Anatomic Pathology Market Share, Size, Trends, Industry Analysis Report

By Product; By Application (Disease Diagnosis, Drug Discovery and Development, Others); By End-Use (Hospitals, Research Laboratories, Diagnostic Laboratories, Others), By Region; Segment Forecast, 2022 - 2030

- Published Date:Feb-2022

- Pages: 112

- Format: PDF

- Report ID: PM2253

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

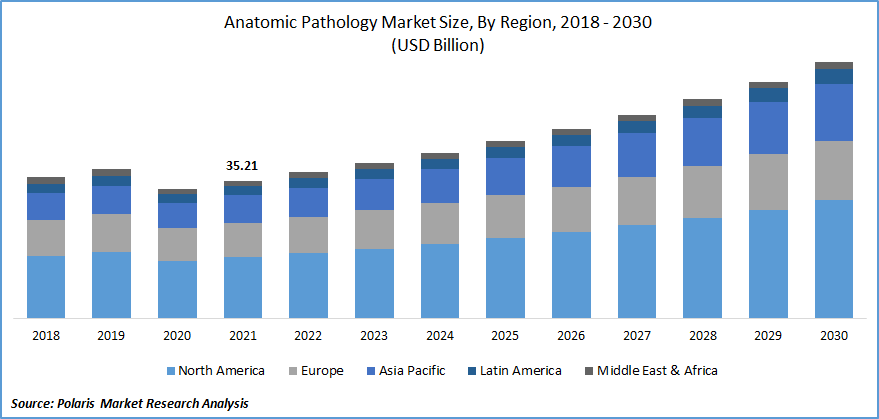

The global anatomic pathology market was valued at USD 35.21 billion in 2021 and is expected to grow at a CAGR of 7.3% during the forecast period. The high incidence of cancer and other target diseases, reimbursement availability, suggestions for cancer screening, and the increased focus on personalized care are all driving the growth of the global anatomic pathology market.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Moreover, emerging economies such as India, China, and Brazil are expected to provide considerable potential possibilities for participants in the global market of anatomic pathology throughout the projected period. Anatomic determines the cause and diagnosis of organ tissues infected by disease-causing microorganisms in order to understand how syndrome affects the structure of human organs, both microscopically and holistically. The approach is frequently used to detect and treat various cancer and tumors. It can also help assess other chronic disorders such as severe infections, liver diseases, autoimmune diseases, and others.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The geriatric population is rapidly growing, as is the incidence rate of cancer and other chronic disorders. Cancer is the world's second-leading cause of death. As per National Cancer Institute, in the U.S., an average of 1,806,590 new cancer cases have been reported in 2020, with 606,520 people dying from the disease.

Similarly, as per the European Society for Medical Oncology, the number of new cancer cases in the EU and EFTA nations is expected to rise by 21.4 percent between 2020 and 2040, from 2.8 million in 2020 to 3.4 million in 2040. Cancer fatalities are expected to increase by 32.2 percent during the same period, from 1.3 million in 2020 to 1.7 million in 2040 which in turn is expected to boost the market of anatomic pathology over the forecast period.

Report Segmentation

The market is primarily segmented on the basis of product, by application, by end-use, and region.

|

By Product |

By Application |

By End-Use |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Product

The consumables sector dominated the anatomic pathology market in 2021. The segment's expansion is fueled by the availability of a wide range of goods and a high rate of consumable utilization in research findings. The low cost and convenient availability of pathology consumables encouraged the segment's growth, boosting the anatomic pathology market growth.

ISH iVIEW Blue Plus; and Instrument Cleaning Kit are some of the most important reagents and kits. Furthermore, the substantial share of this category can be linked to the availability of diagnostic test reimbursements, rapid growth in the geriatric population, and rising cancer and other chronic illness incidences. On the contrary, the instruments segment is further expected to increase due to ongoing technological improvements and ongoing efforts by anatomic pathology market competitors to produce anatomic pathological instruments with superior designs.

Insight by Application

The disease diagnosis category is expected to account for a major market share over the forecast period. Pathology protocols allow researchers to investigate the origin of diseases and their consequences. As a result, anatomic pathology is increasingly being used in illness diagnosis on the market.

The anatomic pathology process aids in discovering a tumor when it is in the inflammatory and growing stromal cells stage, lowering tumor eradication costs. Furthermore, the segment's growth is accelerated by manufacturers' increased focus on launching creative and revolutionary diagnostics techniques. The surging prevalence of chronic diseases like cancer and the growing geriatric population are driving the disease diagnosis segment, boosting the anatomic pathology industry forward.

Geographic Overview

North America accounted for the greatest revenue share in 2021 in the anatomic pathology industry due to the presence of major players and favorable government initiatives connected to pathological training programs. Further, the rising healthcare expenditures, favorable reimbursement scenarios for diagnostic tests, and government initiatives for cancer screening in the region are all major factors driving the region's growth.

Asia Pacific is expected to grow at a significant share over the forecast period, owing to an increase in the senior population base and the incidence of chronic diseases across the areas. For instance: according to AgeingAsia.org, the number of populations aged 60 and above was 11,988,000 in 2019 and is expected to rise by 29,841,000 in 2050. Also, the total percentage of the population aged 60 and above was 12.3% in 2019 and is expected to increase by 27.2 % in 2050.

Competitive Insight

Abcam plc, Agilent Technologies, Amos Scientific Pty Ltd., Beckton, Bio SB, BioGenex, Bright Instruments, Cardinal Health, Cell Signaling Technology, Inc., CellPath Ltd., Danaher Corporation, Diapath S.p.A, Dickson and Company, F. Hoffmann-La Roche AG, Histo-Line Laboratories, Hologic, Inc., Jinhua Yidi Medical Equipment Co., Ltd., Laboratory Corporation of America Holdings, Lupetec, Medimeas, MEDITE Medical GmbH, Merck KGaA, MICROS AUSTRIA, Milestone Medical, NeoGenomics Laboratories, Inc., PHC Holdings Corporation, Quest Diagnostics Incorporated, R. K. SCIENTIFIC INSTRUMENT PRIVATE LIMITED, Sakura Finetek, Sakura Finetek USA, Inc., and SLEE medical GmbH are some of the major market players operating in the anatomic pathology market.

Anatomic Pathology Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 35.21 billion |

|

Revenue forecast in 2030 |

USD 65.54 million |

|

CAGR |

7.3% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By Application, By End-Use, By By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Amos Scientific Pty Ltd., Beckton, Bio SB, BioGenex, Bright Instruments, Cardinal Health, Cell Signaling Technology, Inc., CellPath Ltd., Danaher Corporation, Diapath S.p.A, Dickson and Company, F. Hoffmann-La Roche AG, Histo-Line Laboratories, Hologic, Inc., Jinhua Yidi Medical Equipment Co., Ltd., Laboratory Corporation of America Holdings, Lupetec, Medimeas, MEDITE Medical GmbH, Merck KGaA, MICROS AUSTRIA, Milestone Medical, NeoGenomics Laboratories, Inc., PHC Holdings Corporation, Quest Diagnostics Incorporated, R. K. SCIENTIFIC INSTRUMENT PRIVATE LIMITED, Sakura Finetek, Sakura Finetek USA, Inc., and SLEE medical GmbH |