U.S. Sterilization Services Market Size, Share, Trends, Industry Analysis Report

: By Service (Contract Sterilization Services and Validation Sterilization Services) and Delivery Mode – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 118

- Format: PDF

- Report ID: PM5644

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

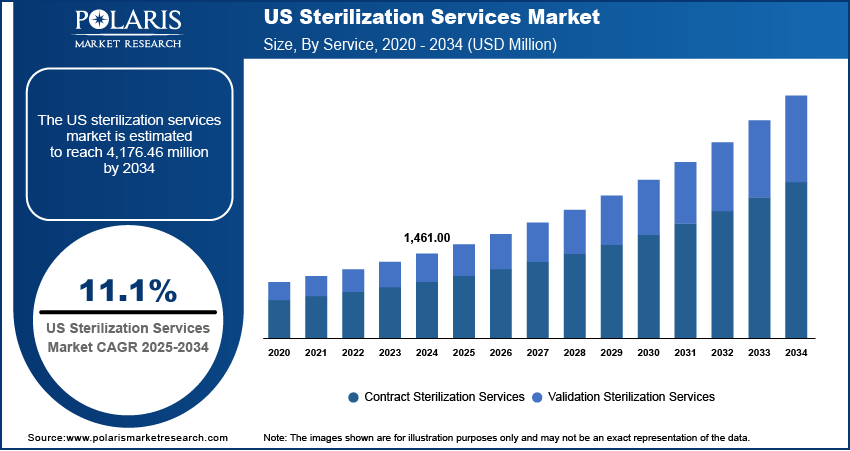

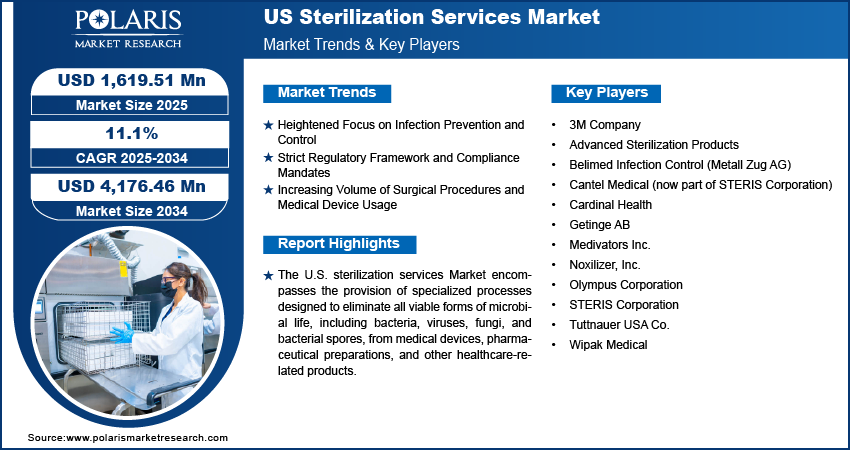

The U.S. sterilization services market size was valued at USD 1,461.00 million in 2024, exhibiting a CAGR of 11.1% during 2025–2034. Rising surgical volumes, infection control efforts, strict regulations, and increased outsourcing for sterility compliance drive the market.

Key Insights

- Contract sterilization services dominate due to rising outsourcing by healthcare providers seeking cost savings and access to advanced technologies.

- Onsite sterilization is growing rapidly due to hospitals needing faster instrument turnaround and tighter control in high-volume surgical settings.

Industry Dynamics

- Rising surgical procedures and medical device usage drive sustained demand for sterilization to ensure patient safety and infection control.

- Strict FDA and CDC regulations compel healthcare providers to adopt advanced sterilization services to ensure compliance and product safety.

- Outsourcing to specialized vendors supports scalability, reduces in-house costs, and enables access to cutting-edge sterilization technologies.

- The increasing complexity of medical devices boosts demand for validated sterilization protocols tailored to specific materials and configurations.

- High costs and technical barriers to validation and onsite sterilization setups limit adoption among smaller healthcare facilities and manufacturers.

Market Statistics

2024 Market Size: USD 1,461.00 million

2034 Projected Market Size: USD 4,176.46 million

CAGR (2025–2034): 11.1%

To Understand More About this Research: Request a Free Sample Report

The U.S. sterilization services Market encompasses specialized processes aimed at eliminating all forms of microbial life, including bacteria, viruses, fungi, and spores, from medical devices, pharmaceutical products, and other healthcare-related items. This critical service ensures that products are safe for use and prevents the transmission of infections in healthcare settings. The market size is substantial and continues to expand, driven by several key factors that influence market dynamics. One significant market drive is the increasing emphasis on infection control, particularly in hospitals and clinics, to reduce the prevalence of Hospital-Acquired Infections (HAIs). The rising number of surgical procedures performed annually also fuels market demand for effective sterilization services to ensure patient safety.

Furthermore, stringent regulatory standards enforced by agencies like the Food and Drug Administration (FDA) and the Centers for Disease Control and Prevention (CDC) mandate high levels of sterility for medical devices and pharmaceutical products. This regulatory landscape acts as a significant market growth factor, compelling manufacturers and healthcare providers to utilize professional sterilization services. The growing trend of outsourcing sterilization processes to specialized third-party vendors, known as contract sterilization services, also contributes significantly to the market development. Consequently, the market outlook for U.S. sterilization services remains positive, with consistent market demand trends and increasing market penetration across various healthcare sectors.

Market Dynamics

Heightened Focus on Infection Prevention and Control

The escalating emphasis on preventing and controlling infections within healthcare settings stands as a significant market drive for the U.S. sterilization services Market. The Centers for Disease Control and Prevention (CDC) has consistently highlighted the critical need to minimize the occurrence of Hospital-Acquired Infections (HAIs), which pose a substantial threat to patient health and contribute significantly to healthcare costs. Approximately 1 in 31 hospitalized patients in the US has at least one HAI at any given time. Each year, HAIs account for over 680,000 infections and billions of dollars in excess healthcare costs in the US.

According to a study published in the American Journal of Infection Control in 2023, analyzing data from the National Healthcare Safety Network (NHSN), HAIs remain a persistent challenge across U.S. healthcare facilities, underscoring the ongoing demand for effective sterilization wraps and practices. The report emphasizes the continued prevalence of central line-associated bloodstream infections (CLABSIs), catheter-associated urinary tract infections (CAUTIs), surgical site infections (SSIs), and ventilator-associated pneumonia (VAP), despite years of focused prevention efforts. This unwavering focus on minimizing infections necessitates the widespread adoption of reliable and effective terminal sterilization services, thereby significantly driving the growth of the U.S. sterilization services Market.

Strict Regulatory Framework and Compliance Mandates

The stringent regulatory landscape governing the sterilization of medical devices and pharmaceutical products in the United States acts as a powerful market growth factor for the U.S. sterilization services Market. Agencies such as the Food and Drug Administration (FDA) play a crucial role in establishing and enforcing rigorous standards to ensure the safety and efficacy of these products. The FDA's guidelines, as outlined in various publications and compliance documents available on their website, mandate that medical devices are properly sterilized to prevent patient harm. For instance, a research article published in the PDA Journal of Pharmaceutical Science and Technology in 2022 discussed the evolving regulatory expectations for sterilization validation, highlighting the increasing scrutiny on ensuring the effectiveness and consistency of sterilization methods. The article emphasized the importance of adhering to standards set by organizations like the Association for the Advancement of Medical Instrumentation (AAMI), which are often referenced by the FDA. The necessity to meet these demanding regulatory mandates and avoid potential repercussions strongly propels the demand for and consequently the growth of the U.S. sterilization services Market.

Increasing Volume of Surgical Procedures and Medical Device Usage

The consistent rise in the volume of surgical procedures performed across the United States, coupled with the expanding utilization of a wide array of medical devices, constitutes another significant market drive for the U.S. sterilization services Market. Data from the National Center for Health Statistics (NCHS), a part of the CDC, indicates a continuous trend of increasing surgical interventions due to factors such as an aging population, advancements in surgical techniques, and greater accessibility to healthcare services. The number of surgical procedures performed in the US continues to rise. For example, approximately 500,000 percutaneous coronary interventions are performed annually, highlighting the significant volume of procedures requiring sterile instruments.

Research published in Health Affairs in 2021 analyzed the trends in medical device utilization in ambulatory surgical centers, highlighting the expanding scope and volume of device-intensive procedures performed outside of traditional hospital settings. This proliferation of medical devices in diverse healthcare environments further amplifies the need for reliable sterilization services to maintain safety standards. The increasing complexity of some medical devices also necessitates specialized sterilization techniques that healthcare facilities may not possess in-house, thereby driving the outsourcing trend and bolstering the market size of sterilization service providers. Consequently, the escalating number of surgical procedures and the widespread adoption of medical devices across the healthcare continuum are key factors continually fueling the market demand and promoting the expansion of the U.S. sterilization services Market.

Segment Insights

Market Assessment – By Service

The U.S. sterilization services Market is segmented by service into contract sterilization services and validation sterilization services. Among these service types, contract sterilization services currently holds the largest portion of the overall market share. This dominance can be attributed to the increasing trend among medical device manufacturers and healthcare providers to outsource their sterilization needs to specialized third-party vendors. This preference for contract services stems from several advantages, including the ability to leverage the expertise and advanced technologies offered by these specialized firms without the need for significant capital investment in in-house sterilization infrastructure.

The validation sterilization services are anticipated to exhibit the highest market growth rate in the coming years. This accelerated growth is propelled by the escalating complexity of medical devices and the increasingly stringent regulatory scrutiny surrounding sterilization processes. As medical devices become more intricate and incorporate advanced materials, the validation of sterilization methods to ensure their effectiveness and compatibility becomes paramount. Regulatory bodies like the FDA are placing greater emphasis on comprehensive validation studies and documentation to demonstrate that sterilization processes consistently achieve the required sterility assurance levels. This heightened focus on validation necessitates specialized expertise and sophisticated testing methodologies, driving the demand for dedicated validation services.

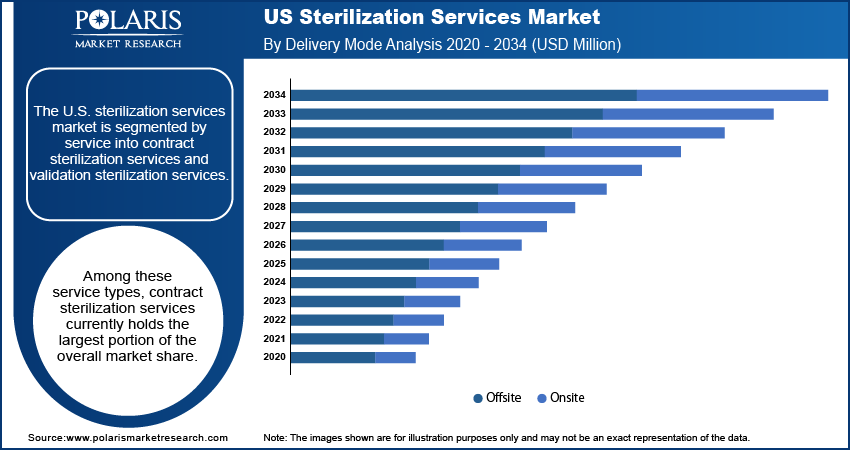

Market Evaluation– By Delivery Mode

The U.S. sterilization services Market is segmented by delivery mode into offsite and onsite. Currently, the offsite delivery mode accounts for the largest market share. This significant share is primarily driven by the widespread preference among healthcare facilities and medical device manufacturers to outsource their sterilization processes to specialized service providers who operate dedicated sterilization facilities. Offsite services offer numerous advantages, including access to advanced sterilization technologies, economies of scale, and the expertise of trained professionals. By utilizing offsite services, clients can avoid the substantial capital investments and operational complexities associated with maintaining in-house sterilization capabilities.

The onsite delivery mode is anticipated to experience the highest market growth rate over the forecast period. This increasing growth is fueled by specific needs within certain healthcare settings, such as large hospital systems with high volumes of reusable medical equipment and an immediate need for sterilized instruments. Onsite sterilization services offer the benefit of rapid turnaround times and enhanced control over the sterilization process, which can be critical in time-sensitive surgical environments. The ability to have sterilization capabilities readily available within the healthcare facility can improve operational efficiency and reduce reliance on external transportation logistics.

Key Players and Competitive Insights

Some names of major active players in the U.S. sterilization services market include STERIS Corporation, Cantel Medical (now part of STERIS Corporation, but mentioning separately as per the instruction to list active players), Getinge AB, Advanced Sterilization Products (a Fortive company), Medivators Inc. (also part of Cantel Medical/STERIS), 3M Company, Cardinal Health, Olympus Corporation, Belimed Infection Control (Metall Zug AG), Wipak Medical, Noxilizer, Inc., and Tuttnauer USA Co.

The competitive landscape of the U.S. sterilization services Market is characterized by a mix of large, well-established global players and smaller, more specialized companies. Competition is based on factors such as service portfolio breadth, technological innovation, geographic reach, pricing strategies, and the ability to meet stringent regulatory requirements. Key market insights reveal a growing trend towards consolidation, as larger players acquire smaller entities to expand their service offerings and market presence. The focus on developing more efficient and environmentally friendly sterilization technologies is also a significant aspect of the competitive environment. Furthermore, the ability to provide customized sterilization solutions and value-added services like logistics and instrument tracking plays a crucial role in gaining a competitive edge within the market.

STERIS Corporation, located in Mentor, Ohio, offers a comprehensive range of sterilization and infection prevention products and services. Their offerings include contract sterilization services utilizing various modalities such as ethylene oxide, gamma irradiation, and electron beam, as well as a wide array of sterilization equipment for healthcare facilities, including steam sterilizers, low-temperature sterilization systems, and high-level disinfectants.

Getinge AB, headquartered in Gothenburg, Sweden, has a significant presence in the U.S. sterilization services Market. Their offerings encompass a wide spectrum of sterilization solutions, including contract sterilization services utilizing steam, ethylene oxide, and radiation, as well as the provision of sterilization equipment such as steam sterilizers, washer-disinfectors, and chemical disinfection systems for hospitals and life science industries.

List of Key Companies

- 3M Company

- Advanced Sterilization Products (a Fortive company)

- Belimed Infection Control (Metall Zug AG)

- Cantel Medical (now part of STERIS Corporation)

- Cardinal Health

- Getinge AB

- Medivators Inc. (also part of Cantel Medical/STERIS)

- Noxilizer, Inc.

- Olympus Corporation

- STERIS Corporation

- Tuttnauer USA Co.

- Wipak Medical

U.S. Sterilization Services Market Industry Developments

- November 2024: Los Angeles-based private equity firm Vance Street Capital partnered with the management team of Prince Sterilization Services to support the company’s continued expansion. This strategic collaboration seeks to accelerate growth in the pharmaceutical and medical device sterilization sectors.

- August 2024: Advanced Sterilization Products (ASP), a division of Fortive, secured FDA clearance for the ULTRA GI Cycle, a hydrogen peroxide gas plasma sterilization method for duodenoscopes. This innovation is designed to improve patient safety in healthcare environments.

U.S. Sterilization Services Market Segmentation

By Service Outlook (Revenue-USD Million, 2020–2034)

- Contract Sterilization Services

- Validation Sterilization Services

By Delivery Mode Outlook (Revenue-USD Million, 2020–2034)

- Offsite

- Onsite

U.S. Sterilization Services Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,461.00 million |

|

Market Size Value in 2025 |

USD 1,619.51 million |

|

Revenue Forecast by 2034 |

USD 4,176.46 million |

|

CAGR |

11.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The U.S. sterilization services market has been segmented into detailed segments of service and delivery mode. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies

Growth and marketing strategies within the U.S. sterilization services Market are increasingly focused on highlighting the value proposition of specialized expertise and regulatory compliance. Companies are emphasizing their ability to provide consistent, reliable sterilization services that mitigate the risks associated with inadequate sterilization. Marketing efforts often target healthcare facilities and medical device manufacturers, underscoring the cost-effectiveness and efficiency gains achieved through outsourcing. Expansion strategies include broadening service portfolios to encompass a wider range of sterilization modalities and value-added services like logistics and validation. Furthermore, companies are focusing on building strong relationships with regulatory bodies and showcasing their adherence to the latest standards to gain a competitive advantage. Digital marketing and educational content aimed at raising awareness about the importance of proper sterilization also form key components of their outreach.

FAQ's

The U.S. sterilization services market size was valued at USD 1,461.00 million in 2024 and is projected to grow to USD 4,176.46 million by 2034.

The market is projected to register a CAGR of 11.1% during the forecast period, 2024-2034.

Key players in the U.S. sterilization services market include STERIS Corporation, Cantel Medical (now part of STERIS Corporation, but mentioning separately as per the instruction to list active players), Getinge AB, Advanced Sterilization Products (a Fortive company), Medivators Inc. (also part of Cantel Medical/STERIS), 3M Company, Cardinal Health, Olympus Corporation, Belimed Infection Control (Metall Zug AG), Wipak Medical, Noxilizer, Inc., and Tuttnauer USA Co.

The offistr segment accounted for the larger share of the market in 2024.

Following are some of the U.S. sterilization services market trends: ? Increased Outsourcing: A growing number of hospitals and medical device manufacturers are opting to outsource their sterilization needs to specialized contract sterilization service providers to improve efficiency and focus on core operations. ? Stringent Regulatory Focus: Heightened scrutiny and more rigorous enforcement of sterilization standards by regulatory bodies like the FDA are driving demand for validated and compliant sterilization services. ? Technological Advancements: The adoption of advanced sterilization technologies, including low-temperature sterilization methods and innovative sterilization equipment, is becoming more prevalent to handle a wider range of medical devices and materials.

The U.S. sterilization services market refers to the industry dedicated to ensuring that medical devices, pharmaceutical products, and other healthcare-related items are free from harmful microorganisms. These services employ various methods to eliminate bacteria, viruses, fungi, and spores, making products safe for patient use and preventing infections in healthcare settings. Sterilization services are crucial for hospitals, clinics, medical device manufacturers, and pharmaceutical companies to comply with stringent regulatory standards and maintain a safe healthcare environment. This market includes both contract sterilization services, where companies outsource their sterilization needs, and validation services, which verify the effectiveness of sterilization processes.