Animal Feed Phytase Market Share, Size, Trends, Industry Analysis Report

By Form (Liquid, Granules or Powder); By Class (3 Phytase, 6 Phytase); By Source; By Livestock; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jun-2023

- Pages: 117

- Format: PDF

- Report ID: PM3353

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

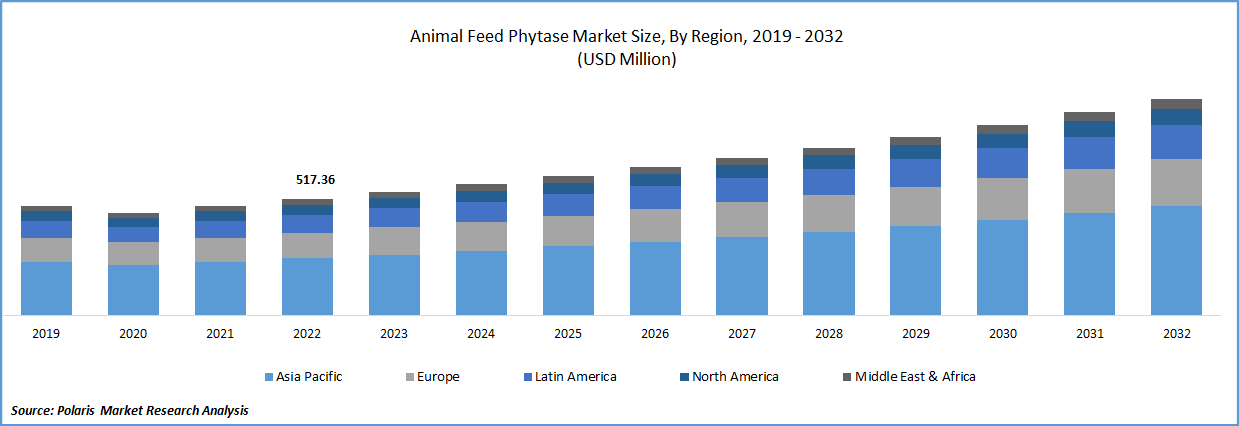

The global animal feed phytase market was valued at USD 517.36 million in 2022 and is expected to grow at a CAGR of 6.4% during the forecast period. Livestock emissions, specifically methane and nitrous oxide, are significant contributors to global greenhouse gas emissions and climate change. As a result, there is a growing demand for sustainable livestock production practices that can reduce emissions and minimize the environmental impact of animal agriculture. This is one of the key factors that is fueling the growth of the animal feed phytase market. Cattle, sheep, goats, pigs, and poultry husbandry together contribute for 18% of global greenhouse gas emissions when the complete food chain is taken into consideration.

To Understand More About this Research: Request a Free Sample Report

Additionally, phytase can improve the overall efficiency of animal feed, leading to reduced feed consumption and less waste. This can help reduce the environmental footprint of livestock production and make it a more sustainable practice. This will fuel the growth of the market in upcoming years.

Land degradation can reduce the quality and availability of grains and other feedstuffs, which in turn can lead to lower nutrient levels in animal feed. This can increase the demand for phytase to help animals better absorb the available nutrients. Additionally, land degradation can lead to soil erosion, which can result in nutrient runoff and reduced soil fertility.

According to the United Nations Convention to Combat Desertification (UCCD) over half of humankind is directly impacted by up to 40% of the planet's degraded land, which also poses a threat to about half of the global economy (US$44 trillion). This can make it more challenging for farmers to produce high-quality crops, leading to increased demand for phytase to help compensate for reduced nutrient levels in animal feed. This will create a wide range of opportunities for the growth and demand for the animal feed phytase market.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

As the global population continues to grow, so does the demand for meat and poultry products. According to the Food and agricultural organization of the United States, Due to rising individual consumption and population expansion, it is anticipated that the demand for poultry meat and eggs would continue to rise. This will lead to an increase in the demand for animal feed, including feed with added phytase, which helps improve the digestibility of plant-based ingredients. There is a growing awareness about the importance of animal health, and many farmers are now looking for ways to improve the health and wellbeing of their livestock. Phytase has been shown to help improve the digestibility of phosphorus, which is essential for animal growth and development.

Many governments around the world are implementing regulations aimed at reducing the environmental impact of livestock farming. This has led to a shift towards more sustainable farming practices, including the use of animal feed with added phytase, which can help reduce the amount of phosphorus excreted by livestock. There have been several technological advancements in the production of animal feed phytase, which have helped to improve its efficacy and reduce its cost. This has made it more accessible to farmers, leading to an increase in its use. There is a growing demand for organic and natural products, including animal feed. Phytase is a natural enzyme, and its use in animal feed aligns with the growing consumer demand for sustainable and natural products.

Report Segmentation

The market is primarily segmented based on form, class, source, Livestock, and region.

|

By Form |

By Class |

By Source |

By Livestock |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Powder segment is expected to witness fastest growth over the forecast period

Powder form is projected to witness higher growth in upcoming years. Powder form of phytase has a longer shelf-life than liquid form, making it easier to store and transport, reducing the risk of spoilage, and improving the overall efficiency of the supply chain. This form of phytase is typically less expensive than the liquid form, making it a more cost-effective option for farmers and feed manufacturers. This form of phytase is easier to handle and mix with animal feed compared to other forms such as liquid or granular. This ease of handling makes it more convenient for animal feed producers to incorporate phytase.

6 Phytase segment accounted for the largest market share in 2022

6 Phytase segment is expected to have a higher growth rate. 6-phytase has been shown to be more effective than 3-phytase in releasing phosphorus from phytate, resulting in better growth performance and improved feed conversion rates in animals. It can work in a broader pH range compared to 3-phytase, making it more versatile and effective in a wider range of animal feed formulations. The use of 6-phytase in animal feed can lead to a reduction in the excretion of phosphorus by livestock, which can help to reduce the environmental impact of animal agriculture.

Microorganisms segment is expected to hold the significant revenue share

Microorganisms segment is projected to witness higher growth. The increasing adoption of microbial phytases in animal feed is driven by their high efficacy in improving nutrient utilization, reducing feed costs and promoting sustainable animal production. Additionally, advancements in microbial fermentation technology have enabled the production of high-purity and high-activity phytase enzymes at lower costs, further driving the growth of this segment.

The demand in Latin America is projected to witness higher growth rate

Latin America is expected to have a higher growth rate for the market. Animal feed industry is growing rapidly in this region due to increasing demand for meat and dairy products, growing awareness of the benefits of feed additives such as phytase, and favorable government policies that support the growth of the animal feed sector.

Moreover, the Latin American region has a growing trend towards sustainable animal production practices, which is driving the adoption of phytase as a means of reducing the environmental impact of animal production. With 1.9 giga tonnes CO2-eq of emissions from the specialized production of beef, Latin America and the Caribbean have the highest levels. Historical land-use changes caused large CO2 emissions due to deforestation and pasture growth, despite drastically slowing down in recent years.

Asia Pacific is projected to witness a larger revenue share for the animal feed phytase market. This has a large and growing animal feed industry, driven by the increasing demand for animal protein and the growing awareness of the benefits of feed additives such as phytase. The region is home to several major animal feed producing countries such as China, India, and Japan, which are expected to drive the growth of the animal feed phytase market in the region.

According to projections, India's demand for poultry meat will rise by nine million tonnes by 2020, which will result in an additional 27 MMT of feed and roughly six million tonnes of increased protein need. (Equivalent to 60 MMT of cereals/2.4 MMT of the soybean;). The increasing demand for meat and dairy products in the region is driving the adoption of phytase in animal feed to improve animal performance and reduce feed costs.

Competitive Insight

Some of the major players operating in the global market include BASF, DuPont, DSM, AB Enzymes, Beijing Smistyle, Jinan Tiantianxiang, Guangdong VTR Bio-Tech, Huvepharma, Novozymes, Qingdao Vland Biotech, Kemin Industries & Adisseo.

Recent Developments

- In February 2023, Barentz & AB Enzymes extended their exclusive distribution contract. Barentz has agreed to extend the distribution arrangement for AB bake & food enzymes throughout much of Europe.

- In November 2022, Novozymes & LinusBio, a pioneer in precision exposome sequencing, officially revealed they are collaborating to create a novel, non-invasive technique and test it in a clinical study.

Animal Feed Phytase Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 549.54 million |

|

Revenue forecast in 2032 |

USD 962.07 million |

|

CAGR |

6.4% from 2023- 2032 |

|

Base year |

2022 |

|

Historical data |

2019- 2021 |

|

Forecast period |

2023- 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Product, By Wax Type, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

BASF SE, DuPont, DSM, AB Enzymes, Beijing Smistyle Sci. & Tech. Development, Jinan Tiantianxiang, Guangdong VTR Bio-Tech, Huvepharma, Novozymes, Qingdao Vland Biotech, Kemin Industries and Adisseo. |

FAQ's

The global animal feed phytase market size is expected to reach USD 962.07 million by 2032.

Key players in the animal feed phytase market are BASF, DuPont, DSM, AB Enzymes, Beijing Smistyle, Jinan Tiantianxiang, Guangdong VTR Bio-Tech, Huvepharma.

Latin America contribute notably towards the global animal feed phytase market.

The global animal feed phytase market expected to grow at a CAGR of 6.4% during the forecast period.

The animal feed phytase market report covering key segments are form, class, source, Livestock, and region.