High-End Lighting Market Size, Share, Trends, Industry Analysis Report

: By Product Type, Technology (LED, Halogen, Incandescent, and Connected Lighting), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM1631

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

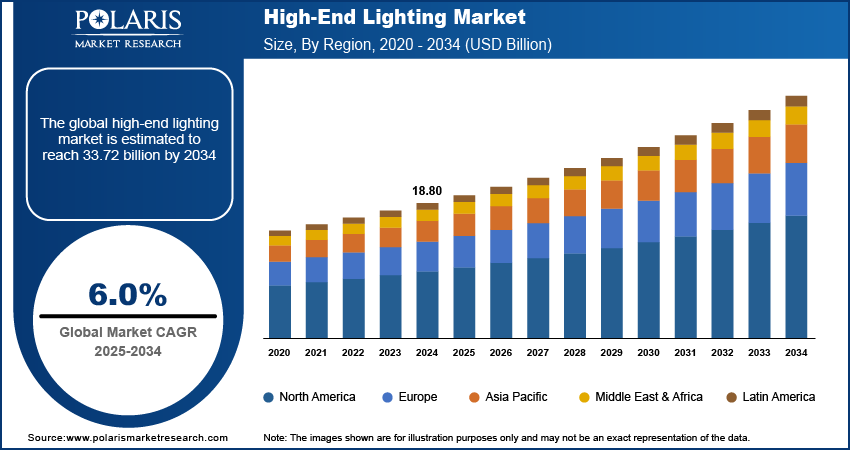

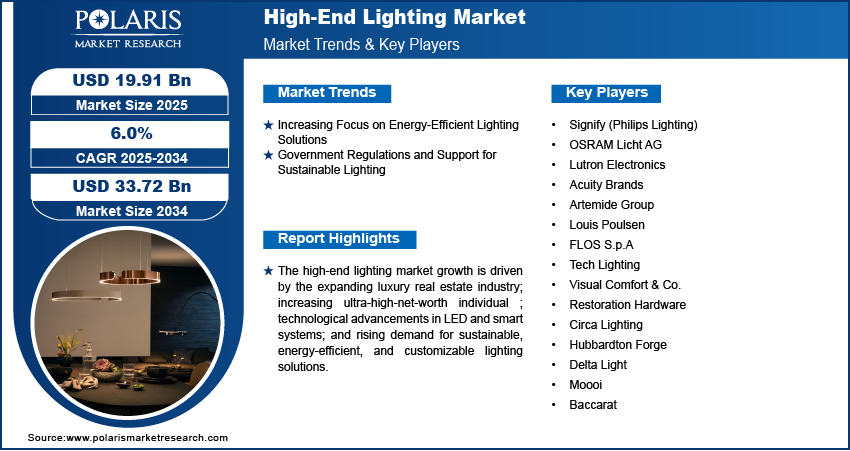

The high-end lighting market size was valued at USD 18.80 billion in 2024 and is projected to grow at a CAGR of 6.0% during the forecast period. The market for high-end lighting is primarily driven by increasing urbanization and rising disposable income globally.

Key Insights

- The chandeliers segment accounts for the largest market share. The segment’s dominance is attributed to the growing demand for chandeliers in luxury hospitality projects.

- The LED segment led the market in 2024, as LED technology perfectly aligns with the demands of the luxury market.

- Europe accounted for the largest share of the market. This is due to the presence of leading design houses and the region’s strong heritage in luxury craftsmanship.

- Asia Pacific is projected to register the highest growth rate in the coming years, primarily due to rapid urbanization and growing appreciation for luxury interior design services in the region.

Industry Dynamics

- The rising focus on the use of energy-saving technologies across residential, commercial, and industrial sectors is driving demand for high-end LED lighting.

- The implementation of regulations and incentives by governments globally for the adoption of sustainable lighting solutions is fueling market expansion.

- The development of smart cities and sustainable infrastructure in major economies is expected to provide several market opportunities in the coming years.

- High initial cost associated with high-end lighting may present challenges to market growth.

Market Statistics

2024 Market Size: USD 18.80 billion

2034 Projected Market Size: USD 33.72 billion

CAGR (2025-2034): 6.0%

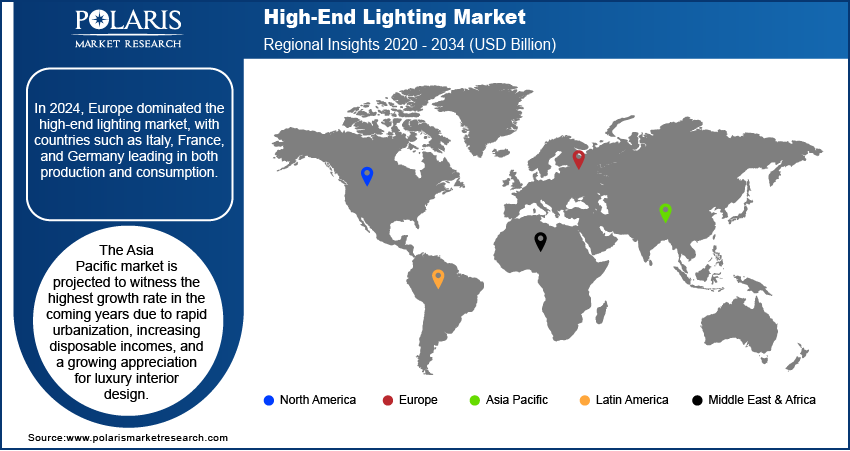

Europe: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

The global high-end lighting market insight represents a premium segment of the lighting industry. The high-end lighting is made with sophisticated design, superior quality materials, advanced technology integration, and exceptional craftsmanship. The market caters to luxury residential properties, high-end commercial spaces, hospitality sectors, and prestigious architectural projects. The market has shown remarkable resilience and growth, driven by increasing urbanization and rising disposable incomes globally. According to the Organization for Economic Co-operation and Development (OECD), real per capita household income experienced a 0.9% increase in the first quarter of 2024 compared to same quarter in 2023. The sector has evolved significantly with the integration of smart technology, sustainable practices, and innovative design aesthetics, moving beyond traditional luxury lighting to incorporate connected solutions and energy-efficient features. The market offers various premium lighting solutions, including chandeliers, pendant lights, wall sconces, and specialized architectural lighting, with prices typically ranging from several thousand to hundreds of thousands of dollars per piece. High-end lighting manufacturers differentiate themselves through unique design signatures, customization capabilities, and the use of premium materials such as hand-blown glass, precious metals, and crystals. The sector has also witnessed a significant shift toward sustainable luxury, with many manufacturers incorporating eco-friendly materials and energy-efficient LED technology while maintaining premium aesthetics and performance.

Market Dynamics

Increasing Focus on Energy-Efficient Lighting Solutions

Governments worldwide are implementing policies to encourage the use of energy-saving technologies. According to the US Department of Energy, LED lighting alone accounts for ∼75% less energy usage than traditional incandescent lighting, contributing significantly to energy savings. In the European Union, the Energy Efficiency Directive mandates energy-saving measures, with lighting accounting for a large share of energy consumption. This has led to the adoption of energy-efficient lighting products, such as LEDs and smart lighting, among residential, commercial, and industrial sectors, driving the demand for high-end, energy-efficient lighting solutions. Thus, the rising focus on energy-efficient lighting solutions drives the high-end lighting market growth.

Government Regulations and Support for Sustainable Lighting

Governments across the world boost the adoption of sustainable lighting solutions through regulations and incentives. In the US, the Energy Star program, administered by the Environmental Protection Agency (EPA), encourages the use of energy-efficient lighting, offering certifications for high-performance products. Similarly, the EU has introduced eco-design regulations such as EU Ecodesign Regulation (EU) 2019/2020, ensuring that lighting products meet strict environmental standards. These regulatory frameworks push both manufacturers and consumers toward high-end, energy-efficient lighting products that meet sustainability goals. The increasing emphasis on sustainability by government bodies and consumers alike fosters the development of advanced lighting solutions with a focus on reducing environmental footprints and energy consumption. Hence, government regulations and support for sustainable lighting fuel the high-end lighting market expansion.

Segment Analysis

High-End Lighting Market Assessment by Product Type

The high-end lighting market assessment, based on product type, include chandeliers, pendant lights, wall sconces, floor lamps, table lamps, and architectural lights. The chandeliers segment dominates the market share, primarily due to growing demand in luxury hospitality projects. Chandeliers, in particular, have maintained their leadership position through continuous innovation in design and integration of smart features while maintaining traditional craftsmanship appeal.

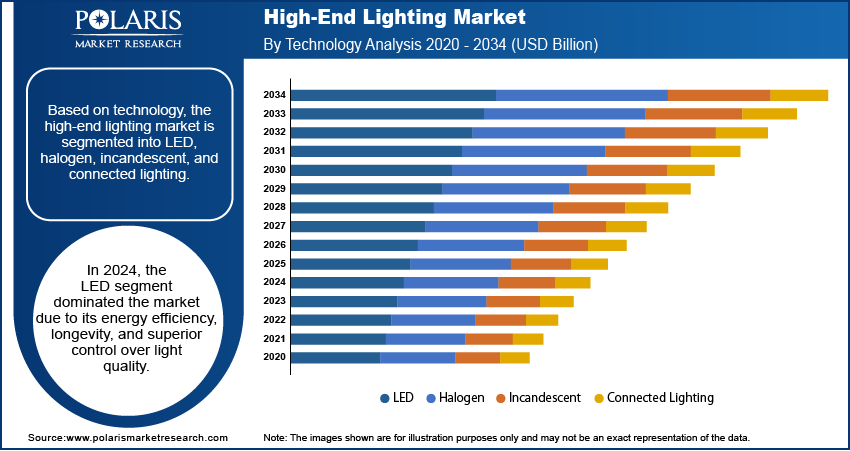

High-End Lighting Market Evaluation by Technology

The high-end lighting market evaluation, based on technology, include LED, halogen, incandescent, and connected lighting. The LED segment accounted for the largest high-end lighting market share in 2024. This dominance is attributed to the perfect alignment of LED lighting technology with luxury market demands, which offer energy efficiency, longevity, and unprecedented control over light quality and color temperature. The connected lighting sub-segment has shown the highest growth rate, driven by increasing integration with home automation systems and the growing preference for personalized lighting experiences in luxury spaces.

Regional Insights

Europe dominated the global high-end lighting market share, with countries such as Italy, France, and Germany leading in both production and consumption. This dominance is attributed to the region's strong heritage in luxury craftsmanship, presence of established design houses, and robust luxury real estate market. Italy, in particular, leads the European market due to its renowned design expertise, traditional craftsmanship, and strong export networks in the luxury lighting segment. According to Trading Economics, Italy's exports of luxury furniture reached ∼USD 1.234 billion in 2022. This figure highlights the significant market value and trade presence of Italian luxury furniture on the global stage.

The Asia Pacific high-end lighting market revenue is projected to witness the highest growth rate in the coming years, with China, Japan, and Singapore driving significant demand. This growth is fueled by rapid urbanization, increasing disposable incomes, and a growing appreciation for luxury interior design services. China, specifically, is emerging as a key market, driven by its booming luxury real estate sector and the increasing number of high-net-worth individuals. The country's focus on developing smart cities and sustainable architecture has created substantial opportunities for high-end lighting manufacturers.

Market Players and Competitive Analysis Report

The high-end lighting market stats exhibits a complex competitive landscape where traditional luxury lighting manufacturers compete with technology-driven new entrants. Companies such as Signify and OSRAM lead through their technological capabilities and global presence. On the other side, boutique manufacturers such as FLOS and Artemide maintain strong positions through design excellence and brand heritage. Market players are increasingly focusing on customization capabilities, sustainable practices, and smart technology integration to maintain competitive advantage. Strategic partnerships with architects, interior designers, and luxury property developers have become crucial for market success. Companies are also investing heavily in R&D to develop innovative products that combine traditional craftsmanship with modern technology, while expanding their distribution networks in emerging markets.

Deltalight is a Belgian company that has been involved in architectural lighting design and manufacturing since its founding in 1989 by Paul Ameloot. The company focuses on creating lighting solutions that combine functionality with design, catering to both interior and exterior environments. Delta Light provides a variety of lighting products across different sectors, including architectural, commercial, and residential lighting. Their offerings include decorative and technical lighting solutions, with products like the "Entero" series featuring advanced LED technology suitable for various settings such as retail and hospitality projects. The company has expanded its reach through strategic acquisitions, incorporating brands like AQForm and LEDsGo into its portfolio. Additionally, its North American brands, including LF Illumination, Delray, VLT, and Softform, offer solutions for commercial and residential projects. Delta Light operates globally, with a presence in over 120 countries. The company maintains a network of showrooms and offices in major design cities such as Milan, London, Miami, LA, Paris, Amsterdam, Hong Kong, Dubai, and New York. It also has subsidiaries in regions like South America, Russia, the Middle East, Eastern Europe, and North America. In recent years, Delta Light has expanded its operations in Spain through the establishment of Delta Light Iberia SL, aiming to improve local customer service and project delivery.

Signify N.V., formerly known as Philips Lighting N.V., is a Dutch multinational lighting company based in Eindhoven, the Netherlands. It was spun off from Royal Philips in 2016 and changed its name to Signify in May 2018. Despite the name change, Signify continues to produce lighting products under the Philips brand through a licensing agreement with Royal Philips. The company is a major player in the lighting industry, focusing on energy-efficient and connected lighting solutions for both consumer and professional markets. Signify's product range includes various lighting solutions such as LED lamps, luminaires, high-intensity discharge lamps (HID), compact fluorescent, halogen, and incandescent lamps. The company also offers connected lighting systems like Philips Hue and WiZ. Additionally, it provides specialty lighting products, including electronic components and electronic ballasts. Signify operates through four main business segments which include consumer, professional, OEM, and conventional. The consumer segment offers LED lamps and connected products, while the professional segment provides LED lamps, luminaires, and connected lighting systems for commercial customers. The OEM segment supplies lighting components to the industry, and the conventional segment focuses on special lighting, digital projection, and lamp electronics. Signify operates in over 70 countries across the Americas, Europe, the Middle East and Africa, and Asia Pacific. The company has manufacturing facilities in all major regions. Its products are sold in 180 countries.

List of Key Companies

- Signify (Philips Lighting)

- OSRAM Licht AG

- Lutron Electronics

- Acuity Brands

- Artemide Group

- Louis Poulsen

- FLOS S.p.A

- Tech Lighting

- Visual Comfort & Co.

- Restoration Hardware

- Circa Lighting

- Hubbardton Forge

- Delta Light

- Moooi

- Baccarat

High-End Lighting Market Developments

January 2024: Signify, a global player in lighting, announced the availability of new Philips Hue lights and accessories to design personalized lighting experiences. The new Philips Hue Dymera wall light offers individually controllable up and down light to create an architectural look both indoors and outdoors.

June 2023: Signify announced the new Philips Hue lights and app features that provide additional ways to personalize the lighting in the home. The Philips Hue luster bulb is available in warm-to-cool white and color light, and the Philips Hue panels are available in new shapes. The Philips Hue app has two new features—the brightness balancer and additional time slots for motion sensors.

June 2023: OSRAM, a global player in optical solutions, introduced the fifth generation of its popular OSLON Square Hyper Red horticulture LED designed to offer faster plant growth and enable optimized system cost.

High-End Lighting Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Chandeliers

- Pendant Lights

- Wall Sconces

- Floor Lamps

- Table Lamps

- Architectural Lights

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- LED

- Halogen

- Incandescent

- Connected Lighting

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Residential

- Commercial

- Hospitality

- Museums & Art Galleries

- Government Buildings

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

High-End Lighting Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 18.80 billion |

|

Market Size Value in 2025 |

USD 19.91 billion |

|

Revenue Forecast by 2034 |

USD 33.72 billion |

|

CAGR |

6.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global high-end lighting market size was valued at USD 18.80 billion in 2024 and is projected to grow to USD 33.72 billion by 2034.

The global market is projected to record a CAGR of 6.0% during the forecast period.

North America held the largest share of the global market in 2024.

A few of the key players in the market are Signify (Philips Lighting), OSRAM Licht AG, Lutron Electronics, Acuity Brands, Artemide Group, Louis Poulsen, FLOS S.p.A, Tech Lighting, Visual Comfort & Co., Restoration Hardware, Circa Lighting, Hubbardton Forge, Delta Light, Moooi, and Baccarat

The LED segment dominated the market in 2024 due to its specifications such as energy efficiency, longevity, and superior control over light quality.