Medical Equipment Maintenance Market Size, Share, Trends, Industry Analysis Report

: By Equipment (Imaging Equipment, Surgical Instruments, Electromedical Equipment, Endoscopic Devices, and Others), Service, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 120

- Format: PDF

- Report ID: PM4039

- Base Year: 2024

- Historical Data: 2020-2023

Medical Equipment Maintenance Market Overview

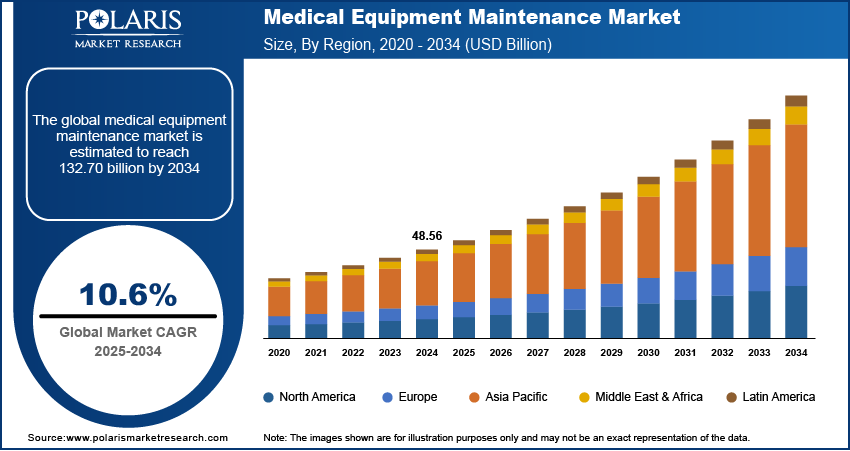

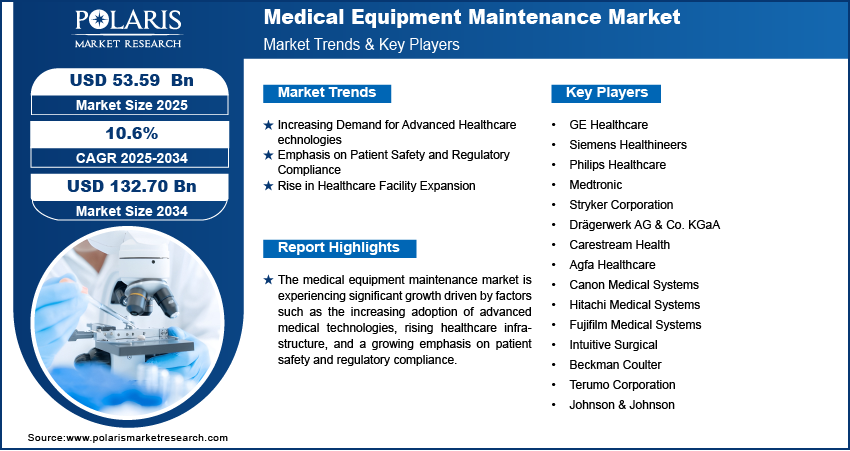

The medical equipment maintenance market size was valued at USD 48.56 billion in 2024. The market is projected to grow from USD 53.59 billion in 2025 to USD 132.70 billion by 2034, exhibiting a CAGR of 10.6% during 2025–2034.

The medical equipment maintenance market refers to the services and solutions provided to ensure the proper functioning, safety, and longevity of medical devices. This market includes routine servicing, calibration, repair, and software updates for a wide range of medical equipment, such as diagnostic machines, imaging devices, and laboratory instruments.

The medical equipment maintenance market drivers include the increasing demand for advanced healthcare technologies, a growing emphasis on patient safety and regulatory compliance, and the rising number of healthcare facilities worldwide. Additionally, trends such as the integration of predictive maintenance technologies, the adoption of third-party maintenance providers, and advancements in data analytics for equipment monitoring are shaping the market.

To Understand More About this Research: Request a Free Sample Report

Medical Equipment Maintenance Market Dynamics

Increasing Demand for Advanced Healthcare Technologies

The demand for advanced medical technologies has significantly increased due to the growing complexity of healthcare services and the need for more accurate and efficient diagnoses and treatments. Hence it is among the major drivers of medical equipment maintenance market. As healthcare facilities adopt more advanced medical devices, the importance of ensuring these devices remain operational becomes critical. Regular maintenance is essential for minimizing downtime, preventing errors, and ensuring that equipment meets regulatory standards. For example, in the US, approximately 50% of medical equipment is nearing or past its life expectancy, making maintenance services more vital for healthcare providers. The shift towards digitization and the implementation of IoT-based devices further amplifies the demand for specialized maintenance to ensure these connected devices function properly.

Emphasis on Patient Safety and Regulatory Compliance

Patient safety is a top priority for healthcare providers, and well-maintained equipment plays a crucial role in minimizing the risk of malfunctions that could harm patients. Regular maintenance helps ensure compliance with stringent healthcare regulations and standards, such as those set by the FDA and ISO, which require medical equipment to meet safety and performance criteria. Failing to meet these standards can result in penalties, legal actions, or a decline in patient trust. A study by the US Department of Health and Human Services indicated that malfunctioning medical devices were involved in more than 1,000 deaths annually, further emphasizing the importance of routine maintenance for patient safety and compliance with regulatory requirements. This in turn, influences the medical equipment maintenance market in a positive manner.

Rise in Healthcare Facility Expansion

With the rapid expansion of healthcare facilities worldwide, including hospitals, outpatient centers, and diagnostic labs, the need for effective medical equipment maintenance has become more prominent. New healthcare facilities often require ongoing equipment servicing to ensure that newly installed devices operate optimally and remain compliant with industry standards. Additionally, the rising number of healthcare institutions in developing countries is increasing the overall demand for maintenance services. In regions such as Asia Pacific, the expansion of the healthcare infrastructure is expected to fuel the medical equipment maintenance market growth. For instance, India’s healthcare infrastructure is projected to reach $372 billion by 2022, creating a significant demand for regular equipment maintenance services to support this growth.

Medical Equipment Maintenance Market Segment Insights

Medical Equipment Maintenance Market Assessment by Equipment

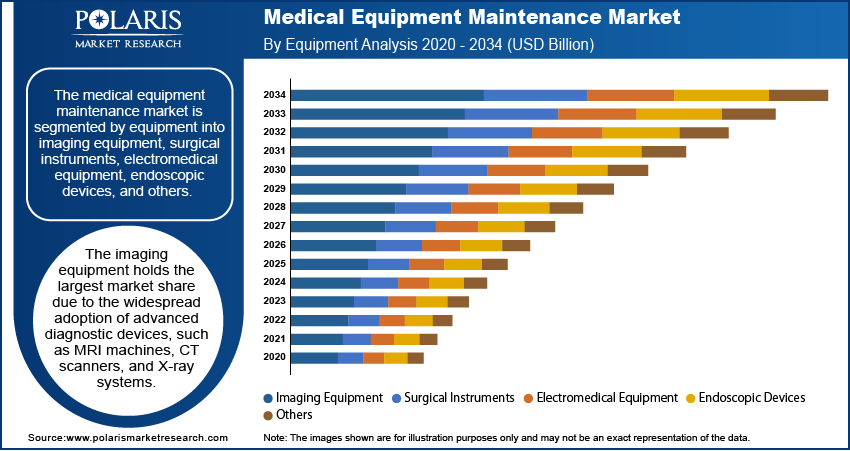

The medical equipment maintenance market is segmented by equipment into imaging equipment, surgical instruments, electromedical equipment, endoscopic devices, and others. The imaging equipment holds the largest market share due to the widespread adoption of advanced diagnostic devices, such as MRI machines, CT scanners, and X-ray systems. These devices are critical to healthcare facilities and require regular maintenance to ensure accurate results and prevent costly downtime. Imaging equipment is also subject to stringent regulatory standards, increasing the demand for maintenance services. The growth of this segment is driven by the expansion of diagnostic centers and hospitals, particularly in emerging economies where healthcare infrastructure is rapidly developing.

Electromedical equipment, including devices such as pacemakers, defibrillators, and patient monitoring systems, is experiencing the fastest growth in the medical equipment maintenance market. As healthcare facilities continue to prioritize patient safety and regulatory compliance, the demand for maintenance services for these high-stakes devices has risen significantly. Additionally, the increasing use of connected medical devices, especially in critical care settings, has led to a greater focus on maintaining these devices to prevent failures that could jeopardize patient health. Endoscopic devices and surgical instruments are also important segments, with maintenance services required to ensure precise operations and extend the longevity of the equipment, although these segments experience slower growth compared to imaging and electromedical equipment.

Medical Equipment Maintenance Market Evaluation by Service

The medical equipment maintenance market is segmented by service into preventive maintenance, corrective maintenance, and operational maintenance. Preventive maintenance holds the largest medical equipment maintenance market share due to the widespread adoption of proactive maintenance strategies aimed at minimizing equipment downtime and extending the lifespan of medical devices. Healthcare facilities are increasingly adopting scheduled maintenance practices to ensure equipment is regularly checked, calibrated, and serviced, reducing the likelihood of failures. Preventive maintenance is critical in ensuring compliance with regulatory standards, especially in regions with strict health and safety guidelines. Its dominance is driven by the growing awareness of the cost-efficiency of preventing breakdowns rather than reacting to them.

Corrective maintenance is witnessing significant growth, primarily due to the rising complexity of medical equipment and the inevitable need for repairs when devices malfunction or break down. As healthcare facilities operate under high pressure, the demand for rapid and efficient corrective maintenance services is increasing.

Medical Equipment Maintenance Market Outlook by End Use

The medical equipment maintenance market segmentation, based on end use, includes hospitals, diagnostic imaging centers, dialysis centers, ambulatory surgical centers, dental clinics & specialty clinics, and others. Hospitals hold the largest market share due to their extensive use of a wide range of medical equipment, from imaging systems to electromedical devices. The critical nature of operations in hospitals requires continuous maintenance to ensure equipment functions effectively, supporting the large patient volumes and complex procedures. This segment benefits from the growing number of hospitals worldwide, particularly in emerging markets, where healthcare infrastructure expansion drives the demand for equipment maintenance services. Additionally, hospitals face stringent regulatory requirements, further boosting the need for routine maintenance and repair services.

The diagnostic imaging centers segment is also registering the fastest growth, driven by the increasing demand for advanced imaging technologies such as MRI, CT scans, and X-ray machines. As the use of diagnostic imaging grows, the need for specialized maintenance services to keep these high-tech devices operational becomes more prominent. Diagnostic imaging centers are crucial in early disease detection and are expanding globally, especially in developed regions. The rise in preventive healthcare and diagnostic services is a key factor contributing to the growth of this segment, which necessitates regular maintenance to minimize downtime and avoid costly repairs. Other segments, such as dialysis centers and ambulatory surgical centers, are also important but experience slower growth compared to hospitals and diagnostic imaging centers.

Medical Equipment Maintenance Market Regional Insights

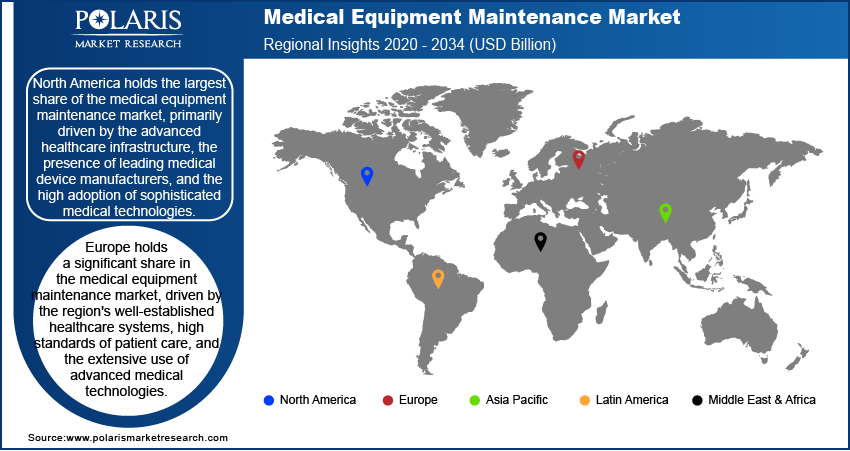

By region, the study provides medical equipment maintenance market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share, primarily driven by the advanced healthcare infrastructure, the presence of leading medical device manufacturers, and the high adoption of advanced medical technologies. The US is a key contributor to this dominance, with its well-established healthcare system that requires regular maintenance of a wide array of medical equipment, from diagnostic imaging systems to electromedical devices. Additionally, stringent regulatory requirements and a strong emphasis on patient safety further boost the demand for maintenance services in the region. The growing number of healthcare facilities, coupled with the increasing complexity of medical devices, continues to fuel market growth in North America. Other regions, such as Europe and Asia Pacific, also show strong potential, particularly with the rising investments in healthcare infrastructure, but North America remains the leader in market share.

Europe holds a significant share in the medical equipment maintenance market, driven by the region's well-established healthcare systems, high standards of patient care, and the extensive use of advanced medical technologies. Countries such as Germany, France, and the UK are major contributors to the market, where healthcare facilities are increasingly investing in maintenance services to ensure compliance with strict regulatory standards and minimize equipment downtime. The demand for medical equipment maintenance in Europe is also influenced by the aging population, which requires more frequent diagnostic procedures and treatments. The growing trend of hospital expansions, along with a strong focus on preventive healthcare, is expected to further drive the demand for maintenance services in the region.

The medical equipment maintenance market in Asia Pacific is experiencing the fastest growth, primarily driven by the rapid expansion of healthcare infrastructure in countries such as China, India, and Japan. The increasing adoption of advanced medical technologies, coupled with the rising healthcare expenditure, has fueled the demand for maintenance services to ensure the proper functioning and longevity of medical equipment. Additionally, the growing middle-class population and improved access to healthcare services are contributing to the rising number of diagnostic and treatment centers, further expanding the market. While healthcare standards are improving, the need for routine and corrective maintenance services remains critical to ensure the efficiency and safety of medical devices in this rapidly developing region.

Medical Equipment Maintenance Market – Key Players and Competitive Insights

Key players in the medical equipment maintenance market include GE Healthcare, Siemens Healthineers, Philips Healthcare, Medtronic, Stryker Corporation, Drägerwerk AG & Co. KGaA, Carestream Health, Agfa Healthcare, Canon Medical Systems, Hitachi Medical Systems, Fujifilm Medical Systems, Intuitive Surgical, Beckman Coulter, Terumo Corporation, and Johnson & Johnson. These companies provide comprehensive maintenance solutions across various segments, including imaging equipment, surgical instruments, and electromedical devices. They offer preventive, corrective, and operational maintenance services to healthcare facilities, ensuring that medical equipment remains compliant with regulations and functions optimally. Their maintenance services are critical in reducing downtime and improving the longevity of high-cost medical devices.

The competitive landscape in the medical equipment maintenance industry is marked by companies that offer specialized maintenance solutions, ranging from comprehensive equipment management programs to repair and calibration services. Major players are focusing on expanding their service offerings to include predictive maintenance and digital monitoring solutions, which enable healthcare providers to manage equipment more efficiently and minimize unplanned disruptions. As the healthcare industry increasingly adopts advanced technologies, competition in the market is intensifying, with companies emphasizing innovation in service delivery. Partnerships and collaborations with healthcare providers are also common strategies, as these companies aim to strengthen their position in a rapidly growing market.

In terms of growth strategies, key players are investing in expanding their service networks and enhancing their capabilities through the adoption of advanced tools and technologies. Many are integrating digital tools, such as cloud-based monitoring and data analytics, into their maintenance services to provide real-time insights into equipment performance. Additionally, the rise in demand for medical equipment maintenance in emerging markets, particularly in Asia Pacific, is encouraging global companies to enhance their service offerings in these regions. To maintain competitiveness, companies are focusing on improving the quality and efficiency of their services while also addressing the increasing demand for cost-effective maintenance solutions in healthcare facilities.

GE Healthcare is a prominent player in the medical equipment maintenance market. It provides maintenance services for a wide range of medical equipment, including imaging systems and patient monitoring devices. The company offers both preventive and corrective maintenance services to ensure the continuous operation of medical equipment across healthcare facilities. GE Healthcare has a strong presence in global markets, focusing on improving the efficiency and reliability of medical equipment through its services.

Siemens Healthineers is another key player. It provides various maintenance services for medical technologies, such as diagnostic imaging systems, laboratory equipment, and other medical devices. The company focuses on maintaining the operational reliability of healthcare equipment, helping healthcare providers avoid costly breakdowns, and ensuring patient safety. Siemens Healthineers has been actively involved in expanding its service offerings globally, with a particular emphasis on providing high-quality maintenance solutions in developing regions.

List of Key Companies in Medical Equipment Maintenance Market

- GE Healthcare

- Siemens Healthineers

- Philips Healthcare

- Medtronic

- Stryker Corporation

- Drägerwerk AG & Co. KGaA

- Carestream Health

- Agfa Healthcare

- Canon Medical Systems

- Hitachi Medical Systems

- Fujifilm Medical Systems

- Intuitive Surgical

- Beckman Coulter

- Terumo Corporation

- Johnson & Johnson

Medical Equipment Maintenance Market Developments

- December 2024: Siemens Healthineers launched a new initiative to enhance its remote monitoring capabilities, allowing healthcare providers to monitor equipment performance in real-time and address potential issues before they lead to failures.

- October 2024: GE Healthcare announced the expansion of its maintenance services in emerging markets, particularly in Asia, aiming to support the growing demand for healthcare infrastructure.

Medical Equipment Maintenance Market Segmentation

By Equipment Outlook (Revenue-USD Billion, 2020–2034)

- Imaging Equipment

- Surgical Instruments

- Electromedical Equipment

- Endoscopic Devices

- Others

By Service Outlook (Revenue-USD Billion, 2020–2034)

- Preventive Maintenance

- Corrective Maintenance

- Operational Maintenance

By End Use Outlook (Revenue-USD Billion, 2020–2034)

- Hospitals

- Diagnostic Imaging Centers

- Dialysis Centers

- Ambulatory Surgical Centers

- Dental Clinics & Speciality Clinics

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Medical Equipment Maintenance Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 48.56 billion |

|

Market Size Value in 2025 |

USD 53.59 billion |

|

Revenue Forecast by 2034 |

USD 132.70 billion |

|

CAGR |

10.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The medical equipment maintenance market size was valued at USD 48.56 billion in 2024 and is projected to grow to USD 132.70 billion by 2034.

The market is projected to register a CAGR of 10.6% during the forecast period, 2025-2034.

North America had the largest share of the market.

Key players in the medical equipment maintenance market include GE Healthcare, Siemens Healthineers, Philips Healthcare, Medtronic, Stryker Corporation, Drägerwerk AG & Co. KGaA, Carestream Health, Agfa Healthcare, Canon Medical Systems, and Hitachi Medical Systems.

The imaging equipment segment accounted for the larger share of the market in 2024.

Medical equipment maintenance refers to the process of ensuring that medical devices and equipment function properly, safely, and reliably through regular inspection, servicing, calibration, and repair. This maintenance is critical for ensuring the accuracy of diagnoses and treatments, minimizing downtime, and extending the lifespan of expensive medical devices. The maintenance process can be divided into preventive maintenance, which involves scheduled checks and repairs before equipment fails, and corrective maintenance, which addresses issues after a device malfunctions. Additionally, operational maintenance ensures that equipment remains in optimal working condition during its everyday use.

A few key trends in the market are described below: