Zero Liquid Discharge System Market Share, Size, Trends, Industry Analysis Report

By System (Conventional, Hybrid); By Process; By End Use Industry; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 118

- Format: PDF

- Report ID: PM4351

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

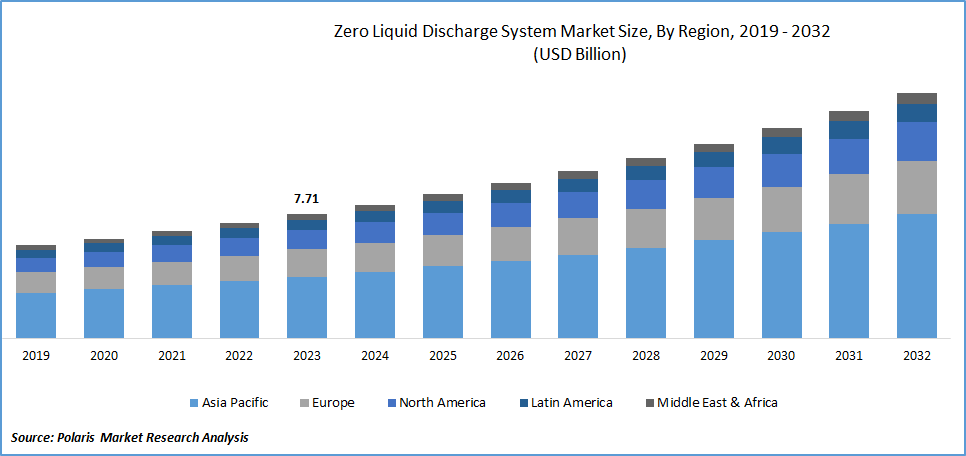

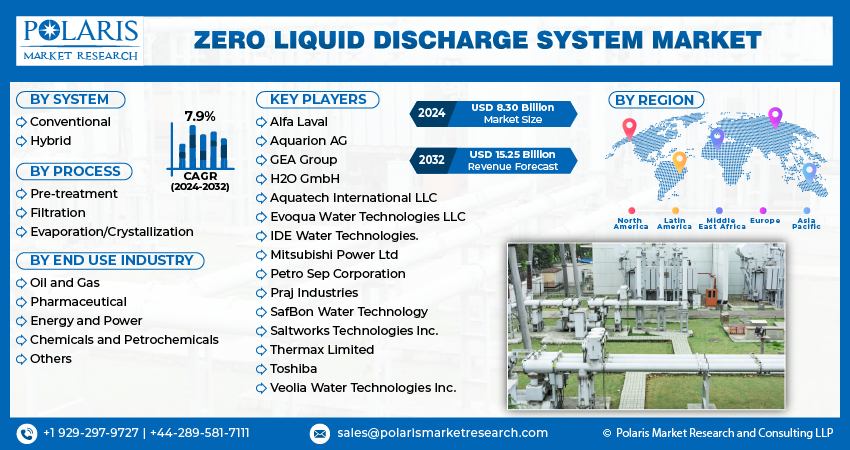

The global zero liquid discharge (ZLD) system market was valued at USD 7.71 billion in 2023 and is expected to grow at a CAGR of 7.9% during the forecast period.

ZLD systems facilitate the recovery of valuable resources, such as salts, minerals, and other byproducts, creating revenue opportunities for industries. These recovered resources can be sold or used within the production process, contributing to enhanced financial performance and resource efficiency.

Although ZLD systems necessitate an initial capital investment, they deliver substantial long-term cost savings. By reducing water procurement costs, curtailing expenses related to wastewater treatment, and potentially generating revenue from the sale of recovered resources, ZLD systems prove financially beneficial over time. In addition, several companies are investing in ZLD systems for greater efficiency and cost savings.

The research report offers a quantitative and qualitative analysis of the zero liquid discharge (ZLD) system market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

To Understand More About this Research: Request a Free Sample Report

- For instance, in May 2022, Evonik Catalysts inaugurated a state-of-the-art Zero Liquid Discharge (ZLD) plant at its Dombivli facility in India. This cutting-edge plant significantly diminishes the demand for fresh water in production procedures and transforms materials once deemed as waste into marketable products.

Many corporations are embracing ZLD systems as a means of aligning with their corporate sustainability goals. The adoption of these systems underscores a commitment to responsible water management and environmental stewardship, fostering a positive corporate image and appealing to environmentally conscious stakeholders.

Industries with substantial water consumption, including power generation, petrochemicals, mining, and textiles, are witnessing growth and thus providing opportunities for the wider adoption of ZLD systems. As these sectors expand, the demand for sustainable water management solutions continues to rise. Ongoing research and development in ZLD technology are driving improvements in system efficiency and cost-effectiveness. These advancements are expanding the accessibility of ZLD systems, enabling a broader range of industries to benefit from these technologies.

The COVID-19 pandemic initially disrupted the ZLD system market, causing supply chain interruptions, project delays, and shifts in corporate priorities. However, post-pandemic, several trends and opportunities have emerged. Industries now recognize the importance of resilience and sustainability, fostering an increased interest in ZLD systems. Regulatory changes and heightened public awareness of environmental issues are driving ZLD adoption. As industries recover and expand, there is a growing demand for ZLD systems, particularly in emerging markets. Continued technological advancements and potential government support are making ZLD systems more efficient and cost-effective, making them an attractive option for a broader range of industries.

Growth Drivers

Stringent environmental regulations, and water scarcity are factors projected to spur the market demand

Evolving and increasingly strict environmental regulations globally compel industries to limit their liquid waste discharges. ZLD systems offer a reliable means to achieve compliance with these stringent standards, ensuring environmentally responsible practices and averting costly fines and legal penalties.

Regions grappling with water scarcity due to factors like drought, population growth, and climate change are actively seeking ZLD solutions. These systems enable industries to maximize water recycling, drastically reduce freshwater intake, and secure a sustainable water source, addressing the urgent need for water conservation in water-scarce areas.

ZLD systems play a pivotal role in minimizing the environmental impact of liquid waste discharges. By preventing the release of pollutants and contaminants into water bodies, these systems protect aquatic ecosystems, safeguard drinking water sources, and contribute to a cleaner environment.

Report Segmentation

The market is primarily segmented based on system, process, end use industry, and region.

|

By System |

By Process |

By End Use Industry |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By System Analysis

Conventional segment accounted for a significant share in 2023

The conventional segment accounted for a significant share in 2023. Conventional zero liquid discharge systems provide a range of significant advantages. They enable industries to comply with strict environmental regulations by effectively eliminating liquid waste discharge. Moreover, ZLD systems recover valuable resources, such as salts and minerals, which can be sold or reused, potentially creating additional revenue streams. By recycling and reusing treated wastewater, they markedly reduce the demand for freshwater, making them especially suitable for regions with water scarcity. ZLD systems offer long-term cost savings by decreasing water procurement, treatment, and disposal expenses.

By Process Analysis

Evaporation/Crystallization emerged as the largest segment in 2023

The evaporation/crystallization emerged as the largest segment in 2023. In a zero liquid discharge system, the evaporation/crystallization process concentrates liquid waste. Initially, wastewater is collected and pretreated to remove impurities. The treated wastewater is then heated, causing water to evaporate, which raises the concentration of dissolved solids. When the solution reaches a critical point, solutes begin to crystallize, facilitated by cooling, seeding, or additives. The resulting solid crystals are separated from the remaining liquid using techniques like centrifugation or filtration. These recovered solids may have value and can be sold or reused. The remaining substantially reduced liquid can undergo further treatment or be disposed of responsibly, achieving zero liquid discharge.

By End Use Industry Analysis

Energy and power segment accounted for a significant share in 2023

The energy and power segment accounted for a significant share in 2023. ZLD systems are essential in the energy and power sector. They treat and recycle wastewater generated by power plants, reducing the need for freshwater intake and ensuring compliance with stringent environmental regulations. ZLD systems recover valuable resources from concentrated brine, which can be reused or sold for added revenue. They significantly lower water consumption, which is especially crucial in water-scarce regions. These systems offer long-term cost savings by reducing water procurement and disposal expenses. Furthermore, ZLD systems align with sustainability goals, demonstrating responsible water management and enhancing the industry's reputation while improving the efficiency and longevity of critical equipment.

Regional Insights

North America emerged as the largest region in 2023

North America emerged as the largest region in 2023. The U.S. government, at both the federal and state levels, has been implementing increasingly stringent environmental regulations, particularly concerning wastewater discharge and water quality. ZLD systems have gained popularity as they align with these regulatory requirements, helping industries achieve compliance by minimizing or eliminating liquid waste discharge into water bodies. Various industries, such as energy production, chemicals, petrochemicals, and mining, continue to expand in North America. These sectors often have high water consumption rates and generate substantial wastewater. ZLD systems are being adopted to manage the water-intensive processes within these growing industries efficiently.

The Zero Liquid Discharge (ZLD) system market in Asia-Pacific has thrived due to stringent environmental regulations, expanding industries, and the need to combat water scarcity. Many Asian countries have intensified their environmental rules, prompting industries to adopt ZLD systems to reduce liquid waste discharge. With growing manufacturing, power generation, and petrochemical sectors, ZLD systems are essential for managing their substantial wastewater. Water scarcity issues in certain Asian regions have also made ZLD an attractive solution. Technological advancements, government support, cost-efficiency, and increasing public awareness of environmental issues further drive the adoption of ZLD systems across the continent.

Key Market Players & Competitive Insights

The zero liquid discharge system sector exhibits a fragmented landscape, and competition is expected to intensify due to the active participation of numerous players. Prominent firms in this industry consistently introduce innovative strategies to bolster their market position. These key players prioritize strategies like forming partnerships and fostering collaborations to gain a competitive edge over their peers and establish a significant market presence.

Some of the major players operating in the global market include:

- Alfa Laval

- Aquarion AG

- Aquatech International LLC

- Evoqua Water Technologies LLC

- GEA Group

- H2O GmbH

- IDE Water Technologies.

- Mitsubishi Power Ltd

- Petro Sep Corporation

- Praj Industries

- SafBon Water Technology

- Saltworks Technologies Inc.

- Thermax Limited

- Toshiba

- Veolia Water Technologies Inc.

Recent Developments

- In October 2023, Saltworks provided a comprehensive zero liquid discharge (ZLD) industrial desalination solution to a mining facility in the United States. This modular and digitally optimized plant facilitated the quick installation and implementation of an intelligently automated ZLD system, all while minimizing resource inputs.

Zero Liquid Discharge System Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 8.30 billion |

|

Revenue forecast in 2032 |

USD 15.25 billion |

|

CAGR |

7.9% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By System, By Process, By End Use Industry, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Seeking a more personalized report that meets your specific business needs? At Polaris Market Research, we’ll customize the research report for you. Our custom research will comprehensively cover business data and information you need to make strategic decisions and stay ahead of the curve.

FAQ's

Aquarion AG, Aquatech International LLC, Evoqua Water Technologies LLC, Saltworks Technologies Inc are the key companies in Zero Liquid Discharge System Market.

The global zero liquid discharge (ZLD) system market is expected to grow at a CAGR of 7.9% during the forecast period.

The Zero Liquid Discharge System Market report covering key segments are system, process, end use industry, and region.

Rising industrialization across sectors are the key driving factors in Zero Liquid Discharge System Market.

The global zero liquid discharge system market size is expected to reach USD 15.25 billion by 2032.