AI Infrastructure Market Share, Size, Trends, Industry Analysis Report

By Technology (Machine Learning, Deep Learning), End-Use; By Deployment; By Offering; By Region; Segment Forecast, 2025 - 2034

- Published Date:Oct-2025

- Pages: 114

- Format: PDF

- Report ID: PM2218

- Base Year: 2024

- Historical Data: 2020 - 2023

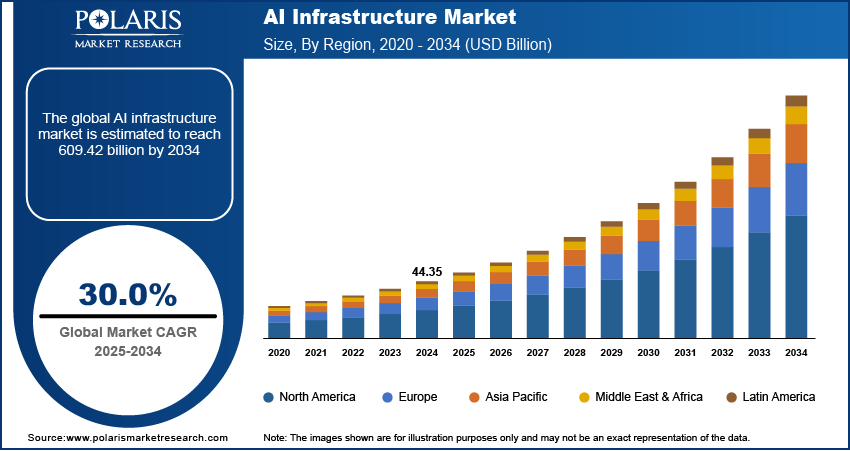

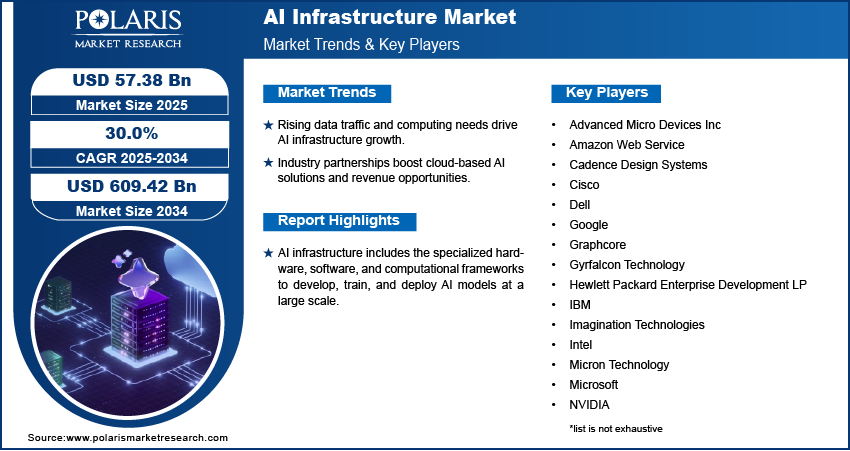

The global AI infrastructure market was valued at USD 44.35 billion in 2024 and is expected to grow at a CAGR of 30.0% during the forecast period. The increasing number of cross-industry collaborations and partnerships, tied with the increasing adoption of cybersecurity technologies, artificial intelligence, IoT, robots, industrial automation, and machine vision technology, is attributed to the artificial intelligence infrastructure industry demand.

Key Insights

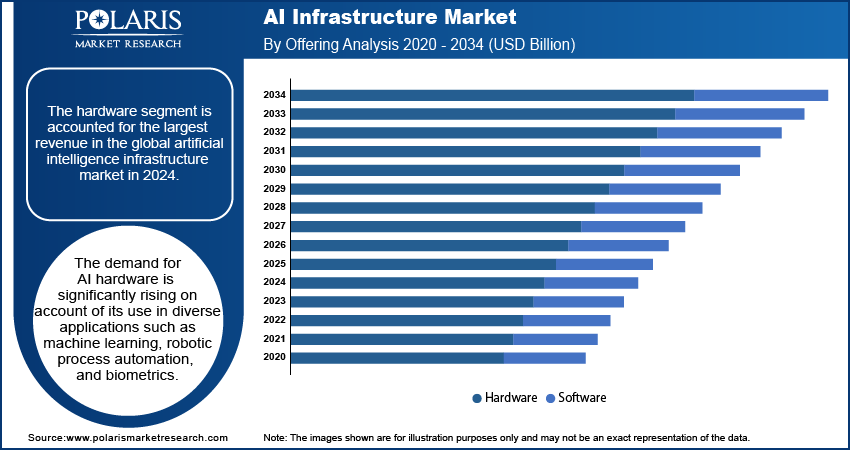

- In 2024, the hardware segment dominated the global AI infrastructure market. This is due to the increasing demand for AI hardware in various applications, including machine learning, robotic process automation, and biometrics.

- The machine learning technology segment is expected to witness rapid growth during the forecast period. This is due to the adoption of AI and machine learning following the pandemic.

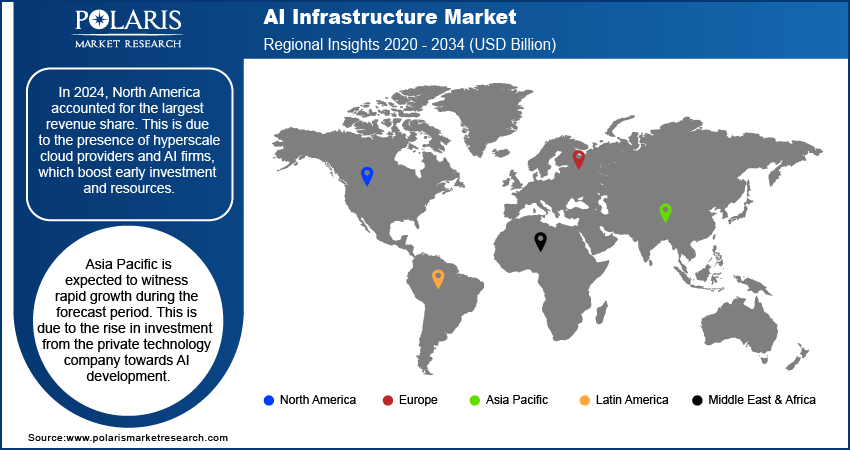

- In 2024, North America accounted for the largest revenue share. This is due to the presence of hyperscale cloud providers and AI firms, which boost early investment and resources.

- Asia Pacific is expected to witness rapid growth during the forecast period. This is due to the rise in investment from the private technology company towards AI development.

Industry Dynamics

- Increasing demand for data traffic and computing power has boosted the AI infrastructure growth due to the heavy investments in chips by manufacturers.

- Partnerships across industries have accelerated the demand for AI infrastructure. This is due to the access to AI resources and increase the demand for cloud-based solutions, offering new revenue options.

- High energy consumption and operational costs associated with running AI hardware advances create challenges for widespread adoption.

- The rise in demand for generative AI creates opportunities for infrastructure such as cloud GPUs and AI-as-a-service platforms.

Market Statistics

- 2024 Market Size: USD 44.35 billion

- 2034 Projected Market Size: USD 609.42 billion

- CAGR (2025-2034): 30.0%

- Largest market in 2024: North America

To Understand More About this Research: Request a Free Sample Report

AI infrastructure includes the specialized hardware, software, and computational frameworks to develop, train, and deploy AI models at a large scale. Deep learning algorithms, along with machine learning algorithms, assist enterprises to achieve network efficiencies. This advancement in technology works as the core utility for modern digital innovation. Components from underlying silicon, such as GPU and AI accelerators, enhance their growth, supporting software and data management platforms. Increasing investments in AI infrastructure create opportunities and boost its refinement and capacity to resolve the complexity of these models for organizations, which can be pursued at a faster speed repeatedly. Thus, a robust AI infrastructure enables everything from advanced generative AI applications to an autonomous enterprise environment.

Industry Dynamics

Growth Drivers

The demand for high computing power and the surge in data traffic is increasing, thereby driving the growth of the global artificial intelligence infrastructure market. GPU/CPU manufacturers, such as NVIDIA, Intel, Huawei, Samsung, and Qualcomm, have made investments in chip advancement that are compatible with artificial intelligence solutions. Apart from CPUs and GPUs, Application-Specific Integrated Circuits (ASICs) and Field-Programmable Gate Arrays (FPGAs) are also being developed for artificial intelligence applications. For instance, Google built a new ASIC called Tensor Processing Unit (TPU). Such supportive initiatives undertaken by manufacturers are likely to support the growth of the artificial intelligence infrastructure industry. Furthermore, the rise in adoption of cloud-based services has been observed across various application areas, such as government organizations, education, BFSI, and healthcare, among others.

Cross-industry collaborations for AI infrastructure drive market expansion due to the partnerships in domain expertise with technological capability. Traditional manufacturing and healthcare enterprises contain large, complex, and valuable data sets and problems, but they often lack the in-house infrastructure to analyze them effectively. The collaboration with cloud providers and AI companies enables access to scale with these AI resources without the capital expenditure of building them in-house. This shift creates demand for cloud GPUs, AI-as-a-service platforms, and associated tools. Therefore, these collaborations lower the AI adoption risk while creating predictable and expanding revenue opportunities for infrastructure providers, thereby boosting both investment and innovation in the market.

Report Segmentation

The market is primarily segmented on the basis of offering, deployment, technology, end-use, and region.

|

By Offering |

By Deployment |

By Technology |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Segmental Insights

Offering Analysis

The hardware segment is accounted for the largest revenue in the global artificial intelligence infrastructure market in 2024. The demand for AI hardware is significantly rising on account of its use in diverse applications such as machine learning, robotic process automation, and biometrics. In addition, the significant opportunities from developing countries demand advanced IT products, and escalating demand for artificial intelligence hardware in a high-performance computing data center is expected to boost the growth of the AI infrastructure market. Companies have often created new opportunities in the global artificial intelligence infrastructure market including Non-Volatile Memory, artificial intelligence optimized storage system, high-speed interconnect, and programmable switches. The industries and businesses are adopting artificial intelligence hardware including pharmaceutical and healthcare, manufacturing, and financial services industries. Therefore, the demand for artificial intelligence infrastructure is becoming a key factor for artificial intelligence infrastructure market growth worldwide.

The artificial intelligence software and services segment is expected to demonstrate the highest CAGR, owing to the increasing amount of digital data is accelerating the need for data mining and analytics to retrieve applicable information from images, videos, speech, and audio. Furthermore, AI applications including video analytics, inference, sparse matrices, primitives, and multi-hardware communication capabilities, are accelerating the segment growth over the approaching years.

Technology Analysis

The machine learning technology segment captured the largest revenue share in 2024. This is due to integration of AI in machine learning which provides systems the capability to learn automatically and enhance their performance by using experience deprived of being programmed explicitly. The contribution of AI infrastructure market has grown up towards various applications such as cloud service providers and governmental organizations with the introduction of AI machine learning. Besides, the rise in the technological proliferation of data with an immense need to descend maximum information from available data can provide the use of machine learning in artificial intelligence.

The machine learning technology segment is projected to be the fastest-growing segment during the forecast period. This is due to the AI and machine learning have been broadly adopted after pandemic. Several organizations are utilizing machine learning to scale up customer communications, and help accelerate research and treatment processes. Therefore, the demand for machine learning technology is growing robustly and contributing to segmental growth worldwide.

Geographic Overview

North America dominated the AI infrastructure market in 2024. This is due to the adoption of technological innovations, capital investments, and talent. This growth is also contributed to by the presence of hyperscale cloud providers and AI firms, which boost early investment and resources. This is further boosted by capital funding, which enables the commercialization of AI technologies. A specialized talent from leading institutions continuously boosts the AI infrastructure environment. Moreover, developed data centers and early access to the advanced semiconductor parts from major collaborations assure an essential advantage for infrastructure. Thus, this combination creates a cycle that strengthens this region's dominant position.

Asia Pacific is expected to witness the fastest growth during the forecast period. This is due to the rise in investment from the private technology company towards AI development on account of the availability of economic workforces along with massive volume and a broad range of data generated by the users of mobile internet and several applications, this primarily drives the AI infrastructure market in the Asia Pacific region. The large amount of data produced enables AI systems to generate more innovative insights, thus, offering companies to reduce costs, improve productivity, scale operations, and enhance more targeted products and services to consumers. These aforementioned factors are likely to strengthen sales across Asia Pacific.

Europe is also expected to contribute a significant share in the global market during the forecast years. For instance, the Europe commission has planned to invest USD 2.8 billion from the budget of USD 10.5 billion during 2021-2027 in order to promote AI across the European economy and society. Hence, it may positively influence the demand for a global artificial intelligence infrastructure market that creates lucrative opportunities in the near future.

Competitive Insight

Some of the major players operating in the global AI infrastructure market include Advanced Micro Devices, Inc, Amazon Web Service, Cadence Design Systems, Cisco, Dell, Google, Graphcore, Gyrfalcon Technology, Hewlett Packard Enterprise Development LP, IBM, Imagination Technologies, INTEL, Micron Technology, Microsoft, NVIDIA, Samsung Electronics, Sensetime, SK Hynix, Tenstorrent, Toshiba, Wave Computing, and Xilinx.

Industry Developments

October 2025: OpenAI, Samsung Electronics, Samsung SDS, Samsung C&T, and Samsung Heavy Industries collaborated to accelerate advancements in global AI data center infrastructure and develop future technologies. This collaboration will enhance development across various sectors, such as semiconductors, data centers, shipbuilding, cloud services, and maritime technologies.

October 2025: Fujitsu collaborated with NVIDIA to create a full-stack AI infrastructure that integrates AI agents. The collaboration will focus on co-developing and delivering an AI agent platform tailored for industry-specific AI agents in sectors such as healthcare, manufacturing, and robotics, along with an AI computing infrastructure.

AI Infrastructure Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 44.35 billion |

| Market size value in 2025 | USD 57.38 billion |

|

Revenue forecast in 2034 |

USD 609.42 billion |

|

CAGR |

30.0% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Offering, By Deployment, By Technology, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Advanced Micro Devices, Inc, Amazon Web Service, Cadence Design Systems, Cisco, Dell, Google, Graphcore, Gyrfalcon Technology, Hewlett Packard Enterprise Development LP, IBM, Imagination Technologies, INTEL, Micron Technology, Microsoft, NVIDIA, Samsung Electronics, Sensetime, SK Hynix, Tenstorrent, Toshiba, Wave Computing, and Xilinx. |

FAQ's

• The global market size was valued at USD 44.25 billion in 2024 and is projected to grow to USD 609.42 billion by 2034.

• The global market is projected to register a CAGR of 30.0% during the forecast period.

• North America dominated the global market share in 2024.

• A few key players in the market are Advanced Micro Devices, Inc, Amazon Web Service, Cadence Design Systems, Cisco, Dell, Google, Graphcore, Gyrfalcon Technology, Hewlett Packard Enterprise Development LP, IBM, Imagination Technologies, INTEL, Micron Technology, Microsoft, NVIDIA, Samsung Electronics, Sensetime, SK Hynix, Tenstorrent, Toshiba, Wave Computing, and Xilinx.

• In 2024, the hardware segment dominated the global AI infrastructure market.

• The machine learning technology segment is expected to witness rapid growth during the forecast period.