Security Screening Market Share, Size, Trends, Industry Analysis Report

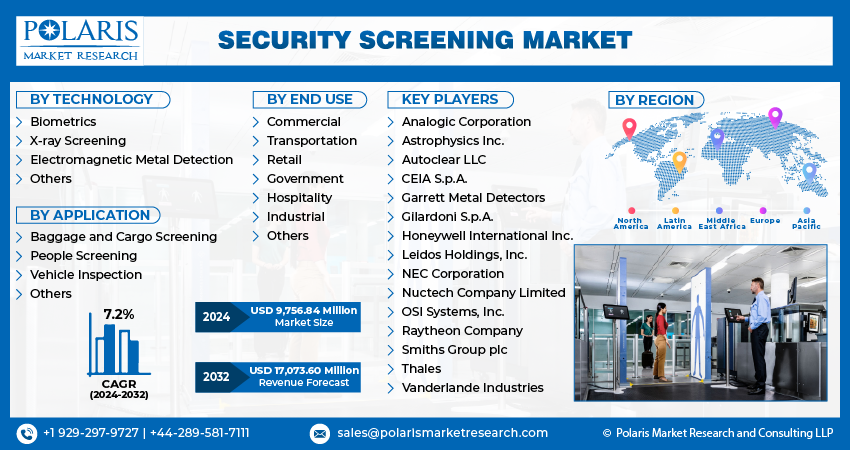

By Technology (Biometrics, X-ray Screening, Electromagnetic Metal Detection, Others); By Application; By End Use; By Region; Segment Forecast, 2024- 2032

- Published Date:Apr-2024

- Pages: 119

- Format: PDF

- Report ID: PM4825

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

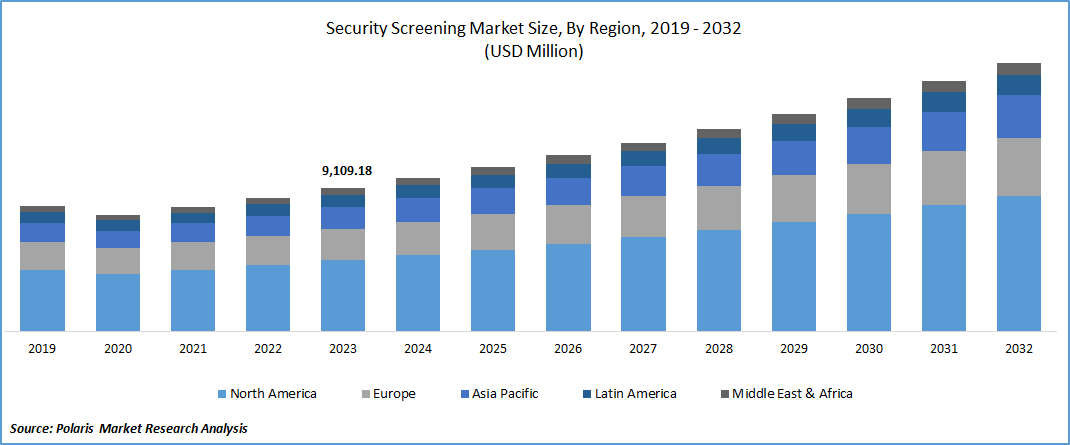

Security Screening Market size was valued at USD 9,109.18 million in 2023. The market is anticipated to grow from USD 9,756.84 million in 2024 to USD 17,073.60 million by 2032, exhibiting the CAGR of 7.2% during the forecast period.

Market Introduction

The growth of the travel and tourism industry fuels demand in the security screening market size. With a rising number of global travelers, transportation hubs must prioritize passenger safety and security. This surge in travel volume necessitates efficient security screening measures to mitigate potential threats like terrorism and smuggling. Consequently, airports and transportation authorities invest in advanced screening technologies such as baggage and cargo screening systems, metal detectors, and body scanners. Stringent regulations and evolving threats drive continuous innovation in security screening solutions.

To Understand More About this Research:Request a Free Sample Report

In addition, companies operating in the market are introducing new products to expand market reach and strengthen presence.

For instance, in November 2022, Evolv Technology, a key player in AI-driven weapons detection for security screening, revealed the introduction of the latest iteration of its sophisticated AI-powered software platform and features through Evolv Express 3.0/5.0.

Ongoing innovation enhances screening systems' capabilities to detect evolving threats effectively. Advanced imaging technologies like millimeter-wave and CT scanners provide higher resolution for better threat detection with fewer false alarms. AI and machine learning enable systems to analyze data efficiently and detect suspicious behavior in real-time. Additionally, biometric authentication integration improves accuracy, while cloud-based solutions facilitate data storage and collaboration. These advancements make security screening systems more robust, efficient, and adaptable to emerging challenges, driving market expansion.

Industry Growth Drivers

Increasing Security Threats are Projected to Spur the Product Demand

The security screening market trends sees a surge in demand driven by escalating security threats worldwide. Concerns over terrorism, smuggling, and illegal activities prompt investments in advanced screening technologies such as baggage and cargo screening systems, metal detectors, and biometric identification systems. Governments, airports, transportation hubs, critical infrastructure facilities, and commercial establishments prioritize deploying state-of-the-art security screening solutions to ensure public safety. With evolving security threats, the market is set for growth as organizations seek proactive measures to mitigate risks and protect assets.

Stringent Regulatory Requirements are Expected to Drive Security Screening Market Growth

Stringent regulatory requirements are a key driver in the market. Governments globally enforce regulations to ensure public safety, particularly in sectors like transportation and critical infrastructure. Mandates demand the adoption of advanced screening technologies to detect threats such as explosives and weapons. Entities such as the TSA and ECAC set guidelines for airport passenger and baggage screening, while similar regulations apply to government buildings and event venues. Compliance drives continuous innovation and investment in security screening technologies. Market players develop solutions that meet regulatory standards while maintaining operational efficiency in threat detection, fostering growth in the industry.

Industry Challenges

High Cost of Implementation is likely to Impede the Market Growth

The market faces limitations due to the high cost of implementation. Deploying advanced screening technologies entails substantial upfront expenses for equipment procurement, installation, and personnel training. Additionally, ongoing investments are necessary for maintenance, software updates, and staff education. Limited budgets pose challenges, particularly for smaller organizations or facilities, potentially compromising security measures' quality or scope. Moreover, budget constraints may deter investments in advanced screening technologies, especially in regions with competing priorities.

Report Segmentation

The security screening market analysis is primarily segmented based on technology, application, end use, and region.

|

By Technology |

By Application |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Technology Analysis

Biometrics Segment Held Significant Revenue Share in 2023

The biometrics segment held significant revenue share in 2023. Biometrics offer superior security through unique physical or behavioral characteristics, reducing unauthorized access risks. Widening adoption across sectors, driven by security needs, fuels its growth. Compliance with regulations mandating biometric use in critical sectors also contributes to market growth. Continuous technological enhancements, including touchless and multimodal systems, enhance appeal and functionality. Furthermore, seamless integration with existing security systems enhances overall effectiveness.

By Application Analysis

People Screening Segment Held Significant Revenue Share in 2023

The people screening segment held significant revenue share in 2023. Airports and transportation hubs prioritize screening technologies to handle large passenger volumes efficiently. Government facilities and public venues also invest in screening solutions to enhance safety. Heightened terrorism concerns globally drive increased demand for detecting concealed threats. Additionally, regulatory requirements mandate effective people screening measures in various sectors. Continuous technological advancements, such as more accurate body scanners and biometric identification systems, further boost the effectiveness of people screening.

By End Use Analysis

Transportation Segment Held Significant Revenue Share in 2023

The transportation segment held significant revenue share in 2023. High passenger volumes in transportation hubs necessitate mandatory security screening to ensure safety and prevent security threats. Stringent government regulations mandate advanced security measures, driving investments in screening technologies. Transportation facilities are prime targets for security threats, making robust screening crucial for threat detection and deterrence. Advanced screening technologies enable efficient operations and minimize delays, enhancing overall operational efficiency.

Regional Insights

Asia-Pacific Region is Expected to Experience Significant Growth During the Forecast Period

Asia-Pacific region is expected to experience significant growth during the forecast period. Rapid economic development drives increased investments in infrastructure, including airports and transportation hubs, boosting demand for security screening solutions. Growing concerns over terrorism and security threats prompt governments and organizations to adopt advanced screening technologies. The expanding aviation industry in countries like China and India necessitates enhanced security measures at airports to accommodate rising passenger traffic. Additionally, government initiatives to modernize transportation infrastructure contribute to market growth. Stringent regulations and compliance standards further drive the adoption of security screening technologies across various sectors in the Asia-Pacific region.

The security screening market size in North America is characterized by stringent security regulations, particularly in high-volume transportation hubs like airports and seaports. Technological advancements are prevalent, fostering the development and adoption of cutting-edge screening technologies to address evolving threats. Government investments in critical infrastructure security and border control initiatives further drive market growth. Additionally, the persistent threat of terrorism necessitates continuous investments in security screening solutions across the region.

Key Market Players & Competitive Insights

The security screening market involves a diverse array of players, and the expected arrival of new contenders is poised to intensify rivalry. Established leaders continuously enhance their technologies to maintain a competitive advantage, emphasizing effectiveness, reliability, and safety. These firms prioritize strategic actions such as establishing collaborations, improving product portfolios, and participating in cooperative endeavors. Their aim is to outperform competitors within the field, securing a significant security screening market share.

Some of the major players operating in the global security screening market include:

- Analogic Corporation

- Astrophysics Inc.

- Autoclear LLC

- CEIA S.p.A.

- Garrett Metal Detectors

- Gilardoni S.p.A.

- Honeywell International Inc.

- Leidos Holdings, Inc.

- NEC Corporation

- Nuctech Company Limited

- OSI Systems, Inc.

- Raytheon Company

- Smiths Group plc

- Thales

- Vanderlande Industries

Recent Developments

- In March 2024, 3DX-Ray revealed that its Axis-CXi system, a cabinet-style mail screening x-ray system, fully incorporates AI machine learning software functionality. Engineered to transform mail screening and building entrance security, the newly integrated AI software introduces an intelligent dimension to the AXIS-CXi cabinet X-ray system, enhancing precision and effectiveness in threat detection.

- In May 2022, Athena Security introduced Entryway Security Solution, designed for rapid and seamless security screening. This multi-sensor walk-through metal detector facilitates swift pedestrian traffic flow while ensuring robust security measures.

- In August 2023, Smiths Detection unveiled the SDX 100100 DV series. This lineup consists of two dual-view X-ray scanners designed to meet the diverse needs of security environments. The SDX 100100 DV HC model is equipped with a high conveyor, tailored for use in airports, parcel services, carriers, customs facilities, and other high-security settings. Meanwhile, the SDX 100100 DV LC variant, featuring a low conveyor, supports the screening of oversized baggage and break-bulk freight up to 100 x 100cm in size.

Report Coverage

The security screening market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, technologies, applications, end uses, and their futuristic growth opportunities.

Security Screening Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 9,756.84 million |

|

Revenue forecast in 2032 |

USD 17,073.60 million |

|

CAGR |

7.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Security Screening Market report covering key segments are technology, application, end use, and region.

Security Screening Market Size Worth $ 17,073.60 Million By 2032

Security Screening Market exhibiting the CAGR of 7.2% during the forecast period.

Asia-Pacific is leading the global market

The key driving factors in Security Screening Market are Stringent regulatory requirements are expected to drive security screening market growth