US Endoscope Cleaning Timers Market Size, Share, Trends, Industry Analysis Report

: By Product (1-Hour Cleaning Timers, 5/7-Day Cleaning Timers), and End User– Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 125

- Format: PDF

- Report ID: PM5673

- Base Year: 2024

- Historical Data: 2020-2023

US Endoscope Cleaning Timers Market Overview

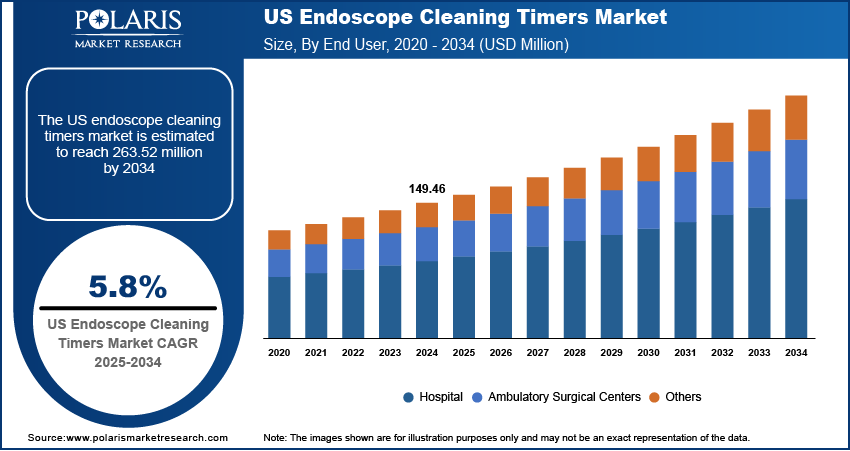

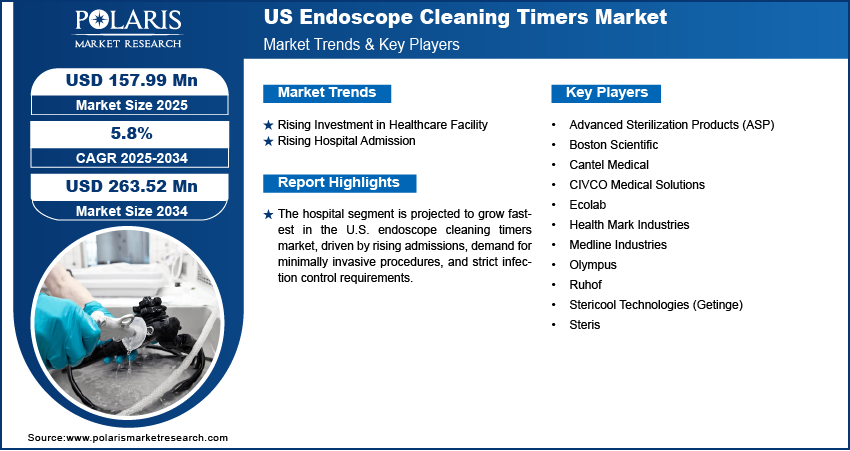

US endoscope cleaning timers market size was valued at USD 149.46 million in 2024. The US endoscope cleaning timers industry is projected to grow from USD 157.99 million in 2025 to USD 263.52 million by 2034, exhibiting a compound annual growth rate (CAGR) of 5.8% during the forecast period.

Endoscope cleaning timers are specialized devices or built-in system features used to monitor and control the duration of each step in the endoscope cleaning and disinfection process. They help ensure compliance with standardized cleaning protocols by accurately timing procedures like pre-cleaning, flushing, and high-level disinfection.

The rise in healthcare-associated infections, particularly those caused by improperly reprocessed endoscopes, has significantly increased the demand for reliable endoscope cleaning systems. According to the Patient Safety Network, in 2023, 633,300 patients in the US had HAI. Inadequate cleaning can result in cross-contamination between patients, raising the risk of infections. This has led healthcare facilities to adopt advanced endoscope disinfection technology, such as automated endoscope reprocessors (AERs), to ensure thorough and effective cleaning. Endoscope reprocessing solutions are now crucial to infection control strategies, making cleaning timers an essential component for maintaining compliance with strict infection control standards, thereby driving the growth of the US endoscope cleaning timers market revenue.

To Understand More About this Research:Request a Free Sample Report

Rising focus on strict regulatory guidelines to ensure patient safety and prevent infections is driving the demand for these devices among healthcare providers. The CDC, FDA, and other regulatory bodies have established comprehensive cleaning standards for medical devices like disposable endoscopes. These standards push healthcare facilities to invest in automated endoscope reprocessing equipment that guarantees adherence to these regulations. Endoscope cleaning systems must pass rigorous quality control to meet the standards for high-level disinfection equipment. The demand for accurate endoscope cleaning timers has increased, as they help ensure that the cleaning process is both effective and compliant, thereby driving the growth of the US endoscope cleaning timers market value.

US Endoscope Cleaning Timers Market Dynamics

Rising Investment in Healthcare Facility

Healthcare facilities across the United States are investing more in high-quality medical equipment such as disinfectant and sterilization equipment including endoscope sterilization equipment, to improve patient outcomes and maintain high safety standards. For instance, in December 2024, Advocate Health Care invested USD 1 billion on Chicago’s South Side. Improving access to outpatient and specialty care. Hospitals are prioritizing investments in endoscope reprocessing solutions to ensure that their equipment is properly cleaned and disinfected after each use as the number of minimally invasive surgeries increases. These investments include advanced endoscope cleaning systems that feature integrated cleaning timers to monitor and control the cleaning process, thereby driving the growth of the US endoscope cleaning timers market demand.

Rising Hospital Admission

An increase in hospital admissions in the United States is significantly impacting the demand for medical equipment, including endoscope cleaning systems. Factors such as an aging population, higher rates of chronic diseases, and a surge in mental health issues are contributing to more frequent hospital visits and longer stays. According to the American Hospital Association, in 2023, 31,967,073 hospital admissions were recorded in community hospitals alone across the US. This heightened demand places additional strain on healthcare facilities, necessitating the acquisition of advanced medical devices and reprocessing equipment to maintain patient safety and operational efficiency, thereby driving the growth of the US endoscope cleaning timers market expansion.

US Endoscope Cleaning Timers Market Segment Analysis

US Endoscope Cleaning Timers Market Assessment by End User Outlook

The US endoscope cleaning timers market assessment based on end user includes hospital, ambulatory surgical centers, and others. The hospital segment is expected to witness fastest growth in the forecast period driven by the rising number of hospital admissions, increased demand for minimally invasive procedures, and the growing need to follow strict infection control standards. Hospitals perform a high volume of endoscopic procedures daily, making reliable and efficient cleaning systems essential. To ensure patient safety and regulatory compliance, more hospitals are adopting automated endoscope reprocessing solutions that include cleaning timers, thereby driving segmental growth in the US endoscope cleaning timers market report.

US Endoscope Cleaning Timers Market Evaluation by Product Outlook

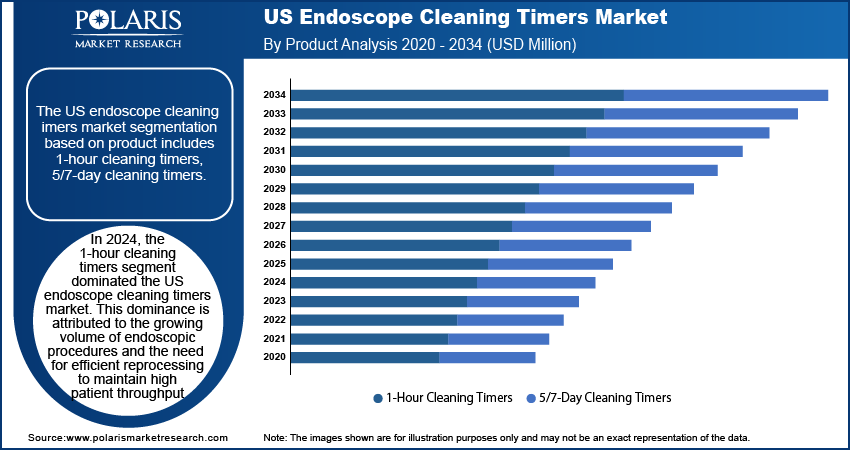

The US endoscope cleaning timers market evaluation, based on product, includes 1-hour cleaning timers, 5/7-day cleaning timers. The 1-hour cleaning timers segment dominated the US endoscope cleaning timers market in 2024. This dominance is attributed to the growing volume of endoscopic procedures and the need for efficient reprocessing to maintain high patient throughput. A 1-hour cleaning cycle aligns with the typical cleaning duration required for high-level disinfection, ensuring that endoscopes are ready for reuse within a clinically acceptable timeframe. Hospitals, which perform numerous endoscopic procedures daily, favor these timers to streamline workflows and adhere to infection control standards, thereby driving the segmental growth in the US endoscope cleaning timers market statistics.

US Endoscope Cleaning Timers Market Key Players & Competitive Analysis Report

The US endoscope cleaning timers market stats is undergoing significant transformation, with a multitude of enterprises actively seeking to innovate and carve out their niche. Dominant global players in this sector harness their capabilities in extensive R&D and cutting-edge technologies to maintain a competitive edge. These corporations are employing strategic maneuvers, including mergers, acquisitions, partnerships, and collaborations, to refine their product portfolios and penetrate new markets.

Emerging companies are also making a notable impact by introducing groundbreaking products tailored to meet the specific demands of various market segments. Relentless advancements in product technology and functionalities further intensify this competitive landscape. Major players in the US endoscope cleaning timers market, includes, Advanced Sterilization Products (ASP); Boston Scientific; Cantel Medical; CIVCO Medical Solutions; Ecolab; Health Mark Industries; Medline Industries; Olympus; Ruhof; Stericool Technologies (Getinge); Steris.

Boston Scientific Corporation, established in 1979 and based in Marlborough, Massachusetts, is a multinational medical device company. It designs, manufactures, and markets a range of products used in various medical fields such as cardiology, electrophysiology, endoscopy, urology, gynecology, and neuromodulation. The company is known for devices like drug-eluting stents and implantable defibrillators. The company’s product portfolio includes cardiovascular devices such as stents, pacemakers, and defibrillators; electrophysiology products like catheters and ablation systems; endoscopy devices including visualization systems and forceps; urology and pelvic health devices such as catheters and lithotripsy equipment; neuromodulation devices including deep brain stimulation systems; and peripheral intervention products like atherectomy systems and guidewires. These products are used in minimally invasive procedures across various medical specialties. Boston Scientific operates in multiple regions worldwide, including North America, Europe, Asia Pacific, Latin America, and the Middle East. Its main headquarters is in the United States, with regional offices in France for Europe and Singapore for Asia Pacific. The company has manufacturing facilities in the US, Ireland, Costa Rica, Malaysia, and Puerto Rico. The company provides Aegis One-Hour Indicator, which is a peel-off label that visually signals when one hour has elapsed between endoscope pre-cleaning and manual cleaning, helping staff track and comply with manufacturer reprocessing time limits. It adheres to transport systems like CinchPad for convenient monitoring during endoscope reprocessing.

Olympus Corporation was established in 1919 in Tokyo, Japan, initially focusing on the domestic production of microscopes. Over time, the company expanded its scope to medical technology, particularly in the field of endoscopy. In 1950, Olympus developed the world’s first gastrocamera, marking its entry into medical imaging and endoscopic devices. The company is headquartered in Hachioji-shi, Tokyo. Olympus’s business is primarily divided into two main segments: Endoscopic Solutions and Therapeutic Solutions. The Endoscopic Solutions segment includes products such as endoscopes, laparoscopes, video imaging systems, and integrated operating room equipment. These products are used in gastrointestinal and surgical endoscopy procedures. This segment also covers equipment for cleaning and reprocessing endoscopes, as well as repair and maintenance services. The therapeutic solutions segment provides surgical energy devices and instruments used in fields such as respiratory care, urology, gynecology, and ear, nose, and throat treatments. Olympus has exited the Life Science and Industrial Solutions sectors, which are now managed by Evident, to focus on medical devices. The company operates globally with regional headquarters and subsidiaries in the Americas, Asia Pacific, and Europe. The Americas headquarters is located in Center Valley, Pennsylvania, covering the US, Canada, and Latin America. The Asia Pacific regional office is based in Hong Kong, with significant operations in Japan, China, India, and other countries. Manufacturing facilities are located in Japan and Vietnam. Europe and the Middle East also have multiple sales offices and support centers.

Key Companies in the US Endoscope Cleaning Timers Market include:

- Advanced Sterilization Products (ASP)

- Boston Scientific

- Cantel Medical

- CIVCO Medical Solutions

- Ecolab

- Health Mark Industries

- Medline Industries

- Olympus

- Ruhof

- Stericool Technologies (Getinge)

- Steris

US Endoscope Cleaning Timers Market Development

In July 2023, the new Olympus ETD Endoscope Washer Disinfector was launched, enhancing endoscopy reprocessing efficiency with superior cleaning, sustainability, and digital integration, while reducing workload and exceeding disinfection standards.

In October 2022, Getinge launched an updated ED-Flow automated endoscope reprocessor, enhancing digital connectivity and data management. The new features aim to improve uptime, productivity, and infection prevention, while ensuring safe and reliable reprocessing.

US Endoscope Cleaning Timers Market Segmentation:

By Product Outlook (Revenue USD Million, 2020–2034)

- 1-Hour Cleaning Timers

- 5/7-Day Cleaning Timers

By End User Outlook (Revenue USD Million, 2020–2034)

- Hospital

- Ambulatory Surgical Centers

- Others

US Endoscope Cleaning Timers Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 149.46 million |

|

Market size value in 2025 |

USD 157.99 million |

|

Revenue Forecast in 2034 |

USD 263.52 million |

|

CAGR |

5.8% from 2025–2034 |

|

Base year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The US endoscope cleaning timers market size was valued at USD 149.46 million in 2024 and is projected to grow to USD 263.52 million by 2034.

The market is projected to grow at a CAGR of 5.8% during the forecast period, 2025-2034.

The key players in the market are Advanced Sterilization Products (ASP); Boston Scientific; Cantel Medical; CIVCO Medical Solutions; Ecolab; Health Mark Industries; Medline Industries; Olympus; Ruhof; Stericool Technologies (Getinge); and Steris.

The 1-hour cleaning segment dominated the US endoscope cleaning timers market in 2024. 1-hour cleaning cycle aligns with the typical cleaning duration required for high-level disinfection, ensuring that endoscopes are ready for reuse within a clinically acceptable timeframe.

The hospital segment is expected to witness fastest growth in the forecast period driven by the rising number of hospital admissions, increased demand for minimally invasive procedures, and the growing need to follow strict infection control standards.