A2 Milk Market Share, Size, Trends & Industry Analysis Report

By Product; By Packaging (Bottles, Cartons, Others); By Distribution Channel; By Region; Segment Forecast, 2025 - 2034

- Published Date:Jun-2025

- Pages: 115

- Format: PDF

- Report ID: PM2763

- Base Year: 2024

- Historical Data: 2020-2023

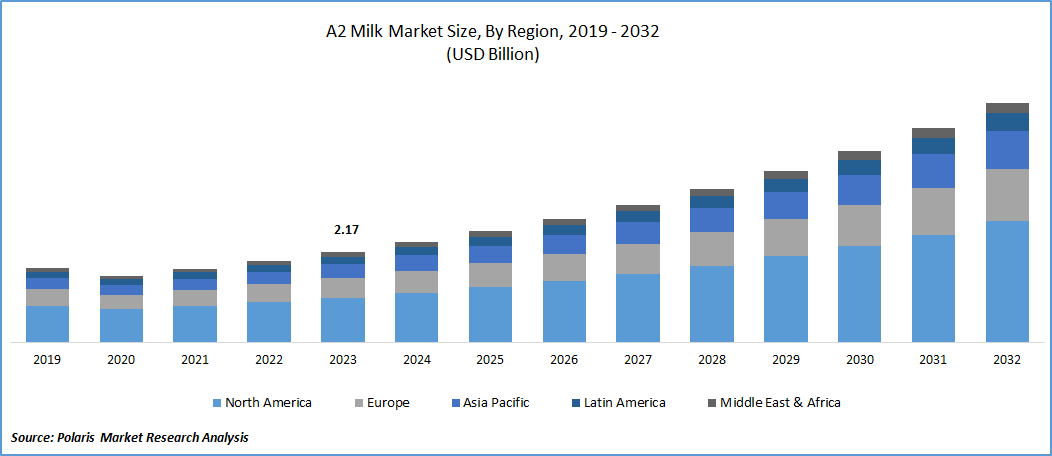

The global A2 Milk Market was valued at USD 12.5 billion in 2024 and is expected to grow at a CAGR of 8.10% from 2025 to 2034. Rising consumer awareness of lactose sensitivity and health-conscious dairy preferences are driving the demand for A2 milk products.

The global market is experiencing growth driven by the increasing preference of individuals for nutritious food, boosted by rising health awareness, particularly in the consumption of A2 milk. A2 milk powder, known for its easy digestibility compared to traditional milk, is expected to contribute significantly to market revenue and witness continuous growth in the forecast period. The COVID-19 pandemic has heightened citizen awareness of nutrition, fitness, and immunity, further influencing market dynamics.

Various producers offer A2 milk in both liquid and powder forms, packaged in different formats like cartons and bottles. Additionally, these producers employ diverse distribution channels, including supermarkets, hypermarkets, convenience stores, and online platforms, to enhance revenue. The introduction of various flavors is anticipated to boost product adoption. However, in countries such as the U.S., Germany, the U.K., and Australia, governments have implemented regulations governing the production and distribution of milk and milk products. For example, in the U.S., the Food & Drug Administration (FDA) has published guidelines for the production of milk and related products.

To Understand More About this Researc: Request a Free Sample Report

Furthermore, participants in the dairy products sector are acquiring fat-free and health-oriented milk products to attract a broad customer base, anticipating substantial gains in the market throughout the evaluation period. Moreover, the noteworthy expansion of the food and beverages industry in emerging economies like China and India is expected to offer abundant opportunities for market growth.

The surge in health consciousness and the escalating demand for highly nutritious beverage products among youth and millennials are fueling the global market for A2 milk. Simultaneously, as consumers become more apprehensive about their health due to increasing chronic conditions like high blood pressure and heart disease, opportunities for the A2 milk industry are expected to emerge. Moreover, the market is set to receive a boost from the increasing investments made by leading players. Key industry players are acquiring organic A2 milk, widely recommended in fitness centers for weight reduction. The growing demand for healthful and invigorating beverages, particularly among consumers in North America, stands out as a significant driver of industry growth.

Industry Dynamics

- Growth Drivers

- The increasing incidence of diseases associated with the excessive consumption of A1 milk is expected to drive market growth.

The well-established health benefits of milk worldwide are experiencing a shift in consumption patterns due to the availability of various options. Among different milk types, cow milk is widely considered healthy and is composed of two major proteins, namely A1 and A2. A1 milk, derived from cows of Western origin that yield large quantities of milk, is extensively available and consumed. The heightened consumption of A1 milk has been linked to health issues, including cognitive disorders and histamine in children, as well as obesity, heart disease, and diabetes in other age groups. Consequently, the superior health benefits of A2 milk compared to the adverse effects of excessive A1 milk consumption are driving the growth of the A2 milk market.

Report Segmentation

The market is primarily segmented based on packaging, product, distribution channel, and region.

|

By Packaging |

By Distribution Channel |

By Product |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Packaging Analysis

- The Cartons segment held the largest revenue share in 2024

Carton packaging is a safer and more convenient option for food storage, providing enhanced protection and prolonged durability for the enclosed products. With its lower weight, carton packaging also contributes to reducing transportation costs. The carton segment has been the primary contributor to global market revenue, driven by substantial demand for robust packaging within the global dairy products industry.

Furthermore, the bottles segment is anticipated to experience the fastest CAGR. Milk bottles, whether made of plastic or glass, are commonly employed by milkmen for the delivery of fresh milk, and their reusable nature allows for refilling. The increasing demand for convenient packaging solutions in the dairy beverages industry is expected to contribute to the growth of this segment during the forecast period.

By Product Analysis

- The Liquid segment accounted for the highest market share during the forecast period

Consumers opt for fresh milk, appreciating its content of essential nutrients like calcium, vitamins, and proteins. Consequently, liquid products have been the predominant contributors to market revenue, driven by their convenience and widespread consumption.

Additionally, the powder segment is poised for rapid expansion, fueled by the growing utilization of powdered A2 milk in infant formula, contributing significantly to its market growth. The heightened demand for powder extends to various applications, including confectionery, baked desserts, and salty products within the industry. The low moisture content in powder enhances durability and allows for longer storage periods.

Regional Insights

- Asia Pacific dominated the largest market in 2024

The region emerges as a significant market, propelled by the growing recognition of the benefits of A2 beta-casein milk in developing nations such as China and India. Additionally, the Asia Pacific region serves as a key production center for the product, driven by the prevalence of A2 breed cows and the escalating demand for dairy products in the region

The growing prevalence of lactose intolerance in North America has led to an increased demand for the product in the region. Additionally, advancements in innovation and research and development activities are playing a crucial role in driving market growth. The ready availability of A2 beta-casein milk and the expansion of distribution channels, including supermarkets and hypermarkets, are also contributing to market growth in the region.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- Erden Creamery Private Limited

- Freedom Foods Group

- Godrej Jersey

- Gujarat Co-operative Milk Marketing Federation Ltd. (GCMMF)

- Nestle S.A.

- PROVILAC Dairy Farms Pvt. Ltd.

- Ripley Farms

- The A2 Milk Company

- Vedaaz Organics Pvt. Ltd.

- Vinamilk

Recent Developments

- In february 2025, The a2 Milk Company launched an HMO infant formula in China in late FY25 and established a Global R&D Centre focused on A1-protein-free milk and product innovation tailored for Chinese consumers.

- January 2024: Mother Dairy, a well-reputed manufacturer of milk and milk products, unveiled that its Buffalo Milk variety would be available to consumers. According to Mother Dairy, the milk will first be made available in the Delhi-NCR area before spreading to Maharashtra, Uttar Pradesh, and Haryana.

- July 2023: A Greener World, a non-profit food product certifier, certified The a2 Milk Company's Grassfed a2 Milk and Grassfed A2 Milk 2% minimum Fat Milk Regenerative. By quantifying the benefits for water, air, soil, infrastructure, biodiversity, social responsibility, and animal welfare, this certification provides a guarantee of sustainability and regeneration.

- In August 2022, the a2 Milk Company (a2MC) has broadened its range of a2 Milk® products in Australia by introducing a lactose-free option to address the requirements of the one in four Australians with milk intolerance, whether self-diagnosed or professionally diagnosed.

- In October 2021, Hershey has collaborated with two consumer packaged goods (CPG) companies to launch a co-branded milk with a2 Milk. In January, Hershey's a2 Milk, made with 2% reduced-fat milk and Hershey's cocoa, is set to be introduced. Through this partnership with a2, Hershey aims to enter the premium milk market and enhance brand recognition beyond the realms of snacks and confections. Unlike most milk products that contain both A1 and A2 proteins, A2 Milk exclusively features the A2 protein, backed by medical studies indicating that A1 protein may cause stomach upset.

A2 Milk Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD13.5 billion |

|

Revenue forecast in 2034 |

USD 25.3 billion |

|

CAGR |

8.10% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Type, By Product, By Lubrications, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

Key companies in A2 Milk Market are Erden Creamery Private Limited, Freedom Foods Group, Godrej Jersey, Gujarat Co-operative Milk Marketing Federation Ltd.

The CAGR estimated to be calculated for the A2 Milk Market Is 8.10%

The A2 Milk Market report covering key segments are packaging, product, distribution channel, and region.

The key driving factors in A2 Milk Market are Expanding Capital Investments, Advancing Hybrid Fuel Infrastructure, and Leveraging Big Data Analytics to Propel Market Expansion

The global A2 Milk market size is expected to reach USD 25.3 billion by 2034