AAMI Level 3 Surgical Gown Market Size, Share, & Trends, Analysis Report

By Usability (Disposable Gowns, Reusable Gowns), By Gown Type, By Surgery, By End Use and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5835

- Base Year: 2024

- Historical Data: 2020-2023

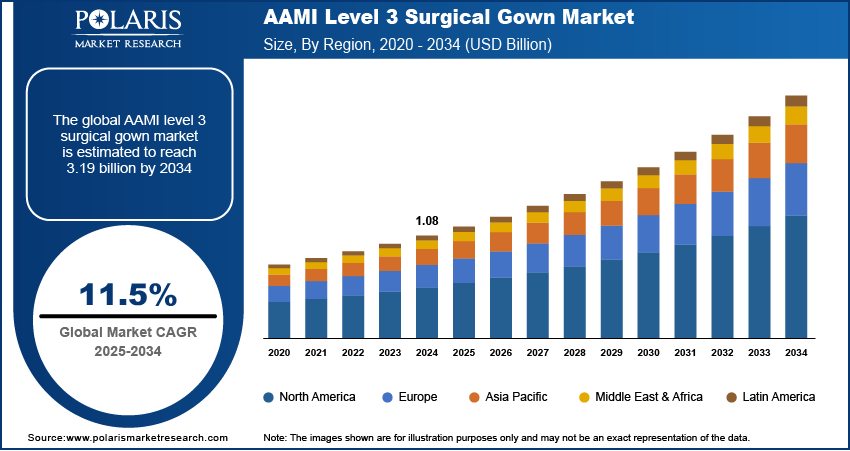

The global AAMI level 3 surgical gown market size was valued at USD 1.08 billion in 2024, growing at a CAGR of 11.5% during 2025–2034. The growth is driven by rising surgeries worldwide and expansion of outpatient clinics, urgent care centers, and ambulatory surgical centers.

Market Overview

An AAMI level 3 surgical gown is a medical garment designed to provide moderate barrier protection against fluid penetration, especially in critical zones like the chest and sleeves. It is commonly used in moderate-risk situations such as blood draws, emergency rooms, and during surgical procedures.

Governments and private sectors around the world are investing more in healthcare infrastructure and services. According to the Government of Canada, the Canadian government invested USD 200 billion in the healthcare sector over 10 years. From building new hospitals to upgrading surgical facilities, this development boosts the demand for essential medical supplies, including surgical gowns. There is a strong focus on safety and quality equipment as part of this investment. AAMI Level 3 surgical gowns are becoming standard in many healthcare settings due to their proven effectiveness and regulatory approval. This rise in healthcare budgets fuels the demand for this gown, thereby driving the growth.

.

To Understand More About this Research: Request a Free Sample Report

Regulatory standards and certifications, such as FDA 510(k) clearance and compliance with AAMI PB70 guidelines, are essential for surgical gowns to be used in healthcare. Products that meet these standards assure safety, reliability, and consistent performance. Healthcare institutions prefer certified gowns because they align with infection control regulations and reduce legal or health-related risks. The growing need for quality assurance and adherence to international standards is motivating manufacturers to invest in Level 3 gowns that meet or exceed these regulations. Consequently, driving the industry growth.

Industry Dynamics

Rising Surgical Procedures Worldwide

The number of surgeries worldwide is rising, due to which the demand for AAMI Level 3 surgical gowns is increasing. According to the Eurostat, in 2022, in Europe alone, 1.10 million cesarean sections were performed. More people are undergoing operations ranging from routine procedures to complex treatments as populations grow and age. Hospitals and surgical centers need reliable protective apparel to reduce the risk of infection and fluid exposure during these procedures. AAMI Level 3 gowns offer protection and are ideal for many surgical environments. This growing demand for safe and sterile surgical environments is pushing healthcare providers to stock up on high-quality gowns, thereby driving the growth.

Expansion of Outpatient Clinics, Urgent Care Centers, and Ambulatory Surgical Centers

The outpatient clinics, urgent care centers, and ambulatory services are expanding. According to the Med Pac, in 2022, approximately 6,100 ambulatory surgical centers (ASCs) served 3.3 million fee-for-service (FFS) Medicare beneficiaries. These facilities perform minor to moderate-risk surgical procedures that require proper protective apparel. Since they operate independently of large hospitals, they need to source gowns that are both cost-effective and compliant with safety standards. AAMI Level 3 gowns offer the right balance of protection and affordability for these environments. The demand for mid-level protective gowns grows as more procedures shift to outpatient settings due to cost-efficiency and patient convenience, thereby driving the growth.

Surgical Gowns Level AAMI 3 Market Segmental Insights

By Usability Analysis

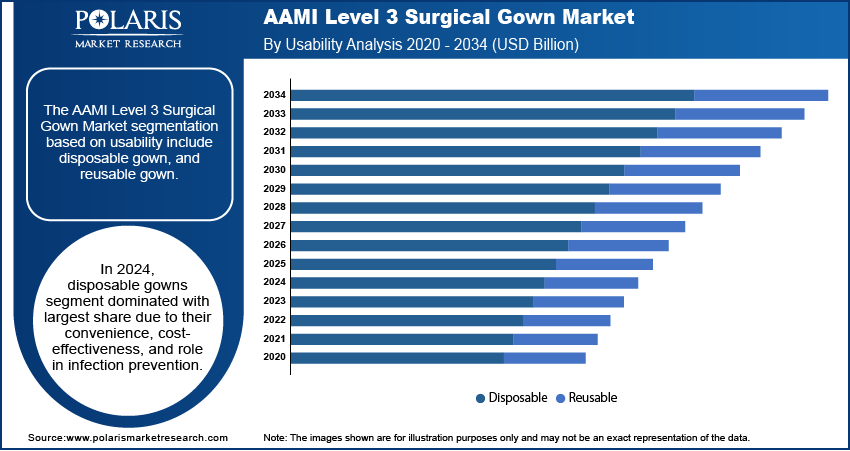

The segmentation based on usability include disposable gowns, reusable gowns. In 2024, disposable gowns segment dominated with largest share due to their convenience, cost-effectiveness, and role in infection prevention. These gowns are designed for single use, minimizing the risk of cross-contamination between patients. Especially in busy hospitals and surgical centers, disposable gowns offer a practical solution for maintaining hygiene and meeting safety standards. Their wide availability and compliance with regulations make them the preferred choice over reusable alternatives. Additionally, the rising demand for quick and efficient infection control during procedures and the need to reduce sterilization costs drives the demand, thereby driving the segment growth.

By Gown Type Analysis

The segmentation based on gown type includes fabric reinforced, non-fabric reinforced. The fabric reinforced segment held the largest share in 2024 due to their reliability and performance in moderate-risk surgeries. These gowns feature extra fabric layers in critical zones like the chest and sleeves, offering better protection against fluids and splashes. Surgeons and healthcare professionals prefer these gowns for their proven safety and durability during procedures such as general surgery and emergency care. The established supply chains, compatibility with existing gown specifications, and widespread trust in fabric-reinforced designs is further driving the demand, thereby fueling the segment growth.

The non-fabric reinforced segment is expected to record significant growth as these gowns use advanced materials like films or coatings instead of traditional fabric reinforcements, providing strong fluid resistance without adding bulk or discomfort. Demand for lightweight yet protective gowns is increasing as healthcare providers prioritize comfort alongside protection, especially during longer procedures. Additionally, technological improvements in synthetic materials and manufacturers' focus on breathable yet impermeable designs are making non-fabric reinforced gowns more popular. Their rising acceptance in outpatient and day surgery centers further drives the demand, thereby driving the segment growth.

By Surgery Analysis

The segmentation based on surgery includes general surgery, orthopedic surgery, endoscopic surgery, gynecological surgery, mastectomy, and others. The orthopedic surgery is expected to record significant growth due to the fluid-intensive nature of these procedures. Surgeons and operating room staff are frequently exposed to blood and body fluids, making protective gowns essential. AAMI Level 3 gowns provide the necessary barrier without restricting movement, which is important during long and physically demanding orthopedic operations. Hospitals prefer these gowns for their balance of protection and comfort, helping reduce infection risks, thereby driving adoption of these gowns in this segment.

Surgical Gowns Level AAMI 3 Market Regional Analysis

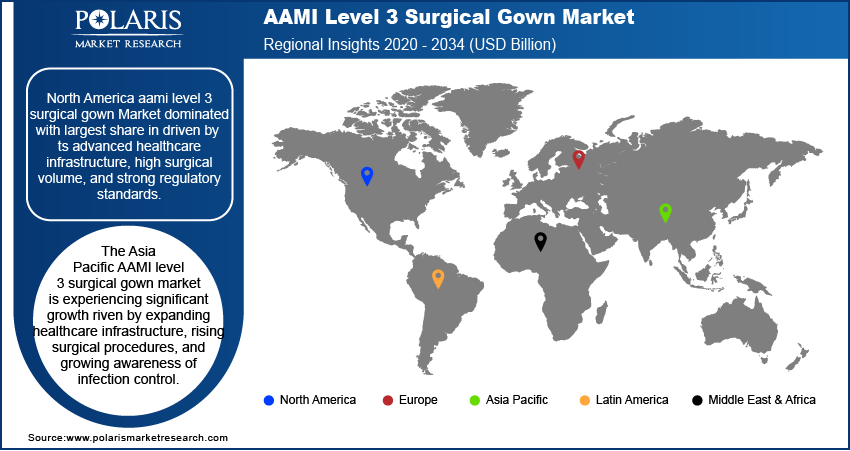

AAMI Level 3 Surgical Gown Market in North America

North America AAMI level 3 surgical gown market dominated with largest share in 2024, driven by its advanced healthcare infrastructure, high surgical volume, and strong regulatory standards. The region’s strict focus on infection control, especially post-COVID-19, has led to widespread adoption of certified protective hospital gowns. Product innovation and availability are strong with major industry players headquartered in the US. Additionally, government investments in public health and preparedness for infectious disease outbreaks further supported demand. Moreover, the high safety standards and steady consumption of single-use surgical protective gear is fueling the growth in North America.

AAMI Level 3 Surgical Gown Market in US

US AAMI level 3 surgical gown market is expected to witness significant growth driven by increased surgeries, higher infection control awareness, and rising healthcare spending. The FDA’s regulatory clarity, including 510(k) clearances, encouraged manufacturers to produce certified gowns at scale. High demand from hospitals and urgent care centers and ambulatory surgical units is driving the growth. Additionally, the US government's focus on strategic stockpiles and public health readiness post-pandemic further drives the growth. Moreover, strong domestic manufacturing capacity and the presence of key players further boosted industry growth in the country.

AAMI Level 3 Surgical Gown Market in Asia Pacific

Asia Pacific AAMI Level 3 Surgical Gown Market is projected witness substantial growth driven by expanding healthcare infrastructure, rising surgical procedures, and growing awareness of infection control. Countries such as India, Japan, and South Korea are investing heavily in hospital upgrades and public health systems. Additionally, the region is home to many cost-effective manufacturing hubs, enabling local and global supply at competitive prices. The demand for high-quality surgical apparel continues to rise as healthcare access increases and medical tourism grows. Moreover, increasing regulatory alignment and adoption of global standards is further fueling the growth in Asia Pacific.

AAMI Level 3 Surgical Gown Market in China

China AAMI Level 3 Surgical Gown Market is expected to experience significant growth by large-scale manufacturing capabilities, rising domestic healthcare needs, and global export demand. Following the COVID-19 pandemic, China has invested heavily in upgrading hospital hygiene standards and expanding its medical product portfolio. Local companies are producing certified gowns that meet international standards, enabling them to serve both domestic and international markets. Hospitals are stocking more disposable protective wear due to growing middle class and increasing numbers of surgeries. Additionally, China’s government support for medical exports and internal healthcare modernization further fuels the growth in China.

AAMI Level 3 Surgical Gown Market in Europe

Europe AAMI level 3 surgical gown market is expected to experience significant growth driven by strong healthcare systems, strict regulatory compliance, and rising focus on infection prevention. Countries across the EU follow standardized medical safety regulations, increasing the demand for certified protective gowns. The region is further experiencing growth in elective surgeries post-COVID recovery, which has boosted the need for moderate-barrier surgical gowns. Environmental concerns are influencing a shift toward sustainable disposable options. Additionally, collaborations between healthcare providers and PPE manufacturers in countries such as France, the UK, and Italy are fueling the expansion, thereby driving the growth in Europe.

AAMI Level 3 Surgical Gown Market in Germany

Germany AAMI Level 3 Surgical Gown Market is expected to experience significant growth as the country is known for its high-quality medical standards and strict regulatory frameworks, due to which Germany heavily relies on certified protective apparel in its hospitals and clinics. The country’s aging population and increasing surgical procedures are fueling the need for effective infection control garments. Furthermore, Germany is a hub for both medical product manufacturing and innovation, contributing to the development and adoption of advanced surgical gowns. Public and private healthcare sectors are investing in quality PPE, thereby driving the growth.

Key Players & Competitive Analysis Report

The industry is highly competitive, with players including Medline Industries, Cardinal Health, Owens & Minor, and Boston Scientific driving innovation and scale. Companies like Dynarex, Henry Schein, and Encompass Group offer broad distribution networks and cost-effec tive solutions. Standard Textile and LDI Solutions focus on durable, reusable gowns, while Taromed and Alleset enhance portfolios through regulatory approvals. Competitive advantages stem from FDA clearances, advanced materials (SMS/SMMS), and infection control capabilities. As healthcare demands rise, differentiation hinges on quality, comfort, and supply chain resilience, positioning top players to meet the evolving needs of hospitals and surgical centers.

Surgical Gowns Level AAMI 3 Market Key Players

- Boston Scientific Corporation

- Cardinal Health.

- Dynarex Corporation

- Encompass Group, LLC

- Henry Schein, Inc.

- LDI Solutions, LLC

- Medline Industries, LP

- Owens & Minor

- Standard Textile Co., Inc.

- Taromed

Industry Developments

In September 2022, LIONCARE successfully launched its Standard and Reinforced SMS Surgical Gowns (Models: LCS601 and LCS601RF), which passed the AAMI Level 3 test, meeting ANSI/AAMI PB70-2012 standards for high-level fluid resistance and critical zone protection.

In January 2022, Alleset received FDA 510(k) clearance for its AAMI Level III Surgical Isolation Gown, expanding its protective apparel portfolio and reinforcing its commitment to safeguarding healthcare workers and patients from exposure to potentially infectious materials.

AAMI Level 3 Surgical Gown Market Segmentation

By Usability Outlook (Revenue, USD Billion, 2020–2034)

- Disposable Gowns

- Reusable Gowns

By Gown Type Outlook (Revenue, USD Billion, 2020–2034)

- Fabric Reinforced

- Non-fabric Reinforced

By Surgery Outlook (Revenue, USD Billion, 2020–2034)

- General Surgery

- Orthopedic Surgery

- Endoscopic Surgery

- Gynecological Surgery

- Mastectomy

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Operating Room

- Intensive Care Unit (ICU)

- Emergency Room

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

AAMI Level 3 Surgical Gown Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1.08 Billion |

|

Market Size Value in 2025 |

USD 1.20 Billion |

|

Revenue Forecast by 2034 |

USD 3.19 Billion |

|

CAGR |

11.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.08 billion in 2024 and is projected to grow to USD 3.19 billion by 2034.

The global market is projected to register a CAGR of 11.5% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Boston Scientific Corporation; Cardinal Health; Dynarex Corporation; Encompass Group, LLC; Henry Schein, Inc.; LDI Solutions, LLC; Medline Industries, LP; Owens & Minor; Standard Textile Co., Inc.; Taromed.

The disposable gown segment dominated the market share in 2024.

The orthopedics segment is expected to witness the significant growth during the forecast period.