Acetic Acid Market Size, Share, Trends, Industry Analysis Report

By Application (Vinyl Acetate Monomer, Purified Terephthalic Acid, Acetate Esters, Acetic Anhydride), By End Use, and By Region -Market Forecast To, 2025 - 2034

- Published Date:Sep-2025

- Pages: 115

- Format: PDF

- Report ID: PM1155

- Base Year: 2024

- Historical Data: 2020-2023

Overview

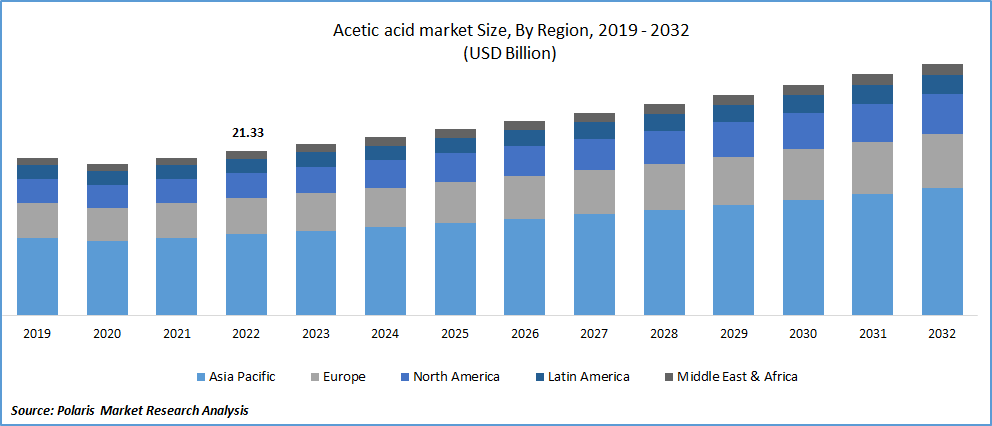

The global acetic acid market size was valued at USD 23.15 billion in 2024. The market is projected to grow at a CAGR of 4.40% during 2025 to 2034. Key factors driving demand for acetic acid include increasing use in producing vinyl acetate monomer (VAM) for paints and coatings, growth in the pharmaceutical sector, and rising consumer demand for processed foods and vinegar.

Key Insights

- The purified terephthalic acid (PTA) segment is projected to grow at a robust CAGR in the coming years, owing to its usage in the production of polyester products such as polyethylene terephthalate (PTE) bottles

- North America dominated the global industry in 2024 and is likely to maintain its dominance over the anticipated period, owing to the growing food & beverage sector.

- Asia Pacific is projected to grow at a high CAGR in the coming years, owing to the rapid urbanization and high consumption of processed foods.

Industry Dynamics

- The high adoption of cosmetics, driven by growing disposable income, is propelling the demand for acetic acid.

- The growing industrialization, particularly in emerging nations such as India and Vietnam, is also increasing the demand for acetic acid.

- The expanding food & beverage sector across the globe is creating a lucrative market opportunity.

- Corrosive and irritant properties of acetic acid may hamper the market growth.

Market Statistics

- 2024 Market Size: USD 23.15 Billion

- 2034 Projected Market Size: USD 35.54 Billion

- CAGR (2025-2034): 4.40%

- North America: Largest Market Share

Acetic acid is a colorless organic compound with a strong, abrasive, and sour smell, acetic acid. It ranks among the most important industrial chemicals and chemical reagents in producing volatile organic esters, such as butyl and ethyl acetates, cellulose acetate, vinyl acetate, and metal acetates. Acetic acid's expanding application in the production of terephthalic acid during the anticipated time this will be supported market growth. Terephthalic acid is a vital component in manufacturing polyester resins, which are commonly used to create PET resins, polyester films, and polyester fibers.

To Understand More About this Research: Request a Free Sample Report

Increasing the use of VAM and other solvents in the chemical sector to create resins and polymers for paints, coatings, films, textile adhesives, and other end goods rise the market demand. VAM is used as adhesive to attach a variety of substrates, including wood, plastic films, paper, and metals. Industry expansion is increasing the demand for vinyl acetate monomers. Additionally, PTA is used to make polyester, and the need for polyester in the textile and packaging sectors is rising, contributing to the growing use of PTA.

The fast population expansion and the adoption of a sustainable and nutrient-dense diet, which has increased food production globally, are to blame for the rise in demand for vinegar. The market for acetic acid is expanding as a result of the rise in vinegar consumption in the food industry. More individuals are using vinegar as a remedy for health issues, including weight loss, cholesterol reduction, blood pressure management, and blood sugar regulation.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

The demand for vinyl acetate monomer, which accounts for the bulk of acetic acid use, is rising in the creation of cosmetics and industrial products. As a result, the rapidly expanding cosmetics industry is fueling an increase in the need for acetic acid. Additionally, acetic acid is frequently employed in the industrial sector as a vital component (chemical reagent) to create cellulose acetate, while it is commonly used in the residential sector as a descaling agent in its diluted form. Acetic acid is also employed in the food business as an acidity regulator and condiment.

Report Segmentation

The market is primarily segmented based on application, end-use, and region.

|

By Application |

By End-Use |

By Region |

|

|

|

Know more about this report: Request for sample pages

PTA Segment is Projected to Grow at a Rapid CAGR Over the Forecast Period

Purified terephthalic acid (PTA) is used in the production of polyester products such as polyethylene terephthalate (PTE) bottles, polyester fiber, and polyester film. This polyester is also utilized in food and beverage containers and textiles. Coatings and other composite materials are examples of additional PTA uses. The growing demand for food and beverages has resulted in a significant usage of polyester containers and bottles. This contributed to the massive need for this type of acid worldwide.

North America Held the Largest Market Share in 2024

North America dominated the global industry in 2024 and is likely to maintain its dominance over the anticipated period. This is due to the need for acetic acid in the food and beverage sector. The meat business makes extensive use of acetic acid to preserve the product. The rising use of paints and coatings is another factor which drove demand for acetic acid in the region. Moreover, the growing urbanization and high adoption of processed food contributed to the market domiannce.

The market in Asia Pacific is projected to grow at a robust pace in the coming years. This is due to growing industrilization, particualry in countires like India and Vietnam. The growth in urban areas in the region is also leading to the market growth in the region. Moreover, high youth population is estimated to propel the demand for acitic acid, as these popualtion are consuming processed food at a rapid pace and acitic acid is needed in the production of processed food.

Competitive Insight

Some of major players operating in the global market of acetic acid market which include Eastman Chemical Company, Jiangsu SOPO (Group) Co. Ltd, Celanese Corporation, Gujrat Narmada Valley Fertilizers & Chemicals Limited, Indian Oil Corporation Ltd, Ashok Alco Chem Limited, DAICEL CORPORATION, DubiChem, INEOS.

Recent Developments

- In January 2021 – The global Aromatics & Acetyls business of BP, which comprises 15 various production sites globally and ten joint ventures, was acquired by INEOS in order to broaden its geographic reach and diversify its product range.

- In March 2020 - To increase the capacity for acetic acid production at the South Korean facility, Lotte of South Korea and BP of the United Kingdom entered into a joint venture. With an increase in capacity of 100,000 t/y by May 2019, the expansion will cost roughly USD 175 million. Companies will be able to satisfy Korea's expanding demand thanks to this project.

Acetic Acid Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 23.15 billion |

| Market size value in 2025 | USD 24.12 billion |

|

Revenue forecast in 2034 |

USD 35.54 billion |

|

CAGR |

4.40% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

|

|

Regional scope |

|

|

Key companies |

Include Eastman Chemical Company, Jiangsu SOPO (Group) Co. Ltd, Celanese Corporation, Gujrat Narmada Valley Fertilizers & Chemicals Limited, Indian Oil Corporation Ltd, Ashok Alco Chem Limited, DAICEL CORPORATION, DubiChem, INEOS. |

FAQ's

Acetic acid market size is expected to reach USD 35.54 Billion by 2034.

Key players are include Eastman Chemical Company, Jiangsu SOPO (Group) Co. Ltd, Celanese Corporation, Gujrat Narmada Valley Fertilizers & Chemicals Limited, Indian Oil Corporation Ltd, Ashok Alco Chem Limited.

North America contribute notably towards the global acetic acid market.

The global acetic acid market expected to grow at a CAGR of 4.40% during the forecast period.

Key segments are application, end-use and region.