Animal Genetics Market Size, Share, & Industry Analysis Report

: By Animal (Poultry, Porcine, Bovine, Canine, and Other Animals), Genetic Material, Genetic Testing Services, and Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 115

- Format: PDF

- Report ID: PM3975

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

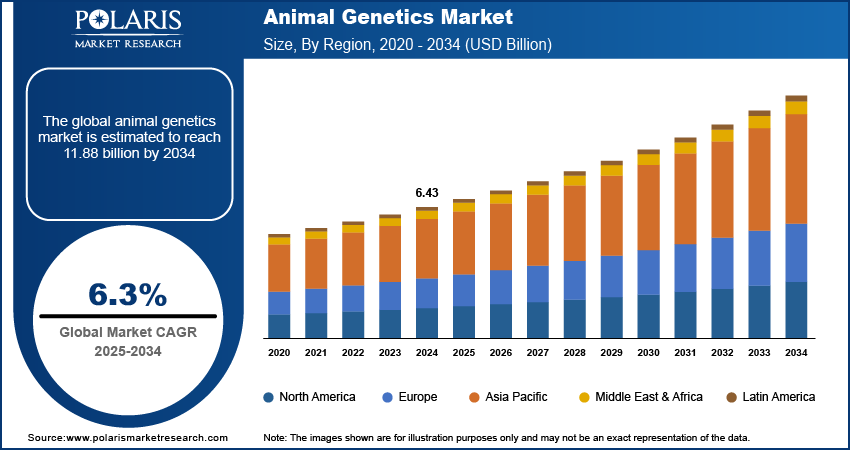

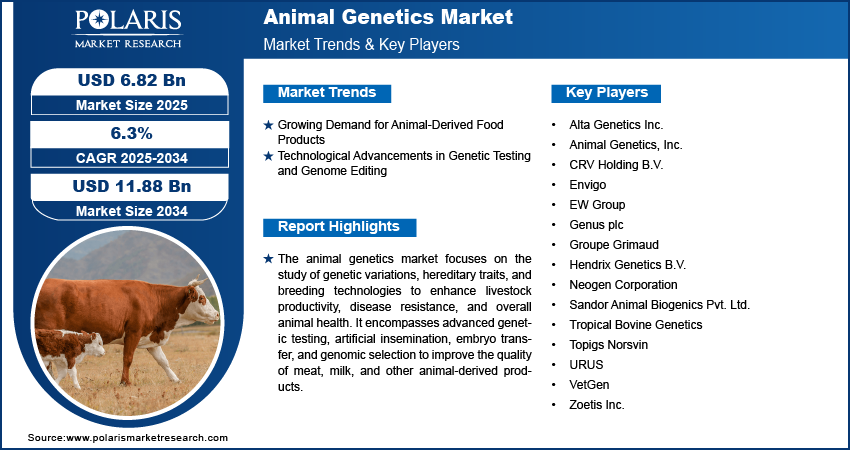

The animal genetics market size was valued at USD 6.43 billion in 2024. The animal genetics industry is projected to grow from USD 6.82 billion in 2025 to USD 11.88 billion by 2034, exhibiting a CAGR of 6.3% during 2025–2034. The market is driven by increasing demand for high-quality animal protein, advancements in genetic technologies, rising awareness of livestock health, growing adoption of artificial insemination, and the need for disease-resistant, high-yielding breeds to enhance productivity and profitability.

Key Insights

- The therapeutics segment leads the nanomedicine market, driven by its broad application in treating cancer, chronic illnesses, and wound healing, alongside increasing demand for precision therapies that enhance efficacy while minimizing side effects.

- Clinical oncology holds the largest share of the nanomedicine market, fueled by the global rise in cancer cases and the growing need for targeted, minimally invasive treatments that improve patient outcomes and reduce systemic toxicity.

- North America dominates global nanomedicine revenue, supported by robust R\&D funding, a strong presence of top pharmaceutical and biotech firms, and advanced healthcare infrastructure that accelerates innovation and early adoption of nanomedical technologies.

- Europe remains a key player in the nanomedicine market, backed by substantial research funding, collaborative academic-industry efforts, and a mature healthcare system that fosters clinical translation and regulatory support for emerging nano therapies.

- Asia Pacific is witnessing rapid growth in the nanomedicine sector, propelled by expanding healthcare needs, increasing investment in biotech research, and growing government focus on modernizing healthcare through advanced medical technologies and infrastructure development.

Industry Dynamics

- Rising demand for advanced, targeted therapies is driving nanomedicine adoption, as patients and healthcare providers seek more effective treatments with fewer side effects for chronic diseases and complex medical conditions.

- Expanding use of nanomedicine in oncology and personalized treatment is creating new growth opportunities, offering precision drug delivery systems that improve therapeutic outcomes and reduce toxicity in cancer care.

- Regulatory challenges, high development costs, and limited clinical data on long-term safety and efficacy hinder broader nanomedicine adoption, particularly in markets with strict medical standards and approval processes.

- Technological advancements in nanocarriers and drug delivery systems are promoting innovation, enabling more efficient, site-specific therapies that align with the healthcare industry's shift toward precision medicine and improved patient outcomes.

Market Statistics

- 2024 Market Size: USD 6.43 billion

- 2034 Projected Market Size: USD 11.88 billion

- CAGR (2025-2034): 6.3%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The animal genetics market focuses on the study of genetic variation and inheritance in animals, primarily for improving breeding, reproduction, and disease resistance. This market encompasses genetic testing, artificial insemination, embryo transfer, and DNA sequencing technologies to enhance livestock productivity and quality. It plays a crucial role in the agriculture, veterinary, and research sectors by supporting advancements in animal health, meat and dairy production, and companion animal breeding. The market is driven by technological advancements, increasing demand for high-quality animal protein, and rising investments in genetic research.

Key drivers of the market include technological advancements in genetic testing and genome editing tools, such as CRISPR, which are facilitating precise genetic modifications to enhance productivity and disease resistance. Additionally, rising awareness of animal health and welfare, coupled with government initiatives supporting sustainable livestock farming, further contributes to animal genetics market growth.

Market Dynamics

Growing Demand for Animal-Derived Food Products

The increasing global population and rising urbanization have led to a heightened demand for animal-derived food products such as meat, milk, and eggs. This surge necessitates advancements in animal genetics to enhance livestock productivity and meet consumer needs. For instance, the Food and Agriculture Organization (FAO) reported that over the past 30 years, global milk production has experienced a significant upsurge, rising by over 77%. Production escalated from 524 million metric tons in 1992 to approximately 930 million metric tons by 2022. This significant production underscores the role of genetic improvements in meeting the escalating demand for animal-based proteins.

Technological Advancements in Genetic Testing and Genome Editing

Innovations in genetic testing and genome editing technologies, such as CRISPR-Cas9, have revolutionized the animal genetics market. These tools enable precise modifications to enhance desirable traits such as disease resistance and productivity in livestock. In March 2022, the US Food and Drug Administration (FDA) declared no safety concerns regarding two gene-edited beef cattle produced by Acceligen, paving the way for their introduction into the US market. This development highlights the potential of advanced genetic technologies in improving livestock quality and production efficiency.

Segment Insights

By Animal Insights

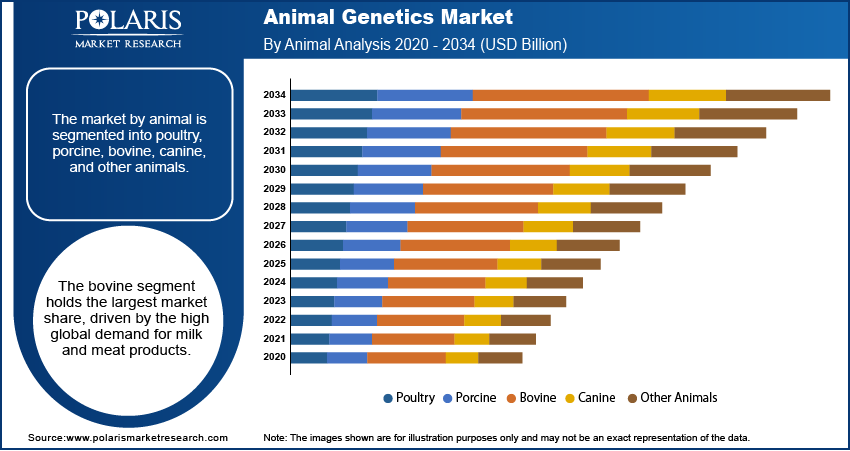

The animal genetics market segmentation, based on animal, includes poultry, porcine, bovine, canine, and other animals. The bovine segment holds the largest market share, driven by the high global demand for milk and meat products. Advancements in genetic technologies have enabled the development of cattle breeds with enhanced productivity and disease resistance, meeting the increasing consumer demand for high-quality dairy and beef products. Additionally, the bovine industry's focus on sustainable farming practices and precision livestock breeding has further propelled the adoption of genetic solutions to improve herd performance and efficiency.

By Genetic Material Outlook

The animal genetics market is segmented by genetic material into semen and embryo. The semen segment holds the largest market share. This surge is driven by the increasing utilization of artificial insemination (AI) and semen sexing technologies in the breeding of cattle, sheep, pigs, and goats. AI facilitates the dissemination of superior genetics without the need for transporting live animals, thereby reducing logistical challenges and enhancing biosecurity measures. The growing awareness of genetic advancements and their role in improving livestock performance has led to a heightened demand for high-quality semen, propelling the expansion of this segment.

Regional Analysis

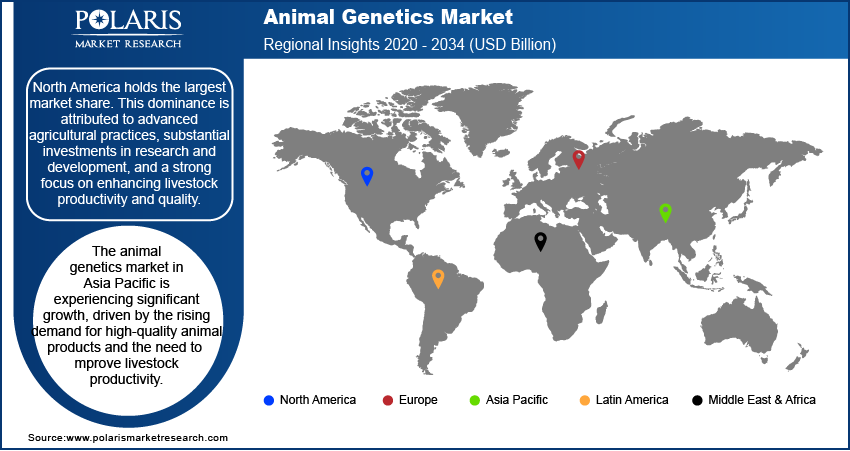

By region, the study provides animal genetics market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share. This dominance is attributed to advanced agricultural practices, substantial investments in research and development, and a strong focus on enhancing livestock productivity and quality. The presence of key industry players, such as Neogen Corporation and Zoetis Inc., further boosts the market in this region. Additionally, the adoption of advanced genetic technologies and a well-established infrastructure for genetic testing and breeding contribute to North America's leading position in the market.

The animal genetics market in Asia Pacific is experiencing significant growth, driven by the rising demand for high-quality animal products and the need to improve livestock productivity. Countries such as China and India are investing heavily in genetic research and breeding programs to enhance the performance of their livestock populations. The region's diverse agricultural landscape presents unique opportunities for genetic advancements tailored to specific local needs. Furthermore, the increasing awareness of the benefits of genetic improvements among farmers and the support from governmental initiatives contribute to the expansion of the market in this region.

Key Players and Competitive Insights

Several key players in the market are actively contributing to advancements in genetic research and breeding technologies. Notable players in this industry include Alta Genetics Inc.; Animal Genetics, Inc.; CRV Holding B.V.; Envigo; EW Group; Genus plc; Groupe Grimaud; Hendrix Genetics B.V.; Neogen Corporation; Sandor Animal Biogenics Pvt. Ltd.; Tropical Bovine Genetics; Topigs Norsvin; URUS; VetGen; and Zoetis Inc.

These companies collectively drive innovation in the market by developing and implementing advanced genetic testing, selective breeding programs, and biotechnological applications. Their efforts aim to enhance desirable traits in livestock and companion animals, such as disease resistance, productivity, and overall health. Through extensive research and development, these organizations contribute to the sustainability and efficiency of animal agriculture, addressing the growing global demand for animal-derived products.

The competitive landscape is characterized by strategic collaborations, mergers, and acquisitions, enabling companies to expand their product portfolios and global reach. Continuous investment in research and development facilitates the introduction of innovative solutions, maintaining a dynamic and evolving market environment. As these key players strive to meet industry challenges, their contributions significantly impact the advancement of animal genetics and the broader field of animal health and production.

Genus plc is a global leader in animal genetics. It specializes in developing advanced breeding programs for livestock to enhance meat and milk production. Operating through divisions such as Genus ABS for cattle and Genus PIC for pigs, the company leverages genomic science and biotechnology to provide farmers with high-quality breeding stock. Its focus on sustainable agricultural practices aims to improve animal health and productivity worldwide.

Neogen Corporation, headquartered in Lansing, Michigan, offers a comprehensive range of products dedicated to food and animal safety. Their portfolio includes diagnostic test kits, veterinary instruments, pharmaceuticals, and genomics services. Neogen serves diverse markets, providing solutions that aid in the detection of contaminants and the enhancement of animal health, thereby supporting the global food supply chain.

List of Key Companies

- Alta Genetics Inc.

- Animal Genetics, Inc.

- CRV Holding B.V.

- Envigo

- EW Group

- Genus plc

- Groupe Grimaud

- Hendrix Genetics B.V.

- Neogen Corporation

- Sandor Animal Biogenics Pvt. Ltd.

- Topigs Norsvin

- Tropical Bovine Genetics

- URUS

- VetGen

- Zoetis Inc.

Market Development

- June 2022: Zoetis announced the completion of its acquisition of Basepaws, a petcare genetics company. This acquisition enhanced Zoetis's portfolio of precision animal health solutions.

Market Segmentation

By Animal Outlook (Revenue-USD Billion, 2020–2034)

- Poultry

- Porcine

- Bovine

- Canine

- Other Animals

By Genetic Material Outlook (Revenue-USD Billion, 2020–2034)

- Semen

- Embryo

By Genetic Testing Services Outlook (Revenue-USD Billion, 2020–2034)

- Genetic Disease Test

- Genetic Trait

- Test DNA Typing

- Other Services

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest f Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest f Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest f Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest f Latin America

Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 6.43 billion |

|

Market Size Value in 2025 |

USD 6.82 billion |

|

Revenue Forecast by 2034 |

USD 11.88 billion |

|

CAGR |

6.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

By Genetic Material By Genetic Testing Services |

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is Report Valuable for Organization?

Workflow/Innovation Strategy: The animal genetics market has been segmented into detailed segments of animal, genetic material, and, genetic testing services. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy: The growth and marketing strategy in the market focuses on research and development investments, strategic collaborations, and geographic expansion. Companies are adopting advanced genomic technologies to enhance breeding efficiency and improve livestock productivity. Partnerships with research institutions and acquisitions of specialized firms are strengthening market presence and expanding service portfolios. Additionally, increasing awareness through digital marketing, educational programs, and direct engagement with farmers and breeders is driving adoption. Regulatory approvals and compliance with international breeding standards further support market expansion in various regions.

FAQ's

The animal genetics market size was valued at USD 6.43 billion in 2024 and is projected to grow to USD 11.88 billion by 2034.

The market is projected to register a CAGR of 6.3% during the forecast period, 2025-2034.

North America had the largest share of the market.

The market key Players include Alta Genetics Inc.; Animal Genetics, Inc.; CRV Holding B.V.; Envigo; EW Group; Genus plc; Groupe Grimaud; Hendrix Genetics B.V.; Neogen Corporation; Sandor Animal Biogenics Pvt. Ltd.; Tropical Bovine Genetics; Topigs Norsvin; URUS; VetGen; and Zoetis Inc.

The bovine segment accounted for the larger share of the market in 2024.

The semen segment accounted for the larger share of the market in 2024.