Adblue Market Share, Size, Trends, Industry Analysis Report

By Type (Packaging, Equipment, Cans, Tanks, and Drums); By Application; By Usage Method; By Region; Segment Forecast, 2023 – 2032

- Published Date:Oct-2023

- Pages: 116

- Format: PDF

- Report ID: PM3813

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

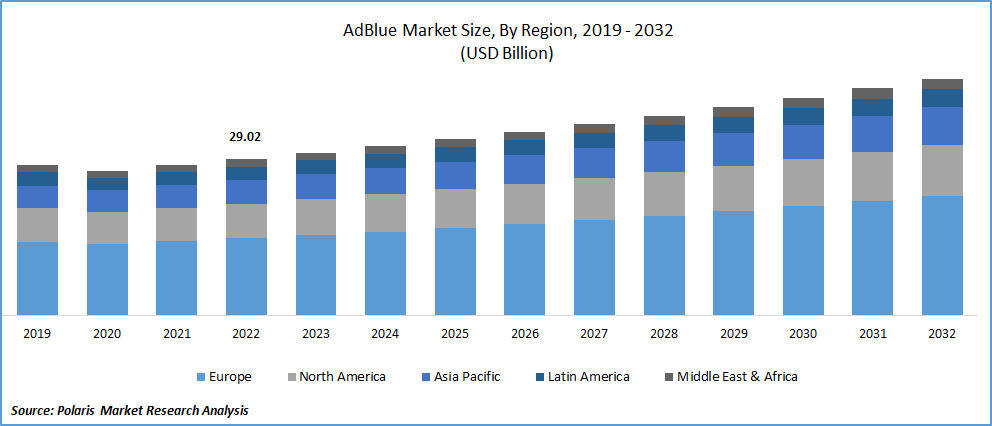

The global adblue market was valued at USD 29.02 billion in 2022 and is expected to grow at a CAGR of 4.2% during the forecast period.

The surging rate of industrialization and urbanization significantly growing demand for heavy-duty vehicles and increasing awareness about the potential benefits of integrating adblue into vehicles in terms of reducing the emission of harmful gases into the atmosphere along with the emergence of the product as an essential component for minimizing NOx levels through converting them into less harmful mixture, are the major factors propelling the market growth. In addition, manufacturers are expanding their production capacities to meet the increasing requirements, which involves setting up new production facilities and upgrading existing ones. They are introducing new products with enhanced properties, which positively contribute towards market growth.

To Understand More About this Research: Request a Free Sample Report

For instance, in May 2023, GreenChem announced the launch of its newly developed SCR cleaner named Effinox, which is a type of urea solution AdBlue that comes with an additive reagent used in diesel vehicles to reduce harmful emissions. It further prevents the urea deposit formulation in vehicles' SCR systems along with the low-road running engines.

Moreover, a large number of governments worldwide are implementing policies, regulations, and incentives to promote cleaner technologies and reduce emissions. Major product manufacturers are leveraging these supportive measures, such as tax incentives, subsidies, and grants, to accelerate market growth and establish a stronger foothold in the industry.

Deadly coronavirus across the globe forced nations to take appropriate actions like lockdowns and stringent regulations on trade activities, which led to the closure of manufacturing facilities for automobiles and affected the global supply chains. However, as the global economies gradually reopened and restrictions eased, commercial vehicle activities started to recover and are likely to be back on track in the coming years.

For Specific Research Requirements, Request for a Customized Report

Growth Drivers

Environmental sustainability initiatives and carbon footprint reduction

Environmental sustainability initiatives and the drive to reduce carbon footprints have become significant drivers for the AdBlue market. AdBlue, a urea-based solution, plays a crucial role in the reduction of nitrogen oxide (NOx) emissions from diesel engines, aligning with global efforts to combat air pollution and greenhouse gas emissions.

As governments, industries, and consumers increasingly prioritize environmental responsibility, the demand for AdBlue has surged. Regulatory mandates, such as Euro VI emissions standards in Europe and similar regulations worldwide, require vehicle manufacturers to integrate selective catalytic reduction (SCR) systems, which depend on AdBlue for NOx reduction. This has led to widespread adoption in the automotive sector.

Furthermore, industries like agriculture, construction, and maritime transportation are also embracing AdBlue to meet emissions targets and reduce their environmental impact. As sustainability campaigns gain momentum and consumers seek eco-friendly products, AdBlue's importance in minimizing the carbon footprint of diesel-powered vehicles and machinery is set to continue growing, making it a key component in the pursuit of a cleaner and greener future.

Report Segmentation

The market is primarily segmented based on type, application, usage method, and region.

|

By Type |

By Application |

By Usage Method |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

The packaging segment held a significant market share in 2022.

The packaging segment held a significant market share because of the surging prevalence among major manufacturers and suppliers towards developing packaging solutions that offer efficiency, ease of use, and minimize product waste along with the continuous innovations in packaging technologies such as stackable containers, secure closures, and user-friendly dispensing systems, enhancing customer satisfaction.

The cans segment is likely to exhibit the fastest growth rate over the next coming years, mainly due to its ability to provide a convenient and portable packaging option for AdBlue, as they are easy to handle, store, and transport, which makes them suitable for smaller applications or for individuals who require smaller quantities of AdBlue. In addition, product cans are widely and easily available at various retail outlets, including automotive supply stores, gas stations, and convenience stores, leading to higher adoption and significant growth of the segment market.

By Application Analysis

The commercial vehicles segment held a significant market share in 2022

The commercial vehicles segment held the majority market share in terms of revenue in 2022, which is mainly driven by significant growth in commercial vehicles sectors mainly influenced by expansions in the logistics and transportation industry along with the growing adoption of AdBlue in these vehicles due to increasing environmental consciousness and the need to address air pollution across the globe. Additionally, Continuous advancements in SCR technology and associated systems have made the products more efficient, reliable, and cost-effective, and the prevalence of these technological advancements makes products easier to integrate into commercial vehicles, further driving the market growth.

The cars passenger vehicles segment is projected to gain a substantial growth rate over the anticipated period on account of significant product use in diesel engines and the rapid development of an extensive refilling network across the world, including service stations, truck stops, and dedicated AdBlue dispensing facilities, which encourages consumers to choose vehicles equipped with innovated systems, thereby boosting the product demand in cars & passenger vehicles market.

By Usage Method Analysis

The pre-combustion segment is projected to witness the highest growth during the anticipated period.

The pre-combustion segment is projected to grow at a healthy CAGR during the anticipated period, which is largely accelerated by significantly rising sales of diesel-engine vehicles globally that require SCR systems and utilize the pre-combustion method for effective operations. Besides this, the pre-combustion method is compatible with a wide range of diesel engines. It can be integrated into various vehicle types, including passenger cars, trucks, buses, and off-road equipment, thereby gaining huge traction and popularity in recent years.

The post-combustion segment led the industry market with a substantial market share in 2022, mainly attributable to a large number of countries and regions that have established stringent emission regulations to reduce pollution levels and protect the environment; hence, the post-combustion usage of AdBlue enables diesel vehicles to meet these regulations by effectively reducing NOx emissions.

Regional Insight

Europe dominated the global market in 2022

The European region dominated the global market with a considerable share in 2022 and is projected to maintain its market dominance throughout the forecast period; that can be majorly driven by the presence of several stringent emissions to curb air pollution and promote environmental sustainability, including the Environmental Protection Agency regulations in the U.S. & Canada, mandating the use of SCR technology and AdBlue to meet NOx emission standards.

In recent years, there has been a growing awareness of environmental issues and a shift toward sustainable practices in developed countries like the US, Canada, and Mexico, thereby increasing number of companies and fleet operators are recognizing the importance of reducing emissions and embracing corporate social responsibility, which in turn, has been positively affecting the market’s growth.

The Asia Pacific region is likely to emerge as the fastest growing region with a noteworthy growth rate over the study period, owing to significant growth in sales of all types of vehicles, including passenger cars, commercial vehicles, and heavy-duty vehicles, and a surge in freight transportation that has resulted in higher consumption of diesel fuel as well as higher demand for AdBlue in the region.

Competitive Insight

The AdBlue market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- AIR Liquide

- Alchem AG

- BASF

- Blue Middle East Company

- Bosch

- CF Industries Holdings

- China Petroleum Corporation

- CrossChem International.

- Cummins Filtration

- Daimler AG

- DUBI CHEM MARINE International

- Fiat Group Automobiles

- Komatsu

- Kruse Automotive

- Mitsui Chemicals

- Nissan Chemicals

- Royal Dutch Shell Plc

- The McPherson Companies

- Yara

Recent Developments

- In April 2022, CrossChem International introduced AdBlue production in Hong Kong, and the company is specially developing it to make unique and particularly suited products for the region. In February this year, the company also received accreditation from the German Association of the Automotive Industry VDA, allowing the company to start manufacturing AdBlue diesel exhaust fluid.

- In December 2021, Bharat Petroleum introduced a new 5 MAK AdBlue with selective catalytic reduction technology. The newly developed AdBlue is further likely to reduce the emission of harmful gases and expand the company’s portfolio.

Adblue Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 30.18 billion |

|

Revenue Forecast in 2032 |

USD 43.90 billion |

|

CAGR |

4.2% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments Covered |

By Type, By Application, By Usage Method, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The adblue market report covering key segments are type, application, usage method, and region.

Adblue Market Size Worth $43.90 Billion By 2032.

The global adblue market is expected to grow at a CAGR of 4.2% during the forecast period.

Europe is leading the global market.

key driving factors in adblue market are 1. environmental sustainability initiatives and carbon footprint reduction.