Durable Medical Equipment Market Size, Share, Trends, Industry Analysis Report

By Product (Personal Mobility Device, Bathroom Safety Device, Medical Furniture), By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM1064

- Base Year: 2024

- Historical Data: 2020-2023

Overview

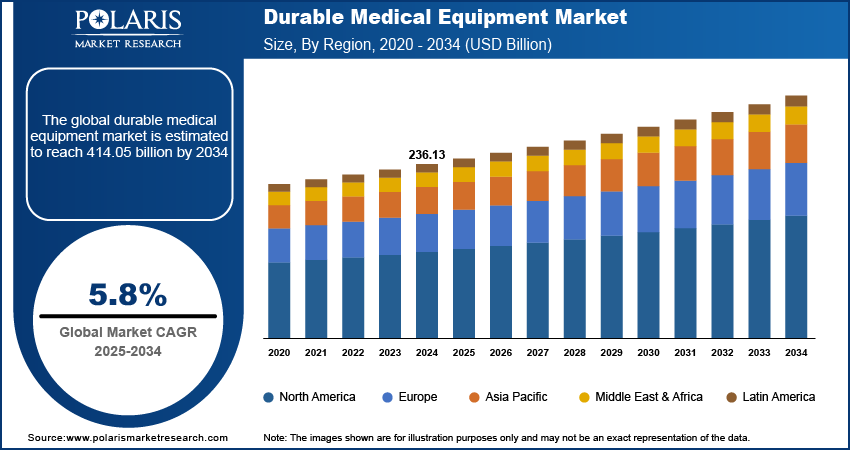

The global durable medical equipment market size was valued at USD 236.13 billion in 2024, growing at a CAGR of 5.8% from 2025 to 2034. The market growth is driven by growing aging population and rising prevalence of chronic diseases.

Key Insights

- In 2024, the monitoring and therapeutic devices segment held the largest market share, as products such as infusion pumps, CPAP machines, and patient monitors are vital for managing both chronic and acute health conditions.

- The ambulatory surgical centers segment is expected to witness strong growth due to increasing demand for affordable and efficient outpatient procedures.

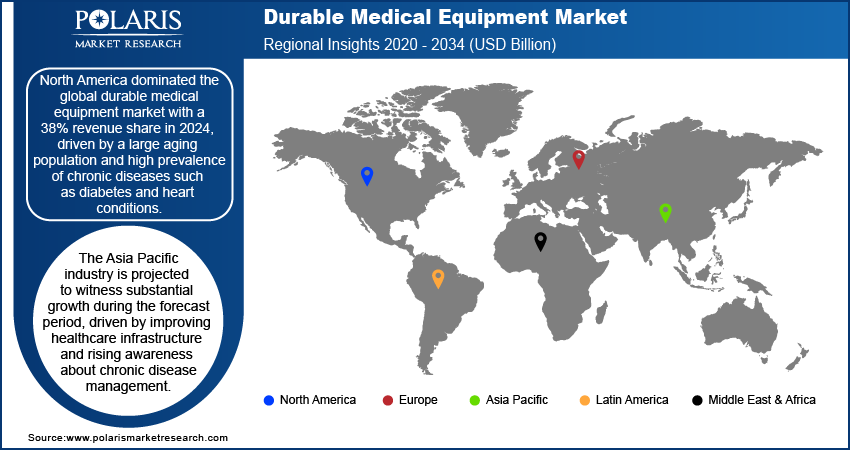

- North America led the market with a 38% revenue share in 2024, supported by a growing aging population and a high incidence of chronic diseases such as diabetes and heart disease.

- The U.S. market is projected to grow at a CAGR of 6.5% during the forecast period, fueled by a robust healthcare system and comprehensive insurance coverage, including Medicare, which facilitates access to durable medical equipment.

- The Asia Pacific industry is anticipated to experience significant growth over the forecast period, driven by advancements in healthcare infrastructure and greater awareness of chronic disease management.

Industry Dynamics

- Growing aging population drives the demand for durable medical equipment.

- Rise in chronic diseases is fueling the industry growth.

- Technological advancements are making durable medical equipment smarter, more efficient, and easier to use.

- High cost of advanced equipment and limited reimbursement policies in some regions restricts patient access and adoption.

Market Statistics

- 2024 Market Size: USD 236.13 billion

- 2034 Projected Market Size: USD 414.05 billion

- CAGR (2025–2034): 5.8%

- North America: Largest market in 2024

AI Impact on Durable Medical Equipment Market

- AI enhances patient care by enabling smart monitoring devices that provide real-time health data, allowing for quicker and more accurate medical interventions.

- AI-driven analytics improve equipment performance by predicting maintenance needs, reducing downtime, and extending the lifespan of medical devices.

- AI-powered personalization helps tailor durable medical equipment settings to individual patient needs, improving comfort and treatment effectiveness.

- High costs of AI integration and limited technical expertise in the healthcare sector restrain the widespread adoption of AI technologies in the durable medical equipment market.

Durable medical equipment refers to medically necessary devices designed for long-term use to aid patients in their daily activities or treatment at home or in healthcare settings. These include items such as wheelchairs, hospital beds, walkers, oxygen equipment, and blood sugar monitors. DME is typically prescribed by a physician and often covered by insurance when deemed essential for a patient’s care or recovery.

Many patients and families prefer receiving care at home instead of in hospitals or long-term care facilities. This is driven by the desire for comfort, reduced healthcare costs, and better recovery outcomes. Durable medical equipment such as home ventilators, portable oxygen systems, and patient lifts make home care possible and safer. Patients can manage serious conditions at home with advancements in medical technology and support from insurance and healthcare providers. The growing popularity of home healthcare is propelling the demand for DME, as people need reliable and user-friendly equipment in their personal care environments, thereby fueling the growth.

Modern technology is making durable medical equipment smarter, more efficient, and easier to use. Innovations include lightweight materials, wireless monitoring, better battery life, and integration with digital health platforms. These improvements help patients and caregivers monitor health in real-time and make informed decisions quickly. For example, smart wheelchairs with navigation aids or CPAP machines that sync with mobile apps improve both usability and health outcomes. Technology improves the appeal and effectiveness of DME products as it continues to evolve, encouraging wider adoption in hospitals, nursing homes, and private homes alike, thereby fueling the growth.

Drivers & Opportunities

Growing Aging Population: The number of elderly individuals is increasing globally. According to the European Commission, in Europe alone, 449.3 million people are 65 years or older as of January 2024. Older adults are more likely to experience chronic health conditions, mobility issues, and require long-term medical care. This increases the demand for durable medical equipment such as wheelchairs, hospital beds, and oxygen equipment. The aging population prefers in-home care, and DME supports independent living and improves their quality of life. Additionally, governments and healthcare providers are further investing more in elder care, thereby boosting the growth.

Rise in Chronic Diseases: Chronic diseases such as diabetes, heart disease, arthritis, and respiratory disorders are becoming more prevalent due to lifestyle factors, aging, and urbanization. According to the Australia Institute of Health and Welfare, as of 2021, 1 in 20 people were diagnosed with diabetes in Australia alone. Managing these conditions requires long-term medical support and equipment such as insulin pumps, CPAP machines, or mobility aids. Hospitals, clinics, and home-care settings rely heavily on durable medical equipment to assist patients in managing symptoms and maintaining functionality. The need for specialized, durable equipment increases as the incidence of chronic illnesses continues to rise, thereby driving the growth.

Segmental Insights

Product Analysis

The segmentation, based on product, includes personal mobility devices, bathroom safety devices & medical furniture, monitoring & therapeutic devices, and others. In 2024, the monitoring & therapeutic devices segment dominated with the largest share. Therapeutic and monitoring products, such as infusion pumps, CPAP machines, and patient monitors, are essential for managing chronic and acute conditions. The rise in lifestyle-related diseases such as diabetes, sleep apnea, and cardiovascular disorders is driving strong demand for these devices. Patients increasingly rely on at-home monitoring to track their health, which reduces hospital visits and improves long-term care. Moreover, these products are becoming smarter and more user-friendly with digital integration and remote monitoring capabilities. Therapeutic and monitoring DME demand is rising as healthcare shifts toward preventive care and remote patient management, thereby fueling the segment growth.

The mobility devices segment accounted for significant growth in 2024 due to the growing elderly population and increasing cases of physical disabilities or injury-related mobility challenges. These products help individuals maintain independence and improve their quality of life. Rising rehabilitation needs after surgeries or accidents are further contributing to the increase in usage. Technological improvements, such as lightweight materials and powered mobility features, are making devices more convenient and accessible. Government support through reimbursement programs and increased focus on home healthcare are further encouraging adoption, thereby boosting the segment growth.

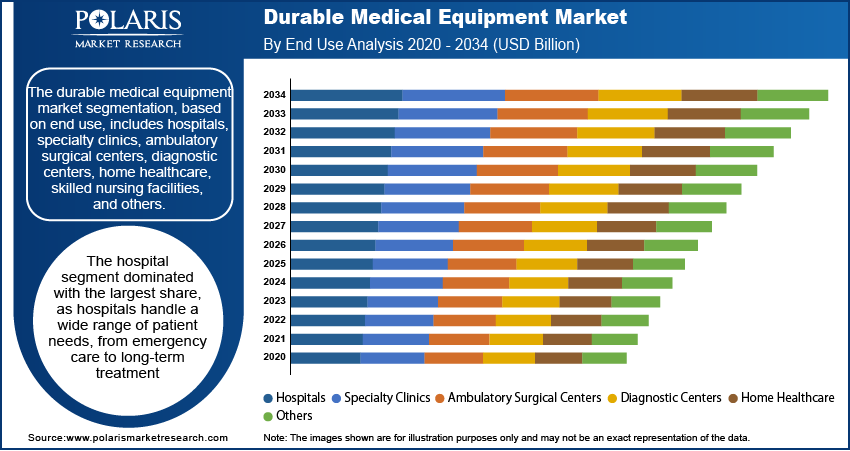

End Use Analysis

The segmentation, based on end use, includes hospitals, specialty clinics, ambulatory surgical centers, diagnostic centers, home healthcare, skilled nursing facilities, and others. The hospitals segment dominated with the largest share in 2024, as they handle a wide range of patient needs, from emergency care to long-term treatment. The expansion of hospital networks, both public and private, is increasing the demand for advanced and reliable DME. A rise in surgeries, admissions, and chronic disease management means hospitals need continuous access to equipment such as beds, monitors, and respiratory support devices. Additionally, the growing emphasis on patient safety and care quality is pushing hospitals to upgrade their DME regularly. Moreover, investments in healthcare infrastructure globally are boosting the segment’s growth and equipment usage.

The ambulatory surgical centers segment is expected to experience significant growth during the forecast period, due to the demand for cost-effective and efficient outpatient procedures. These centers need durable medical equipment such as surgical tables, monitoring systems, and post-operative care tools to deliver high-quality care without overnight stays. Patients prefer ambulatory care services for quicker recovery and lower costs, and this shift is increasing the need for reliable, compact, and portable DME. ASCs are expanding their services as minimally invasive surgeries become more common, driving higher equipment demand. Moreover, supportive insurance policies and faster regulatory approvals for these centers are further fueling the growth in this segment.

Regional Analysis

North America Durable Medical Equipment Market Trends

North America dominated the market with a 38% revenue share in 2024, driven by a large aging population and high prevalence of chronic diseases such as diabetes and heart conditions. Advanced healthcare infrastructure and high healthcare spending support the widespread use of DME. Strong insurance coverage and government programs such as Medicare and Medicaid make equipment more affordable for patients. Additionally, continuous technological innovations and increasing home healthcare adoption boost demand. The region’s focus on improving patient outcomes and quality of care in both hospitals and home settings further fuels the growth in North America.

U.S. Durable Medical Equipment Market Insights

The industry in the U.S. is expected to register a CAGR of 6.5% during the forecast period, due to its well-established healthcare system and extensive insurance coverage, including Medicare, which supports durable medical equipment expenses. The increasing number of elderly patients and chronic disease cases drives steady demand for mobility aids, monitoring, and therapeutic devices. Technological advancements and strong healthcare infrastructure improve product availability and quality. The rising trend of home healthcare services and outpatient care further contributes to the growing need for DME. Moreover, government initiatives encouraging preventive care and rehabilitation fuel expansion in the country.

Asia Pacific Durable Medical Equipment Market Analysis

The Asia Pacific industry is projected to witness substantial growth during the forecast period, driven by improving healthcare infrastructure and rising awareness about chronic disease management. The region has a large and growing elderly population, increasing demand for mobility and therapeutic devices. Economic development in countries such as India and Southeast Asia is expanding access to healthcare services, including home care. Additionally, increasing government investments in healthcare and expanding health insurance coverage encourage more people to afford medical equipment. Urbanization and lifestyle changes are further fueling a rise in chronic health issues, which boosts demand in the region.

China Durable Medical Equipment Market Outlook

The China industry is projected to witness substantial growth during the forecast period due to its large elderly population and increasing prevalence of chronic diseases such as COPD, diabetes, and cardiovascular problems. Government initiatives to strengthen healthcare infrastructure and expand health insurance coverage are making durable medical equipment more accessible. Urbanization and rising disposable incomes enable more patients to invest in quality healthcare products. The Chinese government’s focus on improving home healthcare services and rural healthcare access further increases demand. Additionally, domestic manufacturers are innovating and producing cost-effective equipment, making DME more affordable and boosting market growth in the country.

Europe Durable Medical Equipment Market Trends

The industry in Europe is expected to experience significant growth in the future, due to an aging population and high prevalence of chronic diseases such as arthritis, cardiovascular conditions, and respiratory illnesses. Well-established healthcare systems across countries provide strong support for medical equipment use. Government initiatives and reimbursement policies encourage the adoption of advanced and home-based medical devices. Increasing awareness about home healthcare and rehabilitation services is pushing demand for mobility aids and therapeutic products. Technological innovations and rising healthcare expenditure further contribute to growth. Moreover, the rising shift toward outpatient care and preventive treatment propels the need for durable medical equipment across the region.

Germany Durable Medical Equipment Market Analysis

The market in Germany is expected to experience significant growth driven by its rapidly aging population and high chronic disease rates. The country has a strong healthcare infrastructure with universal health coverage that helps patients access expensive medical devices. Germany’s well-developed home healthcare sector and rehabilitation programs increase demand for DME such as mobility aids and monitoring devices. Investments in healthcare technology and government support for elderly care further drive the demand. Furthermore, the preference for outpatient and home care treatments over hospital stays is expanding the market in the country.

Key Players and Competitive Analysis

The industry is characterized by the presence of well-established players competing on innovation, product quality, distribution networks, and pricing strategies. Key companies such as Medtronic PLC, Stryker, Hill-Rom, and Becton, Dickinson and Company leverage their extensive R&D capabilities and global presence to introduce advanced equipment tailored to various care settings. Medline Industries, Inc., GF Health Products Inc., and Carex Health Brands maintain strong positions through broad product portfolios and partnerships with healthcare providers. ArjoHuntleigh, Invacare Corporation, and Sunrise Medical focus on mobility and patient care solutions, often emphasizing ergonomic design and home care compatibility. Strategic initiatives, including mergers, product launches, and geographic expansion, are common as companies aim to capture market share and address growing demand from aging populations and home healthcare trends. Overall, competition remains intense, driven by innovation, regulatory compliance, and the need for cost-effective, patient-centric medical equipment solutions.

Key Players

- ArjoHuntleigh

- Becton, Dickinson and Company

- Carex Health Brands

- GF Health Products Inc.

- Hill-Rom

- Invacare Corporation

- Medline Industries, Inc.

- Medtronic PLC

- Stryker

- Sunrise Medical

Durable Medical Equipment Industry Developments

In June 2025, Cardinal Health launched the Kendall DL Multi System, a single-patient use device that continuously monitors cardiac activity, blood oxygen, and temperature. The system enhanced clinical workflows, reduced infection risks, and improved diagnostic accuracy across healthcare settings.

In November 2024, HealthTap launched into the durable medical equipment market through a partnership with Aeroflow Health. The collaboration enabled patients to access DME prescriptions virtually, strengthening care continuity and expanding HealthTap’s reach in delivering AI-supported, high-quality primary care services.

Durable Medical Equipment Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Personal Mobility Devices

- Wheelchairs

- Scooters

- Walker and Rollators

- Cranes and Crutches

- Door Openers

- Other Devices

- Bathroom Safety Devices & Medical Furniture

- Commodes and Toilets

- Mattress & Bedding Devices

- Monitoring & Therapeutic Devices

- Blood Sugar Monitors

- Continuous Passive Motion (CPM)

- Infusion Pumps Market

- Nebulizers

- Oxygen Equipment

- Continuous Positive Airway Pressure (CPAP)

- Suction Pumps

- Traction Equipment

- Other Equipment

- Insulin Pumps

- Ostomy Bags & Accessories

- Other

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Diagnostic Centers

- Home Healthcare

- Skilled Nursing Facilities

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Durable Medical Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 236.13 Billion |

|

Market Size in 2025 |

USD 249.48 Billion |

|

Revenue Forecast by 2034 |

USD 414.05 Billion |

|

CAGR |

5.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 236.13 billion in 2024 and is projected to grow to USD 414.05 billion by 2034.

The global market is projected to register a CAGR of 5.8% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are ArjoHuntleigh; Becton, Dickinson and Company; Carex Health Brands; GF Health Products Inc.; Hill-Rom; Invacare Corporation; Medline Industries, Inc.; Medtronic PLC; Stryker; and Sunrise Medical.

The monitoring & therapeutic devices segment dominated the market share in 2024.

The ambulatory surgical center segment is expected to witness the significant growth during the forecast period.