3D Concrete Printing Market Size, Share, Trends, & Industry Analysis Report

By System (Gantry-Based Systems, Crane-Based/Contour Crafting Systems, and Robotic Arm-Based Systems), By Material, By Application, By End User, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5778

- Base Year: 2024

- Historical Data: 2020-2023

Overview

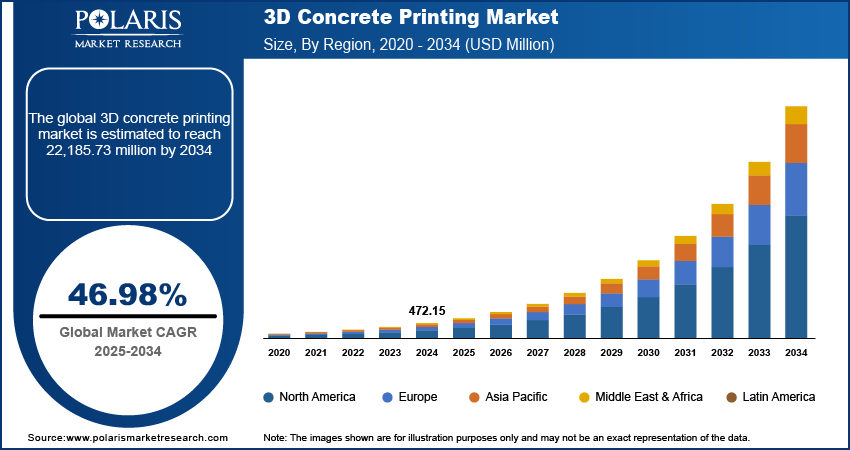

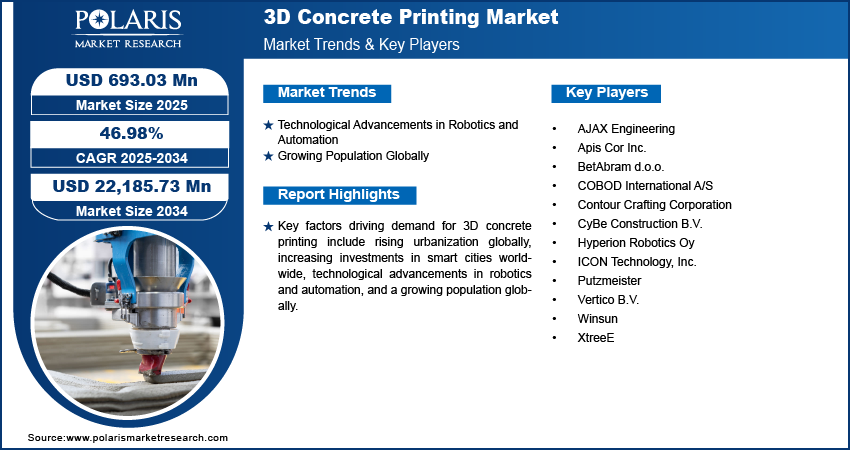

The global 3D concrete printing market size was valued at USD 472.15 million in 2024, growing at a CAGR of 46.98% during 2025–2034. Key factors driving demand for 3D concrete printing include rising urbanization globally, increasing investments in smart cities worldwide, technological advancements in robotics and automation, and a growing population globally.

3D concrete printing is an innovative construction technology that utilizes additive manufacturing processes to create complex concrete structures by layering material precisely under computer control. This technology employs specially formulated cement mixtures, which are extruded through a nozzle and deposited layer by layer to form walls, columns, flooring, slabs, or entire buildings. It offers significant advantages in terms of design flexibility, material efficiency, and speed of construction, and also reduces waste and labor costs. Governments and nonprofit organizations are increasingly using this method to deliver cost-effective housing solutions quickly.

The rising urbanization globally is driving the market growth. Urbanization is fueling the need for affordable housing, infrastructure, and public facilities. Developers and municipal authorities are adopting 3D concrete printing to meet these needs as it helps them accelerate construction timelines and reduce labor costs, enabling rapid development of residential complexes, schools, hospitals, and transportation structures. This technology is further minimizing material waste, which aligns with urban planning goals focused on efficiency, aesthetics, and sustainability. The World Economic Forum, in its 2022 report, stated that the share of the world’s population living in cities is expected to rise to 80% by 2050, from 55% in 2022. Therefore, the rising urbanization globally is driving the demand for 3D concrete technology.

The 3D concrete printing demand is driven by the increasing investments in smart cities worldwide. Smart cities prioritize innovative technologies to optimize infrastructure development. 3D concrete printing aligns perfectly with these goals by reducing construction time, minimizing material waste, and enabling complex architectural designs. Governments and developers in smart cities seek scalable methods to build affordable housing, bridges, and public amenities quickly, and 3D printing meets these requirements with precision and flexibility. Additionally, the technology supports eco-friendly initiatives by lowering carbon emissions compared to traditional construction, making it a preferred choice for sustainable smart cities projects. As of December 2024, the Government of India invested USD 17.60 billion (i.e., ₹1.47 Lakh Crore) in the development of 100 smart cities under the Smart Cities Mission (SCM). Therefore, as investment in smart cities expands, the demand for 3D concrete printing is projected to grow.

Industry Dynamics

Technological Advancements in Robotics and Automation

Construction companies are increasingly deploying advanced robotic arms and automated systems to streamline complex tasks such as layering concrete with high accuracy and consistency. These technologies reduce human error, lower labor costs, and accelerate project timelines, making 3D concrete printing more attractive for large-scale infrastructure and housing projects. Automation also enables the execution of intricate architectural designs that would be difficult or costly with traditional construction methods. Therefore, as robotics and automation continue to evolve, they expand the capabilities of 3D printers, encouraging broader adoption across the construction industry.

Growing Population Globally

The population is rising rapidly across the world. The Population Reference Bureau stated that the Asia population is projected to increase 10% by 2050 to 5.3 billion, up from 4.8 billion in 2024. The expanding population is creating pressures on governments and private developers to find faster and more efficient construction methods. 3D concrete printing addresses this demand by enabling quicker project completion, reducing material waste, and minimizing labor dependency. Therefore, as population growth rises, especially in developing regions such as Asia, authorities seek scalable construction technologies that can meet the rising need for affordable homes, schools, hospitals, and public infrastructure. This urgent demand fuels wider adoption of 3D concrete printing worldwide.

Segmental Insights

By System Analysis

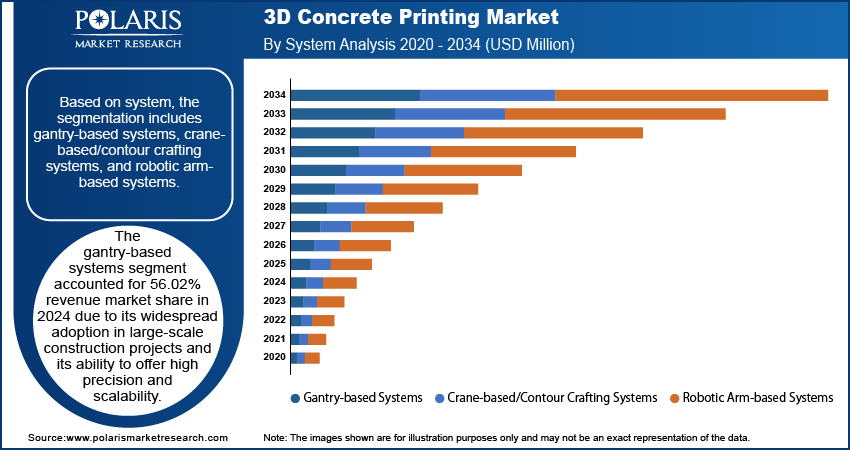

Based on system, the segmentation includes gantry-based systems, crane-based/contour crafting systems, and robotic arm-based systems. The gantry-based systems segment accounted for 56.02% revenue market share in 2024 due to its widespread adoption in large-scale construction projects and its ability to offer high precision and scalability. Construction firms prefer gantry systems as they efficiently build large structural elements such as walls and bridges while maintaining consistent quality. These systems operate on fixed tracks, which ensures stability and minimizes human intervention, reducing labor costs and construction errors. The system's compatibility with a variety of concrete mixtures and its proven success in residential, commercial, and infrastructure applications have further fueled its dominance in the market.

The robotic arm-based systems segment is estimated to grow at a robust pace in the coming years, owing to its flexibility, mobility, and suitability for complex construction projects. Manufacturers and construction companies are increasingly turning to robotic arms for customized designs and intricate architectural features, especially in urban environments with limited space. These systems enable enhanced precision and reduced material wastage, aligning well with sustainability goals and modern design preferences. Additionally, advancements in automation and artificial intelligence integration are improving the efficiency and adaptability of robotic arms, making them a preferred choice for next-generation construction projects.

By Material Analysis

In terms of material, the segmentation includes cement-based concrete mixes and geopolymer-based mixes. The cement-based concrete mixes segment held a larger share in 2024 due to its widespread availability, cost-effectiveness, and established usage in conventional and automated construction. Construction firms prefer cement-based mixes as they offer high compressive strength, ease of preparation, and compatibility with existing printing systems. The familiarity of builders and engineers with cement materials also fueled the adoption of cement-based concrete mixes, as it eliminates the need for significant process adjustments.

By Application Analysis

Based on application, the segmentation includes residential housing, commercial & office buildings, public infrastructure, emergency & disaster relief shelters, and architectural & decorative elements. The residential housing segment dominated the revenue share in 2024 due to increasing global demand for affordable, quickly constructed homes and the technology’s ability to reduce labor and material costs. Construction companies adopted automated concrete printing methods in housing projects to address labor shortages and meet project timelines without compromising structural quality. The capability of 3D concrete 3D construction printing to design and produce customized, energy-efficient homes further attracted governments and private developers, particularly in regions facing housing shortages or urban expansion pressures.

By End User Analysis

Based on end user, the segmentation includes government & public sector, private real estate developers, construction contractors, defense/military agencies, and educational & research institutions. The private real estate developers segment is projected to hold a significant share in 2034 due to growing urbanization. Developers are prioritizing 3D concrete printing technology for residential projects due to its ability to produce customized designs at lower costs compared to conventional methods. The growing emphasis on eco-friendly construction, coupled with reduced reliance on skilled labor, makes it an attractive solution for mass housing initiatives. Furthermore, innovations in architectural aesthetics and structural efficiency are driving developers to adopt the technology more widely, particularly in regions facing housing crises.

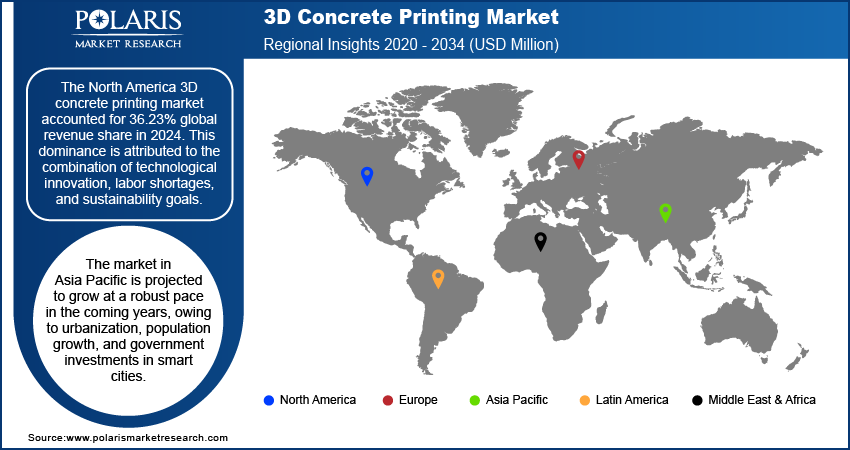

Regional Analysis

The North America 3D concrete printing market accounted for 36.23% global revenue share in 2024. This dominance is attributed to the combination of technological innovation, labor shortages, and sustainability goals. The region's focus on reducing construction costs and timelines, particularly in residential and infrastructure projects, propelled the adoption of 3D concrete printing technology. Government initiatives, such as the US Department of Energy’s support for additive manufacturing in construction, also fueled the adoption. Additionally, the need for affordable housing and disaster-resilient structures in areas prone to hurricanes and earthquakes pushed demand for 3D concrete printing in the region.

US 3D Concrete Printing Market Insight

The US held 56.23% regional market share in 2024 due to the rising housing demand, labor shortages, and the push for sustainable construction. The technology's ability to offer faster, cheaper, and more customizable housing solutions contributed to its high adoption in both urban and rural development projects in the country. Military and aerospace sectors in the US also invested in 3D concrete printing for rapid infrastructure deployment. Regulatory support, including building code adaptations for 3D-printed structures, further encouraged market growth in the US in 2024.

Asia Pacific 3D Concrete Printing Market

The market in Asia Pacific is projected to grow at a robust pace in the coming years, owing to urbanization, population growth, and government investments in smart cities. Countries such as India, Japan, and Singapore are adopting 3D concrete printing to address housing shortages and infrastructure demands. The technology’s ability to reduce material waste also aligns with sustainability goals in the region, promoting its demand. Additionally, the need for low-cost, rapid construction in disaster-prone areas is driving its adoption.

China 3D Concrete Printing Market Overview

China is a major consumer of 3D concrete printing, driven by government-backed initiatives in construction innovation and urbanization. The country’s "Made in China 2025" plan promotes advanced manufacturing, including 3D printing in construction. Large-scale projects, such as 3D-printed bridges and affordable housing, showcase China’s leadership in this market. Labor cost savings and the ability to construct complex architectural designs quickly are key factors driving the 3D concrete printing adoption in China.

Europe 3D Concrete Printing Market

In Europe, the demand for 3D concrete printing is growing due to stringent sustainability regulations, a shortage of skilled labor, and the need for energy-efficient buildings. The EU’s push for carbon-neutral construction aligns with 3D construction printing technology as it reduces material waste and lower emissions. Countries such as Germany, the Netherlands, and France are leading in research and deployment of 3D concrete printing, with projects ranging from social housing to commercial buildings. The technology’s precision and design flexibility make it ideal for restoring historic structures and creating modern architecture in Europe.

Key Players & Competitive Analysis Report

The 3D concrete printing industry is rapidly evolving, driven by technological advancements, sustainability demands, and the need for cost-efficient construction. Key players such as COBOD, XtreeE, CyBe Construction, ICON, and Apis Cor are competing through innovation, scalability, and strategic partnerships. Emerging competitors such as Vertico, Sika, and ACCIONA are entering the market with material innovations, such as high-performance concrete mixes and sustainable additives, to enhance print speed and structural integrity.

A few major companies operating in the 3D concrete printing market include AJAX Engineering; Apis Cor Inc.; BetAbram d.o.o.; COBOD International A/S; Contour Crafting Corporation; CyBe Construction B.V.; Hyperion Robotics Oy; ICON Technology, Inc.; Putzmeister; Vertico B.V.; Winsun; and XtreeE.

Key Players

- AJAX Engineering

- Apis Cor Inc.

- BetAbram d.o.o.

- COBOD International A/S

- Contour Crafting Corporation

- CyBe Construction B.V.

- Hyperion Robotics Oy

- ICON Technology, Inc.

- Putzmeister

- Vertico B.V.

- Winsun

- XtreeE

Industry Developments

March 2025: Vertico introduced the Solo Robot, an advanced standalone 3D concrete printing system designed to enhance construction efficiency and flexibility.

February 2023: Putzmeister announced the launch of the INSTATIQ brand for 3D printing construction.

January 2024: AJAX Engineering, a manufacturer of concrete equipment, launched its 3D concrete printer, APX 1.0

3D Concrete Printing Market Segmentation

By System Outlook (Revenue, USD Million, 2020–2034)

- Gantry-Based Systems

- Crane-Based/Contour Crafting Systems

- Robotic Arm-Based Systems

By Material Outlook (Revenue, USD Million, 2020–2034)

- Cement-Based Concrete Mixes

- Geopolymer-Based Mixes

By Application Outlook (Revenue, USD Million, 2020–2034)

- Residential Housing

- Commercial & Office Buildings

- Public Infrastructure

- Emergency & Disaster Relief Shelters

- Architectural & Decorative Elements

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Government & Public Sector

- Private Real Estate Developers

- Construction Contractors

- Defense/Military Agencies

- Educational & Research Institutions

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

3D Concrete Printing Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 472.15 Million |

|

Market Size in 2025 |

USD 693.03 Million |

|

Revenue Forecast by 2034 |

USD 22,185.73 Million |

|

CAGR |

46.98% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 472.15 million in 2024 and is projected to grow to USD 22,185.73 million by 2034.

The global market is projected to register a CAGR of 46.98% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are AJAX Engineering; Apis Cor Inc.; BetAbram d.o.o.; COBOD International A/S; Contour Crafting Corporation; CyBe Construction B.V.; Hyperion Robotics Oy; ICON Technology, Inc.; Putzmeister; Vertico B.V.; Winsun; and XtreeE.

The gantry-based systems segment dominated the market share in 2024.

The private real estate developers segment is expected to witness the fastest growth during the forecast period.