Airport Security Market Size, Share, Trends, Industry Analysis Report

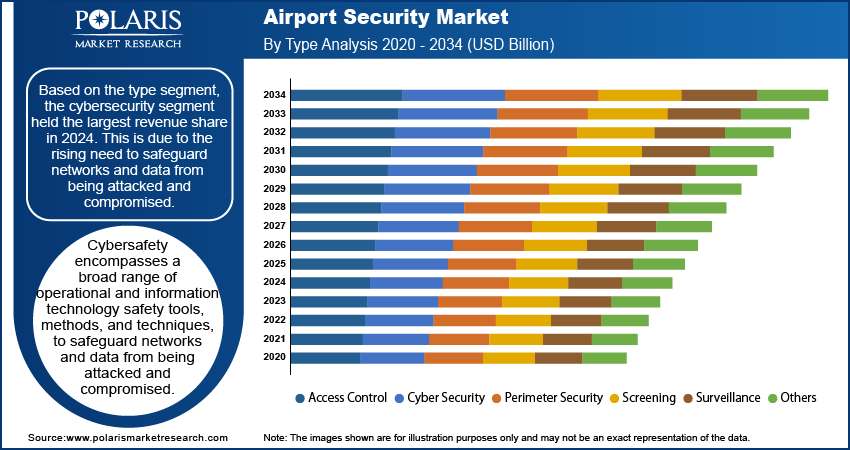

By Type (Access Control, Cyber Security, Perimeter Security, Screening, Surveillance, and Others), By Systems & Equipment, By Technology, and By Region -Market Forecast, 2025 - 2034

- Published Date:Oct-2025

- Pages: 110

- Format: PDF

- Report ID: PM2173

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

The global airport security market size was valued at USD 15.41 billion in 2024. The market is projected to grow at a CAGR of 8.18% during 2025 to 2034. Key factors driving demand for airport security include increasing passenger traffic, the constant threat of terrorism and smuggling, and stringent government regulations.

Key Insights

- The cybersecurity segment held the largest revenue share in 2024. This dominance is attributed to the rising need to safeguard networks and data from being attacked and compromised.

- In 2024, the backscatter X-Ray system segment accounted for the largest market share owing to its ability to offer photo-like images for improved security screening of passengers, luggage, and vehicles.

- Asia Pacific dominated the airport security market in 2024 due to escalating terrorist activities and increased expenditures in aviation infrastructure.

- North America is expected to witness a high CAGR growth in the coming years. This is due to the presence of established players, ongoing infrastructural developments, and increasing air passenger numbers.

Industry Dynamics

- The global airport security market is fueled by increasing investment in the development of aviation infrastructure, especially in emerging countries such as India and Thailand.

- The growth of terrorism and border tension across countries such as China, Russia, Iran, and India is also anticipated to increase demand for airport security.

- Growing urbanization is creating a lucrative market opportunity.

- The high cost of security systems and personnel may hamper the market growth.

Market Statistics

- 2024 Market Size: USD 15.41 Billion

- 2034 Projected Market Size: USD 33.77 Billion

- CAGR (2025-2034): 8.18%

- Asia Pacific: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

AI Impact on Airport Security Market

- Enhances threat detection by analyzing passenger behavior, baggage scans, and facial recognition.

- Improves risk assessment and resource allocation.

- Helps in continuous monitoring with higher accuracy.

- AI with cybersecurity safeguards airport systems from digital threats alongside physical security.

Airport security is the combination of systems, procedures, and technologies that protect passengers, staff, and aircraft from threats such as terrorism and smuggling. It helps to detect and prevent the movement of dangerous goods, unauthorized individuals, or prohibited substances. Airport security includes multiple layers of protection, such as baggage screening, identity verification, surveillance, and physical checks to ensure safe and secure air travel. The growth in the airport security market is being driven by an increase in international trade and the number of flying travelers around the world. Besides, the rising government spending for airline safety is also the factor that is driving the market growth during the forecast period. For instance, in 2018, the TSA has announced that it is spending USD 7.6 Billion on aviation safety. In addition, the European airports would need to invest over USD 17 billion by 2022 to fulfill EU baggage screening rules, according to Airports Council International (ACI).

The potential of criminal attacks and terrorism has prompted governments around the world to improve their safety measures, which leading to an increase in market revenue. Market growth has been also fueled by technological improvements and the availability of a wide range of solutions. Government regulations relating to aviation safety have a beneficial influence on the adoption of monitoring, screening, and access control technology. For instance, the Federal Aviation Regulation (FAR) controls all aviation activities in the United States. The FAR 1542 establishes several airline securities programs. This law encourages the building and using safety equipment, such as the Security Identification Display Area (SIDA), to prevent crimes and terrorism. Similarly, the International Air Transport Association (IATA) resolution 753, in June 2018, mandated member airlines to inspect luggage before aircraft loading. These rules encourage the sector to put in place robust safety measures to manage passengers and goods more effectively.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The increasing investment in the development of aviation infrastructure, especially in emerging countries such as India and Thailand is propelling the market growth. According to India Investment Grid, India is set to construct an additional 80 airports over the next five years. This is increasing the need for airport security systems and equipment such as biometric screening, AI-powered surveillance, and smart baggage handling, as the constructruction of new airports require advanced systems to handle rising passenger volumes and evolving security challenges. The growing number of sophisticated cyberattacks on airport safety systems worldwide has led airports to increase their investment in cyber safety to protect operations and passengers, which contributed to the market growth. Moreover, the growing safety norms by International Air Transport Association is leading to the adoption of airport security systems, which is fueling the market growth.

Report Segmentation

The market is primarily segmented based on type, systems & equipment, technology, and region.

|

By Type |

By Systems & Equipment |

By Technology |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Type

Based on the type segment, the cybersecurity segment held the largest revenue share in 2024. This is due to the rising need to safeguard networks and data from being attacked and compromised. Cybersafety encompasses a broad range of operational and information technology safety tools, methods, and techniques, to safeguard networks and data from being attacked and compromised. Cybersecurity also employs protective and responsive measures such as traditional malware protection, web filtering, and advanced threat protection to protect consumers from Internet-borne dangers. These benefits offered by cybersecurity solutions at the airports contributed to the dominance of the segment.

Insight by Systems & Equipments

Based on the systems & equipments segment, the backscatter X-Ray system segment accounted for the largest market share in 2024, owing to its ability to offer photo-like images for improved security screening of passengers, luggage, and vehicles. This machine is widely used at airports to screen passengers for concealed weapons or explosives by creating detailed images of goods hidden under clothing. use low-energy Moreover, backscatter X-Ray system use low-energy X-radiation, which propelled airports and governments bodies across the globe to invest in these backscatter X-Ray system.

Geographic Overview

Asia Pacific dominated the airport security market in 2024 due to escalating terrorist activities and increased expenditures in aviation infrastructure. The growing government initiatives to promote air travel in countries such as India further contributed to the regional dominance. India launched UDAN Scheme to boost regional connectivity and promote air travel. Moreover, China's Aviation Administration aims to build 200 additional airports by 2035 to fulfill 450 airports. China invested about USD 70 billion on upgrades to ground infrastructure, air traffic control systems, and other systems. These factors propelled the market dominance in the Asia Pacific.

North America is expected to witness a high CAGR growth in the global market in the coming years. This is attributed to the presence of established players, continuing infrastructural developments, and growing air passengers. Moreover, market development is influenced by the adoption of international standards increased safety, and the use of modern machinery for safety. The Department of Homeland Security (DHS) and the Transportation Security Administration (TSA), among other regulatory agencies in the United States are concentrated on guaranteeing safety standards adapted to the particular operational environment of each airport, which is fueling the market growth.

Competitive Insight

Some of the major players operating in the global market include American Science and, Engineering Inc, Autoclear LLC, Axis Communication AB, Delta Air Lines Inc., FLIR Systems Inc., Honeywell International Inc, OSI Systems Inc, Robert Bosch GmbH, SafranMorpho, Siemens AG, Smiths Detection, Thales Group.

Recent Developments

April 2024, Smiths Detection, a global company in threat detection and security screening technologies, announced that it has launched the SDX 10060 XDi, a X-ray system for airport security.

Airport Security Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 15.41 billion |

| Market size value in 2025 | USD 16.64 billion |

|

Revenue forecast in 2034 |

USD 33.77 billion |

|

CAGR |

8.18% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

20225- 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments covered |

|

|

Regional scope |

|

|

Key Companies |

American Science and, Engineering Inc, Autoclear LLC, Axis Communication AB, Delta Air Lines Inc., FLIR Systems Inc., Honeywell International Inc, OSI Systems Inc, Robert Bosch GmbH, SafranMorpho, Siemens AG, Smiths Detection, Thales Group. |

FAQ's

• The global market size was valued at USD 15.41 billion in 2024 and is projected to grow to USD 33.77 billion by 2034.

• The global market is projected to register a CAGR of 8.18% during the forecast period.

• Asia Pacific dominated the market in 2024.

• A few of the key players in the market include American Science and, Engineering Inc, Autoclear LLC, Axis Communication AB, Delta Air Lines Inc., FLIR Systems Inc., Honeywell International Inc, OSI Systems Inc, Robert Bosch GmbH, SafranMorpho, Siemens AG, Smiths Detection, Thales Group.

• The cybersecurity segment dominated the market revenue share in 2024.