X-Ray Security Screening Market Size, Share, Trends, Industry Analysis Report

: By End Use (Transit, Commercial, and Government), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM3385

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

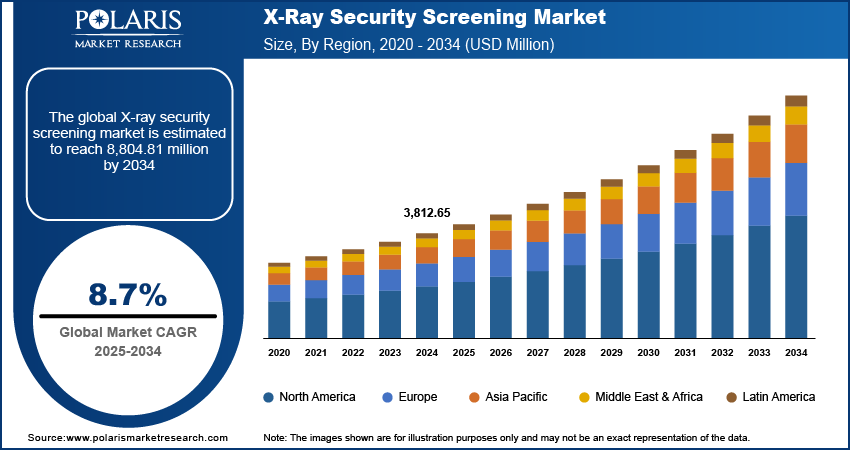

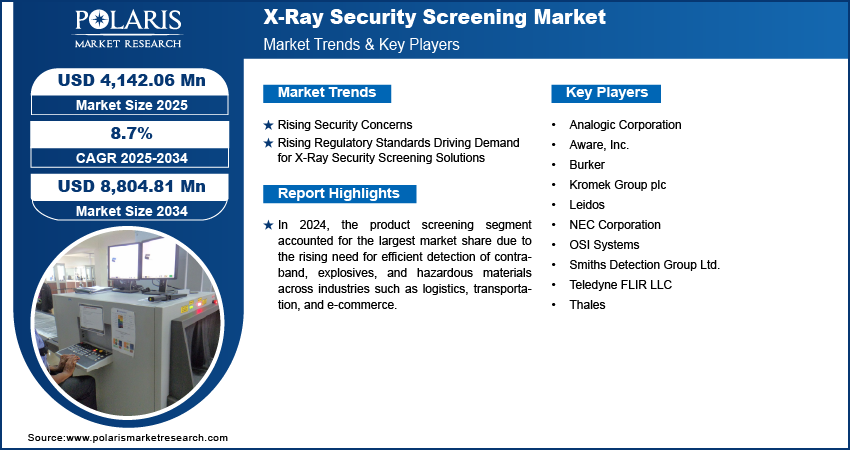

The X-ray security screening market was valued at USD 3,812.65 million in 2024, exhibiting a CAGR of 8.7% during 2025–2034. The market growth is primarily fueled by the global rise in air travel and increased demand for noninvasive and efficient screening solutions.

Key Insights

- The government segment led the market in 2024. The segment’s dominance is primarily driven by rising investments in national security.

- The product screening segment dominated the market in 2024, owing to the growing need for efficient detection of explosives and hazardous materials.

- North America accounted for the largest market share in 2024. Stringent government regulations and increased security concerns contribute to the region’s leading market share.

- Asia Pacific is anticipated to register the highest CAGR during the projection period. Rising security concerns and growing investments in advanced screening technologies drive the regional market growth.

Industry Dynamics

- The demand for advanced screening solutions, including X-ray security scanning, has increased with rising global threats such as terrorism and smuggling.

- The imposition of stringent security measures by governments and regulatory authorities globally drives market expansion.

- The expansion of the e-commerce sector is expected to drive the demand for X-ray security screening for efficient and secure screening of parcels.

- Regulatory complexities and compliance issues may present market challenges.

Market Statistics

2024 Market Size: USD 3,812.65 million

2034 Projected Market Size: USD 8,804.81 million

CAGR (2025-2034): 8.7%

North America: Largest Market in 2024

AI Impact on X-ray Security Screening Market

- AI improves threat detection accuracy in X-ray security screening by reducing human error and false positives.

- It speeds up image analysis, leading to faster screening and shorter wait times.

- Automation enhances operational efficiency by minimizing manual inspections and lowering labor costs.

- AI also enables real-time analysis and adaptive learning, continuously improving detection capabilities over time.

To Understand More About this Research: Request a Free Sample Report

The X-ray security screening market refers to the industry that involves the use of X-ray technology to detect threats, contraband, and prohibited items in various settings, such as airports, government buildings, transportation hubs, and other high-security areas. This technology allows for noninvasive inspection of baggage, cargo, and personal belongings, enhancing safety and security.

The rise in global air travel and the expansion of airports and transportation hubs are contributing to the X-ray security screening market growth, as there is a heightened demand for advanced security screening systems to ensure efficient and secure operations. Additionally, the increase in global e-commerce and international trade is significantly driving the market demand. There is a growing need for efficient and secure cargo screening solutions to prevent the transport of illegal or hazardous goods. This is further boosting the X-ray security screening market demand.

The demand for noninvasive and efficient screening solutions that minimize disruptions and enhance operational efficiency is driving the adoption of X-ray security screening systems across various sectors. Additionally, continuous advancements in X-ray imaging technologies, such as 3D imaging, improved detection capabilities, and real-time analysis, are significantly boosting X-ray security screening market development by offering better accuracy and efficiency.

Market Dynamics

Rising Security Concerns

Increasing global security threats, including terrorism, smuggling, and other criminal activities, are driving the demand for advanced screening solutions. In January 2025, Federal law enforcement arrested eight suspects in connection with a charge alleging a conspiracy involving warehouse owners, logistics executives, and truck drivers. They are charged with smuggling millions of dollars worth of fake and illicit goods from China into the US. Airports, public spaces, and critical infrastructure are adopting advanced security measures, including X-ray screening systems, to prevent security breaches and ensure public safety as these threats continue to evolve. The heightened focus on safety has led to a surge in market demand for sophisticated, reliable, and noninvasive screening technologies. With the growing emphasis on enhanced security measures, governments and private sectors invest in advanced X-ray technologies to safeguard against potential risks. Thus, the need for better detection and the growing implementation of security infrastructure at critical locations, due to rising security concerns, are expected to propel the X-ray security screening market development during the forecast period.

Rising Regulatory Standards Driving Demand for X-Ray Security Screening Solutions

Governments and regulatory bodies are increasingly imposing stringent security measures, which ensure the adoption of effective, noninvasive screening solutions. This shift is contributing to the X-ray security screening market demand, as businesses and institutions are required to integrate advanced security technologies, such as X-ray security screening, to comply with the standards and protocols. Therefore, the need for sophisticated X-ray systems that provide accurate and timely security checks continues to fuel market demand across sectors as regulations tighten globally.

Segment Insights

Assessment by End Use Outlook

The global X-ray security screening market segmentation, based on end use, includes transit, commercial, and government. In 2024, the government segment accounted for the largest market share due to increased investments in national security, stringent regulatory mandates, and the growing need for advanced threat detection solutions in high-risk locations such as airports, border checkpoints, and government buildings. Rising geopolitical tensions, terrorism concerns, and smuggling activities have prompted governments worldwide to enhance security infrastructure with advanced X-ray screening technologies. Additionally, initiatives focused on modernizing security protocols and upgrading screening equipment have significantly contributed to the X-ray security screening market growth for the government segment.

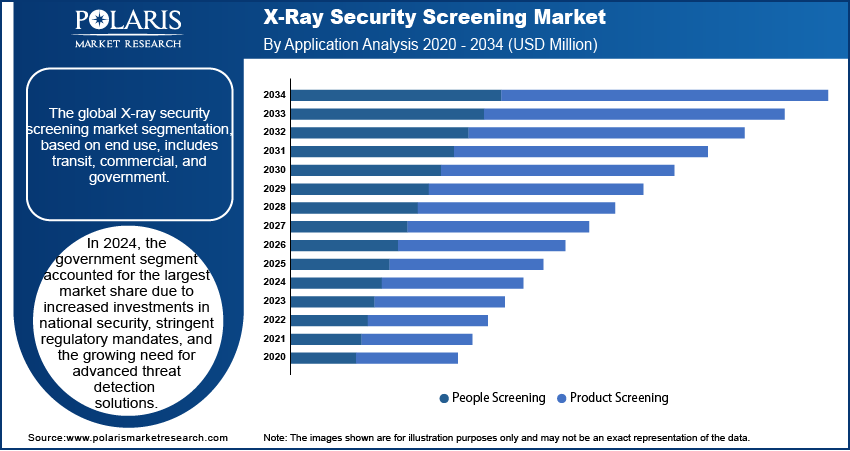

Evaluation by Application Outlook

The global X-ray security screening market segmentation, based on application, includes people screening and product screening. In 2024, the product screening segment accounted for a larger market share due to the rising need for efficient detection of contraband, explosives, and hazardous materials across industries such as logistics, transportation, and e-commerce. The surge in global trade and e-commerce shipments has heightened the demand for advanced screening solutions, such as X-ray security screening, to ensure regulatory compliance and prevent security threats. Additionally, technological advancements in high-resolution imaging and automated threat detection to enhance accuracy and efficiency in product screening processes have driven the X-ray security screening market demand.

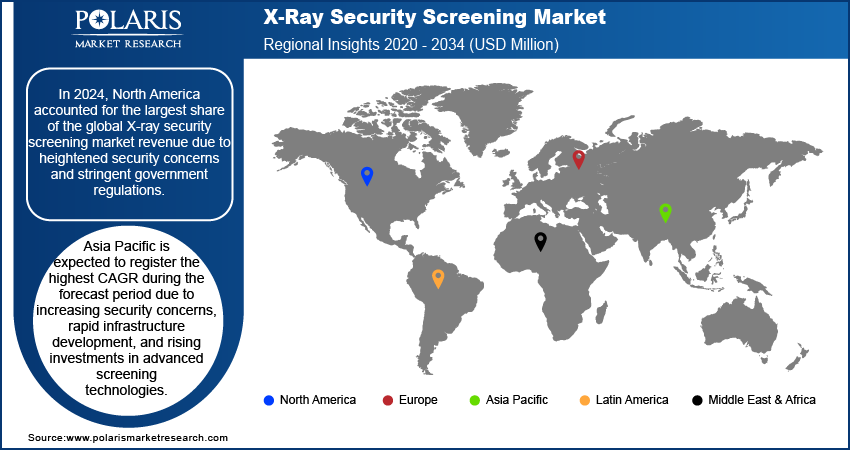

Regional Analysis

By region, the study provides X-ray security screening market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest share due to heightened security concerns and stringent government regulations. Significant investments in advanced screening technologies across airports, transportation hubs, and critical infrastructure boost the North America X-ray security screening market expansion. The Department of Homeland Security (DHS) has markedly enhanced its capacity to monitor and counteract terrorist and criminal financing.

Moreover, the region's strong presence of key industry players, continuous technological advancements, and increasing adoption of artificial intelligence in X-ray screening systems have driven market growth. Additionally, the rising volume of air luxury travel, e-commerce shipments, and cargo trade has amplified the market demand for high-precision security screening solutions, contributing to the overall market expansion and reinforcing North America's dominant position in the industry.

Asia Pacific is expected to register the highest CAGR during the forecast period due to increasing security concerns, rapid infrastructure development, and rising investments in advanced screening technologies. Growing air passenger traffic, expanding e-commerce, and heightened border security measures are significantly driving the X-ray security screening market demand across the region. For instance, the Investment Information and Credit Rating Agency of India projected that domestic air traffic in India will rise by 7–10% and reach 164–170 million passengers in FY25. In the first half of FY25, domestic traffic reached 79.3 million, growing 5.3% year-on-year. Additionally, government initiatives to enhance public safety, strengthen customs inspections, and modernize transportation hubs are accelerating market growth. The increasing adoption of AI-driven X-ray screening systems and advancements in threat detection technologies further contribute to the Asia Pacific X-ray security screening market expansion.

Key Players & Competitive Analysis Report

The competitive landscape of the X-ray security screening market is characterized by the presence of key global and regional players competing through technological advancements, product innovation, strategic partnerships, and regulatory compliance. Leading companies focus on enhancing market growth by developing AI-driven threat detection, high-resolution imaging, and automated screening solutions to improve security efficiency and accuracy. The market is also witnessing increased mergers and acquisitions, and collaborations aimed at market expansion and strengthening distribution networks. Additionally, stringent government regulations and growing market demand for advanced screening solutions in aviation, logistics, and border security drive continuous investments in research and development, further intensifying industry competition.

Thales Group is engaged in the development and provision of advanced technology solutions, specializing in aerospace, defense, security, and transportation systems. The company was founded in 1968 as Thomson-CSF and rebranded as Thales in 2000, and headquartered in Paris, France. Thales' product portfolio includes electronic systems, software solutions, cybersecurity services, and critical information systems for various industries. The services provided by Thales encompass air traffic management, military avionics, surveillance systems, and in-flight entertainment solutions. The company operates globally with a presence in over 56 countries. Moreover, in the X-Ray security screening, Thales plays a vital role by offering advanced imaging technologies that enhance security measures at airports and other critical infrastructure. Their X-ray systems are designed to detect threats and contraband effectively while ensuring efficient processing of passengers and cargo. Thales develops innovative security solutions that meet the evolving needs of governments and organizations worldwide.

NEC Corporation is engaged in the development and integration of IT and network solutions, specializing in information technology and communications. The company was founded in 1899 and is headquartered in Tokyo, Japan. NEC's product portfolio includes a wide range of hardware and software solutions such as servers, cloud computing services, biometric authentication systems, and telecommunications equipment. The services provided by NEC encompass system integration, consulting, and managed services across various sectors such as public safety, healthcare, and transportation. The company has a significant global presence with operations in over 50 countries, serving private enterprises and government agencies. Moreover, in the X-ray security screening, NEC Corporation contributes through its advanced imaging technologies that enhance safety protocols at transportation hubs. Their solutions focus on improving threat detection capabilities while streamlining security processes for passengers and cargo.

List of Key Companies

- Analogic Corporation

- Aware, Inc.

- Burker

- Kromek Group plc

- Leidos

- NEC Corporation

- OSI Systems

- Smiths Detection Group Ltd.

- Teledyne FLIR LLC

- Thales

X-Ray Security Screening Industry Developments

In January 2025, Smiths Detection and Fukuoka International Airport Co., Ltd. expanded their partnership to deliver seven HI-SCAN 6040 CTiX Model S X-ray scanners, provided with iLane A20 robotic tray return systems, for the newly renovated international terminal.

In September 2024, RaySecur launched the MailSecur MS400 T-ray Screening System, engineered to identify smaller and more hazardous concealed threats. This advanced technology expands detection capabilities, addressing the increasing sophistication of concealed threats in mailed packages.

In August 2023, Smiths Detection launched the SDX 100100 DV series dual-view X-ray scanners. Designed for high-throughput screening, these systems effectively inspect break-bulk freight and oversized baggage, ensuring both efficiency and robust security.

X-Ray Security Screening Market Segmentation

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Transit

- Commercial

- Government

By Application Outlook (Revenue – USD Million, 2020–2034)

- People Screening

- Product Screening

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3,812.65 million |

|

Market Size Value in 2025 |

USD 4,142.06 million |

|

Revenue Forecast by 2034 |

USD 8,804.81 million |

|

CAGR |

8.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 3,812.65 million in 2024 and is projected to grow to USD 8,804.81 million by 2034.

The global market is projected to register a CAGR of 8.7% during the forecast period.

In 2024, North America accounted for the largest share due to heightened security concerns and stringent government regulations.

A few of the key players in the market are Analogic Corporation; Aware, Inc.; Burker; Kromek Group plc; Leidos; NEC Corporation; OSI Systems; Smiths Detection Group Ltd.; Teledyne FLIR LLC; and Thales.

In 2024, the government segment accounted for the largest market share due to increased investments in national security, stringent regulatory mandates, and the growing need for advanced threat detection solutions.

In 2024, the product screening segment accounted for a larger market share due to the rising need for efficient detection of contraband, explosives, and hazardous materials across industries such as logistics, transportation, and e-commerce.