing, ultimately bolstering emergency response capabilities.

The landscape of wireless broadband in public safety is evolving rapidly, influenced by emerging trends such as the adoption of 5G technologies and mission-critical communication solutions. These trends underscore a commitment to leveraging innovation for more efficient emergency response systems, enhancing resilience and connectivity.

- For instance, in October 2024, Ericsson has Launched a software toolkit designed to bolster the capabilities of 5G Standalone networks while facilitating premium services with distinct connectivity features. This portfolio upgrade responds to the increasing demands on network capacity and performance spurred by the growth of new use cases and heightened expectations for the quality of the 5G experience among mobile users.

Key Takeaway

- North America dominated the largest market and contributed to more than 38% of the share in 2023.

- The Asia Pacific market is expected to be the fastest-growing CAGR during the forecast period.

- By offering, the service segment accounted for the largest market share in 2023.

- By end-use category, the video surveillance and monitoring segment is projected to grow at a fastest CAGR during the projected period.

What are the market drivers driving the demand for the wireless broadband in public safety market?

Rising Public Expectations have been projected to spur market demand.

Rising public expectations in the context of emergency response are driven by an increasing awareness of the potential risks and impacts of emergencies and disasters. As individuals become more informed about the various threats that could affect their communities, there is a growing expectation for public safety agencies to deliver rapid and effective responses when crises occur.

Wireless broadband technologies play a crucial role in meeting these heightened expectations by enabling faster communication, more efficient coordination, and enhanced situational awareness among emergency responders. In times of crisis, every second counts, and the ability to quickly transmit vital information can make a significant difference in mitigating the impact of an emergency. With wireless broadband, emergency responders can access real-time data, including maps, live video feeds, and sensor information, allowing them to make more informed decisions and respond more effectively to evolving situations. This level of connectivity facilitates seamless communication between different agencies and personnel involved in the response efforts, ensuring a coordinated and cohesive approach to emergency management.

Moreover, the public increasingly expects transparency and accountability from public safety agencies, particularly in the age of social media and instant communication. Wireless broadband technologies enable agencies to provide timely updates and information to the public, fostering trust and confidence in their ability to handle emergencies competently.

Which factor is restraining the demand for wireless broadband in public safety?

The issue of funding constraints and budget limitations faced by public safety agencies are expected to hinder the growth of the market.

Deploying and maintaining wireless broadband networks, especially those equipped with the latest technologies like LTE and 5G, requires significant financial investment. Public safety agencies often operate within tight budgetary constraints, and allocating resources for infrastructure upgrades and ongoing operational costs can be challenging. Additionally, the prioritization of funds for other essential needs, such as personnel, equipment, and training, may limit the available budget for investing in wireless broadband solutions. Furthermore, the cost of implementing and maintaining wireless broadband networks may vary depending on factors such as geographic coverage, population density, and the scale of the deployment. Rural areas, for example, may face higher costs due to the need for extensive infrastructure development to ensure adequate coverage.

Report Segmentation

The market is primarily segmented based on offering, system, application, end use and region.

|

By Offering |

By System |

By Application |

By End Use |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Offering Insights

Based on offering analysis, the market is segmented into hardware, software, and service. The service segment held the largest market in 2023. Public safety agencies often lack the resources, expertise, and infrastructure necessary to manage and maintain wireless broadband networks on their own. As a result, they rely on service providers to handle various aspects of network management, including installation, monitoring, troubleshooting, and maintenance. Service providers offer specialized skills and resources to ensure the smooth operation of wireless broadband networks, thereby allowing public safety agencies to focus on their core mission of emergency response.

Service providers typically offer subscription-based service models that allow public safety agencies to access wireless broadband networks on a pay-as-you-go basis. This subscription model eliminates the need for large upfront investments in infrastructure and equipment, making it more cost-effective for agencies with limited budgets. Additionally, subscription-based services offer flexibility and scalability, allowing agencies to scale their network usage up or down based on changing needs and priorities. By partnering with service providers, public safety agencies can benefit from end-to-end support throughout the lifecycle of their wireless broadband networks, ensuring reliability, performance, and security.

By Application Insights

Based on application analysis, the market has been segmented on the basis of automatic vehicle tracking, GIS (Geographic information system), public control and management, real-time incident management, video surveillance and monitoring, and others. The video surveillance and monitoring segment is anticipated to grow at the highest compound annual growth rate (CAGR) during the forecast period concerning the wireless broadband in public safety market. Public safety agencies are increasingly recognizing the value of video surveillance and monitoring as essential tools for enhancing situational awareness, crime prevention, and emergency response. Video footage provides valuable insights into incidents, enabling responders to assess threats, coordinate resources, and make informed decisions in real-time. As a result, there is a growing demand for video-based security solutions that leverage wireless broadband networks to transmit high-quality video streams securely and efficiently. Technological advancements in video surveillance and monitoring systems have significantly improved their capabilities and effectiveness. High-definition (HD) and ultra-high-definition (UHD) cameras, along with advanced analytics and artificial intelligence (AI) algorithms, enable agencies to capture, analyze, and act upon video data more effectively. Wireless broadband networks provide the bandwidth and reliability required to support these advanced video technologies, driving the adoption of video surveillance solutions in public safety applications.

Many cities and municipalities are investing in smart city initiatives aimed at enhancing public safety, urban management, and quality of life. Video surveillance plays a crucial role in smart city deployments, enabling authorities to monitor traffic, detect crimes, manage crowds, and respond to emergencies more effectively.

Regional Insights

North America region accounted for the largest market share in 2023. North America has been at the forefront of adopting advanced wireless technologies such as LTE (Long-Term Evolution) and 5G networks. These technologies offer higher bandwidth, lower latency, and improved reliability, making them well-suited for public safety applications. As a result, public safety agencies in North America have been quick to leverage these technologies to enhance their communication and response capabilities. North America has robust regulatory frameworks governing public safety communications, including mandates and standards that prioritize the use of wireless broadband networks for emergency response. Regulatory bodies such as the Federal Communications Commission (FCC) in the United States have implemented regulations to ensure that public safety agencies have access to reliable and interoperable communication systems. Compliance with these regulations has driven the adoption of wireless broadband solutions in the region.

Asia Pacific

Asia Pacific is expected for the growth of fastest CAGR during the forecast period. As urban areas expand, there is a growing need for advanced communication technologies, including wireless broadband, to support emergency response and disaster management efforts. Governments across the Asia Pacific region is prioritizing public safety and security, leading to significant investments in infrastructure and technology. Initiatives such as smart city development and digitalization projects include provisions for enhancing public safety through the deployment of wireless broadband networks. Government funding and support are driving the adoption of wireless broadband solutions in the region.

Competitive Landscape

The competitive landscape of the wireless broadband in public safety market is characterized by intense competition among key players. Major companies focus on innovation, strategic partnerships, and mergers to enhance their product offerings and expand their market. The companies compete based on factors such as product quality, pricing, reliability, and customer service. Additionally, regulatory compliance and adherence to industry standards play a crucial role in shaping the competitive dynamics of the market.

Some of the major players operating in the global market include:

- Verizon Communications Inc.

- Cisco Systems, Inc

- Ericsson

- Huawei Technologies Co. Ltd

- Broadcom

- Extreme Networks

- Motorola Solutions

- L3Harris Technologies, Inc

- Hughes Network Systems, LLC

- ZTE Corporation

Recent Developments

· In July 2023, Huawei launched its router, the Huawei Router 3B Pro, equipped with Wi-Fi-7 capabilities. The router comes with a unique feature that allows it to transfer a single file using both 2.4gHz and 5gHz channels simultaneously, resulting in faster transmission speeds. This feature is particularly useful in high-density areas with multiple devices, as it ensures an uninterrupted and stable connection.

· In December 2023, TDL Gentek and RADWIN have united their efforts to deliver high-quality wireless broadband solutions to Canada.

Report Coverage

The wireless broadband in public safety market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, offering, system, application, end use and their futuristic growth opportunities.

Wireless Broadband in Public Safety Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 39.10 Billion |

|

Revenue forecast in 2032 |

USD 219.84 Billion |

|

CAGR |

24.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Offering, By System, By Application, By End-Use, And By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global wireless broadband in public safety market size is expected to reach USD 219.84 billion by 2032

Key players in the market are Verizon Communications Inc., Cisco Systems, Inc., Ericsson, Huawei Technologies Co. Ltd, Broadcom, Extreme Networks

North America contribute notably towards the global Wireless Broadband in Public Safety Market

The wireless broadband in public safety market exhibiting a CAGR of 24.1% during the forecast period.

The Wireless Broadband in Public Safety Market report covering key segments are offering, system, application, end use and region.