3D Cell Culture Market Size, Share & Industry Analysis Report

: By Source (Animal-derived Cell, Human-derived Cell, and Others), By Product Type, By Application, By End User, and Region – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 143

- Format: PDF

- Report ID: PM1336

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

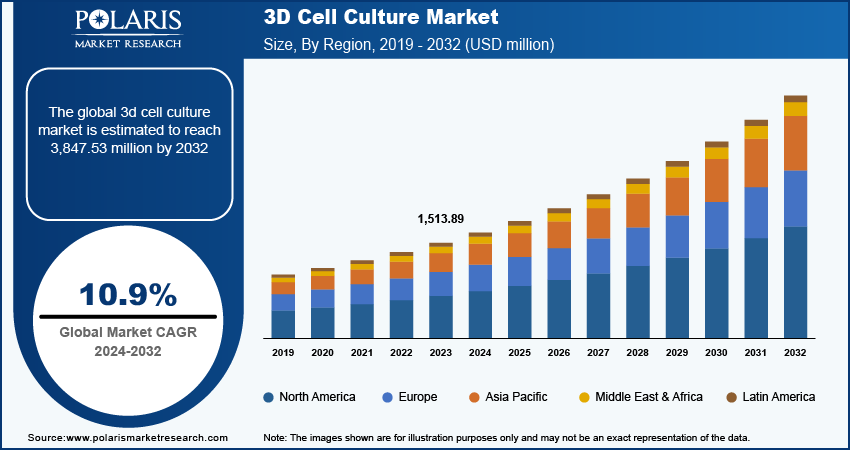

The global 3D cell culture market was valued at USD 1.5 billion in 2024 and is expected to grow at a CAGR of 10.0% from 2025 to 2034. The market expansion is supported by rising adoption in drug discovery and regenerative medicine research.

The 3D cell culture technique allows the cells to grow in a 3D environment outside the original organism. In this technique, the cells are grown in a condition that resembles more in-vivo and have space to succeed in all three dimensions and interact with each other. The expansion of this industry is driven by significant advancements in research and development activities. In cancer research, these techniques enable the generation of more biologically relevant models, such as organoids, which closely resemble patient physiology compared to 2D cultures. For instance, in 2022, the American Association for Cancer Research (AACR) annual meeting highlighted that the early detection of the pre-cancer stage is done utilizing cancer models in 3D cell culture. Such utilization in research and development is driving innovation and expanding the market globally.

To Understand More About this Research: Request a Free Sample Report

Innovative technology and product launches are fuelling 3D cell culture market expansion as new technology and products have kept the market growing across the globe. Many companies are investing in new products in the 3D cell culture. For instance, in October 2023, Molecular Devices launched the CellXpress.ai Automated Cell Culture System, an advanced 3D Biology Innovation Hub designed to expedite dependable drug discoveries. The system leverages machine learning technology to automate complex feeding and passaging schedules, integrating an incubator, liquid handler, and imager. Such product launches improve efficiency, simplify processes, and expedite the advancement of potential therapeutics to pre-clinical trials. Consequently, innovative product releases are propelling market growth as it provides scientists with greater control and time efficiency in the laboratory.

Trends and Drivers

Expansion of Biotechnology Industries Globally

Biotechnology companies are making huge investments in the expansion of new facilities that drive the market by fostering research and development into advanced cell culture techniques. Firms are investing substantial funds as there is a heightened focus on developing and utilizing more refined cell culture models that simulate in vivo environments. For instance, in April 2022, Nanolive SA received a USD 20 million investment to drive the growth of digital assay solutions. The investment was led by Taiwania Capital, the life science venture capital company based in Taiwan, to assist in screening thousands of live cells in 3D. These types of investments are fuelling the growth of drug discovery and cell therapy, which are driving the 3D cell culture market.

Regenerative Medicine Boosts Market Growth

The growing adoption of regenerative medicine is propelling the market. 3D bioprinting plays an important role in tissue engineering by enabling the creation of functional tissues for regenerative medicine. It allows for the precise fabrication of tissue engineering scaffolds with patient-specific spatial geometry, controlled microstructures, and the precise positioning of different cell types. Manufacturers are coming up with new innovative technology and products to boost market growth. For instance, in October 2023, CELLINK, a bioprinting technology company, introduced CELLINK Vivoink, an advancement in the sector of regenerative medicine and tissue engineering. Such innovations in regenerative medicine have facilitated the regeneration of damaged organs or tissues into functional ones through the use of 3D bioprinting. Thus, the advancements in regenerative medicine are fuelling the 3D cell culture market.

Segment Insights

Application Insights

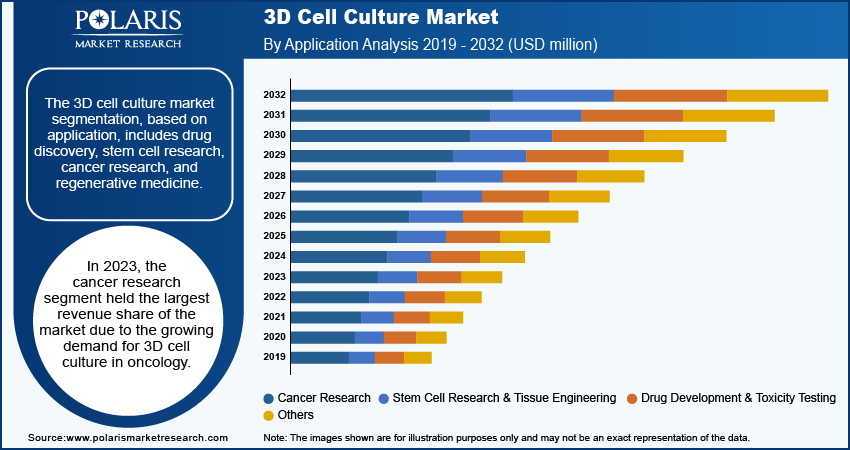

The 3D cell culture market segmentation, based on application, includes drug discovery, stem cell research, cancer research, and regenerative medicine. In 2024, the cancer research segment held the largest revenue share of the market due to the growing demand for this technique in oncology. Several market players are introducing innovative technologies to meet the growing demand for 3D cell culture to treat cancer. For instance, in January 2024, Predictive Oncology introduced an innovative 3D cell technology to speed up the discovery of cancer therapeutic drugs. Such advancements offer a representative approach for testing potential drugs in clinical settings and more reliable predictions of clinical outcomes. Therefore, the innovations by key market players have contributed to the dominance of the cancer research segment.

End User Insights

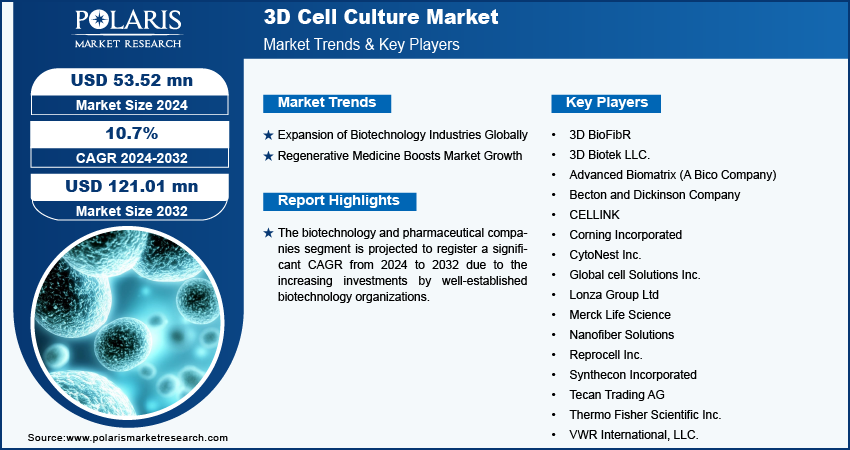

The 3D cell culture market segmentation, based on end–user, includes academics institutes, biotechnology and pharmaceutical companies, contract research laboratories, and others. The biotechnology and pharmaceutical companies segment is projected to register a significant CAGR from 2024 to 2032 due to the increasing investments by well-established biotechnology organizations. For instance, in May 2024, ChargePoint Technology made a significant investment in a new manufacturing facility in Speke, Liverpool, specifically for its single-use products to meet the growing demand in the market for disposable technologies and equipment. Such investments by biotechnology organizations are anticipated to boost the growth of the segment within the industry.

Regional Insights

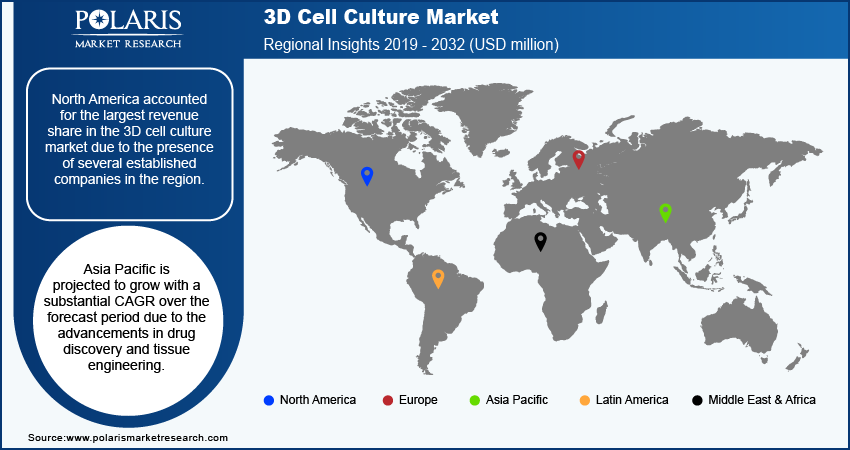

In 2024, North America 3D cell culture market accounted for the largest revenue share due to the presence of several established companies in the region. Major multinational corporations and biotechnology firms headquartered in the region, such as VWR International, Corning Inc., and Nanofiber Solutions, are driving innovation through their advanced research and development capabilities. The entities are making substantial investments in 3D cell culture, leading to the development of advanced commercial products and solutions. Thus, the strong infrastructure, substantial research and development funding, and strategic partnerships by these well-established players in the region have significantly strengthened the pharmaceutical industry, further contributing to the dominance of North America in the global market.

Asia Pacific 3D cell culture market is projected to grow with a substantial CAGR over the forecast period due to the advancements in drug discovery and tissue engineering. For instance, in June 2024, Researchers at the Department of Bioengineering (BE) at the Indian Institute of Science (IISc) developed an innovative 3D hydrogel culture system that closely replicates the environment of the mammalian lung. The platform provides a monitoring system that studies the mechanism of tuberculosis bacterial infection in lung cells. Such rapid technological advancements in tissue engineering and hydrogel are resulting in the growing demand for research, drug discovery, and regenerative medicine in Asia Pacific, which is expected to fuel the industry in this region.

China 3D cell culture market is anticipated to grow significantly due to the favorable regulatory environment supporting biotech advancements. China’s government has implemented various policies and initiatives, including the 14th Five‐Year Plan, that emphasize strengthening coordination and leadership in drug safety, innovating and enhancing support mechanisms, and actively engaging in global drug safety governance. Thus, China's supportive regulatory policies to advance its biotechnology sector are driving the growth of the market in the country.

Key Players & Competitive Insights

The 3D cell culture market is dynamic, with several players striving to innovate and differentiate from each other. Major global companies are dominating the market by leveraging extensive research and development capabilities, advanced culture technologies, and broad distribution networks to maintain a competitive edge. The players are engaged in strategic activities such as mergers and acquisitions, partnerships, and collaborations to enhance their product portfolios and expand their market presence.

Additionally, startups are contributing to the market by introducing innovative hydrogel culture technologies and catering to niche applications. This competitive scenario is further intensified by ongoing advancements in biotechnology and drug discovery, increased focus on sustainability, and the growing demand for tissue engineering, regenerative medicine, and personalized medicine. Major players in the industry include 3D BioFibR; 3D Biotek LLC.; Advanced Biomatrix (A Bico Company); Becton and Dickinson Company; CELLINK; Corning Incorporated; CytoNest Inc.; Global cell Solutions Inc.; Lonza Group Ltd; Merck Life Science; Nanofiber Solutions; Reprocell Inc.; Synthecon Incorporated; Tecan Trading AG; Thermo Fisher Scientific Inc.; and VWR International, LLC.

CELLINK, a subsidiary of BICO, is a 3D bioprinting company that specializes in providing advanced 3D bioprinting products, services, and technologies. The company focuses on developing technologies to democratize 3D bioprinting, empowering leading researchers worldwide to shape the future of health. CELLINK develops alternatives to animal models, accelerating drug discovery and regenerative medicine. The company has a presence in more than 65 countries worldwide. CELLINK also partners with other life science companies to deliver solutions to the life science industry. In December 2022, CELLINK and the Indian Institute of Science launched the Centre of Excellence for 3D Bioprinting in India. This center offers 3D Bioprinting technology developed by CELLINK, enabling significant advancements in research.

Corning Incorporated develops specialty materials, optical communications, display technologies, environmental technologies, and life sciences businesses in domestic and international markets. The environmental technologies segment specializes in supplying filter products and ceramic substrates designed for emissions control in gasoline, mobile, and diesel applications. The company's life sciences division provides a range of laboratory products, such as consumables (liquid handling plastics, plastic vessels, cell culture media, specialty surfaces, and serum), glassware, general labware, and equipment. In February 2022, Corning introduced the Corning Matribot bioprinter, a device that facilitates dispensing and printing with Corning Matrigel matrix, collagen, and other temperature-sensitive hydrogels without the need for cold blocks, ice buckets, or a cold room. The device is capable of bioprinting with hydrogels that require ambient temperature, such as alginate-based bioinks.

List of Key Companies

- 3D BioFibR

- 3D Biotek LLC.

- Advanced Biomatrix (A Bico Company)

- Becton and Dickinson Company

- CELLINK

- Corning Incorporated

- CytoNest Inc.

- Global cell Solutions Inc.

- Lonza Group Ltd

- Merck Life Science

- Nanofiber Solutions

- Reprocell Inc.

- Synthecon Incorporated

- Tecan Trading AG

- Thermo Fisher Scientific Inc.

- VWR International, LLC.

3D Cell Culture Market Developments

In May 2025, advanced stem cell products from REPROCELL were launched in India by Bioserve India. The launch featured 3D cell culture systems, enabling tissue-mimicking platforms for enhanced drug screening and toxicity testing, supporting regenerative medicine advancements.

In July 2024, CytoNest Inc. launched its inaugural commercial offering, the CytoSurge 3D fiber scaffold. This innovative product is designed to enhance cell manufacturing and tissue engineering processes, with wide-ranging applications in cell research, biopharmaceuticals, cell therapeutics, and the development of cultured meat and seafood.

In June 2023, 3DBioFibR unveiled its latest products, the μCollaFibR™ (pronounced micro-CollaFibR™) and CollaFibR™ 3D scaffold, which are produced using the company's advanced dry-spinning technology. These new collagen fiber products are designed to meet the demands of tissue engineering and tissue culture applications at scale.

In December 2022, eNUVIO introduced the innovative EB-Plate, the first fully reusable 3D cell culture microplate available in the market. The release of this product aligns with the increasing traction of the zero-waste movement within laboratory settings.

3D Cell Culture Market Segmentation

By Source Outlook

- Human-derived Cell

- Animal-derived Cell

- Others

By Product Type Outlook

- Scaffold Based

- Hydrogels

- Polymeric Scaffolds

- Micropatterned Surface Microplates

- Nanofiber Base Scaffolds

- Scaffold Free

- Hanging Drop Microplates

- Spheroid Microplates with ULA Coating

- Magnetic Levitation

- Bioreactors

- Microfluidics

- Bioprinting

By Application Outlook

- Drug Discovery

- Stem Cell Research

- Cancer Research

- Regenerative Medicine

By End User Outlook

- Academics Institutes

- Biotechnology and Pharmaceutical Companies

- Contract Research Laboratories

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

3D Cell Culture Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1.5 billion |

|

Market Size Value in 2025 |

USD 1.65 billion |

|

Revenue Forecast in 2034 |

USD 3.9 billion |

|

CAGR |

10.00% from 2024 to 2032 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The 3D cell culture market size was valued at USD 1.5 billion in 2024 and is projected to grow to USD 3.9 billion by 2034.

The market is projected to grow at a CAGR of 10.0% from 2025 to 2034.

North America had the largest share of the market in 2024.

The key players in the market are 3D BioFibR; 3D Biotek LLC.; Advanced Biomatrix (A Bico Company); Becton and Dickinson Company; CELLINK; Corning Incorporated; CytoNest Inc.; Global cell Solutions Inc.; Lonza Group Ltd; Merck Life Science; Nanofiber Solutions; Reprocell Inc.; Synthecon Incorporated; Tecan Trading AG; Thermo Fisher Scientific Inc.; and VWR International, LLC.

The cancer research segment held the largest market share in 2024.

The cancer research segment accounted for the largest revenue share of the market in 2024 due to the use of 3D cell culture in oncology for disease modeling, drug discovery, and regenerative medicine