Aircraft Seating Market Size, Share, Trends, Industry Analysis Report

: By Aircraft (Narrow-body, Wide-body, Regional Jet, Business Jet, and Military), By Seat, By Component, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 118

- Format: PDF

- Report ID: PM2002

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

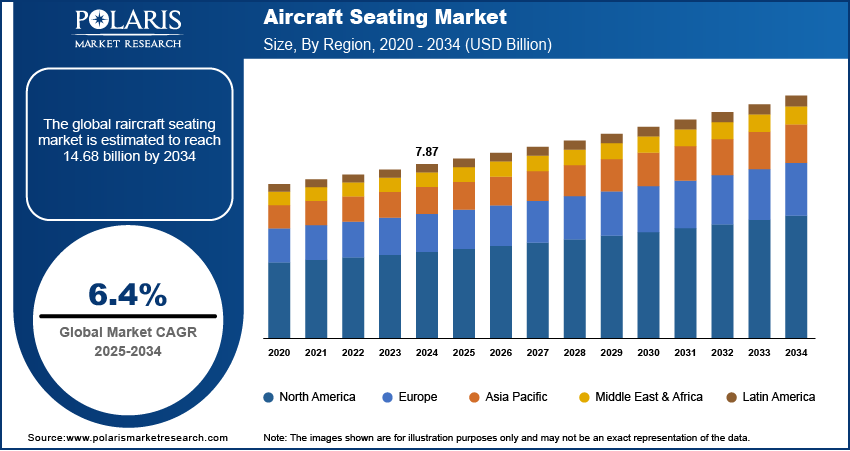

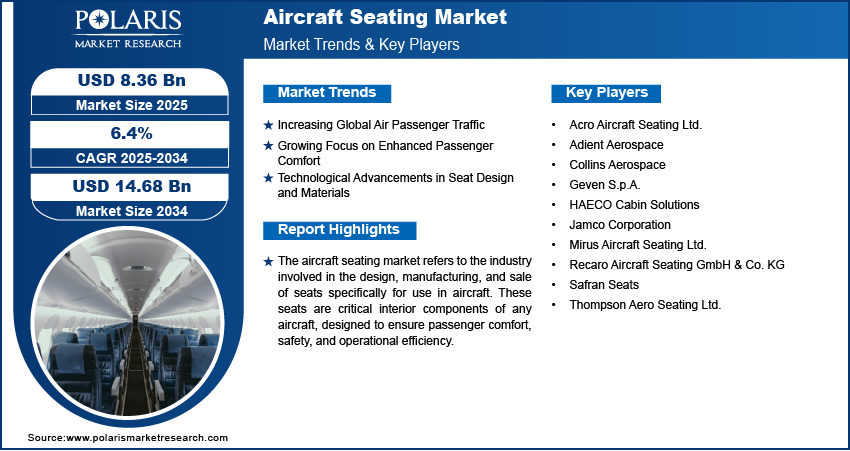

The aircraft seating market size was valued at USD 7.87 billion in 2024. It is projected to grow from USD 8.36 billion in 2025 to USD 14.68 billion by 2034, exhibiting a CAGR of 6.4% during 2025–2034.

The aircraft seating market encompasses the design, production, and distribution of seats specifically engineered for installation in various types of aircraft, ranging from commercial airliners and business jets to regional transport and general aviation aircraft. These seats are crucial components of the cabin interior, directly impacting passenger comfort, safety, and the overall operational efficiency of the aircraft. Electric aircraft seats are typically constructed using lightweight yet durable materials, such as aluminum alloys and composite materials, to minimize the overall weight of the aircraft, thereby contributing to fuel efficiency. Modern aircraft seating solutions often integrate features such as adjustable headrests, lumbar support, in-seat entertainment systems, and connectivity options, reflecting the industry's increasing focus on enhancing the passenger experience. The sector is subject to stringent regulatory standards and certification processes to ensure passenger safety and the reliability of seating systems under various flight conditions.

To Understand More About this Research: Request a Free Sample Report

The increasing global air passenger traffic, fueled by rising disposable incomes, globalization, and the expansion of tourism, particularly in emerging economies, boosts the aircraft seating market growth. This surge in air travel necessitates the expansion of airline fleets and the procurement of new aircraft, consequently boosting the demand for aircraft seats. Furthermore, airlines are increasingly focusing on improving passenger comfort and the overall in-flight experience to attract and retain customers. This emphasis on passenger experience is driving the demand for more comfortable, ergonomically designed, and feature-rich seating solutions, especially in premium cabin classes. Technological advancements in seat design and materials, including the development of lightweight composites and innovative structural designs, also contribute significantly to the growth opportunities by enabling fuel efficiency and enhanced functionality.

Market Dynamics

Increasing Global Air Passenger Traffic

The continuous rise in the number of people traveling by air is a significant factor driving the market growth. As per the International Civil Aviation Organization (ICAO), global passenger traffic is projected to double by 2042 compared to 2024. This surge in air travel demand is primarily attributed to factors such as increasing disposable incomes, the globalization of businesses, and the growing popularity of tourism across the globe. Airlines are responding to this escalating demand by expanding their existing fleets and ordering new aircraft to accommodate the growing passenger volumes. Consequently, this increase in aircraft procurement directly translates to a higher demand for aircraft seats.

Growing Focus on Enhanced Passenger Comfort

Airlines are increasingly recognizing that providing a comfortable and enjoyable in-flight experience is crucial for attracting and retaining passengers in a competitive market. Modern travelers, especially on long-haul flights, expect comfortable seating with features such as adequate legroom, adjustable recline, lumbar support, and often integrated in-flight entertainment systems. Aircraft seat manufacturers are innovating to meet these evolving demand trends by designing more ergonomic and feature-rich seats. Thus, growing focus on enhanced passenger comfort is a significant driver for the aircraft seating market expansion.

Technological Advancements in Seat Design and Materials

The aircraft seating market is significantly influenced by continuous technological advancements in seat design and the materials used in their construction. Innovations are focused on developing lighter, more durable, and more functional seating solutions. The use of advanced composite materials, such as carbon fiber, helps in reducing the overall weight of the aircraft, leading to improved fuel efficiency for airlines. Furthermore, the integration of smart technologies, including in-seat entertainment, connectivity options, and even wireless control systems for seat adjustments, is becoming increasingly attractive and thereby driving adoption.

Segment Insights

Market Assessment by Aircraft

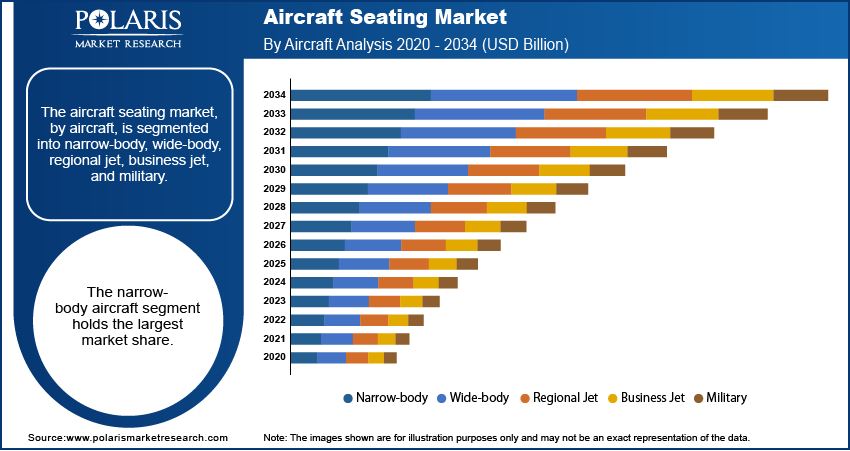

The aircraft seating market, by aircraft, is segmented into narrow-body, wide-body, regional jet, business jet, and military. The narrow-body aircraft segment holds the largest share. This dominance is primarily attributed to the sheer volume of narrow-body aircraft in operation globally and the continuous demand for these aircraft from both full-service carriers and low-cost airlines for short- to medium-haul routes. The high production rates of popular narrow-body models and the frequent need for cabin retrofits and upgrades in this substantial fleet contribute significantly to the narrow-body aircraft seating segment growth.

The business jet segment is anticipated to exhibit the fastest growth rate during the forecast period. This projected high growth is driven by several factors, including the increasing demand for private air travel, the growing preference for personalized and luxurious cabin interiors, and the rising number of high-net-worth individuals globally. Business jet owners often prioritize bespoke seating solutions that offer superior comfort, advanced features, and premium materials, leading to higher value per seat. Furthermore, the expanding interest in fractional ownership and charter services also contributes to the increased demand for business jets and their specialized seating requirements. This focus on customization and the expanding customer base is expected to fuel the growth rate of the business jet segment in the coming years.

Market Evaluation by Seat

The market, by seat, is segmented into economy class, premium economy, business class, and first class. The economy class segment accounts for the largest share. This significant share is primarily due to the sheer volume of economy class seats installed in commercial electric aircraft globally. Economy class cabins typically constitute the majority of the seating capacity in most aircraft, catering to the largest segment of air travelers. The consistent demand for air travel and the high density of economy class seats in airline fleets ensure that this segment remains the largest shareholder in the sector.

The premium economy segment is projected to witness the fastest growth rate during the forecast period. This anticipated high growth is driven by airlines increasingly recognizing the revenue potential of offering an intermediate cabin class that bridges the gap between economy and business class. Premium economy appeals to both leisure and business travelers seeking enhanced comfort and amenities without the higher cost of business class. The growing demand for this cabin class is prompting airlines to expand their premium economy offerings, leading to a higher demand for premium economy seats.

Market Assessment by Component

By component, the market is segmented into seat actuators, foams, fittings, and others. The fittings segment holds the largest share. Fittings encompass a wide array of essential hardware components required for the assembly and functionality of aircraft seats, including seat tracks, reclining mechanisms, armrests, tray tables, and safety belts. The sheer volume of these components needed for every aircraft seat, across all cabin classes and aircraft types, contributes to the substantial market size of the fittings segment. The consistent demand for new aircraft and the ongoing maintenance and refurbishment activities within the existing fleet ensure a continuous and high demand for various aircraft seat fittings.

The seat actuators segment is anticipated to exhibit the fastest growth rate during the forecast period. This projected high growth is primarily driven by the increasing demand for enhanced passenger comfort and the integration of advanced features in aircraft seats, particularly in premium cabin classes. Seat actuators, which enable functions such as seat recline, leg rest extension, and lumbar support adjustment, are becoming increasingly sophisticated with the integration of electromechanical systems. The growing trend of airlines focusing on providing a more comfortable and personalized passenger experience, coupled with technological advancements in actuator design for lighter and more efficient systems, is expected to fuel the growth rate of the seat actuators segment.

Market Assessment by End Use

By end use, the market is segmented into OEM and aftermarket. The OEM segment holds a larger share, due to the direct installation of seats in newly manufactured aircraft. The volume of new aircraft deliveries by major aircraft manufacturers translates directly into a substantial demand for aircraft seats by the original equipment manufacturer (OEM). Furthermore, the specifications and requirements for seats in new aircraft are often intricate and detailed, contributing to the significant share of the OEM segment. The consistent production of new aircraft ensured the largest share of the OEM segment in 2024.

The aftermarket segment is anticipated to exhibit the fastest growth rate during the forecast period. The aftermarket encompasses the replacement, refurbishment, and upgrade of aircraft seats in existing aircraft fleets. Several factors are contributing to this high growth, including the aging global aircraft fleet, airlines' increasing focus on cabin retrofits to enhance passenger experience, and the demand for cost-effective solutions for seat maintenance and upgrades. The need to replace worn-out seats, customize cabin interiors, and incorporate newer technologies in existing aircraft is driving significant market development for the aftermarket segment.

Regional Outlook

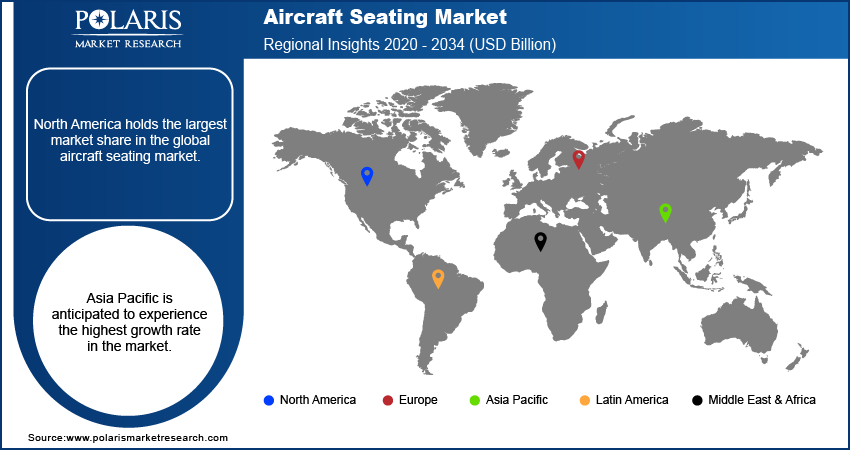

By region, the aircraft seating market report provides insight into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest market share in 2024. This significant share can be attributed to the region's well-established aviation infrastructure, the presence of major aircraft manufacturers, and a large number of airlines operating extensive domestic and international routes. The high volume of air travel within North America, coupled with a significant existing aircraft fleet, drives substantial demand for aircraft seats in the OEM and aftermarket segments. Furthermore, the region's focus on passenger comfort and safety standards contributed to the demand for advanced and high-quality seating solutions, contributing to North America's leading position in the global aircraft seating market.

The Asia Pacific market is anticipated to witness the fastest growth rate during the forecast period. This rapid growth is fueled by the region's burgeoning air passenger traffic, driven by increasing disposable incomes, rapid urbanization, and the expansion of the tourism sector in many Asian countries. The growing number of new aircraft orders and deliveries in Asia Pacific is directly boosting the demand for aircraft seats. Additionally, the increasing focus on enhancing passenger experience and the rising adoption of air travel for both business and leisure purposes are contributing to the high growth potential in the Asia Pacific aircraft seating market.

Key Players and Competitive Analysis

A few key players actively operating in the aircraft seating market include Collins Aerospace (RTX Corporation), Safran Seats (Safran S.A.), Recaro Aircraft Seating GmbH & Co. KG, Adient Aerospace (a joint venture between Boeing and Adient), HAECO Cabin Solutions (HAECO Group), Jamco Corporation, Geven S.p.A., Acro Aircraft Seating Ltd., Mirus Aircraft Seating Ltd., and Thompson Aero Seating Ltd. These companies are engaged in the design, manufacturing, and supply of a wide range of aircraft seats for various aircraft types and cabin classes, catering to the evolving needs of airlines and passengers globally.

The competitive landscape of the industry is characterized by intense rivalry among a relatively small number of major players. Competition is driven by factors such as product innovation, seat comfort, lightweighting, customization options, cost-effectiveness, and the ability to meet stringent regulatory standards. Market insights reveal a trend toward collaborations and joint ventures, such as Adient Aerospace, to leverage complementary expertise and expand market penetration. Companies are also focusing on developing sustainable seating solutions and integrating advanced technologies such as in-seat power and connectivity to enhance their market share and cater to the evolving demand trends. The market entry assessments for new players are often challenging due to the high capital investments required and the stringent certification processes.

Collins Aerospace, a business unit of RTX Corporation, is headquartered in Charlotte, North Carolina, USA. The company offers a comprehensive portfolio of aircraft seating solutions across all cabin classes, from economy to first class, for both commercial and business aircraft. Their offerings include technologically advanced seats with features focused on passenger comfort, ergonomics, and weight optimization. Collins Aerospace is a significant player in the aircraft seating along with aerospace parts manufacturing industry due to its broad product range, global presence, and strong relationships with major aircraft manufacturers and airlines.

Safran Seats, a subsidiary of Safran S.A., is based in Issy-les-Moulineaux, France. The company designs, manufactures, and services a wide spectrum of aircraft seats for various aircraft segments, including narrow-body, wide-body, and regional jets. Safran Seats provides innovative seating solutions with a strong emphasis on design, passenger experience, and operational efficiency for airlines. Their extensive product line and global support network make them a relevant and prominent player in the aircraft seating market, addressing diverse demands and industry trends.

List of Key Companies in Aircraft Seating Market

- Acro Aircraft Seating Ltd.

- Adient Aerospace

- Collins Aerospace

- Geven S.p.A.

- HAECO Cabin Solutions

- Jamco Corporation

- Mirus Aircraft Seating Ltd.

- Recaro Aircraft Seating GmbH & Co. KG

- Safran Seats

- Thompson Aero Seating Ltd.

Aircraft Seating Industry Developments

- April 2025: flynas, a Saudi low-cost airline, announced an agreement with Safran Seats to equip its upcoming fleet of 60 Airbus A320neo aircraft with the latest generation of Safran's economy class seats, some featuring a premium configuration.

- April 2025: Satair and Collins Aerospace, a business unit of RTX Corporation, extended their cabin interior parts distribution agreement for another four years, continuing a partnership that began over 50 years ago. This agreement ensures the efficient and quick delivery of Collins' line of oxygen systems, Goodrich lighting solutions, and beverage makers for various aircraft platforms.

Aircraft Seating Market Segmentation

By Aircraft Outlook (Revenue – USD Billion, 2020–2034)

- Narrow-body

- Wide-body

- Regional Jet

- Business Jet

- Military

By Seat Outlook (Revenue – USD Billion, 2020–2034)

- Economy Class

- Premium Economy

- Business Class

- First Class

By Component Outlook (Revenue – USD Billion, 2020–2034)

- Seat Actuators

- Foams

- Fittings

- Others

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- OEM

- Aftermarket

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Aircraft Seating Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 7.87 billion |

|

Market Size Value in 2025 |

USD 8.36 billion |

|

Revenue Forecast by 2034 |

USD 14.68 billion |

|

CAGR |

6.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The aircraft seating market has been segmented into detailed segments of aircraft, seat, component, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies: The aircraft seating market growth strategy is significantly influenced by the increasing global air traffic management and airlines' focus on enhancing passenger experience. Key marketing strategies revolve around product innovation, emphasizing comfort, lightweighting, and customization. Companies are also focusing on sustainability and integrating advanced technologies to differentiate their offerings. Strategic collaborations with airlines and aircraft manufacturers, along with a strong aftermarket presence for maintenance and upgrades, are crucial for market penetration. Furthermore, highlighting the value proposition of fuel efficiency through lightweight seats and superior passenger satisfaction through ergonomic designs is central to marketing efforts in this competitive landscape.

FAQ's

The market size was valued at USD 7.87 billion in 2024 and is projected to grow to USD 14.68 billion by 2034.

The market is projected to register a CAGR of 6.4% during the forecast period.

North America held the largest share of the market in 2024.

A few players actively operating in the market are Collins Aerospace (RTX Corporation), Safran Seats (Safran S.A.), Recaro Aircraft Seating GmbH & Co. KG, Adient Aerospace (a joint venture between Boeing and Adient), HAECO Cabin Solutions (HAECO Group), Jamco Corporation, Geven S.p.A., Acro Aircraft Seating Ltd., Mirus Aircraft Seating Ltd., and Thompson Aero Seating Ltd.

The narrow-body segment accounted for the largest share of the market in 2024.

Following are a few of the market trends: ? Increasing Demand for Lightweight Materials: Airlines are continuously seeking to reduce aircraft weight to improve fuel efficiency and lower operational costs, driving the adoption of lightweight composite materials such as carbon fiber and titanium in seat construction. ? Growing Focus on Passenger Comfort and Experience: Airlines are investing in more ergonomic seat designs with features such as adjustable headrests, lumbar support, increased legroom, and enhanced recline to attract and retain passengers, particularly in premium cabin classes. ? Integration of Technology: Modern aircraft seats are increasingly incorporating technology such as in-seat power outlets, USB ports, in-flight entertainment systems, and even connectivity options, enhancing the passenger experience.

An aircraft seat is a specialized chair designed to accommodate passengers and sometimes crew members during air travel. These seats are typically arranged in rows within the aircraft fuselage. They are engineered with lightweight yet durable materials to minimize the overall weight of the aircraft, contributing to fuel efficiency.