Advanced Ceramic Aditives Market Share, Size, Trends, Industry Analysis Report

By Product (Dispersant, Binder), By Application (Automotive, Machinery, Medical), By Region, And Segment Forecasts, 2023 - 2032

- Published Date:Sep-2023

- Pages: 119

- Format: PDF

- Report ID: PM3743

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

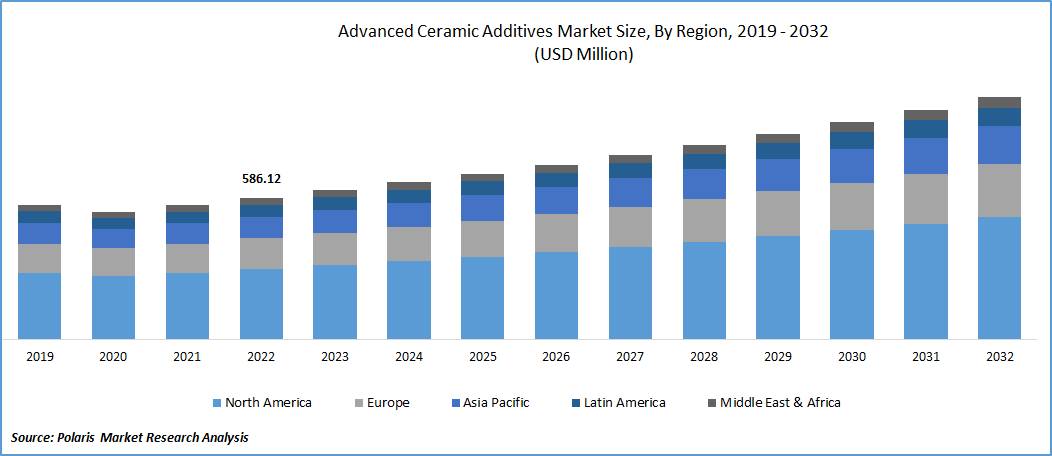

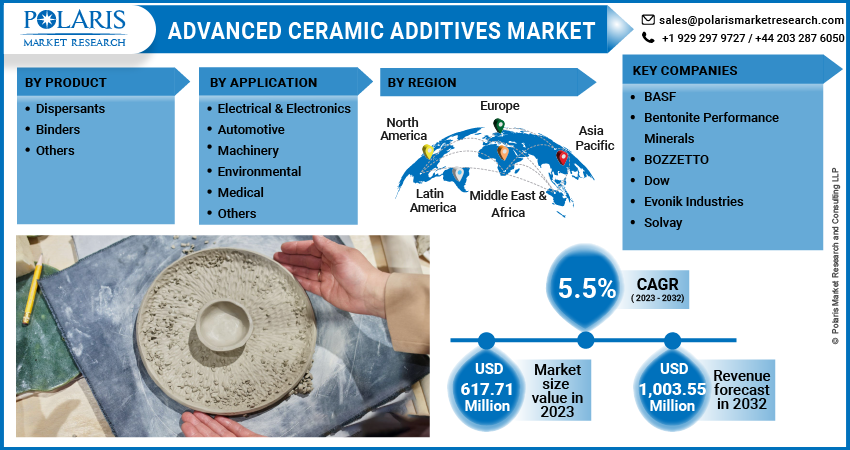

The global advanced ceramic additives market was valued at USD 586.12 million in 2022 and is expected to grow at a CAGR of 5.5% during the forecast period.

The world is experiencing a demographic shift with a notable increase in the aging population. As people age, the demand for medical services, treatments, and devices tends to rise. Elderly individuals often require medical interventions such as joint replacements, dental implants, and various diagnostic procedures.

To Understand More About this Research: Request a Free Sample Report

The growing geriatric population and the adoption of advanced medical technologies in developing countries create a fertile ground for the medical industry's expansion. As healthcare needs become more complex, and patient expectations evolve, the demand for advanced ceramics and tailored additives will likely continue to grow. Manufacturers are expected to focus on developing advanced ceramic materials with improved characteristics and introducing additives that enhance their functionalities, thereby catering to the evolving needs of the medical sector.

The increasing adoption of advanced ceramics, particularly in medical applications, is expected to drive the demand for additives in the foreseeable future. Advanced ceramics have gained prominence as a preferred material for the production of medical devices and components due to their exceptional properties. These components demand higher precision and tolerances, which can be effectively achieved through the judicious utilization of additives. Consequently, the expansion of the medical devices sector is poised to positively impact the demand for advanced ceramic additives.

The surge in demand for advanced ceramics within the United States is predominantly propelled by the growing adoption of lightweight materials in sectors such as automotive, aerospace, and defense. This heightened usage of advanced ceramics in these industries has consequently led to the increased application of specialized additives in precise compositions. These additives play a crucial role in optimizing the rheological properties of catalyst wash coats, which are coatings used in various applications, particularly in the automotive industry for emission control systems. By adjusting the viscosity and flow characteristics of these catalyst wash coats through the incorporation of additives, manufacturers can enhance the efficiency and performance of the end products, further accentuating the demand for advanced ceramic additives.

The expansion of the medical industry, particularly in the aftermath of the emergence of COVID-19, has brought significant advantages to the growth of the advanced ceramic additives market. The increased emphasis on healthcare and the demand for high-quality and effective medical devices and equipment have highlighted the necessity for materials that can ensure both safety and performance. Advanced ceramics have gained prominence in this context due to their unique properties and capabilities.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

High mechanical strength

Medical devices and equipment need to adhere to rigorous regulatory approval standards to ensure patient safety and effective functionality. Advanced ceramics offer characteristics such as biocompatibility, chemical inertness, and high mechanical strength, making them well-suited for medical applications. These materials are capable of withstanding the challenges posed by diverse healthcare practices, ranging from diagnostic tools to implantable devices. For instance, advanced ceramics can be used in components like surgical instruments, dental implants, prosthetics, and diagnostic equipment due to their resistance to wear, corrosion, and high temperatures. Their ability to provide accurate measurements, low friction, and durability further contributes to their suitability in medical applications.

Report Segmentation

The market is primarily segmented based on product, application, and regions.

|

By Product |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Application Analysis

Electronics segment held the largest share in 2022

The electronics segment held the largest revenue share. Advanced ceramics play a pivotal role in this industry by serving as essential components in various applications. They are extensively employed in the fabrication of crucial components like spark plugs, capacitors, both fixed and variable resistors, inductors, as well as circuit protection devices. Their incorporation into these components enhances their performance and functionality, thereby contributing to the efficiency and reliability of electrical and electronic devices.

The semiconducting, piezoelectric, and magnetic attributes of advanced ceramics make them highly suitable for applications that require precise control over electrical signals, responsiveness to mechanical stress, and manipulation of magnetic fields. These properties enable them to meet the stringent demands of the modern electrical and electronics sector, where performance, miniaturization, and technological advancements are paramount.

The automotive segment will grow at a substantial pace. Industry ainvestments, particularly in the realm of electric vehicles (EVs), are poised to exert a positive influence on the demand for advanced ceramics and concurrently drive the consumption of additives in the foreseeable future. For instance, in July 2022, Volvo unveiled a substantial commitment amounting to EUR 1.20 Bn for its new manufacturing plant in Slovakia.

By Product Analysis

Dispersants segment is expected to grow at fastest pace during forecast period

The dispersants segment will grow at the fastest pace. Dispersants, in this context, play a pivotal role in the dispersion of powdered ceramics within solvents, serving to effectively stabilize the slurry against undesired processes such as sedimentation or flocculation. These additives also contribute to regulating the rheological properties of the mixture, thereby facilitating the reduction of agglomeration. Additionally, they play a significant role in achieving a narrow particle size distribution while concurrently exerting an influence on viscosity levels.

The increasing requirement for dispersants within the realm of advanced ceramics is driven by their cost-effectiveness and the expanding scope of end-use sectors such as electronics and medical applications. These additives contribute to significant reductions in both water consumption and energy expenditure, leading to enhanced production efficiency. Additionally, dispersants offer the flexibility to tailor the properties of the slurry to align with specific customer demands.

Binders play a pivotal role in facilitating the cohesion of ceramic particles, resulting in heightened structural integrity. They enhance the mechanical robustness of materials, preventing fractures and maintaining their form throughout the manufacturing process. A standard binder composition encompasses two key constituents: polymers and waxes.

By Regional Analysis

North America held the largest revenue share in 2022

North America is expected to dominate the market. Increasing financial commitments aimed at enhancing the production of advanced ceramics are poised to contribute to market expansion. For instance, in May 2021, Apple Inc. allocated a substantial sum of USD 45 million to Corning Incorporated. This investment is geared towards amplifying manufacturing capabilities and catalyzing research and development endeavors for novel and cutting-edge technologies.

Corning Incorporated stands as a pioneer in material science technology, specializing in the creation of advanced ceramic substrates and delivering precision glass components to Apple Inc. for their iPhone 12 lineup. Notably, Apple Inc. has dedicated an investment of approximately USD 450 million to Corning Incorporated over the past four years. This financial commitment aims to drive innovation in the development of ceramic shields utilized in their products.

APAC will grow at the fastest pace. The region's growth is primarily due to the thriving end-use industry. For instance, CoorsTek's announcement in February 2021 regarding the initiation of the first phase of an engineered ceramics production plant situated in Rayong, Thailand. This strategic step aimed to establish a manufacturing facility in the region strategically positioned to meet the escalating demand. Such proactive initiatives are projected to fuel the need for additives within the market over the forecast period.

Governments in the region are providing incentives and support for the growth of advanced manufacturing industries. This support includes funding for research, development, and innovation in materials science and technology. The shift towards electric and hybrid vehicles is increasing the demand for advanced ceramics in various components such as batteries, sensors, and engine parts. Additives are used to improve the performance and reliability of these ceramic components. The region is investing heavily in research and development, leading to the development of cutting-edge technologies and products that rely on advanced ceramics.

Competitive Insight

The advanced ceramic additives market is fragmented and is anticipated to witness competition due to several players' presence. Major key players in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- BASF

- Bentonite Performance Minerals

- BOZZETTO

- Dow

- Evonik Industries

- Solvay

Recent Developments

In April 2023, Mills Rock Advanced Material, a entity of the Mills Rock Capital, has recently completed the acquisition of the Asbury Carbons, a prominent provider of advanced materials solutions. This strategic move aims to broaden Mills Rock Advanced Material's business scope and further invest in the advanced materials and additive solutions sector, capitalizing on the increasing prospects within the market.

Advanced Ceramic Additives Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 617.71million |

|

Revenue Forecast in 2032 |

USD 1,003.55 million |

|

CAGR |

5.5% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments Covered |

By Product, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation |

FAQ's

The Advanced Ceramic Additives Market Market report covering key segments areproduct, application, and regions.

Advanced Ceramic Aditives Market Size Worth $ 1,003.55 Million By 2032

The global advanced ceramic additives marketis expected to grow at a CAGR of 5.5% during the forecast period

North America region is leading the global market.

key driving factors in Advanced Ceramic Additives Market Are Shift towards electric and hybrid vehicles