Anatomic Pathology Equipment & Supplies Market Share, Size, Trends, Industry Analysis Report

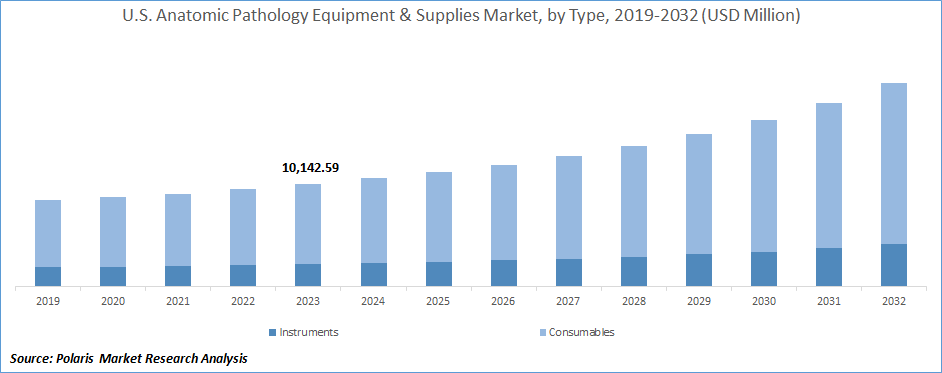

By Type (Instruments, Consumables); By End-Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jun-2024

- Pages: 117

- Format: PDF

- Report ID: PM4972

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

Anatomic Pathology Equipment & Supplies Market size was valued at USD 30,394.80 million in 2023. The market is anticipated to grow from USD 32,033.08 million in 2024 to USD 59,564.79 million by 2032, exhibiting the CAGR of 7.8% during the forecast period.

Industry Trends

The growing healthcare infrastructure around the world has emerged as a significant driver for the anatomic pathology equipment and supplies market. Anatomic pathology plays a crucial role in modern healthcare by providing accurate diagnoses of diseases based on the examination and analysis of bodily tissues. As healthcare infrastructure continues to expand in developing countries and as existing healthcare systems improve, the demand for anatomic pathology equipment and supplies is expected to rise significantly.

To Understand More About this Research:Request a Free Sample Report

Advancements in technology have revolutionized the anatomic pathology equipment and supplies market. Anatomic pathology is a critical component of modern healthcare that involves the examination and diagnosis of disease through the analysis of bodily tissues. Advancements in technology have greatly improved the accuracy and efficiency of anatomic pathology diagnosis, reduced the risk of errors and improved patient outcomes.

One of the most significant advancements in anatomic pathology technology is the development of digital pathology. Digital pathology involves the digitization of glass slides and the analysis of digital images using specialized software. This technology allows for remote access to digital slides, making it possible for pathologists to collaborate on diagnoses from anywhere in the world. Digital pathology has greatly increased the efficiency and accuracy of anatomic pathology diagnosis, allowing pathologists to analyze larger quantities of slides in less time.

Key Takeaways

- North America dominated the market and contributed over 35% share of the anatomic pathology equipment & supplies market in 2023

- By type category, the consumables segment dominated the global anatomic pathology equipment & supplies market size in 2023

- By end-use category, the clinical segment is projected to grow with a significant CAGR over the anatomic pathology equipment & supplies market forecast period

What are the Market Drivers Driving the Demand for Market?

Growing Prevalence of Chronic Diseases

The growing prevalence of chronic diseases is one of the primary drivers for the anatomic pathology equipment and supplies market. Chronic diseases such as cancer, diabetes, and cardiovascular diseases are among the leading causes of death worldwide. According to the World Health Organization, chronic diseases account for approximately 60% of all deaths globally. This high prevalence of chronic diseases has resulted in an increased demand for accurate and efficient diagnosis, which in turn has driven the growth of the anatomic pathology equipment and supplies market.

The prevalence of chronic diseases is expected to increase in the coming years, further driving the growth of the anatomic pathology equipment and supplies market. This increase can be attributed to factors such as changing lifestyles, an aging population, and environmental factors such as pollution. As the prevalence of chronic diseases increases, the demand for anatomic pathology equipment and supplies is expected to grow, particularly in emerging markets.

Which Factor is Restraining the Demand for the Market?

Lack of Skilled Professionals and Stringent Regulatory Environment

One of the major restraints that could hinder the growth of the anatomic pathology equipment and supplies market is the lack of skilled professionals. Pathology is a highly specialized field that requires a high level of skill and expertise. However, there is a shortage of trained pathologists and laboratory technicians in many parts of the world. This shortage can result in delays in diagnosis and treatment, which can ultimately impact patient outcomes.

Furthermore, the cost of training and education required to become a pathologist or laboratory technician is high, which can act as a deterrent for individuals to pursue this career path. This lack of skilled professionals can limit the adoption of anatomic pathology equipment and supplies and slow down the growth of the market. The anatomic pathology equipment and supplies market is heavily regulated by entities like the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA), which enforce strict guidelines and regulations. These regulations are put in place to ensure the safety and efficacy of equipment and supplies used in anatomic pathology.

Report Segmentation

The market is primarily segmented based on type, end-use, and region.

|

By Type |

By End-Use |

By Region |

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Type Insights

Based on type category analysis, the market has been segmented on the basis of instruments and consumables. The consumables segment captured the largest market share in the anatomic pathology equipment and supplies market primarily due to their recurrent usage and indispensability in diagnostic procedures. Consumables such as reagents, antibodies, kits, and stains are essential for the preparation, staining, and analysis of tissue samples, making them critical to everyday laboratory operations. The high volume of tests conducted for disease diagnosis, cancer research, and routine pathology studies drives the continuous demand for these products.

Additionally, advancements in consumable technologies, such as more sensitive and specific reagents, enhance the accuracy and efficiency of pathological analyses, further propelling their market dominance. The consumables segment's growth is also fueled by the increasing prevalence of chronic diseases and cancer, leading to a higher frequency of diagnostic tests and, consequently, a steady consumption of these supplies.

By End-Use Insights

Based on end-use category analysis, the market has been segmented on the basis of clinical and non-clinical. The clinical segment is seeing a substantial CAGR in the market. This is primarily due to the increasing prevalence of chronic diseases and cancer worldwide, which requires more frequent and advanced diagnostic testing. As a result, there is a growing demand for clinical anatomic pathology services. Advances in personalized medicine and targeted therapies further amplify the need for precise pathological diagnostics to tailor treatments to individual patients. Additionally, technological innovations in pathology equipment, such as automated staining systems and digital pathology solutions, enhance diagnostic accuracy and efficiency, encouraging their adoption in clinical settings. The increasing focus on early disease detection and preventive healthcare also boosts the utilization of anatomic pathology tests in clinical practice.

Anatomic Pathology Equipment & Supplies Market Regional Insights

North America

North America held the largest market share in the anatomic pathology equipment and supplies market since the region boasts a well-established healthcare infrastructure and a high level of investment in medical research and development. The presence of numerous leading biotechnology and pharmaceutical company’s fosters innovation and rapid adoption of advanced pathology equipment and supplies. Additionally, the high prevalence of chronic diseases and cancer in North America drives significant demand for diagnostic and pathological services. Robust healthcare spending, coupled with favorable government policies and funding for cancer research and diagnostics, further supports market growth.

Asia Pacific

The market in the Asia Pacific region is experiencing rapid growth due to the increase in healthcare spending and significant investments in medical infrastructure, driven by rising incomes and improving healthcare access. The growing prevalence of chronic diseases and cancer in densely populated countries such as China and India necessitates enhanced diagnostic capabilities and more frequent pathological examinations. Additionally, increased awareness of early disease detection and the benefits of personalized medicine are fueling demand for advanced pathology equipment and supplies.

Anatomic Pathology Equipment & Supplies Market Competitive Landscape

The competitive landscape of the market is marked by the presence of several key players who dominate through technological innovation, extensive product portfolios, and robust distribution networks. Leading companies leverage their substantial R&D investments to introduce cutting-edge products that enhance diagnostic accuracy and efficiency. The industry giants also engage in strategic mergers, acquisitions, and partnerships to expand their market presence and product offerings. The Anatomic Pathology Equipment & Supplies Market is also characterized by the presence of numerous regional and niche players who provide specialized products and cost-effective solutions, catering to specific market needs and driving competition.

Some of the major players operating in the global market include:

- Agilent Technologies, Inc

- Becton, Dickinson and Company

- BioGenex.

- Bright Instrument Co Limited

- CellPath Ltd.

- Diapath S.p.A.

- Hologic, Inc.

- Jinhua Yidi Medical Appliance Co.,Ltd

- MEDITE Medical GmbH

- Merck KGaA

- PHC Holdings Corporation

- R. K. SCIENTIFIC INSTRUMENT PRIVATE LIMITED

Recent Developments

- In January 2023, Agilent and Akoya Biosciences announced partnership to drive multiplex tissue assay development for biopharma applications.

- In January 2023, CellPath signed an agreement with Dreampath Diagnostics for distribution in UK. Dreampath Diagnostics provides solution for pathology laboratories for innovation solution to help automation, digital traceability and workflow in pathology labs.

- In September 2022, PHC Holdings Corporation acquired Microm Microtech France (MMFrance) and Laurypath in a strategic expansion of Epredia’s presence in Europe.

- In January 2021, Hologic, Inc. has acquired European Molecular Diagnostic company, Diagenode to strengthens the company’s molecular diagnostics business by expanding our international capabilities and to provide more differentiated test menu.

- In June 2019, PHC Holdings Corporation completed acquisition of Anatomical Pathology business of Thermo Fisher Scientific Inc. The business will serve as a global provider of comprehensive solutions in the anatomical pathology sector.

Report Coverage

The anatomic pathology equipment & supplies market report emphasizes on key regions across the globe to provide better understanding of the sealant to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, end-use, and their futuristic growth opportunities.

Anatomic Pathology Equipment & Supplies Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 32,033.08 million |

|

Revenue forecast in 2032 |

USD 59,564.79 million |

|

CAGR |

7.8% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Anatomic Pathology Equipment & Supplies Market report covering key segments are type, end-use, and region.

Anatomic Pathology Equipment & Supplies Market Size Worth USD 59,564.79 Million by 2032

Anatomic Pathology Equipment & Supplies Market exhibiting the CAGR of 7.8% during the forecast period

North America is leading the global market

The key driving factors in Anatomic Pathology Equipment & Supplies Market are Advancement in technology.