Aerospace Robotics Market Share, Size, Trends, Industry Analysis Report

By Solution (Traditional Robots, Collaborative Robots); By Component; By Payload; By Application; By Region; Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 126

- Format: PDF

- Report ID: PM2368

- Base Year: 2024

- Historical Data: 2020 - 2023

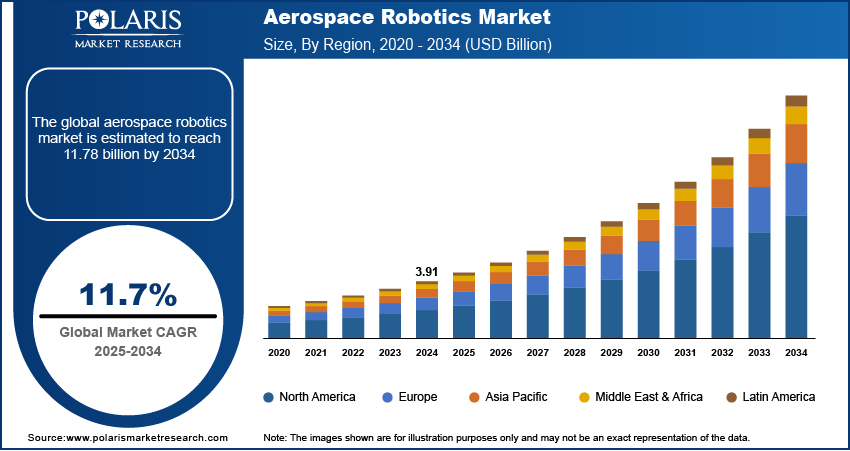

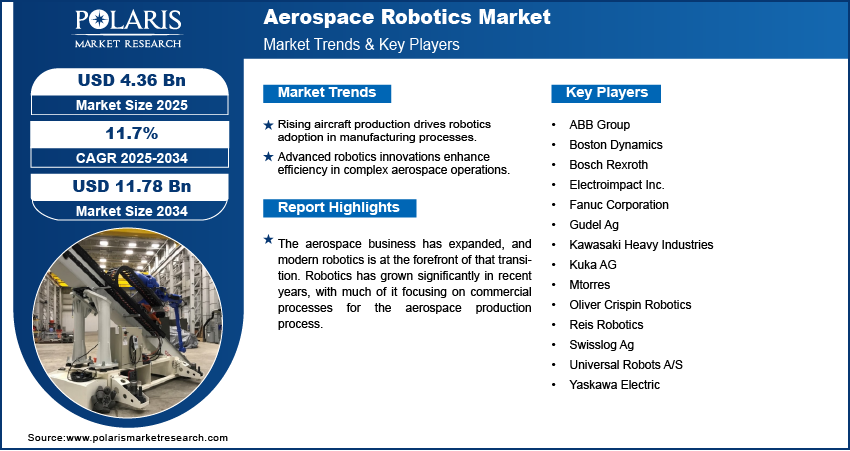

The global aerospace robotics market was valued at USD 3.91 billion in 2024 and is expected to grow at a CAGR of 11.7% during the forecast period. Key factors driving demand includes shortage of skilled labor, capital intensive technology, and increased demand for automation for efficient aircraft manufacturing.

Key Insights

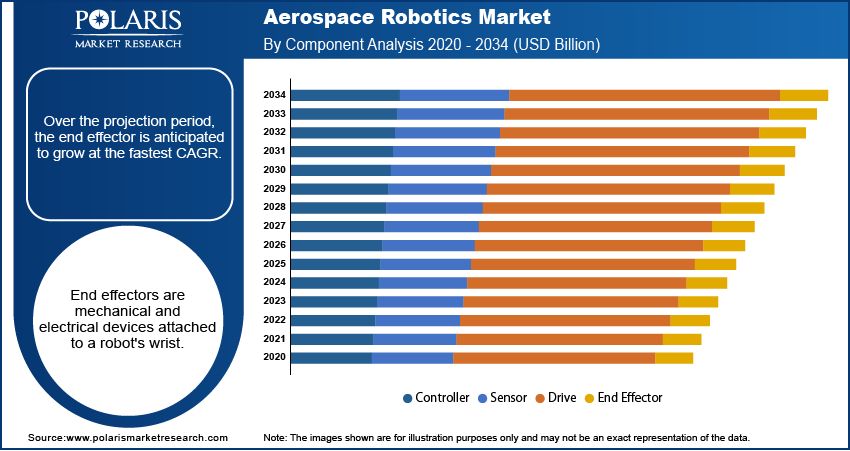

- The end effector is expected to witness rapid growth during the forecast period. This is due to the mechanical and electrical devices attached to a robot's wrist.

- The traditional robot segment dominated the market in 2024. This is due to the increased use of traditional robots in applications such as fastening, welding, drilling, and painting.

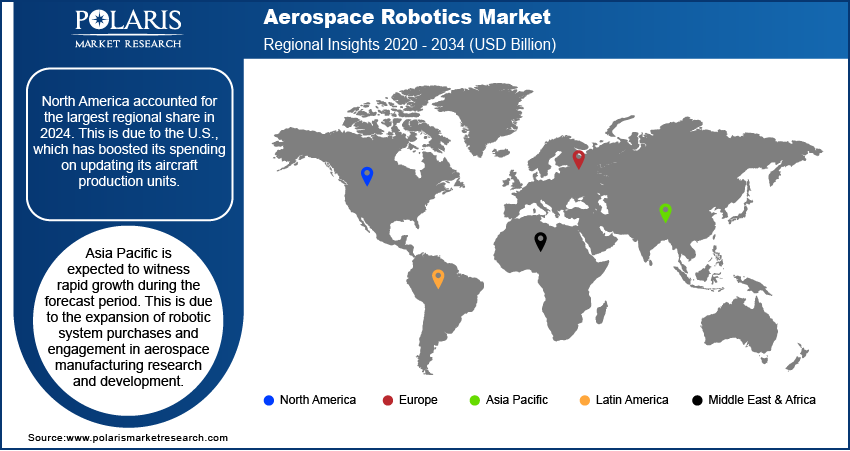

- North America accounted for the largest regional share in 2024. This is due to the U.S., which has boosted its spending on updating its aircraft production units.

- Asia Pacific is expected to witness rapid growth during the forecast period. This is due to the expansion of robotic system purchases and engagement in aerospace manufacturing research and development.

Industry Dynamics

- Rising aircraft production rates to accommodate the demand will improve efficiency, accuracy, and scalability in the manufacturing process and facilitates the adoption of robotics directly.

- Innovation continues to focus on increasing the sophistication and agility of robots performing complex aerospace processes, increasing use and supporting commercial development.

- High up-front costs and complexity of integration for robotics systems, particularly for small-manufacturers creates a barrier to adoption.

- The rise in development of collaborative robots (cobots) and AI also enable new possibilities for automating complex assembly and processes.

Market Statistics

- 2024 Market Size: USD 3.91 billion

- 2034 Projected Market Size: USD 11.78 billion

- CAGR (2025-2034): 11.7%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

AI Impact on Aerospace Robotics Market

- Robots equipped with AI-based vision systems demonstrate micro-assembly and inspection functionality with greater accuracy than humans, particularly with very complex components for aircraft, and increased defect rates.

- AI algorithms and visual sensors are expected to be used to review robot sensor data to analyze probable failures prior to their occurrence to reduce unplanned downtime and maintain production standards on critical assembly lines.

- AI provides analytical systems that allow the robot to change its behaviors in real-time workflows to accept variability in parts or jobs, thus increasing interoperability on the production floor.

- AI is expected to schedule and coordinate multiple robots effectively for scheduled workflow, and workflow improvements for efficiency in large-volume aerospace manufacturing.

The aerospace business has expanded, and modern robotics is at the forefront of that transition. Robotics has grown significantly in recent years, with much of it focusing on commercial processes for the aerospace production process.

The increased demand for automation for efficient aircraft manufacture has driven the market growth. Furthermore, rising labor costs around the world contribute to market expansion. However, the shortage of experienced professionals and the high cost of robotic device installation are restraining the market's growth.

On the contrary, an increase in IoT (Internet of Things) trends in aircraft manufacturing firms and rapid growth in the global aerospace industry create a lucrative growth opportunity for the market. The COVID-19 pandemic has altered the market's dynamics for the following years, as demand for new aircraft has decreased since the coronavirus outbreak.

Aircraft OEMs focus on variables such as nations' governments planning to revamp supply chain management while considering the epidemic to combat the pandemic. To minimize the consequences of the pandemic on commercial aviation, aircraft manufacturers are looking forward to optimizing their overall operations and focusing on inventory management.

Machine operators must adhere to social distancing and other safety standards when working in the industrial industry. This has also shifted the market for aerospace robotics in a positive direction, as the companies' key concern is worker safety. As a result, demand for the employment of robots in the production process will rise, as robots are the ideal substitutes for shop floor workers.

Industry Dynamics

Growth Drivers

Aviation interconnections enable commerce and business, governments, and education, while air cargo provides vital services, transporting 35% of global trade by value and providing aid to global health systems. Also, people desire and require a connection. Global aircraft production is predicted to expand as demand for new aircraft fleets in various countries rises as global air passenger traffic increases.

According to Bureau of Transportation statistics, With 605,508 flights operated in July 2021, there were 65 percent more flights than in July 2020, when there were 367,933 flights. Thus, the rise in demand for aircraft fleets has significantly increased the demand for robotics in aircraft manufacturing.

On account of the increasing demand for aircraft components, suppliers can use collaborative robots in the production process to manufacture high-quality aircraft parts and systems in less time. Furthermore, following the COVID-19 pandemic, modifying manufacturing process safety requirements is expected to enhance market growth.

Report Segmentation

The market is primarily segmented based on component, solution, payload, application, and region.

|

|

|

|

|

|

|

|

|

|

Know more about this report: Request for sample pages

Segmental Analysis

Component Analysis

Over the projection period, the end effector is anticipated to grow at the fastest CAGR. End effectors are mechanical and electrical devices attached to a robot's wrist. An aeronautical robot's end effectors are grippers, welding torches, force-torque sensors, material removal tools, collision sensors, and tool changers. Because it has a variety of gripping techniques and styles, the gripper is the most often utilized end effector in aerospace robots.

Solution Analysis

The traditional robot segment dominated the market in 2024 due to the reliability and precision in repetitive and high-stakes manufacturing tasks. These robots are used in applications such as fastening, welding, drilling, and painting, which is essential in aircraft assembly. Their integration into the existing production units offer a low level of risk and a clear ROI as compared to the other technologies. Moreover, the developed supplier base and operator familiarity reduce the need for new training. These advances boost the demand for traditional robots.

Regional Analysis

North America Aerospace Robotics Market Assessment

North America accounted for the largest regional share in 2024. The U.S. has greatly boosted its spending on updating its aircraft production units in recent years. Furthermore, significant manufacturers are driving market expansion in the U.S.

For instance, in October 2021, Reliable Robotics has raised USD 100 million in funding to automate traditional fixed-wing planes to transport freight and eventually passengers and has acquired $100 million in funding. Moreover, the government will invest in sophisticated technology robots to cater to the growing aerospace industry.

Asia Pacific Aerospace Robotics Market Insights

Asia Pacific is expected to witness fastest growth during the forecast period due to China, Japan, and India which are likely to expand robotic system purchases in the Asia Pacific area and engage in aerospace manufacturing research and development. Furthermore, many countries have invested in automated technologies to improve their manufacturing capacities and speed up the manufacturing process.

To improve the productivity of their facilities, Chinese and Indian companies are adopting robotic technologies from Western nations. On the other hand, many aerospace robotics producers are based in the Asia Pacific.

The formation of governmental and private market robotics initiatives has boosted the demand for robots in regions like North America, Europe, and China. In comparison, the IoT has played a significant impact on developing the robotics industry in Europe and the United States. The global demand for aerospace robotics has risen steadily over the years and continues to do so.

Competitive Insights

The competitive landscape features vendor strategies focused on boosting capabilities in AI and collaborative systems. The competitive intelligence and strategy indicate that key players are positioning themselves to make targeted investment decisions to develop robotic systems to conduct complex assembly tasks. Addressing latent demand and opportunities in the commercial and defense segments. The main disruption and trend in the industry is flexible automation as a way to combat supply chain challenges. Expert's insight now suggests that vendor assessments prioritize agility and resilience over focus on precision. Moreover, the growth projection is strong due to the increased aircraft production rates, though factors such as economic and geopolitical changes remain part of the consideration.

Kuka AG, ABB Group, Fanuc Corporation, Yaskawa Electric, Kawasaki Heavy Industries, Mtorres, Oliver Crispin Robotics, Gudel Ag, Electroimpact Inc., Universal Robots A/S, Swisslog Ag, Reis Robotics, Boston Dynamics, Bosch Rexroth, and others are some of the players operating in the market.

Aerospace Robotics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3.91 Billion |

|

Market size value in 2025 |

USD 4.36 Billion |

|

Revenue forecast in 2034 |

USD 11.78 Billion |

|

CAGR |

11.7% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Component, By Payload, By Solution, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Kuka AG, ABB Group, Fanuc Corporation, Yaskawa Electric, Kawasaki Heavy Industries, Mtorres, Oliver Crispin Robotics, Gudel Ag, Electroimpact Inc., Universal Robots A/S, Swisslog Ag, Reis Robotics, Boston Dynamics, and Bosch Rexroth. |

FAQ's

• The global market size was valued at USD 3.91 billion in 2024 and is projected to grow to USD 11.78 billion by 2034.

• The global market is projected to register a CAGR of 11.7% during the forecast period.

• North America dominated the global market share in 2024.

• A few market players are Kuka AG, ABB Group, Fanuc Corporation, Yaskawa Electric, Kawasaki Heavy Industries, Mtorres, Oliver Crispin Robotics, Gudel Ag, Electroimpact Inc., Universal Robots A/S, Swisslog Ag, Reis Robotics, Boston Dynamics, and Bosch Rexroth.

• The traditional robot segment dominated the market in 2024.

• The end effector is expected to witness rapid growth during the forecast period.