Wrapping Machine Market Share, Size, Trends, Industry Analysis Report, By Mode of Operation (Automatic, Semi-automatic); By Machine Type; By Application; By Region; Segment Forecast, 2021 - 2028

- Published Date:Aug-2021

- Pages: 108

- Format: PDF

- Report ID: PM1938

- Base Year: 2020

- Historical Data: 2016-2019

Report Outlook

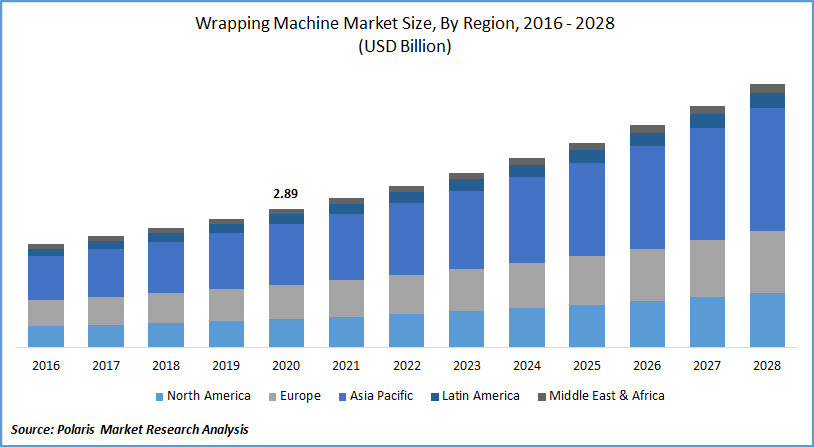

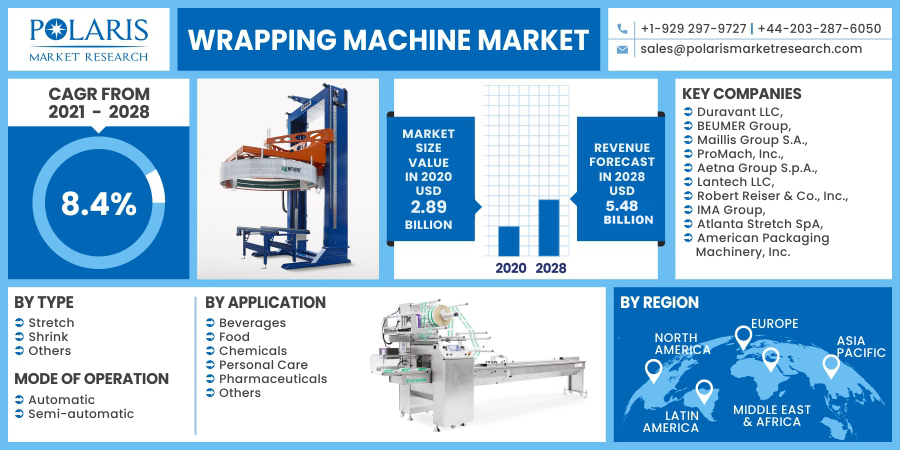

The global wrapping machine market was valued at USD 2.89 billion in 2020 and is expected to grow at a CAGR of 8.4% during the forecast period. The transportation of consumer and industrial goods to different locations requires secure and safe packaging, which is anticipated to enhance the market demand for wrapping machines.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The packaging market demand for wrapping machines is increasing as a result of the modernization trend, which involves delivering packaged products to customers' doorsteps. As a result, the market demand for wrapping machines is anticipated to widen. Furthermore, it plays a vital role in the manufacturing industry's products and in-built packaging processes.

Industry Dynamics

Growth Drivers

PLC control, or industrial computer control systems, are used in wrapping machines to track the acceleration of the wrapping process to make decisions based on the product's efficiency and productivity. Most producers are using machines to improve productivity and efficiency, which is driving overall growth.

With the rising demand for ready-to-eat foods, dairy goods, and other packaging materials, the food & beverage industry requires more effective packaging solutions, driving up the demand for the wrapping machine market over the forecast period.

The need for the machines to integrate with upstream production processes has resulted in developing automation techniques for the industry. OEE techniques are used in lean packaging operations to manage the packaging process. Because of the increased demand for packaged goods, lean manufacturing operations are now being widely used. Increased spending on branded goods and continued manufacture of medicines and drugs.

As a result, the production process improves. Furthermore, E-commerce companies in India, Indonesia, China, the United States, and elsewhere are introducing lean packaging operations, driving business growth.

For instance, in April 2020, VELTEKO launched two new vertical wrapping machines, namely - DOYPACK-360 and PRIME-360. DOYPACK-360 is a bag packing system for high-quality items developed by DOYPACK. DOYPACK-360 is the highest-performing DOYPACK bag shaping, packing, and closing machinery on the market. It has a sturdy body made of the finest quality materials and components, resulting in a high look and the smoothest DOYPACK bags on the market.

The PRIME-360, on the other hand, incorporates advanced VELTEKO technology to provide superior product packaging efficiency. To ensure high-quality packaging, the powerful machine makes use of high-quality materials and branded components. PRIME-360 is made in the United States.

Know more about this report: request for sample pages

Wrapping Machine Market Report Scope

The market is primarily segmented based on type, mode of operation, application, and region.

|

By Type |

Mode of Operation |

By Application |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Type

Based on type, the stretch segment held the largest market share in 2020. This type of wrapping is commonly used to keep loads and goods together on a pallet for transportation and storage. It can be used in a variety of specialty films. Colored stretch film, vented pallet wrap, UV stretch wrap, pre-stretched stretch film, anti-static stretch film, and so on are some examples.

This packaging is safe and durable, and it keeps products safe from dust and moisture. Furthermore, stretch wrapping equipment is less expensive than other types of wrapping. Therefore, it is gaining a lot of traction among manufacturers, which eventually supporting the segment’s growth.

On the other hand, shrink packaging is projected to grow at the highest CAGR in the given timeframe. This form of packaging is used to shield a product from any foreign material. It could also be used to wrap objects in a container. However, this is less famous in end-use industries. This type of wrap is commonly used to cover foods such as meats, cheese, and vegetables.

Insight by Mode of Operation

By 2028, the automatic mode of operation is anticipated to attain the majority of the market share due to the rising market demand for automation from various application industries. Automation in wrapping machines has many benefits, including reduced human interference, quicker packing, and effective wrapping of several items, improving overall efficiency.

Consumer packaged goods (CPG) manufacturers are increasingly focusing on increasing efficiency to gain a competitive edge, retain market share, and expand their customer base. Consequently, they are gradually turning to creative and sophisticated automated wrapping machines.

Insight by Application

In 2020, the food industry held the largest market share. Wrapping machines are often used in the food industry to package various foods such as chocolates, confectioneries, cookies, bakery products, and fruits. Perishable food products with limited shelf lives, such as bakery, dairy, and allied items, are vulnerable to waste, contamination, and climatic changes.

As a result, demand for the wrapping machine market is expected to rise, especially in the food processing industry. Government legislation and policies for food packaging are also likely to boost market growth by preventing food degradation and pollution.

Over the forecast timeframe, the chemical segment is expected to be the attain highest CAGR. The growth is attributed to the factors such as handling, distribution, and storage of chemicals that require careful packaging. They are potentially dangerous, and anyone who makes contact with these chemicals may get harmed. Furthermore, many chemical packaging regulations are expected to boost business growth.

Geographic Overview

Market demand for wrapping machines is expected to rise in the Asia Pacific as the food & beverage and pharmaceutical industries are expanding. Also, developing countries in the region, like India and China, have seen a significant rise in the industrial sector, which is intended to facilitate market demand to grow even further.

Moreover, the market demand for wrapping machines in the region is rapidly increasing, owing to the expansion of the food & beverage industry. Wrapping devices are in high demand in various industries, including pharmaceutical products, food manufacturing, consumer products, and electronics. Consumer preferences for product reliability are growing.

Competitive Insight

Companies are focusing their efforts on organic growth to strengthen their research and development, which will allow them to offer innovative services to consumers and achieve a competitive edge.

Some of the major players operating in the global market include Duravant LLC, BEUMER Group, Maillis Group S.A., ProMach, Inc., Aetna Group S.p.A., Lantech LLC, Robert Reiser & Co., Inc., IMA Group, Atlanta Stretch SpA, and American Packaging Machinery, Inc.

Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 2.89 billion |

|

Revenue forecast in 2028 |

USD 5.58 billion |

|

CAGR |

8.4% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2028 |

|

Segments covered |

Type, Mode of Operation. Application, Region |

|

Regional scope |

North America Europe Asia Pacific Latin America; Middle East & Africa |

|

Key Companies |

Duravant LLC, BEUMER Group, Maillis Group S.A., ProMach, Inc., Aetna Group S.p.A., Lantech LLC, Robert Reiser & Co., Inc., IMA Group, Atlanta Stretch SpA, and American Packaging Machinery, Inc. |