Air Core Drilling Market Share, Size, Trends, Industry Analysis Report

By Industry (Mining, Oil & Gas, Construction, Others); By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jul-2022

- Pages: 118

- Format: PDF

- Report ID: PM1188

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

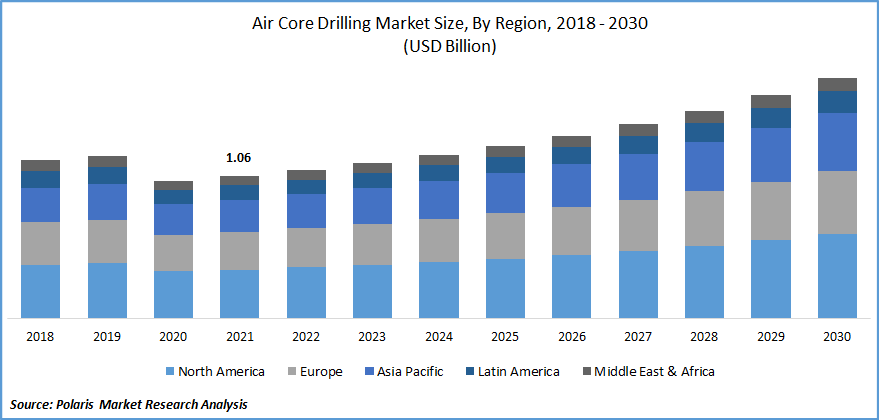

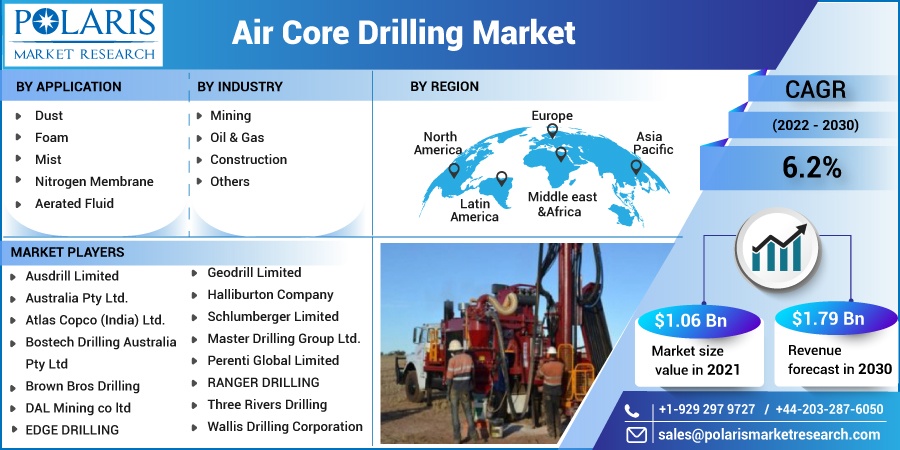

The global air core drilling market was valued at USD 1.06 billion in 2021 and is expected to grow at a CAGR of 6.2% during the forecast period. The major factors that are boosting the growth of market growth include the rising demand for efficient extraction methods in applications including mining and oil & gas wells, rising energy requirements, increased investments in exploration and production (E&P) activities, and improvements in air core drill technology.

Know more about this report: Request for sample pages

High-pressure air and dual-walled rods are used in air core drill operations to drill into the earth and bring the sample back to the surface through an inner tube and a collection device. To drill holes into the earth for water wells, oil wells, or artificial gas extraction wells, the air core drilling market technique is frequently utilized.

To drill a hole into the earth, toughened steel and tungsten blades are utilized. Since air core drill produces cleaner results during mineral exploration, it is generally preferred over Percussion Rotary Air Blast Drilling (PRAB). Soft rock and soil formations that can be drilled to the appropriate depth without the use of bulky machinery are good candidates for the air core drilling market.

Furthermore, mining businesses utilize this technology because it offers quick switching between complimentary drill bits, continuous sample returns, and shorter travel times between boreholes, all of which preserve the ore grade of mineral samples. This method is chosen because it produces drilled cuttings faster, is more accurate than other traditional procedures, and causes little sample damage. These methods are only applicable in developed regions free of water and hydrogen sulfide zones.

The COVID-19 pandemic has spread to over 200 countries all across the globe. COVID-19 has disrupted the global economy and severely jolted both developed and emerging economies. The renewable energy industry was growing with a significant growth rate all across the globe. For instance, in mid-January 2020, the International Energy Agency (IEA) forecasted that the US alone would add 13.5 GW to the solar power capacity in 2020.

It was around 70% higher than the previous single-year high in 2016 of 8 GW. Renewable energy projects in Texas, California, Florida, and South Carolina consist of half of the projects in 2020. Significant growth in residential and commercial renewable projects was also expected due to more efficient solar PV and rooftop systems getting introduced to the market.

However, this prediction is not expected to get fulfilled in the year due to the COVID-19 pandemic. Thus, the rising energy demand is the factor boosting the demand for air core drill technology which has positively impacted the air core drill market methods.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The rising energy demand is the factor that is boosting the market growth during the forecast period. According to the International Energy Agency's (IEA) World Energy Outlook, if the government's policies are continued in the ensuing decades, the world's energy demand will rise by 1.3 percent a year until 2040. Natural gas, which supplies 45% of the world's energy needs, is the main source of energy consumption at the moment.

Moreover, the advantage of air core drill technology is boosting its market demand. Using tungsten drill to create holes in the unconsolidated ground, the air core drilling market has become a popular and reasonably priced drill technique. When the safe removal of sample material is crucial, this boring technique is typically used.

Due to its many benefits, this drill technique is becoming more popular. For instance, an air core drill, which enables real-time sample collecting, speeds up the entire process, and lowers operational expenses, is quite effective at removing material. Air core drill rigs are also lighter than their conventional equivalents, which makes them simpler to use and move about.

Along with these advantages, this core drill technique reduces the possibility of sample contamination because it employs compressed air to clean out any leftovers in the inner tube. Therefore, these benefits are significantly influencing the trends in the air core drilling market.

Report Segmentation

The market is primarily segmented based on application, industry, and region.

|

By Application |

By Industry |

By Region |

|

|

|

Know more about this report: Request for sample pages

Nitrogen mist is expected to witness the fastest growth

When compared to alternative cryogenic nitrogen drill, the nitrogen membrane method is anticipated to expand at the fastest rate throughout the projected period due to lower operational expenses, fewer risks of a downhole fire, and fewer transportation issues. The possibility of down-hole explosions is eliminated using nitrogen and mist techniques.

To restore circulation in traditional mud systems and low-pressure formations, aerated fluid drill technology is used to minimize the weight of the mud. The foam drill aids in entraining cuttings and carrying them out from the wellbore without any need for extra equipment when the fluid/gas ratio is adjusted.

Dust Drilling accounted for the highest market share in 2021

A suitable setting for the employment of air hammers is provided by a dust drill, which is a practical technique. Drill bit life is increased via a dust drill, which does not require a fluid system for cleanup. The method has the highest penetration rate in addition to being the least expensive technique for air core drills. However, because of its inability to handle wellbore fluid influxes, a mist or foam drill must be used when there is water present.

In mature geological formations with consolidated hard rock formations, this technology is frequently employed to lower hydrostatic pressure in the wellbore. In addition, compared to alternative freezing nitrogen drill, the nitrogen membrane technique is anticipated to expand at the highest rate throughout the forecast period due to lower operational costs, a lower risk of down-hole fire, and fewer transportation issues.

Construction Sector is expected to hold the significant revenue share

In the contracting business, an air core drill is a crucial procedure for locating and removing chemical wastes from the surface as well as for creating a surface barrier to stop the spread of contamination. As a result, the market is anticipated to be driven by increased investments in residential and commercial construction projects in emerging nations.

Additionally, it is predicted that the market will increase during the forecast period due to the expanding mining activities in various countries as a result of the rising demand for fossil fuels and other resources to carry out industrial processes.

The demand in North America is expected to witness significant growth

North America is regarded as the top region in the global market due to the increasing demand for effective drill techniques in this region. Technology improvements and the growing demand for effective drill techniques for loose soil hydrocarbon locations characterize the market in the region. Additionally, the U.S.'s increasing energy needs are driving market players to explore unconventional reserves, which is anticipated to support the region's growth.

Due to numerous forthcoming Energy & Power projects and sizable undiscovered hydrocarbon reserves, mostly in South-East Asia, the Asia Pacific is predicted to develop at the quickest rate throughout the forecast period.

Additionally, new market prospects are anticipated as a result of arctic discoveries and an increased focus on water drills. Due to considerable sand hydrocarbon deposits, mostly in Nigeria and Egypt, the Middle East and Africa are likely to have significant expansion during the predicted period.

Competitive Insight

Some of the major players operating in the global market include Ausdrill Limited, Australia Pty Ltd., Atlas Copco (India) Ltd., Bostech Drilling Australia Pty Ltd, Brown Bros Drilling, DAL Mining co ltd, EDGE DRILLING, Geodrill Limited, Halliburton Company, Schlumberger Limited, Master Drilling Group Ltd., Perenti Global Limited, RANGER DRILLING, Three Rivers Drilling, and Wallis Drilling Corporation.

Recent Developments

In June 2022, Krakatoa Resources started 3000worth approximately of air core drill. A variety of potential REE targets can be found on the Yilgarn Craton land, and air-core drill is being done to support ongoing resource-defining drill. The Mt. Clere area is thought to contain clay-attached REE mineralization, which ultimately enables a less expensive downstream refining procedure.

In March 2021, Comacchio has broadened its product offering to include the most varied drill applications, satisfying the demands of clients working on foundations, geotechnics, water wells, geothermal, and mineral exploration, among other projects. Thus, this has broadened the product demand from various applications in the market.

Air Core Drilling Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 1.06 billion |

|

Revenue forecast in 2030 |

USD 1.79 billion |

|

CAGR |

6.2% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Application, By Industry, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Ausdrill Limited, Australia Pty Ltd., Atlas Copco (India) Ltd., Bostech Drilling Australia Pty Ltd, Brown Bros Drilling, DAL Mining co ltd, EDGE DRILLING, Geodrill Limited, Halliburton Company, Schlumberger Limited, Master Drilling Group Ltd., Perenti Global Limited, RANGER DRILLING, Three Rivers Drilling, and Wallis Drilling Corporation. |