Agrigenomics Market Share, Size, Trends, Industry Analysis Report

By Sequencer Type (Sanger Sequencing, Illumina Hi Seq Family, Pacbio Sequencers, Solid Sequencers, Others); By Application; By Objective; By Region; Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 118

- Format: PDF

- Report ID: PM2406

- Base Year: 2024

- Historical Data: 2020 - 2023

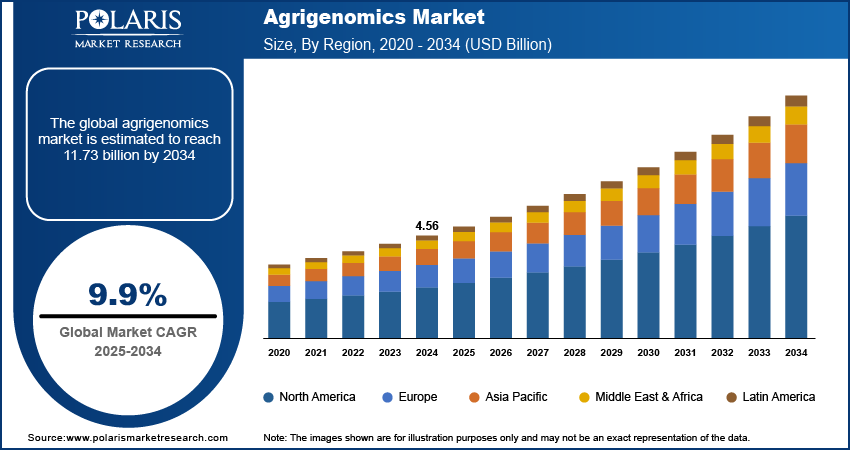

The global agrigenomics market was valued at USD 4.56 billion in 2024 and is expected to grow at a CAGR of 9.9% during the forecast period. The increasing demand for the various types of packed food products, non-alcoholic and alcoholic beverages, and the growing need for the or easy-to-open and sustainable packages are the major factors fostering the market demand across the globe.

Key Insights

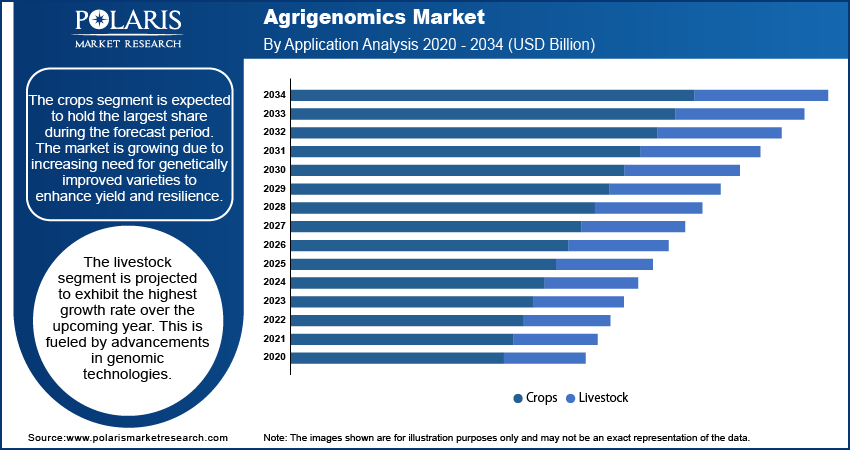

- The crops segment is expected to hold the largest share during the forecast period. The market is growing due to increasing need for genetically improved varieties to enhance yield and resilience.

- The livestock segment is projected to exhibit the highest growth rate over the upcoming year. This is fueled by advancements in genomic technologies.

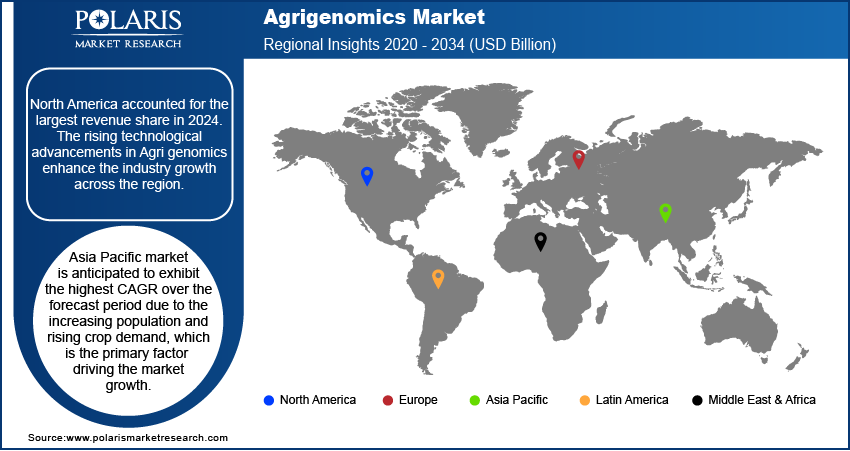

- North America accounted for the largest revenue share in 2024. The market is supported by robust agricultural research, government support, and widespread adoption of genomic technologies.

Industry Dynamics

- The market is fueled due to increasing global population and enhanced resistance to environmental stresses.

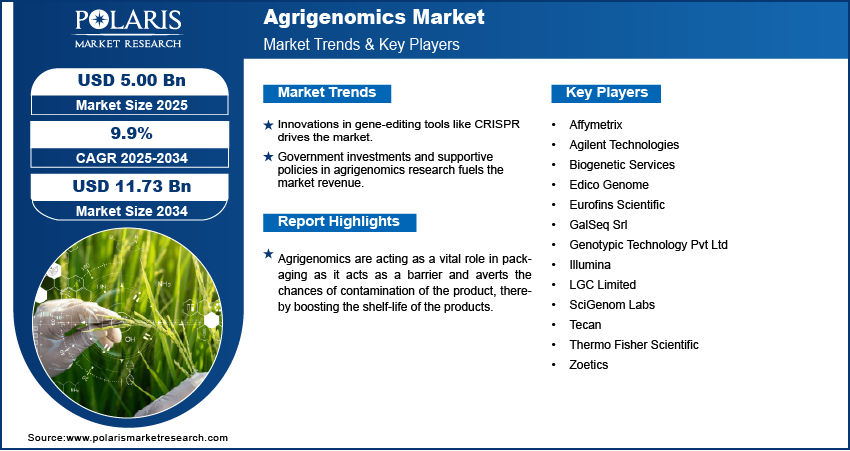

- Innovations in gene-editing tools like CRISPR drives the market.

- Government investments and supportive policies in agrigenomics research fuels the market revenue.

- Growing emphasis on sustainable farming practices helps to grow the market during the forecast period.

Market Statistics

- 2024 Market Size: USD 4.56 Billion

- 2034 Projected Market Size: USD 11.73 Billion

- CAGR (2025-2034): 9.9%

- North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

AI Impact on Agrigenomics Market

- AI helps to analyse gene sequencing analysis, enabling faster identification of beneficial traits.

- AI helps to optimize genome editing processes, reducing trial times and enhancing efficiency of crop.

- AI helps in real-time monitoring and decision-making, improving crop management and yield outcomes sustainably.

Agrigenomics are acting as a vital role in packaging as it acts as a barrier and averts the chances of contamination of the product, thereby boosting the shelf-life of the products. The growing awareness for health and wellness, increasing disposable income, and the rising application of agrigenomics across various end-use industries, including pharmaceutical, personal care, home care, food & beverages, and automotive, further spurs the agrigenomics market demand over the forecast period.

The outbreak of the COVID-19 has shown a significant impact on the various sector of the economy. The agrigenomics market has seen negative impacts due to disruption supply chain, procrastination in trade, and shortened demand. The strict lockdown protocols and social distancing have drastically affected the agrigenomics industry demand during the pandemic. Moreover, the growth of the food & beverage sector, both offline and online food chains, declined during this period because of the apprehension of the virus spreading. However, the gradual opening of the lockdowns also presents various growth prospects for agrigenomics market growth in the coming years.

Industry Dynamics

Growth Drivers

The surging demand for organic food products worldwide among the population is one of the major factors driving the agrigenomics market growth. Agrigenomics is the study of the genetic makeup of various crops in order to enhance the production and nutrition value of crops. The rising demand for bio-engineered food due to its excellent properties fosters agrigenomics industry demand.

On the other hand, increasing usage of agrigenomics in medicinal purposes such as vaccine development supports the agrigenomics industry. Whereas rising research and development activities and expanding government budgets towards technological development of agriculture provide profitable growth to the agrigenomics market.

Additionally, increasing cultivation of hybrid crops and rising spending on food & beverages industries surge the agrigenomics industry demand in the foreseen years. For instance: according to the Indian Brand Equity Foundation (IBEF), in 2020, in India, the food & beverages industry accounts about 3 % of the country’s GDP and is considered the largest employer in the country. Therefore, rising investment in the food & beverages industry is expected to increase agrigenomics industry expansion throughout the forecast period.

Report Segmentation

The market is primarily segmented on the basis of sequencer type, application, objective, and region.

|

By Sequencer Type |

By Application |

By Objective |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Application

The crops segment is expected to hold the largest share during the forecast period. The cultivation, production, and demand for crops are rising rapidly worldwide in various industries such as food, beverages, healthcare, genomics, etc. For instance, according to the World Bank in 2018, the agriculture sector has accounted 4% of the global gross domestic product. Additionally, it is anticipated to account for more than 25% of GDP in developing countries like India. Thereby, the growth of the agriculture sector is fostering agrigenomics industry demand around the world.

The livestock segment is projected to exhibit the highest growth rate in the forecast period. Livestock has major applications across various end-user industries. Additionally, the segment continues to increase owing to the rising number of farmers, breeders, and researchers across the globe. For instance, according to the U.S. National Library of Medicine National Institutes of Health, in 2021, the demand for animal protein is estimated to grow and reach 9 billion humans by 2050. Thus, the surging demand for animal protein and the growth of the livestock segment is leading the industry to grow during the projected timeframe.

Geographic Overview

Geographically, North America accounted for the largest revenue share in 2024. The rising technological advancements in Agri genomics enhance the industry growth across the region. The increasing demand for food and beverages industries across the region provides growth to the industry expansion. On the other growing production and cultivation of crops such as corn, soybean, canola, beet, etc., drives the market adoption in the coming years. for instance: According to NCBI, in 2022, crop production is rising rapidly in the region. It is found that the U.S. agriculture and food sector is producing USD 2 trillion in annual revenue and around USD 130 billion in profit.

Additionally, according to convenience.org, in 2021, the number of restaurants is increasing rapidly, such as Starbucks expanded 287 more stores, and Dominos extended its services with 229 more locations and 6,355 total units. According to members.resturantscanada.org, in 2021, in Canada, the sales of food & beverages from restaurants are projected to increase by 8.7%. Thus, with the growing crop production and rising food & beverage industry, the market is expected to grow in the forecast period.

Moreover, the Asia Pacific market is anticipated to exhibit the highest CAGR over the forecast period due to the increasing population and rising crop demand, which is the primary factor driving the market growth. In the developing countries of the Asia Pacific, rapidly increasing technological advancement toward the betterment of agriculture boosts market growth.

Rising government support and schemes are another major factor driving the market growth. For instance, according to the United Nations, in 2020, it is found that the population is estimated to rise by approximately 2 billion persons in the coming 30 years, from 7.7 billion to 9.7 billion by 2050. As per the same source, China (1.44 billion) and India (1.39 billion) are the two most populous countries globally, representing 19 to18 percent of the global population. Hence, the surging population is propelling the rising need for food & beverages, which, in turn, augments the market growth over the forecast period.

Competitive Insight

Players operating globally include Affymetrix, Agilent Technologies, Biogenetic Services, Edico Genome, Eurofins Scientific, GalSeq Srl, Genotypic Technology Pvt Ltd, Illumina., LGC Limited, SciGenom Labs, Tecan, Thermo Fisher Scientific, and Zoetics.

Agrigenomics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 4.56 Billion |

| Market size value in 2025 | USD 5.00 Billion |

|

Revenue forecast in 2034 |

USD 11.73 Billion |

|

CAGR |

9.9% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Sequencer Type, By Application, By Objective, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Affymetrix, Agilent Technologies, Biogenetic Services, Edico Genome, Eurofins Scientific, GalSeq Srl, Genotypic Technology Pvt Ltd, Illumina., LGC Limited, SciGenom Labs, Tecan, Thermo Fisher Scientific, and Zoetics. |

FAQ's

• The global market size was valued at USD 4.56 billion in 2024 and is projected to grow to USD 11.73 billion by 2034.

• The global market is projected to register a CAGR of 9.9% during the forecast period.

• North America dominated the market in 2024

• A few of the key players in the market are Affymetrix, Agilent Technologies, Biogenetic Services, Edico Genome, Eurofins Scientific, GalSeq Srl, Genotypic Technology Pvt Ltd, Illumina., LGC Limited, SciGenom Labs, Tecan, Thermo Fisher Scientific, and Zoetics.

• The crops segment dominated the market in 2024.