Advanced Distribution Management System Market Size, Share, Trends, Industry Analysis Report

By Services (Managed Services, Professional Services), By Solution, By Deployment Type, By End Use, and By Region -Market Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 119

- Format: PDF

- Report ID: PM2640

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

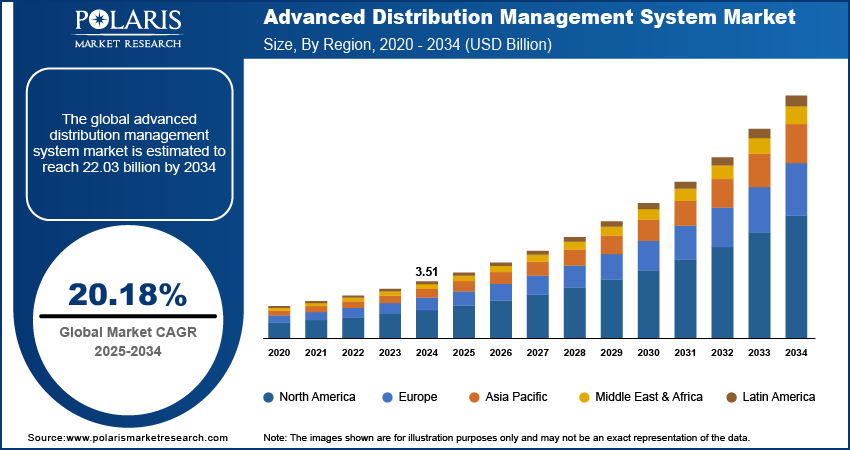

The global advanced distribution management system market size was valued at USD 3.51 billion in 2024. The market is projected to grow at a CAGR of 20.18% during 2025 to 2034. Key factors driving demand for advanced distribution management systems include increasing demand for electricity, growing integration of renewable energy sources, and government initiatives and regulations promoting smart grids.

Key Insights

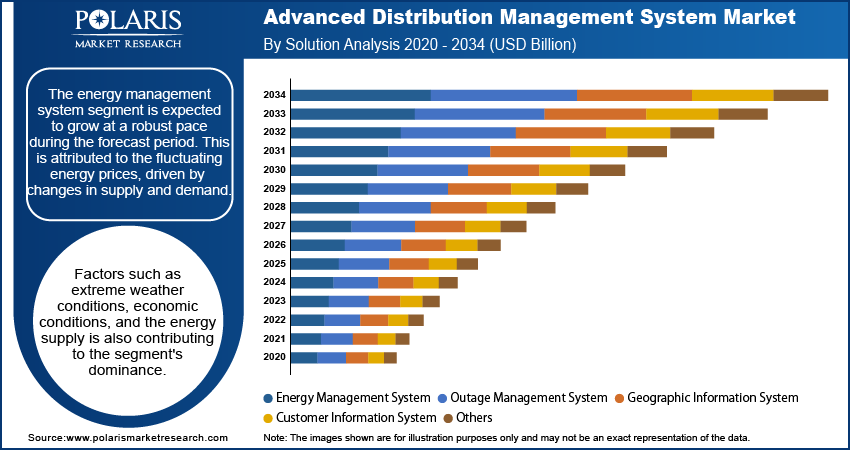

- The energy management system segment is expected to grow at a robust pace in the coming years, owing to fluctuations in energy prices.

- The professional services segment accounted for the largest market share in 2024. This is due to the increasing adoption of consulting and training services.

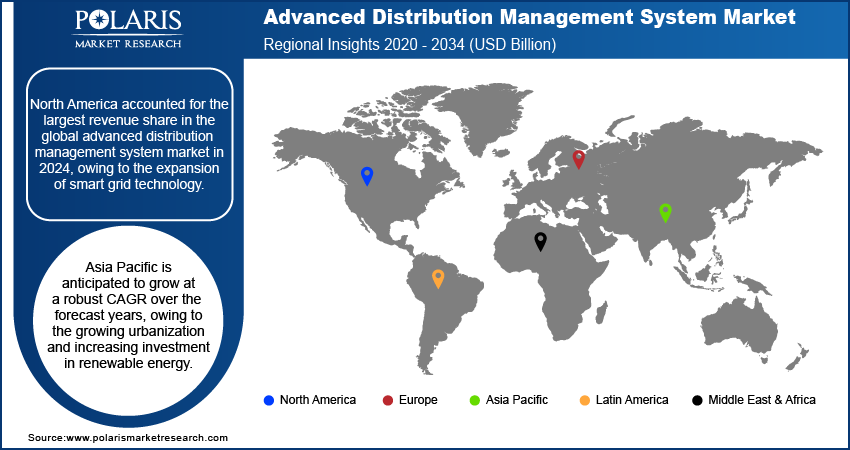

- North America accounted for the largest revenue share in the global advanced distribution management system market in 2024, owing to the expansion of smart grid technology.

- Asia Pacific is anticipated to grow at a robust CAGR over the forecast years, owing to the growing urbanization and increasing investment in renewable energy.

Industry Dynamics

- The rise in energy demand and growing industrialization support the growth of the market.

- The shift toward renewable energy and initiatives to reduce carbon emissions are also anticipated to increase demand for the advanced distribution management system.

- The rising infrastructural development in major emerging economies is creating a lucrative market opportunity.

- Data privacy and cybersecurity may hamper the market growth.

Market Statistics

- 2024 Market Size: USD 3.51 Billion

- 2034 Projected Market Size: USD 22.03 Billion

- CAGR (2025-2034): 20.18%

- North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

An advanced distribution management system (ADMS) is a software module that maintains a set of distribution optimization and management. It is a single software platform that includes DMS, OMS, and SCADA. It includes features that automate outage repair and enhance the functioning of the distribution network. It is also built for benefits such as isolation, fault location, volt/volt-ampere optimization, supporting electric vehicles, and many more functions. The growth of the global advanced distribution management system market is primarily aatributed to an increase in energy demand, greater adoption of automated solutions, and rise in utilization of renewable energy sources.

The main function of the advanced distribution management system is outage management, voltage optimization, and load balancing. sophisticated software. It also helps in seamless coordination of distributed energy resources such as solar, wind, and battery storage. Advanced distribution management system further helps in restore outages, reduce energy losses, and improve grid reliability.

Industry Dynamics

Growth Drivers

The rise in energy demand and growing industrialization is supporting the growth of the market. Industries acorss the globe are deploying advanced distribution management system for reliable, efficient, and uninterrupted power supply to support continuous operations and advanced manufacturing processes. Moreover, industries wordlwide are integrating renewable energy sources and adopting automation. This is creating the need for ADMS in managing distributed energy resources and maintaining grid stability. The growing urbanization and increasing investment in the development of smart cities across the globe is also leading to the adoption of advanced distribution management system for outage management, voltage optimization, and load balancing.

Report Segmentation

The market is primarily segmented based on solution, services, deployment type, end-use, and region.

|

By Solution |

By Services |

By Deployment Type |

By End Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Solution Segment Analysis

The energy management system segment is expected to grow at a robust pace during the forecast period. This is attributed to the fluctuating energy prices, driven by changes in supply and demand. Factors such as extreme weather conditions, economic conditions, and the energy supply is also contributing to the segment's dominance.The World Energy Outlook forecasts that in the next 25 years, energy consumption is expected to rise by 60%, with most of this growth occurring in developing countries. Moreover, the depletion of natural resources and rising focus on carbon zero is pushing the demand for energy management system. The increasing investment in clean energy sources in emerging are expected to propelled the adoptio of energy management system in the coming years.

Service Segment Analysis

The professional services segment accounted for the largest market share in 2024. This is due to the increasing adoption of consulting and training services to reduce the carbon footprint associated with industrial operations and promote the adoption of sustainable and eco-friendly solutions such as advanced distribution management system. Furthermore, a government initiative to prevent exploitation of resources increasingly drove the awareness of advanced distribution management systems for energy management, which increased the demand for professional services such as training and simulations among numerous small and medium enterprise owners.

Automotive & Transportation Segment Analysis

The automotive & transportation is expected to be the fastest growing segment during the forecast period due to the increasing adoption of electric vehicles. According to International Energy Agency, the global electric car sales exceeded 17 million in 2024. Electric vehicles (EVs) need an advanced distribution management system (ADMS) to monitor, manage, and optimize grid stability. The gowth of government focues on sustainable mobility is further leading the segment growth.

Regional Analysis

North America accounted for the largest revenue share in the global advanced distribution management system market in 2024, owing to the expansion of smart grid technology. Smart grid require ADMS to handle the enormous and diverse data from smart meters and sensors. The growing investment in the development of renewable energy facilities in the region further contributed to the market dominance. The presence of key companies in the region and rising product launches also propelled the market dominance in the region.

The market in the Asia Pacific is projected to grow at a robust CAGR in the coming years. This is attributed to the growing urbanization and increasing investment in renewable energy. The increasing adoption of EVs and rising manufacturing of these vehicles, driven by government policies and intiatives in the region is further leading the market growth. A decrease in energy subsidy in the region and the consistent increase in energy prices in many parts of the region is projected to fuel the demand for energy efficiency solutions such as ADMS. Moreover, the rising industrilization, particualry in India and South Korea is creating the need for advanced distribution management system (ADMS).

Competitive Insight

The leading companies operating in the global advanced distribution management system market include AutoGrid, depsys SA, Eaton Corporation, Electrical Transient Analyzer Program, Elipse Software, General Electric, Hitachi Ltd., IBM Corporation, Itron, Landis+GYR, Minsait ACS, Opus One Solutions, PXiSE Energy Solutions, Schneider Electric, and Siemens AG.

The major market players operating in the global market are investing in research and development and technological advancements to expand their offerings in the market. Acquisition and partnerships offer growth opportunities to strengthen market presence and enter new regional markets.

Recent Developments

In July 2022, General Electric launched their new addition of advanced distribution management system solution. This will help in providing real-time mobile situational awareness for better communication between two parties.

In December 2021, General Electric stated that their advanced distribution management system will be embedded in DTEK Kyiv Grids. This was undertaken to provide real-time data and information with its network.

Advanced Distribution Management System Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3.51 billion |

| Market size value in 2025 | USD 4.21 billion |

|

Revenue forecast in 2034 |

USD 22.03 billion |

|

CAGR |

20.18% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

|

|

Regional Scope |

|

|

Key companies |

AutoGrid, depsys SA, Eaton Corporation, Electrical Transient Analyzer Program, Elipse Software, General Electric, Hitachi Ltd., IBM Corporation, Itron, Landis+GYR, Minsait ACS, Opus One Solutions, PXiSE Energy Solutions, Schneider Electric, and Siemens AG. |

FAQ's

• The global market size was valued at USD 3.51 billion in 2024 and is projected to grow to USD 22.03 billion by 2034.

• The global market is projected to register a CAGR of 20.18% during the forecast period.

• North America dominated the market in 2024.

• A few of the key players in the market include AutoGrid, depsys SA, Eaton Corporation, Electrical Transient Analyzer Program, Elipse Software, General Electric, Hitachi Ltd., IBM Corporation, Itron, Landis+GYR, Minsait ACS, Opus One Solutions, PXiSE Energy Solutions, Schneider Electric, and Siemens AG.

• The professional services segment dominated the market revenue share in 2024.