Alfalfa Hay Market Share, Size, Trends, Industry Analysis Report

By Type (Bales, Pellets, and Cubes); By Application; By End User; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 112

- Format: PDF

- Report ID: PM3447

- Base Year: 2023

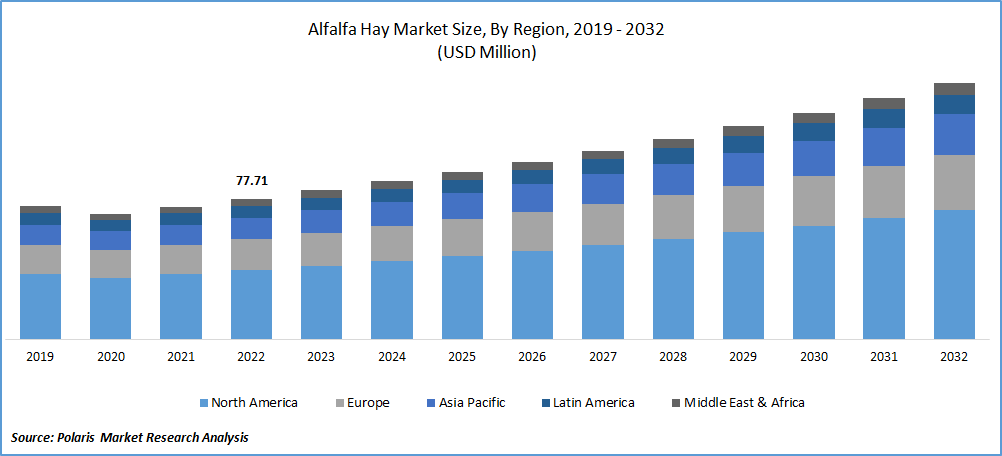

- Historical Data: 2019-2022

Report Outlook

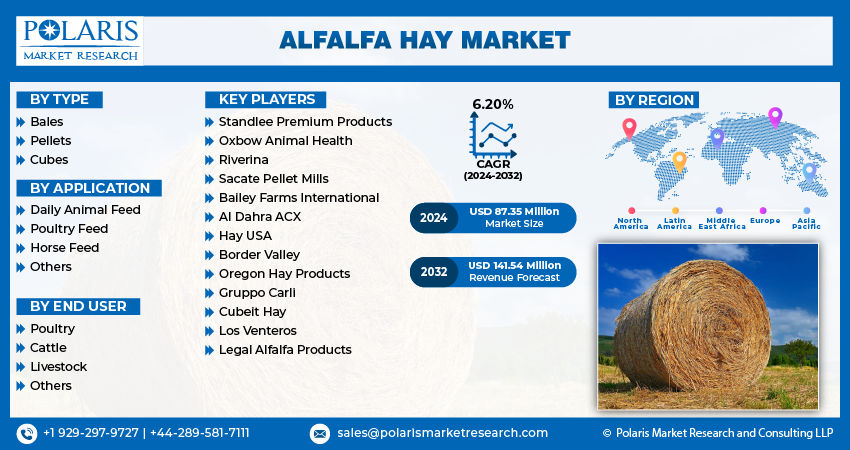

The global alfalfa hay market was valued at USD 82.37 million in 2023 and is expected to grow at a CAGR of 6.20 % during the forecast period. Rapidly growing demand for nutritious animal feed and exponential growth in the cattle feed industry across the globe, milk producers supplied with the nutritionally balanced compound feed, along with the surge in livestock production in the emerging region to meet the demand from animal population, are the key factors boosting the market growth. Additionally, the rising investment towards the development of huge-scale dairy operations and growing focus on higher technological innovations in the market that key companies are introducing is also fueling the market growth over the coming years. For instance, in September 2022, Andy by Anderson Hay & Heinold Feeds introduced new alfalfa-based feed pellets, especially for young house rabbits. These feed pellets will offer several natural ingredients, including forage, vitamins, & minerals.

To Understand More About this Research: Request a Free Sample Report

Moreover, the rapid rise in the rate of urbanization and colonialization of grasslands and significant expansion of city limits coupled with the growing demand for animal and dairy products worldwide is gaining huge traction in recent years. Apart from this, the product has become very critical to animal feed because of its growing importance for crude protein content while boosting productivity.

However, alfalfa hay production is highly dependent on weather conditions such as droughts, floods, and other weather-related events that can reduce yields, affecting the availability and pricing of alfalfa hay and high cost associated with the transportation of product are major factors hampering the demand and growth of the market.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the alfalfa hay market. The rapid spread of the pandemic has disrupted supply chains and caused logistical challenges, which makes it harder for the producers of alfalfa hay to get their product to the market and has created uncertainty in international trade, with some countries having imposed restrictions on imports and exports.

Industry Dynamics

Growth Drivers

The growing use of technology in agriculture, which has helped to improve the efficiency of alfalfa hay production, reducing costs and increasing yields, and the rising integration of advanced technologies such as precision farming and improved irrigation systems are being adopted by farmers to optimize their production and quality, are among the major factors driving the demand and growth of the global market. Furthermore, consumers and producers are constantly becoming more and more aware of the environmental impact of agriculture, leading to an increased demand for sustainable farming practices. As a result, farmers are exploring more sustainable methods of producing alfalfa hay, such as reducing water usage and utilizing crop residue, which has propelled the global market growth at a rapid pace.

Report Segmentation

The market is primarily segmented based on type, application, end user, and region.

|

By Type |

By Application |

By End User |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Pellets segment accounted for the largest market share in 2022

The pellets segment accounted for the largest market share in 2022 and will likely retain its market position throughout the anticipated period. The growth of the segment market can be highly attributed to its ease of storing, transporting, and feed as compared to the traditional baled hay, which makes them more convenient for both producers and consumers, along with the growing product popularity as a rich source of protein, fiber, and various other beneficial nutrients. Additionally, pellets are easier for animals to digest than traditional hay, leading to improved feed efficiency and, ultimately, better weight gain and milk production, propelling the segment market.

The cubes segment is anticipated to grow at the fastest growth rate over the coming years, mainly due to its wide range of beneficial characteristics, including cost-effectiveness and longer shelf life compared to other types of forage available in the market, that fuels the product adoption among horse and livestock producers who required the reliable source of feed throughout the year.

Daily animal feed segment held the significant market revenue share in 2022

The daily animal feed segment held a significant market share in terms of revenue in 2022, which can be largely attributed to its several health benefits for livestock, including improved digestion, increased milk production in dairy cows, and improved weight gain in beef cattle, that make alfalfa hay an attractive option for livestock owners who are looking to improve the health and productivity of their animals.

The poultry feed segment will likely register a significant growth rate during the projected period because of the rising demand and prevalence of poultry meat globally, the continuous change in consumer lifestyles, and the growing awareness regarding the several health benefits of consuming meat products.

Livestock segment is expected to witness highest growth over the forecast period

The livestock segment is projected to grow at the highest CAGR over the anticipated period, which is mainly driven by increasing demand for the product in the regions with limited or unavailability of grazing lands along with the high cost of other alternative feed sources like corn and soybeans among others, which led to higher adoption for the product for livestock feed across the globe. The cattle segment led the industry market with substantial revenue share in 2022, which is highly accelerated by the growing consumption of meat and several other non-veg products by consumers in their daily diets and a large number of cattle animals, especially in Asian countries like India, China, Indonesia, and Malaysia.

North America region dominated the global market in 2022

The North American region dominated the global market, which can be largely accelerated by the growing alfalfa hay production and widespread product adoption, especially in the United States, coupled with the increasing technological innovations by major market players across the region. In addition, several large companies are adopting various business growth and developing strategies to expand their regional presence and product portfolio, creating a huge demand for the market over the coming years.

The Asia Pacific region is expected to be the fastest growing region with a healthy CAGR over the next coming years, owing to the rapidly increasing number of consumers opting for these products due to their numerous health benefits and growing research & development efforts and focus on producing sustainable food production in APAC countries like India, China, and Indonesia.

Competitive Insight

Some of the major players operating in the global market include Standlee Premium Products, Oxbow Animal Health, Riverina, Sacate Pellet Mills, Bailey Farms International, AI Dahra ACX, Hay USA, Border Valley, Oregon Hay Products, Gruppo Carli, Cubeit Hay, Los Venteros, and Legal Alfalfa Products.

Recent Developments

- In June 2022, Anderson Hay & Grain expanded into the US Department of Agriculture-certified Timothy Tay. It offers high-quality hay for guinea pigs, chinchillas, rabbits, & small pets.

- In December 2022, BASF expanded its oleic canola seed production & processing business with the acquisition of Cargill’s Idaho Falls production facility. With this acquisition, the company expanded its production capacity for its InVigor health hybrids.

Alfalfa Hay Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 87.35 million |

|

Revenue forecast in 2032 |

USD 141.54 million |

|

CAGR |

6.20% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019– 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Application, By End User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Standlee Premium Products, Oxbow Animal Health, Riverina, Sacate Pellet Mills, Bailey Farms International, AI Dahra ACX, Hay USA, Border Valley, Oregon Hay Products, Gruppo Carli, Cubeit Hay, Los Venteros, and Legal Alfalfa Products |

FAQ's

key companies in the Alfalfa Hay Market are Standlee Premium Products, Oxbow Animal Health, Riverina, Sacate Pellet Mills, Bailey Farms International.

The global alfalfa hay market expected to grow at a CAGR of 6.2% during the forecast period.

The Alfalfa Hay Market report covering key are type, application, end user, and region.

key driving factors in Alfalfa Hay Market are Incereasing demand for diary and meat products.

The global alfalfa hay market size is expected to reach USD 141.54 million by 2032.