Livestock Monitoring Market Size, Share, Trends, Industry Analysis Report

: By Animal Type (Cattle, Poultry, Swine, Equine, and Others), By Component, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 118

- Format: PDF

- Report ID: PM1783

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

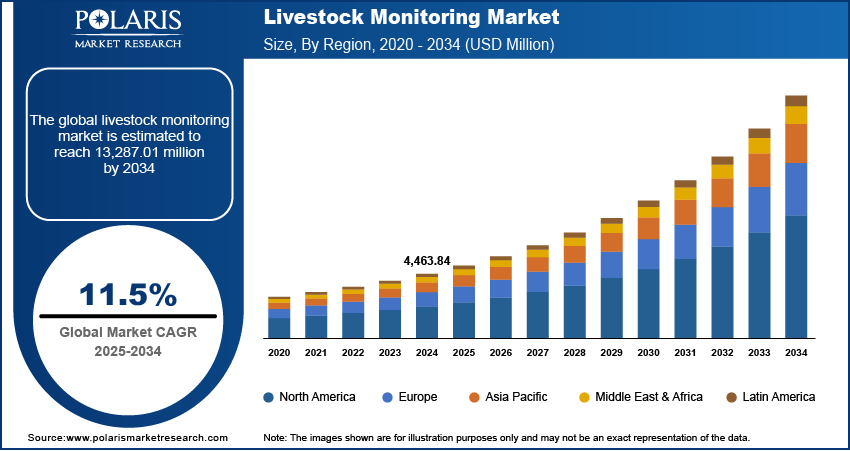

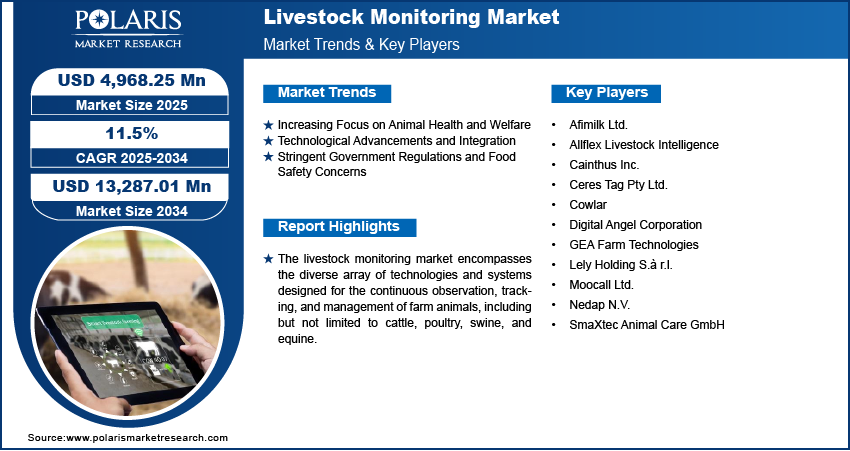

The livestock monitoring market size was valued at USD 4,463.84 million in 2024, growing at a CAGR of 11.5% during 2025–2034. The rising global demand for animal products, growing integration of advanced technologies, and increased focus on sustainable farming practices are the key factors driving market expansion.

Key Insights

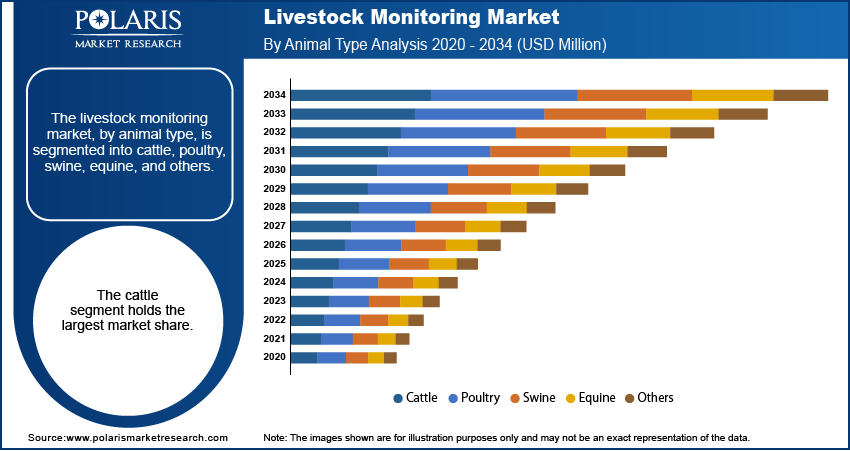

- The cattle segment accounts for the largest share. Cattle are a primary focus for livestock management solutions, owing to the substantial global population of cattle raised for meat and dairy production.

- The hardware segment dominates the market, owing to the fundamental requirement of physical devices for collecting data and monitoring livestock.

- The behavior monitoring segment is projected to register the highest growth rate, primarily due to the growing understanding of the connection between animal behavior and their health, productivity, and welfare.

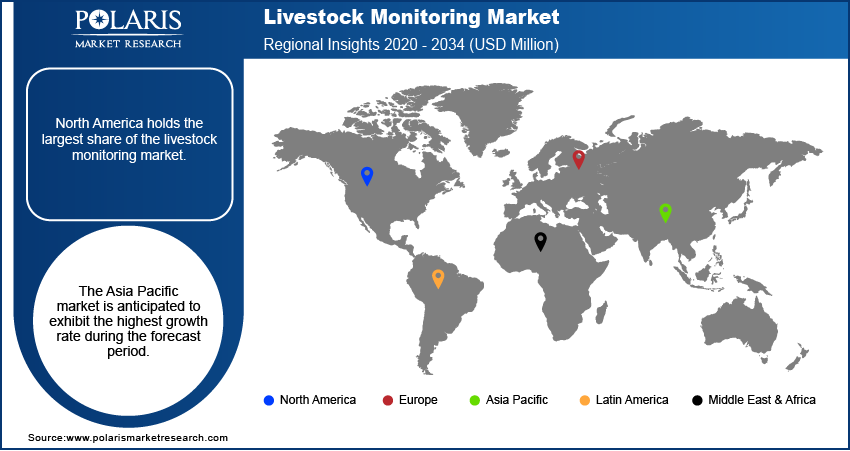

- North America leads the market, primarily due to the presence of well-established large-scale livestock farms in the region.

- Asia Pacific is projected to register the highest growth rate during the projection period. The regional market growth is driven by the growing livestock population in countries like India and China.

Industry Dynamics

- The growing global emphasis on animal health and welfare has prompted consumers and regulatory bodies to push for better living conditions and proactive health management, driving market growth.

- Technological advancements have enabled the development of more advanced livestock monitoring solutions that provide real-time, actionable insights, fueling market expansion.

- Growing emphasis on improving farm efficiency is projected to provide several market opportunities in the coming years.

- Limited internet connectivity may present market challenges.

Market Statistics

2024 Market Size: USD 4,463.84 million

2034 Projected Market Size: USD 13,287.01 million

CAGR (2025-2034): 11.5%

North America: Largest Market in 2024

AI Impact on Livestock Monitoring Market

- AI analyzes sensor and camera data to monitor animal health, behavior, and activity in real time.

- Machine learning models detect early signs of illness or stress, enabling timely interventions.

- AI-powered platforms optimize feeding, breeding, and resource management, improving productivity and sustainability.

- Continuous AI learning enhances predictive capabilities, helping farmers reduce losses and improve overall herd management efficiency.

To Understand More About this Research: Request a Free Sample Report

The livestock monitoring market encompasses the technologies and systems utilized for the systematic observation, tracking, and management of livestock such as cattle, poultry, swine, and equine. These systems employ a variety of tools, including sensors, GPS, Radio-Frequency Identification (RFID) tags, cameras, and data analytics platforms, to gather real-time information on various aspects of animal health, behavior, location, and environmental conditions. The primary aim of livestock monitoring is to optimize farm operations, enhance animal productivity, improve health management, and increase the overall efficiency of livestock-related activities within the agricultural sector. This market is experiencing significant growth, driven by a confluence of factors that are transforming traditional animal husbandry practices.

Increasing global demand for meat, dairy, and other animal products necessitates more efficient and productive livestock management practices, making monitoring solutions crucial for optimizing output. Technological advancements, particularly the integration of the Internet of Things (IoT), Artificial Intelligence (AI), and sensor technologies, have enabled more precise and real-time data collection and analysis, providing valuable insights for farmers. Furthermore, a growing emphasis on animal welfare and health, coupled with stringent regulations regarding food safety and traceability, is encouraging the adoption of livestock monitoring systems to ensure healthier and safer livestock. The ability of these systems to facilitate early disease detection and improve overall herd health contributes significantly to the livestock monitoring market expansion. Additionally, the increasing focus on sustainable farming practices and the need to minimize environmental impact are driving the demand for livestock monitoring solutions that can optimize resource utilization and reduce waste.

Market Dynamics

Increasing Focus on Animal Health and Welfare

A significant driver of the livestock monitoring market development is the growing global emphasis on animal health and welfare. Consumers and regulatory bodies are increasingly concerned about the well-being of livestock, pushing for better living conditions and proactive health management. Livestock monitoring technologies play a crucial role in achieving these standards by enabling continuous observation of animals, facilitating early detection of diseases, injuries, or distress. Healthy and well-cared-for animals are more productive. Monitoring systems can optimize feeding, detect estrus for timely breeding, and identify early signs of discomfort or stress, leading to improved overall efficiency and output. Dairy farms using activity monitoring have reported a 5–10% increase in milk yield.

A study published in PubMed Central in 2023 highlighted the development of a computer vision platform (NUtrack) capable of identifying and continuously monitoring specific behaviors of group-housed pigs, which can indicate health issues. The system achieved high accuracy in identifying individual animals and classifying their behaviors, suggesting its potential as a real-time precision livestock tool for early detection of health problems. This ability to proactively address health concerns and improve animal welfare through continuous monitoring is significantly driving the demand for livestock monitoring solutions.

Technological Advancements and Integration

The livestock monitoring market growth is fueled by rapid technological advancements and their seamless integration into livestock management practices. Innovations in sensor technology, the Internet of Things (IoT), Artificial Intelligence (AI), and data analytics are enabling the development of sophisticated monitoring systems that provide real-time, actionable insights. A research article published in PubMed Central in 2024 discussed Precision Livestock Farming (PLF), which encompasses the use of sensors to capture biological information, algorithms to process this data, and interfaces for utilizing these insights. The paper emphasizes that PLF offers opportunities for early disease detection, more objective and consistent data collection, prediction of animal health and welfare risks, and increased efficiency in animal production. The integration of these advanced technologies is making livestock monitoring more effective and user-friendly, consequently accelerating the penetration of livestock monitoring solutions across the livestock industry.

Stringent Government Regulations and Food Safety Concerns

Increasingly stringent government regulations concerning food safety, animal traceability, and disease control are acting as a major driver for the livestock monitoring market demand. Governments worldwide are implementing policies to ensure the safety and quality of animal products and to prevent the spread of zoonotic diseases. Livestock monitoring systems provide the necessary tools for compliance by offering comprehensive tracking of animal health, location, and environmental conditions. For example, an article in PubMed Central in 2021 highlighted the European Union's legislation on the mandatory identification and registration of goats and sheep, emphasizing the growing regulatory focus on animal traceability. The ability of livestock monitoring technologies to facilitate adherence to these regulations and enhance food safety standards is a critical factor propelling their adoption.

Segment Insights

Market Assessment – By Animal Type

The market, by animal type, is segmented into cattle, poultry, swine, equine, and others. The cattle segment holds the largest livestock monitoring market share. This dominance can be attributed to the substantial global population of cattle raised for meat and dairy production, making it a primary focus for livestock management solutions. The widespread adoption of monitoring technologies in cattle farming is driven by the need for efficient herd management, early detection of diseases that can impact large populations, and optimization of milk and meat yields. Furthermore, the relatively higher value per head of cattle compared to other livestock types often justifies the investment in advanced monitoring systems, contributing to the dominance of the cattle segment.

The poultry segment is anticipated to exhibit the highest growth rate in the coming years. This rapid expansion is fueled by the increasing global demand for poultry meat and eggs, leading to large-scale industrial farming practices. The intensive nature of poultry farming necessitates advanced monitoring solutions to optimize environmental conditions, track bird health at scale, and improve overall operational efficiency. Factors such as the shorter production cycles in poultry farming, coupled with the potential for rapid disease spread within large flocks, are driving significant investments in sophisticated monitoring technologies. This focus on maximizing productivity and minimizing losses in the poultry sector will boost the segment growth during the forecast period.

Market Evaluation – By Component

The market, by component, is segmented into hardware, software, and services. The hardware segment accounts for the largest revenue share. This is primarily due to the fundamental requirement of physical devices such as sensors, tags, cameras, and communication modules for data collection in livestock monitoring. The initial investment in these tangible components forms a significant part of the overall cost of implementing a livestock monitoring system, thus contributing to the substantial growth of the hardware segment. The necessity for robust and reliable hardware to withstand diverse environmental conditions in livestock farming further underpins its dominant position.

The software and services segments are expected to demonstrate the highest growth rate during the forecast period. This rapid growth is driven by the increasing sophistication of monitoring systems and the growing need for advanced data analytics, visualization, and actionable insights. The value derived from livestock monitoring is increasingly dependent on the capabilities of the software platforms to process the data collected by the hardware, providing meaningful information for farm management. Furthermore, the demand for related services such as installation, maintenance, data management, and consulting is also on the rise as end users seek comprehensive solutions, contributing to the accelerated growth of the software and services segments.

Market Assessment – By Application

The market, by application, is segmented into milk harvesting, breeding management, feeding management, animal health monitoring & comfort, heat stress, behavior monitoring, and others. The animal health monitoring & comfort segment holds the largest share, driven by the critical need to ensure the well-being of livestock, reduce disease outbreaks, and optimize their overall comfort for enhanced productivity. The ability of monitoring technologies to provide early warnings of health issues, track vital signs, and manage environmental conditions directly impacting animal comfort makes it a fundamental application area with widespread adoption across various livestock types.

The behavior monitoring segment is anticipated to exhibit the highest growth rate. This rapid expansion is fueled by an increasing understanding of the intricate link between animal behavior and their health, welfare, and productivity. Advanced technologies such as AI-powered video analytics and sophisticated sensor data processing are enabling more detailed and nuanced insights into animal behavior patterns. The ability to detect subtle changes in behavior that may indicate early signs of illness, stress, or estrus is driving significant interest and investment in behavior monitoring applications, positioning it for the most accelerated market development in the coming years.

Regional Analysis

The market demonstrates varied adoption and growth trajectories across different geographical regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Factors such as the prevalence of large-scale livestock farming, technological infrastructure, government initiatives promoting smart agricultural modernization, and the level of awareness regarding animal welfare and precision livestock farming practices influence regional market dynamics. While some regions exhibit mature market penetration, others present significant potential due to rapidly expanding livestock populations and increasing investments in agricultural technology. The market dynamics differ across these regions, shaping the overall global industry outlook.

North America holds the largest share of the livestock monitoring market revenue. This dominance is attributed to the region's well-established large-scale livestock farms, particularly in the US and Canada, and the high adoption rate of advanced and AI in agriculture. Furthermore, stringent regulations related to food safety and animal welfare, coupled with a strong focus on optimizing farm efficiency and productivity, have propelled the demand for sophisticated livestock monitoring solutions. The presence of key players and a robust technological infrastructure further contribute to North America's leading position in terms of market size and penetration.

The Asia Pacific market is anticipated to exhibit the highest growth rate during the forecast period. This growth is driven by the increasing livestock population in countries such as China and India, coupled with a growing awareness of the benefits of livestock monitoring technologies in improving farm productivity and animal health. Government initiatives promoting agricultural modernization and the rising disposable incomes leading to increased demand for animal products are also significant growth factors in this region. As technological adoption accelerates and the need for efficient livestock management intensifies, Asia Pacific is expected to witness the most dynamic market trends in the coming years.

Key Players and Competitive Insights

A few major players actively operating in the market include Afimilk Ltd. (DeLaval Holding AB), Allflex Livestock Intelligence (Antelliq Corporation), Cainthus Inc., Ceres Tag Pty Ltd., Cowlar (Stellapps Technologies Private Limited), Digital Angel Corporation (Datamars SA), GEA Farm Technologies (GEA Group Aktiengesellschaft), Lely Holding S.à r.l., Moocall Ltd., Nedap N.V., and SmaXtec Animal Care GmbH. These companies are at the forefront of developing and deploying various livestock monitoring solutions, catering to different animal types and application areas within the market.

The competitive landscape is characterized by a mix of established agricultural technology providers and innovative startups. Competition is driven by factors such as product innovation, the breadth of offerings, technological advancements, and the ability to provide integrated solutions that address the diverse needs of livestock farmers. Companies are focusing on developing user-friendly platforms, enhancing data analytics capabilities, and expanding their product portfolios to include a wider range of monitoring parameters. Strategic collaborations, partnerships, and a focus on providing value-added services are also key aspects of the competitive environment as players strive to gain a stronger market penetration and cater to the evolving demand trends.

Afimilk Ltd., a part of DeLaval Holding AB and located in Israel, provides comprehensive dairy farm management solutions, including advanced milk analysis, herd management software, and various sensor-based livestock monitoring systems. Their offerings encompass solutions for milk harvesting optimization, animal health monitoring, and reproduction management, making them a relevant player in enhancing efficiency and productivity for dairy farmers in the market.

Allflex Livestock Intelligence, a business unit of Antelliq Corporation and headquartered in France, specializes in the design, development, manufacturing, and delivery of animal and livestock identification and monitoring solutions. Their extensive portfolio includes ear tags, readers, and a range of monitoring devices and software platforms that track animal health, behavior, and location across different livestock species. This broad offering positions them as a significant contributor to traceability and management within the market.

List of Key Companies

- Afimilk Ltd.

- Allflex Livestock Intelligence

- Cainthus Inc.

- Ceres Tag Pty Ltd.

- Cowlar

- Digital Angel Corporation

- GEA Farm Technologies

- Lely Holding S.à r.l.

- Moocall Ltd.

- Nedap N.V.

- SmaXtec Animal Care GmbH

Livestock Monitoring Industry Developments

- June 2025: Globalstar expanded its collaboration with CERES TAG, enhancing satellite-based livestock tracking amid New World Screwworm risks, delivering continuous connectivity, real-time traceability, and biosecurity insights to protect herds across remote ranching areas.

- December 2024: Netherlands-based CowManager introduced the Youngstock Monitor, an AI-driven tool designed to track and analyze calf behavior. The system delivers real-time alerts for early disease detection, aiding in better health management, minimizing treatment needs and mortality, and boosting overall herd productivity.

- November 2024: Germany’s GEA Group launched an AI-powered cattle eye solution featuring Body Condition Scoring for dairy farms. This technology offers real-time health evaluations by detecting lameness and assessing body condition scores, helping optimize herd management, prevent metabolic disorders, and enhance productivity.

Market Segmentation

By Animal Type Outlook (Revenue-USD Million, 2020–2034)

- Cattle

- Poultry

- Swine

- Equine

- Others

By Component Outlook (Revenue-USD Million, 2020–2034)

- Hardware

- Software

- Services

By Application Outlook (Revenue-USD Million, 2020–2034)

- Milk Harvesting

- Breeding Management

- Feeding Management

- Animal Health Monitoring & Comfort

- Heat Stress

- Behavior Monitoring

- Others

By Regional Outlook (Revenue-USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest f Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest f Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest f Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest f Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 4,463.84 million |

|

Market Size Value in 2025 |

USD 4,968.25 million |

|

Revenue Forecast by 2034 |

USD 13,287.01 million |

|

CAGR |

11.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The livestock monitoring market has been segmented into detailed segments of animal type, component, and application. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Entry Strategies: Growth strategies are centered on technological innovation, expanding product portfolios to cater to diverse animal types and applications, and forging strategic partnerships for broader market penetration. Companies are increasingly focusing on integrating AI and advanced analytics to offer more predictive and actionable insights to farmers. Marketing efforts emphasize the return on investment through improved animal health, increased productivity, and optimized resource management. Educational initiatives and demonstrations highlighting the practical benefits of livestock monitoring technologies are crucial for driving adoption, particularly among traditional farming communities. Furthermore, tailoring solutions to specific regional needs and regulatory landscapes is a key aspect of successful market development.

FAQ's

The market size was valued at USD 4,463.84 million in 2024 and is projected to grow to USD 13,287.01 million by 2034.

The market is projected to register a CAGR of 11.5% during the forecast period.

North America held the largest share of the market in 2024.

A few key players include Afimilk Ltd. (DeLaval Holding AB), Allflex Livestock Intelligence (Antelliq Corporation), Cainthus Inc., Ceres Tag Pty Ltd., Cowlar (Stellapps Technologies Private Limited), Digital Angel Corporation (Datamars SA), GEA Farm Technologies (GEA Group Aktiengesellschaft), Lely Holding S.à r.l., Moocall Ltd., Nedap N.V., and SmaXtec Animal Care GmbH

The cattle segment accounted for the largest share in 2024.

Following are a few of the trends: ? Increasing Adoption of IoT and Sensor Technologies: The proliferation of cost-effective and advanced sensors, coupled with the expanding Internet of Things (IoT) infrastructure, is enabling real-time data collection from livestock. This forms the foundation for various monitoring applications. ? Integration of Artificial Intelligence (AI) and Machine Learning (ML): AI and ML algorithms are being increasingly employed to analyze the vast amounts of data generated by monitoring systems. This enables predictive analytics for disease detection, behavior analysis, and optimization of feeding and breeding practices, providing valuable market insights. ? Focus on Precision Farming: There is a growing emphasis on this, which utilizes technology to manage individual animals or small groups within a larger herd. This approach allows for more targeted interventions, improving efficiency and sustainability.

Livestock monitoring refers to the use of technology and systems to observe, track, and manage livestock animals such as cattle, poultry, swine, and horses. These systems employ various tools such as sensors, GPS trackers, RFID tags, cameras, and software platforms to collect real-time data on different aspects of the animals. This data can include their location, health indicators (such as body temperature or activity levels), behavior patterns (feeding and movement), and environmental conditions. The primary goal of livestock monitoring is to improve animal welfare, optimize farm operations, enhance productivity (such as milk or meat yield), enable early detection of diseases, and ensure better overall management of livestock. It provides farmers with valuable insights to make more informed decisions regarding their animals.