Aluminum Nitride Ceramic Heaters Market Size, Share, Trends, Industry Analysis Report

: By Production Technology (Thin-Film Technology and Thick-Film Technology), Power Output, Application, End-Use Industry, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 63

- Format: PDF

- Report ID: PM5552

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

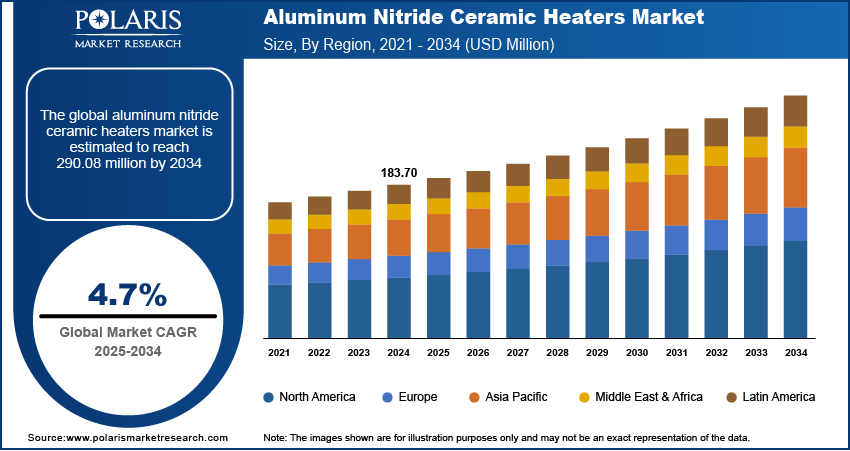

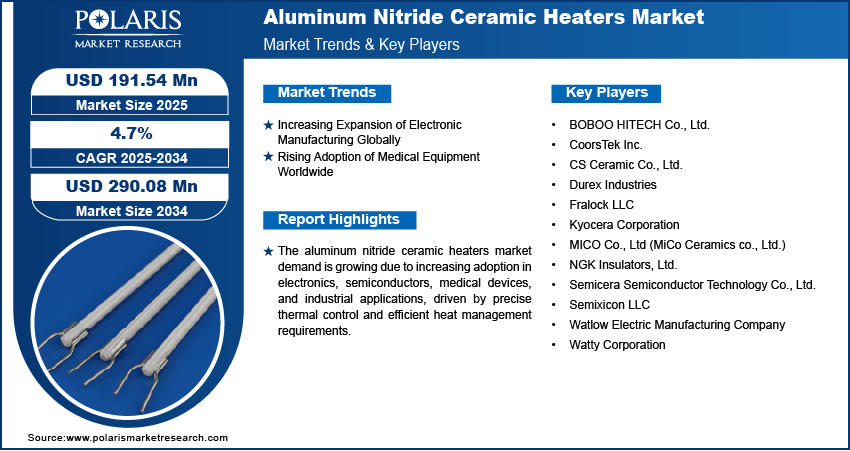

The global aluminum nitride ceramic heaters market size was valued at USD 183.70 million in 2024, growing at a CAGR of 4.7% during 2025–2034. The market growth is primarily driven by the increased need for precise temperature control across sectors such as aerospace, automotive, and semiconductor manufacturing.

Key Insights

- The thin-film technology segment accounted for the largest market share in 2024, owing to its high precision and efficiency in temperature control.

- The high-power heaters segment is projected to register the highest CAGR, primarily driven by the crucial role of these heaters in demanding industrial applications.

- Asia Pacific led the market. The strong presence of the automotive, electronics, and semiconductor sectors drives the regional market dominance.

- North America is projected to experience substantial growth. The growing demand for high-performance materials for advanced manufacturing processes is fueling market growth in the region.

Industry Dynamics

- The expansion of electronic manufacturing globally is fueling the demand for aluminum nitride ceramic heaters for precise temperature control.

- The growing adoption of medical equipment worldwide is driving the need for aluminum nitride ceramic heaters.

- Innovations in thin-film technology are creating several opportunities for market participants.

- High manufacturing costs and supply chain disruption are hindering market growth.

Market Statistics

2024 Market Size: USD 183.70 million

2034 Projected Market Size: USD 290.08 million

CAGR (2025-2034): 4.7%

Asia Pacific: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

The aluminum nitride ceramic heaters are devices that use aluminum nitride (AlN) as a heating element, offering high thermal conductivity, electrical insulation, and stability for precise temperature control in various industries. The demand for aluminum nitride ceramic heaters is growing rapidly, primarily due to their efficiency in heat transfer, electrical insulation, and thermal management across industries such as semiconductor manufacturing, automotive, aerospace, and medical technology. The aluminum nitride ceramic heaters market growth is increasingly driven by expanding sectors that demand advanced solutions for precise temperature control, particularly for electronic components. The need for effective heat dissipation in semiconductor processing emphasizes the growing reliance on AlN ceramic heaters for tasks such as physical vapor deposition (PVD), chemical vapor deposition (CVD), and epitaxy.

The demand for aluminum nitride ceramic heaters is surging in the rapidly expanding automotive sector. The production of electric and hybrid vehicles, which require efficient battery thermal management, contributes significantly to the aluminum nitride ceramic heaters market expansion. Electric vehicles (EVs) and hybrid vehicles heavily rely on AlN ceramic heaters to maintain optimal battery temperature, enhance electronic stability, and regulate cabin temperatures, ensuring overall vehicle efficiency and comfort. According to the International Energy Agency, almost 14 million new electric vehicles were registered globally in 2023, signaling a substantial increase in the need for such heaters.

The aluminum nitride ceramic heaters market demand is rising in the aerospace and defense sectors, where AlN ceramic heaters are used for thermal management in avionics. These heaters are indispensable for managing the temperatures of sensitive electronics and ensuring optimal performance in harsh environments. The aluminum nitride ceramic heaters market expansion is poised to witness sustained growth in the coming years as industries such as automotive, aerospace, and semiconductor manufacturing continue to evolve and demand higher precision and efficiency.

Market Dynamics

Increasing Expansion of Electronic Manufacturing Globally

In electronic manufacturing, aluminum nitride ceramic heaters are crucial for maintaining precise temperature control in processes such as soldering, semiconductor fabrication, and surface mount technology (SMT) due to their superior thermal conductivity (exceeding 170 W/mK). This enables efficient heat transfer and uniform temperature distribution, making them ideal for high-precision electronic applications. Thus, the increasing expansion of electronic manufacturing globally is driving the aluminum nitride (AlN) ceramic heaters market development.

The rapid rise in the manufacturing of miniaturized electronic devices, including smartphones, tablets, and wearables, boosts the aluminum nitride ceramic heater market demand. These devices need compact components that can withstand intense heat without compromising performance, especially over half of the global population owns smartphones. AlN ceramic heaters help dissipate heat effectively while ensuring the reliability and longevity of devices.

The growth in advanced semiconductor manufacturing, driven by the rise of AI, 5G, and automotive electronics, is fueling the aluminum nitride ceramic heaters market expansion. Countries such as China, South Korea, and Japan are significant producers of electronics, with a strong emphasis on consumer devices and semiconductor manufacturing. For instance, the South Korean government reports that there are ∼4,464 companies related to semiconductors, including sectors such as fabless firms, foundries, packaging, materials, and equipment manufacturing in South Korea. This focus on expanding semiconductor and electronics manufacturing has made these nations major consumers of aluminum nitride (AlN) ceramic heaters.

Increasing Adoption of Medical Equipment Worldwide

The increasing adoption of medical equipment worldwide is significantly growing the demand for aluminum nitride ceramic heaters. These heaters are essential in ensuring precise temperature control in various medical devices, including MRI machines, PCR systems, and patient monitoring equipment. For instance, in MRI machines, aluminum nitride ceramic heaters help maintain the temperature of superconducting magnets, improving imaging accuracy and reducing diagnostic errors.

Healthcare investments play a crucial role in driving the aluminum nitride ceramic heaters market expansion. The Ministry of Health and Family Welfare of India reported a 37% increase in healthcare spending between 2020-21 and 2021-22, allowing hospitals and clinics to acquire advanced imaging devices that rely on efficient thermal management. Additionally, the growing aging population worldwide increases the demand for medical equipment such as diagnostic systems and monitoring devices. This surge in healthcare demand further contributes to the market growth, as these heaters provide reliable, uniform heat distribution critical for optimal device performance.

Segment Analysis

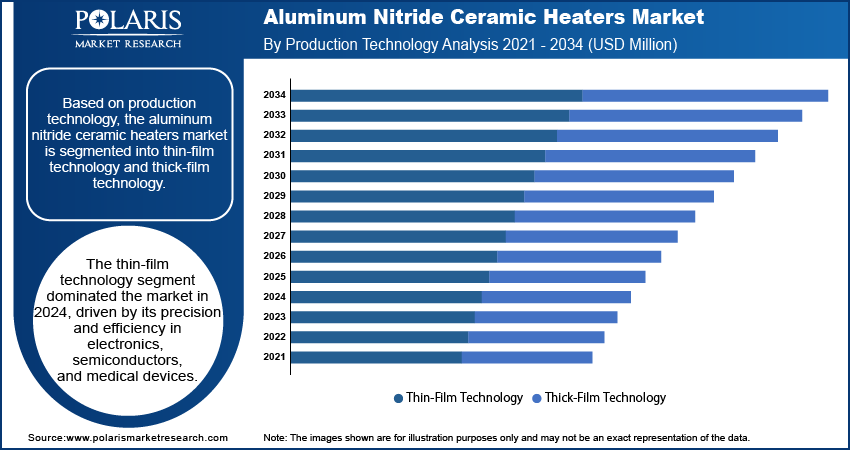

Market Assessment by Production Technology Outlook

The global aluminum nitride ceramic heaters market segmentation, based on production technology, includes thin-film technology and thick-film technology. The thin-film technology segment accounted for around 56% of the market share in 2024 due to its exceptional precision and efficiency in temperature control. This technology is crucial in industries such as electronics, medical devices, and semiconductor manufacturing, where exact heating performance is required. In semiconductor applications, thin-film AlN ceramic heaters are used in equipment such as chemical vapor deposition (CVD) reactors and plasma etching systems, ensuring uniform heat distribution for high-quality semiconductor wafers. Similarly, in medical devices such as PCR machines, thin-film heaters maintain accurate thermal cycles necessary for DNA testing. The growing demand for precise and efficient temperature control across these industries drives the dominance of the thin-film technology segment.

Market Evaluation by Power Output Outlook

The global aluminum nitride ceramic heaters market segmentation, based on power output, includes standard-power heaters, high-power heaters, and low-power heaters. The high-power heaters segment is expected to register the highest CAGR of 5.3% during the forecast period due to their critical role in demanding industrial applications. These heaters provide rapid and consistent heating, making them essential for sectors such as aerospace, automotive, and heavy machinery, where precise temperature control is crucial for engine testing, thermal cycling, and advanced material processing. The increasing adoption of AlN ceramic heaters in these industries is further supported by government programs, such as the US Department of Energy’s Advanced Manufacturing Office, which promotes the use of high-performance materials. The increasing demand for high-power AlN heaters across various applications, as industries seek higher efficiency and reliability in extreme conditions, contributes to the aluminum nitride ceramic heaters market expansion.

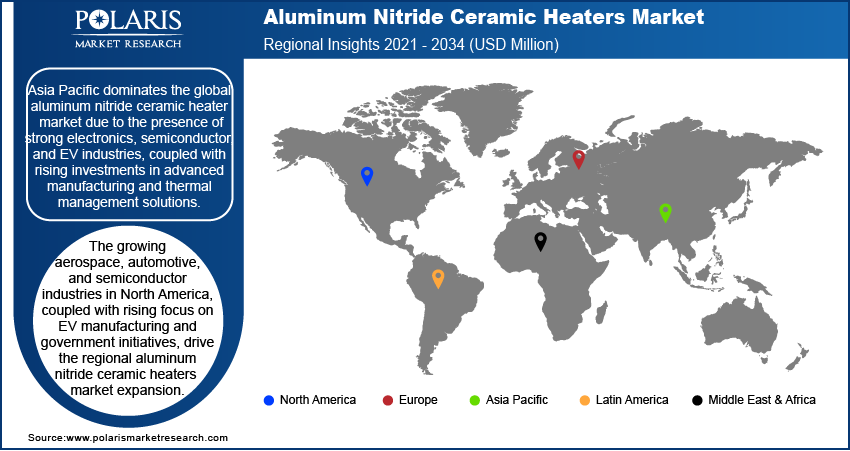

Regional Analysis

By region, the study provides aluminum nitride ceramic heaters market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the global aluminum nitride ceramic heaters market share due to the strong presence of the electronics, semiconductor, and automotive industries across the region. Countries such as China, Japan, and South Korea are major manufacturers of electronic devices, semiconductors, and electric vehicles, which require efficient thermal management solutions. The region’s focus on adopting advanced manufacturing and increasing investments in high-performance materials further contribute to the demand for AlN ceramic heaters in Asia Pacific. Additionally, the rising adoption of electric vehicles and semiconductor technologies in Asia Pacific strengthens the aluminum nitride ceramic heaters market demand in the region.

The North America aluminum nitride ceramic heaters market is experiencing substantial growth due to its strong aerospace, automotive, and semiconductor industries. The increasing demand for high-performance materials for advanced manufacturing processes, such as engine testing and thermal cycling, drives the adoption of AlN ceramic heaters in the region. Additionally, the rising focus on electric vehicles (EVs) and technological advancements in semiconductor production contribute to the aluminum nitride ceramic heaters market expansion. Government initiatives, such as funding for advanced manufacturing and clean energy technologies, also support the adoption of AlN ceramic heaters in North America’s industrial and automotive sectors.

Key Players and Competitive Analysis Report

The competitive landscape of the aluminum nitride ceramic heaters market is characterized by a mix of global leaders and regional players competing for market share through innovation, strategic partnerships, and regional expansion. Key market players such as Fralock LLC; MICO Co., Ltd; and others leverage their robust research and development (R&D) capabilities along with extensive distribution networks to offer advanced aluminum nitride ceramic heaters tailored for various applications. These major companies focus on continuous product innovation to improve efficiency, reliability, and scalability to meet the evolving needs of industries that require advanced power management solutions. At the same time, smaller regional firms are entering the market with specialized aluminum nitride ceramic heaters targeting local market demands, often focusing on customized and cost-effective applications. A few competitive strategies in the aluminum nitride ceramic heaters market include mergers and acquisitions, collaborations with technology firms, and expanding product portfolios to enhance market. BOBOO HITECH Co., Ltd.; MICO Co., Ltd. (MiCo Ceramics Co., Ltd.); Durex Industries; Kyocera Corporation; Semixicon LLC; Semicera Semiconductor Technology Co., Ltd.; Fralock LLC; NGK Insulators, Ltd.; Watlow Electric Manufacturing Company; CoorsTek Inc.; CS Ceramic Co., Ltd.; and Watty Corporation are among the key major players.

BOBOO HITECH Co., Ltd. manufactures semiconductor equipment components, including heaters and electrostatic chucks, with facilities in South Korea and a subsidiary in China, offering products and repair services for global semiconductor fabrication.

MiCo Ceramics Co., Ltd. specializes in aluminum nitride heaters, electrostatic chucks, and ceramic parts for semiconductor equipment, with manufacturing facilities in South Korea and global sales.

List of Key Companies

- BOBOO HITECH Co., Ltd.

- CoorsTek Inc.

- CS Ceramic Co., Ltd.

- Durex Industries

- Fralock LLC

- Kyocera Corporation

- MICO Co., Ltd (MiCo Ceramics co., Ltd.)

- NGK Insulators, Ltd.

- Semicera Semiconductor Technology Co., Ltd.

- Semixicon LLC

- Watlow Electric Manufacturing Company

- Watty Corporation

Aluminum Nitride Ceramic Heaters Industry Development

In November 2024, Watlow and AEQT announced a collaboration agreement, marking a strategic partnership to enhance energy efficiency and innovation in the chemical industry, with a focus on sustainable industrial processes.

In August 2024, the construction of CoorsTek's third factory in Gumi, South Korea, was completed, expanding its semiconductor manufacturing capabilities. This facility was developed to meet growing market demands and enhance production efficiency.

In October 2023, Kyocera International, Inc. expanded its semiconductor and microelectronic device assembly capabilities at its San Diego facility. This investment addresses the increasing demand for advanced domestic assembly solutions in the U.S. semiconductor industry.

Aluminum Nitride Ceramic Heaters Market Segmentation

By Production Technology Outlook (Revenue, USD Million, 2021–2034)

- Thin-Film Technology

- Thick-Film Technology

By Power Output Outlook (Revenue, USD Million, 2021–2034)

- Standard-Power Heaters

- High-Power Heaters

- Low-Power Heaters

By Application Outlook (Revenue, USD Million, 2021–2034)

- Semiconductor Equipment

- Medical Devices

- Aerospace Components

- Automotive Components

- Others

By End-Use Industry Outlook (Revenue, USD Million, 2021–2034)

- Industrial Manufacturing

- Healthcare

- Others

By Regional Outlook (Revenue, USD Million, 2021–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Aluminum Nitride Ceramic Heaters Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 183.70 million |

|

Market Size Value in 2025 |

USD 191.54 million |

|

Revenue Forecast by 2034 |

USD 290.08 million |

|

CAGR |

4.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global aluminum nitride ceramic heaters market size was valued at USD 183.70 million in 2024 and is projected to grow to USD 290.08 million by 2034.

The global market is projected to register a CAGR of 4.7% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few key players in the market are BOBOO HITECH Co., Ltd.; MICO Co., Ltd. (MiCo Ceramics Co., Ltd.); Durex Industries; Kyocera Corporation; Semixicon LLC; Semicera Semiconductor Technology Co., Ltd.; Fralock LLC; NGK Insulators, Ltd.; Watlow Electric Manufacturing Company; CoorsTek Inc.; CS Ceramic Co., Ltd.; and Watty Corporation.

The thin-film technology segment led the market share in 2024.

The high-power heaters segment is anticipated to register the highest growth rate during the forecast period.