AI in Medical Writing Market Share, Size, Trends, Industry Analysis Report

By Type (Scientific Writing, Clinical Writing, Type Writing), By End-use (Medical Devices, Pharmaceutical, Biotechnology), By Region, And Segment Forecasts, 2023 - 2032

- Published Date:Oct-2023

- Pages: 118

- Format: PDF

- Report ID: PM3774

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

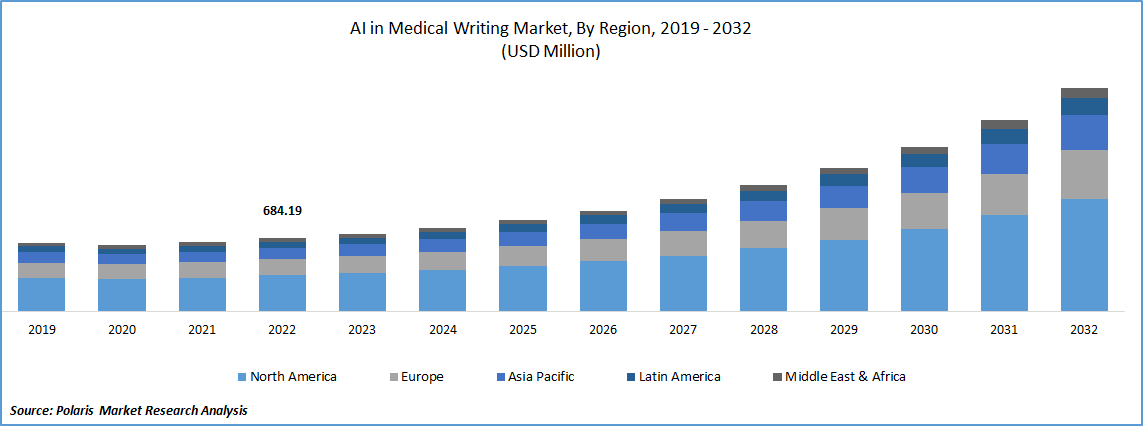

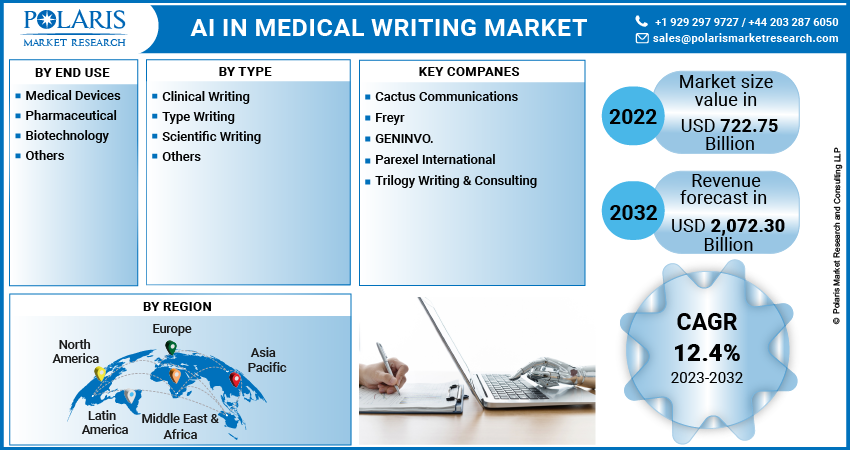

The global AI in medical writing market was valued at USD 684.19 million in 2022 and is expected to grow at a CAGR of 12.4% during the forecast period.

To cope with the dynamic and competitive pharmaceutical landscape, approximately 30 leading pharmaceutical companies have established partnerships with Contract Research Organizations (CROs). These collaborations allow pharmaceutical firms to access specialized expertise and resources offered by CROs, which play a crucial role in supporting their product portfolios. By partnering with CROs, pharmaceutical companies can optimize their R&D efforts, including medical writing projects, while ensuring the development of high-quality drugs and therapies.

To Understand More About this Research: Request a Free Sample Report

The growing demand for methodologies in the stages of drug development by the regulatory authorities has increased complexity in the drug approval process. Regulatory bodies around the world, such as the U.S. Food and Drug Administration (FDA) & the European Medicines Agency (EMA), require rigorous testing and extensive data to ensure safety & efficacy of new drugs and medical devices before they can be approved for market release. This emphasis on comprehensive methodologies and data-driven evidence has driven market growth for technologies and services that support efficient and robust product development processes.

However, the COVID-19 pandemic has had a moderate effect on the market for AI in medical writing. The pandemic disrupted clinical studies and research & development efforts worldwide as healthcare organizations and research institutions had to prioritize resources for COVID-19 related activities. Many clinical studies were put on hold or delayed, leading to a temporary slowdown in the demand for AI solutions in medical writing. Despite the pandemic's impact, the market for AI in precision medicine remains promising. As the world recovers from the pandemic and clinical research activities resume, the demand for AI-driven medical writing solutions is expected to rebound and continue its growth trajectory. The ongoing focus on precision medicine and the increasing need for accurate and efficient medical writing solutions are likely to drive the adoption of AI technologies in the industry.

The COVID-19 pandemic had a significant impact on the financial resources of many pharmaceutical firms, leading to fiscal constraints. As a result, some companies had to cut back on their investments in research and development (R&D) activities, including medical writing projects utilizing AI solutions. During the early stages of the pandemic, there was a slowdown in the number of submissions to medical journals. This was partly due to the focus on COVID-19 research and clinical trials, which diverted resources and attention away from other medical writing and R&D efforts. The decrease in submissions to medical journals affected the demand for AI in medical writing services, thus having a detrimental effect on the market expansion. Despite the challenges brought on by the pandemic, the pharmaceutical industry remains a major driver of R&D spending.

- According to the Congressional Budget Office (CBO) report rin April 2021, the pharmaceutical industry invests 3 times more in R&D compared to other tech sectors like computer & software services. In 2019, R&D expenditures in the U.S. pharmaceutical industry amounted to a around USD 83 Bn.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

Rising investment in research and development activities

Market players are investing more in research and development activities, leading to a higher demand for AI solutions in precision medicine. Additionally, there is a rise in the outsourcing of clinical research to Contract Research Organizations (CROs), further fueling the demand for AI in medical writing. Moreover, new medical device regulations and a favorable environment for clinical studies in developing countries are contributing to the increased adoption of AI in precision medicine. The implementation of new regulations has prompted companies to seek efficient and accurate medical writing solutions to meet compliance requirements.

To navigate the complex regulatory landscape and meet the demands of insurance companies, R&D activities have become paramount for key market players in the pharmaceutical, medical devices, and biotechnology sectors. These companies allocate a considerable portion of their revenues to research and development efforts to stay ahead in the competitive market. By investing in R&D, they can develop innovative and groundbreaking products that address unmet medical needs and offer significant therapeutic benefits to patients.

- As of March 2021, ClinicalTrials.gov reported around 454,928 active recruitment studies, highlighting the ongoing commitment of the industry to conducting clinical trials and advancing medical knowledge. Clinical trials are an integral part of the R&D process, providing valuable data on the safety and efficacy of new drugs and medical devices.

Report Segmentation

The market is primarily segmented based on type, end use, and region.

|

By Type |

By End Use |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Typewriting segment accounted for the largest share in 2022

Typewriting segment accounted for major global share. This segment plays a crucial role throughout the product development process, particularly in scientific documentation. It is instrumental in compiling and reporting statistical data from clinical trials, which is essential for regulatory applications and obtaining authorization for drugs or products. After receiving authorization, the post-approval phase requires rigorous regulatory certification, which often involves extensive paperwork due to stringent regulations and compliance requirements. As a result of these strict restrictions, the typewriting segment remains highly relevant and in demand, as it facilitates accurate and comprehensive documentation to meet regulatory standards.

Clinical writing segment is likely to register highest growth rate. This specialized form of medical writing is regularly utilized by medical professionals and requires comprehensive knowledge of the clinical field and its terminology. A skilled clinical writer must have a deep understanding of the intended audience and the purpose of the written content to ensure its effectiveness. As the number of clinical trials increases, there is a corresponding rise in the demand for AI in medical writing. The need for accurate and well-structured clinical documentation drives the adoption of AI technologies to support and streamline the writing process, making it a vital component of the healthcare and pharmaceutical industries.

By End-Use Analysis

Pharmaceutical segment held substantial market share in 2022

Pharmaceutical segment is projected to hold significant market share. Pharmaceutical companies allocate substantial resources to research and development (R&D) endeavors aimed at discovering and developing new drugs and treatments. Throughout the drug development process, these companies accumulate extensive data from clinical trials, pre-clinical studies, & scientific literature. This data serves as an asset for training AI models in medical writing tasks.

Furthermore, the adoption of AI solutions in medical writing has been highly beneficial for pharmaceutical companies, as it has significantly reduced the time required by medical writers to complete their tasks. According to reports, some companies have experienced an 80% reduction in the time spent on medical writing tasks, demonstrating the substantial impact of AI in streamlining and optimizing the writing process in the pharmaceutical industry.

Medical devices segment witnessed steady growth. The adoption of Natural Language Processing (NLP) algorithms and tools has become increasingly prevalent in medical writing. These advanced technologies enable automation of various tasks, including literature review, data extraction, and summarization of research articles. By leveraging NLP tools, medical writers can streamline their work processes, enhance efficiency, and minimize errors in their documentation.

Regional Insights

North America region dominated the global market in 2022

North America dominated the market share. Within North America, clinical writing in the U.S. is of particular importance as it involves seeking clearance from the FDA (Food and Drug Administration). Meeting the FDA's regulatory requirements demands a comprehensive understanding of the guidelines established by the regulatory body. The applications for FDA registration must be precise and concise to ensure compliance and successful approval.

APAC is likely to emerge as fastest growing region. This growth can be attributed to the increasing healthcare expenditure and a growing demand for effective healthcare solutions in the region. Furthermore, countries such as China, Japan, South Korea, & India have been witnessing rapid technological advancements, particularly in the field of Artificial Intelligence (AI). These technological developments have paved the way for the emergence of AI-powered medical writing tools and solutions, presenting significant opportunities for adoption and advancement in the region's healthcare industry.

Key Market Players & Competitive Insights

The AI in medical writing market is consolidated and is anticipated to witness competition due to limited players' presence. Major players in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Cactus Communications

- Freyr

- GENINVO.

- Parexel International

- Trilogy Writing & Consulting

Recent Developments

- In June 2022, Sanofi, in collaboration with Yesop, a company specializing in AI and Natural Language Processing (NLP), aims to improve the automation of safety reports.

AI in Medical Writing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 722.75 billion |

|

Revenue forecast in 2032 |

USD 2,072.30 billion |

|

CAGR |

12.4% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Type, End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Parexel International, Trilogy Writing & Consulting, Freyr, Cactus Communications, and GENINVO |

FAQ's

The global AI in medical writing market size is expected to reach USD 2,072.30 million by 2032.

Key players in the market are Parexel International, Trilogy Writing & Consulting, Freyr, Cactus Communications.

North America contribute notably towards the global AI in medical writing market.

The global AI in medical writing market is expected to grow at a CAGR of 12.4% during the forecast period.

The AI in medical writing market report covering key segments are type, end use, and region.