Advanced Therapy Medicinal Products CDMO Market Share, Size, Trends, Industry Analysis Report

By Product (Gene Therapy, Cell Therapy, Tissue Engineered, Others); By Phase; By Indication; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM4326

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

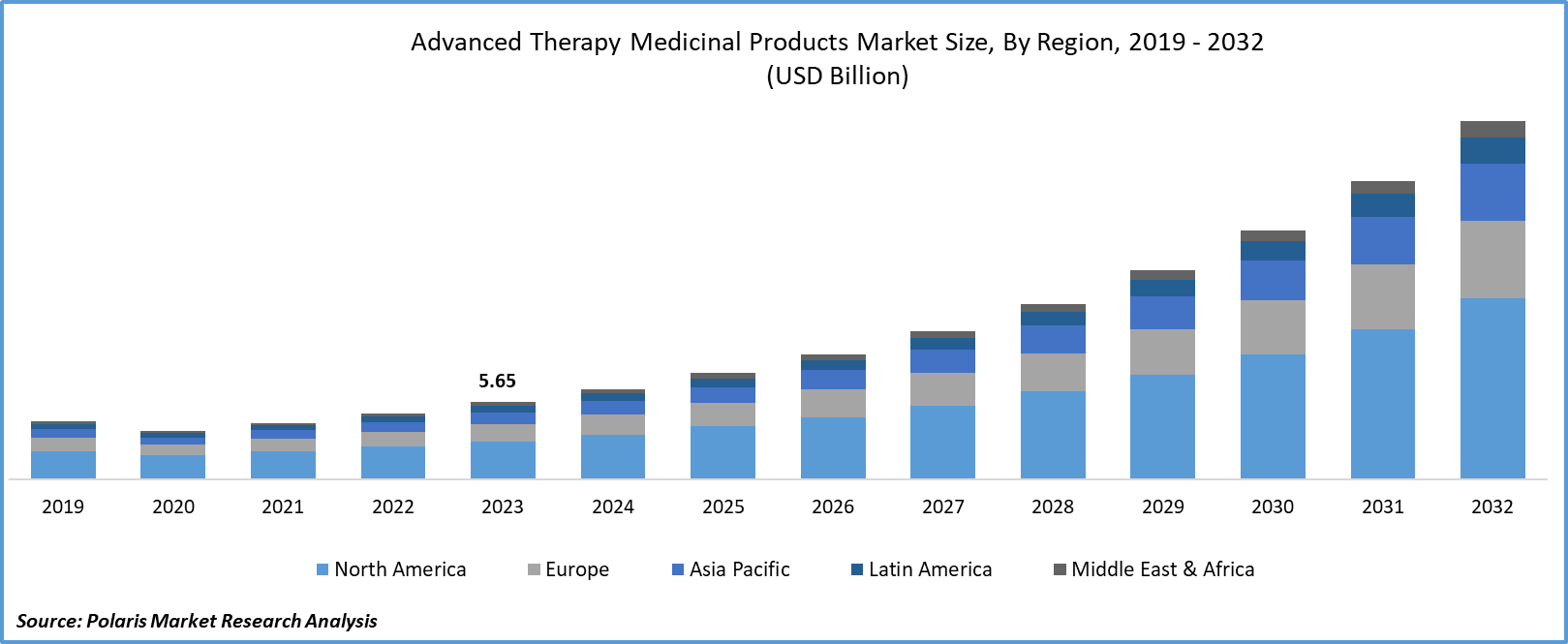

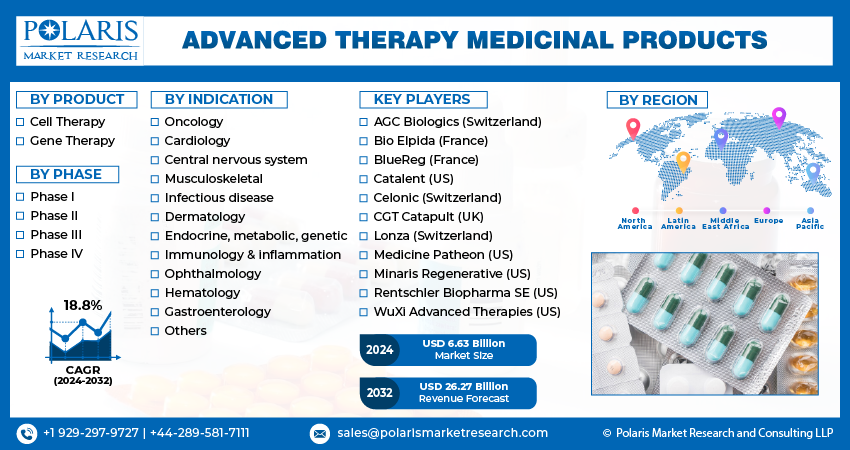

Advanced therapy medicinal products CDMO Market size was valued at USD 5.65 billion in 2023. The market is anticipated to grow from USD 6.63 billion in 2024 to USD 26.27 billion by 2032, exhibiting the CAGR of 18.8% during the forecast period.

Market Overview

The advanced therapy medicinal products contract development and manufacturing organizations (ATMP CDMO) are witnessing huge demand in the marketplace, which is highly attributable to the rising pharmaceutical studies on developing new therapies with the utilization of tissue engineering, gene therapy, and gene therapeutics. Nowadays, cell and gene therapies are widely employed in the healthcare industry, primarily to treat diseases like cancer, autoimmune diseases, and neurological and genetic disorders. This is enabling the demand for CDMOs in the market.

For instance, in January 2023, Charles River and Rznomicare entered a viral vector CDMO partnership. This is to utilize collaborative power in the clinical development of RNA-based anti-cancer gene therapy in liver cancer patients.

Moreover, the prevalence of viral infections in society is emphasizing researchers to explore alternative methods, including generative medicine, with a view to developing cures for existing diseases and countering viral infections.

To Understand More About this Research: Request a Free Sample Report

However, the stringent regulations, higher qualitative checks, and constant need for the adoption of advanced technological infrastructure, which can cost a huge amount, are expected to impede market growth.

Growth Drivers

The Rising Cell and Gene-Based Therapies in Biotechnology

Based on the advanced therapy medicinal products CDMO market analysis, one of the major driver of market growth is growing research studies on gene and cell therapies. According to the report published by the American Society of Gene+Cell Therapy Q3 2023, the gene therapies, including genetically modified therapies, which are in the developing stage, are 2,082, while RNA therapies and non-genetically modified cell therapies constitute 25% and 22%, respectively. These ongoing development activities will require advanced infrastructure to develop and manufacture therapies. This is where the need for CDMO is prominent.

The Higher Production Capability of CDMOs

In the development of cell and gene therapies, specialization in manufacturing teams is vital. The presence of experienced professionals in contract development organizations, along with the higher production capacity and availability of advanced infrastructure, is grabbing attention from biopharmaceutical companies. The growing approvals for the numerous therapies in the marketplace are expected to promote new opportunities for advanced therapeutic medicinal products and market growth.

Restraining Factors

The Talent Shortage Pertaining to Atmp Production is Likely to Impede Market Growth

Based on the ATMP CDMO market analysis, one of the major factors negatively affecting market growth is the lack of proficient people in the manufacturing of cell and gene therapies. As cell and gene therapies are in an emerging stage, the demand is outstripping the supply in the marketplace, which is making it difficult for CDMOs to hire quality staff. However, rising young professionals' interest in building a career in the biopharmaceutical space is expected to have a significant impact on the market in the coming years.

Report Segmentation

The market is primarily segmented based on product, phase, indication, and region.

|

By Product |

By Phase |

By Indication |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

Gene Therapy Segment is Expected to Witness the Highest Growth During the Forecast Period

The gene therapy segment is projected to grow at a CAGR during the projected period, mainly driven by the rising clinical trials of gene therapies. The total number of global gene therapies in various development stages from Q3 2022 to Q3 2023 has grown significantly with 2,031 and 2,082, respectively. These ongoing clinical trials are expected to folster the demand for ATMP CDMO.

In the advanced therapy medicinal products CDMO market forecast, the cell therapy segment led the industry market with a substantial revenue share in 2023. This is highly influenced by the rising approvals of cell therapies in the marketplace.

By Phase Analysis

Phase I Segment Accounted for the Largest Market Share in 2023

The phase I segment accounted for the largest market share in 2023. This usually includes early trials among volunteers. The increasing new developments in generative medicine are highly driving the demand for CDMOs. The number of participants in phase I clinical trials witnessed growth from 240 in Q2 to 256 in Q3 in 2023.

The phase II segment is expected to grow at the fastest rate over the next few years on account of the increased investment in the development process of therapies by biopharmaceutical companies. Normally, the therapies that pass the phase I trial will reach the next stage, which is phase II. It is the initial efficiency trial among the limited number of patients. The success of the therapy in earlier stages is enabling companies to invest higher funds in the second stage, contributing to the significant adoption of CDMO.

By Indication Analysis

Oncology Segment Held the Significant Market Revenue Share in 2023

The oncology segment held a significant market share in revenue in 2023, which was highly accelerated due to the continuous rise in research studies focusing on cancer. According to the Gene, Cell, & RNA Therapy Landscape Report Q3 2023, oncology & rare diseases are the most focused therapy areas in pre-clinical to the pre-registration and phase I to pre-registration.

Cardiology segment is expected to witness a lucrative share during the forecast period, attributable to the rising penetration of health issues related to cardiology among the global population. This is emphasizing the importance of developing therapies to address cardiology among researchers, fueling the adoption of CDMOs in the marketplace

Regional Insights

North America Region Registered the Largest Share of the Global Market in 2023

The North America has the largest market share in 2023 and is expected to continue its dominance over the study period. Region’s growth is attributed to the advancements in biotechnology. Based on the Advanced Therapy Medicinal Products CDMO market trends in the region, the United States registered the dominant share with the presence of robust infrastructure and rising acceptance of gene therapies. For instance, in December 2023, the U.S. Food and Drug Administration announced approval for CRISPR gene-editing therapy for sickle cell disease, Casgevy. This is expected to cumulatively drive the revenue of CDMOs in the region to meet supply targets.

The Asia Pacific region is expected to be grow at high CAGR during the projected period, owing to the growing concerns about incurable health problems among the population. The existence of a larger population in the region is encouraging institutes to invest in gene and cell therapies. For instance, in June 2023, Laurus Labs announced the investment of INR 80 crore in ImmunoACT, a Mumbai-based cell and gene therapy firm. This continuing progress in the pharmaceutical space is expected to contribute to the growth of the CDMO market for advanced therapy medicinal products during the study period.

Key Market Players & Competitive Insights

Strategic Investments to Drive the Competition

The advanced therapy medicinal products CDMO market is a mix of fragmentation and consolidation, with the presence of several players. The rising expansion activities, including mergers, acquisitions, partnerships, and strategic investments in the market, are playing a significant role in propelling the competition among major players. For instance, in June 2023, CDMO Biovian unveiled its plan to invest over €50 million to expand the Finland drug manufacturing facility.

Some of the major players operating in the global market include:

- AGC Biologics (Switzerland)

- Bio Elpida (France)

- BlueReg (France)

- Catalent (US)

- Celonic (Switzerland)

- CGT Catapult (UK)

- Lonza (Switzerland)

- Medicine Patheon (US)

- Minaris Regenerative (US)

- Rentschler Biopharma SE (US)

- WuXi Advanced Therapies (US)

Recent Developments in the Industry

- In November 2023, the European government established the Advanced Therapy Medicinal Products Working Group to regulate gene therapies, cell therapies, and tissue engineering products.

- In July 2023, Korro Bio and Frequency Therapeutics entered into a merger agreement to focus on the advancement of RNA editing programmes as well as to promote Alpha-1 antitrypsin deficiency candidates into trials.

Report Coverage

The advanced therapy medicinal products CDMO market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, phase, indication and their futuristic growth opportunities.

Advanced Therapy Medicinal Products CDMO Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 6.63 billion |

|

Revenue forecast in 2032 |

USD 26.27 billion |

|

CAGR |

18.8% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

key companies in Advanced Therapy Medicinal Products CDMO Market are AGC Biologics, Bio Elpida, BlueReg, Catalent, Celonic, CGT Catapult, Lonza

Advanced therapy medicinal products CDMO Market exhibiting the CAGR of 18.8% during the forecast period.

The Advanced Therapy Medicinal Products CDMO Market report covering key segments are product, phase, indication and region.

key driving factors in Advanced Therapy Medicinal Products CDMO Market are rising cell and gene-based therapies in biotechnology

The global advanced therapy medicinal products CDMO market size is expected to reach USD 26.27 billion by 2032