Yarrow Oil market Size, Share, Trends, Industry Analysis Report

By Application, By Product Type, By Distribution Channel, By End User, By Form, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 125

- Format: PDF

- Report ID: PM6446

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

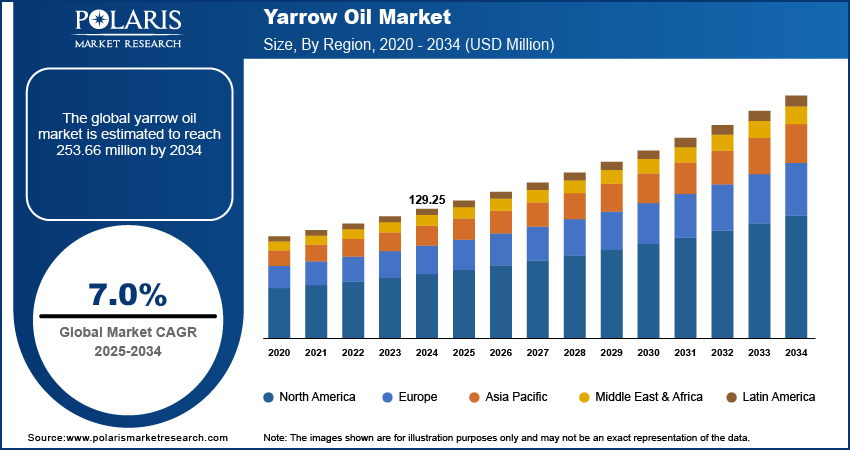

The global yarrow oil market size was valued at USD 129.25 million in 2024 and is anticipated to register a CAGR of 7.0% from 2025 to 2034. Rising trend in consumer preference for natural and organic products boosts the demand for yarrow oil. In the cosmetics and personal care sectors, consumers look for plant-based ingredients with skin benefits. In addition, the growing use of yarrow oil in aromatherapy and traditional medicine systems is helping to increase its demand.

Key Insights

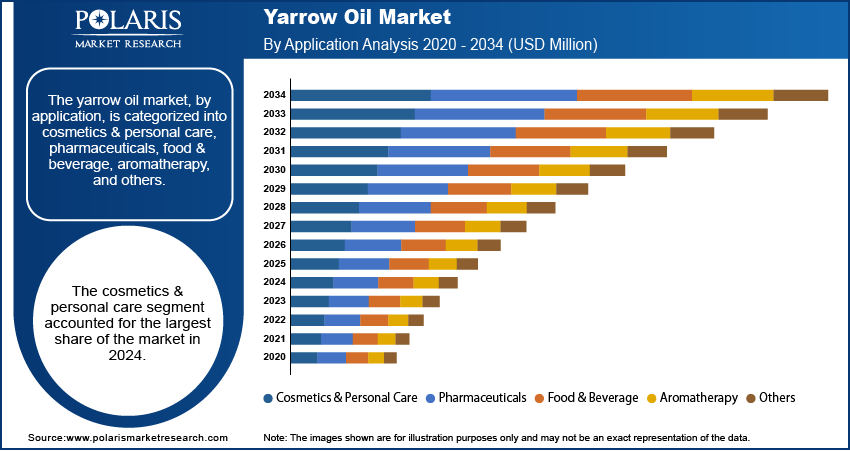

- By application, the cosmetics and personal care segment held the largest share in 2024, driven by rising consumer demand for natural ingredients in skincare and haircare products.

- By product type, in 2024, the yarrow essential oil segment dominated the market, supported by its wide use in aromatherapy and therapeutic applications.

- By distribution channel, the wholesale segment held the largest share in 2024, attributed to bulk purchasing by cosmetic manufacturers and wellness brands.

- By end user, the large enterprises segment held the largest share of the sector in 2024, owing to their strong production capabilities and global distribution networks.

- By form, the liquid form accounted for the largest share in 2024 as it is widely preferred in cosmetics, personal care, and aromatherapy formulations.

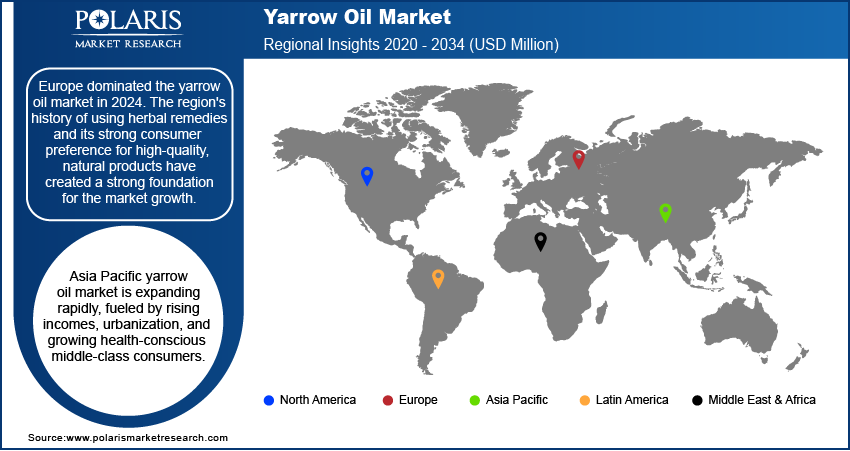

- By region, Europe led the global revenue share in 2024. This is propelled by high consumer preference for organic essential oils and stringent regulations favoring natural products.

Industry Dynamics

- The rising consumer preference for natural and organic ingredients is a major growth factor. Consumers are becoming more aware of product ingredients and are preferring plant-based options over synthetic chemicals, which boosts the demand.

- The increasing use of yarrow oil in cosmetics and personal care products is another important driver. Due to its skin soothing and anti-aging properties, it is being used more often in facial creams and other skincare products.

- A growing interest in aromatherapy and traditional medicine drive the oil demand. As more consumers seek natural ways to relieve stress and improve their health, yarrow oil is being used more widely for various treatments due to its therapeutic properties.

Market Statistics

- 2024 Market Size: USD 129.25 million

- 2034 Projected Market Size: USD 253.66 million

- CAGR (2025–2034): 7.0%

- Europe: Largest market in 2024

AI Impact on Yarrow Oil Market

- AI-based real-time monitoring systems are used to reduce energy consumption and waste during yarrow oil production.

- Yarrow oil manufacturers use AI systems to analyze consumer demand trends in the wellness, aromatherapy, and skincare industries to understand demand and plan production and supply chain effectively.

- AI tools analyze chemical profiles and user preferences to formulate new and customized essential oil blends.

The yarrow oil industry includes the production and sale of yarrow oil, which is an essential oil made from the yarrow plant. This oil is used in many different products across various industries, such as personal care, cosmetics, and health supplements. The industry is defined by the process of growing yarrow and extracting its oil for commercial use.

One of the growth factors for this industry is the growing demand for natural, eco-friendly ingredients. As consumers become more aware of environmental issues, they seek products that are sourced in a sustainable way and have a low environmental impact. This is leading to more demand for yarrow oil, as it is a plant-based product that fits into the green consumer trend. Companies that can show they use sustainable methods for growing and harvesting yarrow plants will have a good chance of growing their business.

The rising interest in herbal and traditional medicine is also a driver. Many people are turning to old health practices and plant-based remedies to deal with common ailments. This has increased the use of yarrow oil due to its known health benefits. For example, yarrow has been used in traditional medicine for a very long time to help with fever and inflammation. As more people explore natural ways to stay healthy, the demand for yarrow oil in these applications will continue to grow.

Drivers and Trends

Increasing Demand for Natural and Organic Products: The growing preference for natural and organic goods is a key driver for the yarrow oil industry. People are becoming more conscious of the ingredients in the products they use and are actively seeking alternatives to synthetic chemicals. This shift in consumer behavior fuels demand for plant-based ingredients such as yarrow oil. The oil is seen as a safer and more sustainable option for personal care, cosmetic, and wellness applications. This trend is especially noticeable in the cosmetics industry, where consumers are looking for "clean beauty" products.

According to a February 2025 report titled "Organic Situation Report, 2025 Edition" by the U.S. Department of Agriculture's Economic Research Service, the compound annual growth rate (CAGR) for inflation-adjusted organic retail sales from 2012 to 2023 was more than 7%. This highlights a sustained and strong consumer interest in organic products. This trend directly benefits the yarrow oil, as it is a natural and organic ingredient used in various products.

Growth in Cosmetics and Personal Care Industries: The expansion of the cosmetics and personal care industries is another important factor driving the growth. Yarrow oil's natural properties, such as its anti-inflammatory and skin-soothing effects, make it a valuable ingredient for a wide range of beauty products. It is used in everything from facial serums and moisturizers to hair care products, appealing to consumers who want effective and gentle ingredients. As these industries continue to innovate and introduce new product lines, the use of yarrow oil is expected to increase in the coming years.

The World Health Organization (WHO) article titled "Traditional, Complementary and Integrative Medicine" noted the rising global attention to traditional medicine. This trend, which often involves using plant-based ingredients such as yarrow oil, has led to a boom in related industries such as the bioeconomy and wellness sectors, which are now valued at trillions of dollars. Thus, the rising personal care and cosmetics sectors show a growing demand for products that use ingredients such as yarrow oil, which helps the growth.

Segmental Insights

Application Analysis

Based on application, the segmentation includes cosmetics & personal care, pharmaceuticals, food & beverage, aromatherapy, and others. The cosmetics & personal care segment held the largest share in 2024. This is due to the rising consumer demand for natural and clean-label products. Yarrow oil is a popular ingredient due to its many benefits for skin and hair health, such as its anti-inflammatory, antioxidant, and moisturizing properties. It is often used in products such as anti-aging creams, serums, and facial oils. The increasing interest in plant-based ingredients for skincare products has led many companies to use yarrow oil in their new product lines. Also, the rise of e-commerce has made it easier for consumers to access a wide variety of these products from smaller, independent brands. This has further boosted the use and sales of yarrow oil, making the cosmetics and personal care segment the leading part of the industry.

The aromatherapy segment is anticipated to register the highest growth rate during the forecast period. This is mainly because more people are turning to essential oils for a natural way to deal with stress and anxiety. The unique, herbaceous scent of yarrow oil is very calming, making it a favorite for diffusers and topical applications. Its use is also growing in professional settings such as spas and wellness centers, where it is used in massages and other treatments. The growing popularity of yoga and meditation, along with a bigger focus on mental health, has led to a major increase in the use of essential oils such as yarrow oil. As more people learn about the therapeutic benefits of aromatherapy, the demand for yarrow oil in this area is expected to continue to rise quickly, positioning it as the fastest-growing application in the industry.

Product Type Analysis

Based on product type, the segmentation includes yarrow essential oil and yarrow extracts. The yarrow essential oil segment held the largest share in 2024. This is because essential oils are a more concentrated form of the plant's active compounds, which makes them highly effective in small amounts. Thus, the essential oil is preferred in a wide range of uses, especially in the cosmetics and personal care, and aromatherapy industries. Yarrow essential oil is also highly valued for its distinct, herbaceous aroma, which is a major draw for consumers and companies in the fragrance industry. Its versatility and strong properties allow it to be used in various applications, from skincare formulations to therapeutic blends. This widespread use and consumer preference have made the essential oil type the dominant one in the industry.

The yarrow extracts segment is anticipated to register the highest growth rate during the forecast period. Yarrow extracts, which are less concentrated than essential oils, are gaining popularity for their use in dietary supplements and functional foods. This growth is driven by the growing consumer interest in herbal remedies and natural health supplements. Yarrow extract is often used in capsule or powder form to promote digestive health and reduce inflammation. The increasing use of yarrow in traditional medicine systems is also boosting demand for extracts. Additionally, the food & beverage industry is finding new ways to use yarrow extracts as a natural flavoring and a source of beneficial compounds, which is contributing to the rapid expansion of this segment.

Distribution Channel Analysis

Based on distribution channel, the segmentation includes online retail, offline retail, wholesale, and direct sales. The wholesale segment held the largest share in 2024. Yarrow oil is a key ingredient in many products, so a large volume of it is sold directly to other businesses. Manufacturers of cosmetics, personal care products, and pharmaceuticals often buy yarrow oil in bulk from wholesalers to use in their own products. The wholesale channel is efficient for large-scale transactions, ensuring a steady supply for these industries. It is the most practical way for producers to sell large quantities of their oil to business clients, which makes it the dominant segment in the distribution channel.

The online retail segment is anticipated to register the highest growth rate during the forecast period. This is due to the increasing number of consumers who are shopping for natural and specialty products on e-commerce sites. Online platforms make it easy for smaller brands and new sellers to reach a global audience without needing a physical store. The growing interest in aromatherapy and do-it-yourself (DIY) wellness products has also led to more consumers buying yarrow oil directly from online stores. These platforms also provide detailed product information and customer reviews, which helps consumers make informed decisions. This shift in consumer behavior toward online shopping is a key driver for this segment's rapid growth.

End User Analysis

Based on end user, the segmentation includes Individual consumers, small and medium enterprises (SMEs), large enterprises, and health & wellness centers. The large enterprises segment held the largest share in 2024. These companies, which include major cosmetic, personal care, and pharmaceutical firms, use yarrow oil in a wide range of their products. They require large and consistent volumes of oil, making them the primary customers. Their research and development efforts also lead to the creation of new products using yarrow oil, which keeps the demand high. Furthermore, these large enterprises have the financial resources to invest in marketing and distribution, ensuring that products containing yarrow oil reach a broad consumer base. This makes the large enterprises segment the dominant end user in the industry.

The individual consumers segment is anticipated to register the highest growth rate during the forecast period. This is driven by a rising interest in do-it-yourself (DIY) products and personal wellness. People are increasingly buying yarrow oil for direct use in aromatherapy, homemade skin and hair care products, and as a natural remedy. The rise of social media and online platforms has made it easier for people to learn about the benefits and uses of yarrow oil, leading to more direct purchases. As consumers become more aware and educated about essential oils, they are moving away from traditional retail and toward buying these oils for their own personal use, leading to a quick rise in this segment's demand.

Regional Analysis

The Europe yarrow oil market accounted for the largest share in 2024. The European market for yarrow oil is well-established and shows strong potential for growth. The region's history of using herbs and botanical extracts in traditional medicine and cosmetics has created a solid foundation. Europe has strict regulations and high standards for natural and organic products, which gives consumers confidence in the quality of yarrow oil. The increasing popularity of natural and sustainable products across the region boost the demand for yarrow oil in Europe.

A significant contributor to the European industry is Germany. The Germany yarrow oil market has a long tradition of using herbal remedies and is a large consumer of natural health products. The German population's strong preference for natural and organic ingredients, combined with a well-developed healthcare and pharmaceutical sector, makes it a key region for yarrow oil. The country's strong economy and high level of consumer spending also support the growth of the cosmetics and aromatherapy industries, which are the main end users of yarrow oil.

North America Yarrow Oil Market Insights

North American is a major contributor to the yarrow oil industry. The industry is driven by a strong consumer focus on health and wellness, which has led to a growing demand for natural, plant-based ingredients. The region has a well-developed personal care and cosmetics industry, which uses yarrow oil in a variety of products. There is also a lot of research and development happening in the area, with companies exploring new uses and applications for yarrow oil in health and beauty products.

U.S. Yarrow Oil Market Overview

The U.S. plays a significant role, with a large and diverse consumer base. The country's strong trend toward natural, organic, and "clean" beauty products is a key driver for the demand for yarrow oil. As consumers become more aware of the ingredients in their products, they are choosing plant-based oils for their skin and hair care routines. The U.S. also has a very active aromatherapy community, which uses yarrow oil for its therapeutic and calming properties.

Asia Pacific Yarrow Oil Market Trends

The Asia Pacific market for yarrow oil is growing rapidly. This growth is driven by rising disposable incomes, urbanization, and a growing middle class that is more aware of health and wellness trends. The region has a rich history of traditional medicine, and yarrow is gaining attention as a valuable botanical ingredient. The expanding cosmetics and personal care sectors in countries such as China and India are also contributing to the rising demand for natural ingredients such as yarrow oil.

China Yarrow Oil Market Outlook

China is a major contributor to the Asia Pacific industry growth. The country has a long history of using herbal remedies in traditional Chinese medicine, which creates a strong foundation for the use of yarrow and other plant-based ingredients. The increasing consumer preference for natural products, anti-aging products, and the expansion of the cosmetics and personal care industries are major factors helping the growth. As more people in China become aware of the health and beauty benefits of yarrow oil, the demand is expected to continue to rise.

Key Players and Competitive Insights

The yarrow oil industry has a competitive landscape with both large, well-known companies and many smaller, specialized producers. The main players focus on product innovation, improving their sourcing methods, and forming smart partnerships to stand out from others. Competition is strong, driven by the increasing demand for natural and organic ingredients, and a relatively low entry barrier for new businesses. Companies are focusing on getting organic certifications and following high-quality standards to attract consumers who care about transparency. The key is to keep innovating, which helps companies stay ahead and meet the changing needs of customers in different industries.

A few prominent companies in the industry include Young Living Essential Oils; doTERRA International, LLC; Biolandes; Amphora Aromatics; Penta Manufacturing; Starwest Botanicals; Aura Cacia; Plant Therapy; Now Foods; Eden Botanicals; New Directions Aromatics; and Florihana.

Key Players

- Amphora Aromatics

- Aura Cacia

- Biolandes

- doTERRA International, LLC

- Eden Botanicals

- Florihana

- New Directions Aromatics

- Now Foods

- Penta Manufacturing

- Plant Therapy

- Starwest Botanicals

- Young Living Essential Oils

Yarrow Oil Industry Developments

May 2025: Penta Fine Ingredients entered into a strategic investment partnership with Keystone Capital to enhance its market position and expand its operational capabilities.

Yarrow Oil Market Segmentation

By Application Outlook (Revenue – USD Million, 2020–2034)

- Cosmetics & Personal Care

- Pharmaceuticals

- Food & Beverage

- Aromatherapy

- Others

By Product Type Outlook (Revenue – USD Million, 2020–2034)

- Yarrow Essential Oil

- Yarrow Extracts

By Distribution Channel Outlook (Revenue – USD Million, 2020–2034)

- Online Retail

- Offline Retail

- Wholesale

- Direct Sales

By End User Outlook (Revenue – USD Million, 2020–2034)

- Individual Consumers

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- Health & Wellness Centers

By Form Outlook (Revenue – USD Million, 2020–2034)

- Liquid

- Solid

By Regional Outlook (Revenue-USD Million, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Yarrow Oil Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 129.25 million |

|

Market Size in 2025 |

USD 137.98 million |

|

Revenue Forecast by 2034 |

USD 253.66 million |

|

CAGR |

7.0%from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 129.25 million in 2024 and is projected to grow to USD 253.66 million by 2034.

The global market is projected to register a CAGR of 7.0% during the forecast period.

Europe dominated the share in 2024.

A few key players include Young Living Essential Oils; doTERRA International, LLC; Biolandes; Amphora Aromatics; Penta Manufacturing; Starwest Botanicals; Aura Cacia; Plant Therapy; Now Foods; Eden Botanicals; New Directions Aromatics; and Florihana.

The cosmetics & personal care segment accounted for the largest share of the market in 2024.

The yarrow extracts segment is expected to witness the fastest growth during the forecast period.