Artificial Intelligence in Agriculture Market Share, Size, Trends, Industry Analysis Report

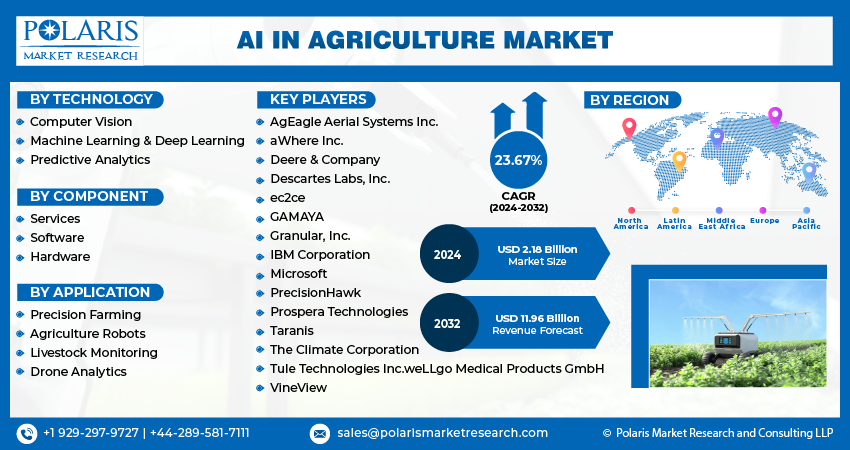

By Technology (Computer Vision, Machine Learning & Deep Learning, and Predictive Analytics); By Application; By Component; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 114

- Format: PDF

- Report ID: PM3922

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

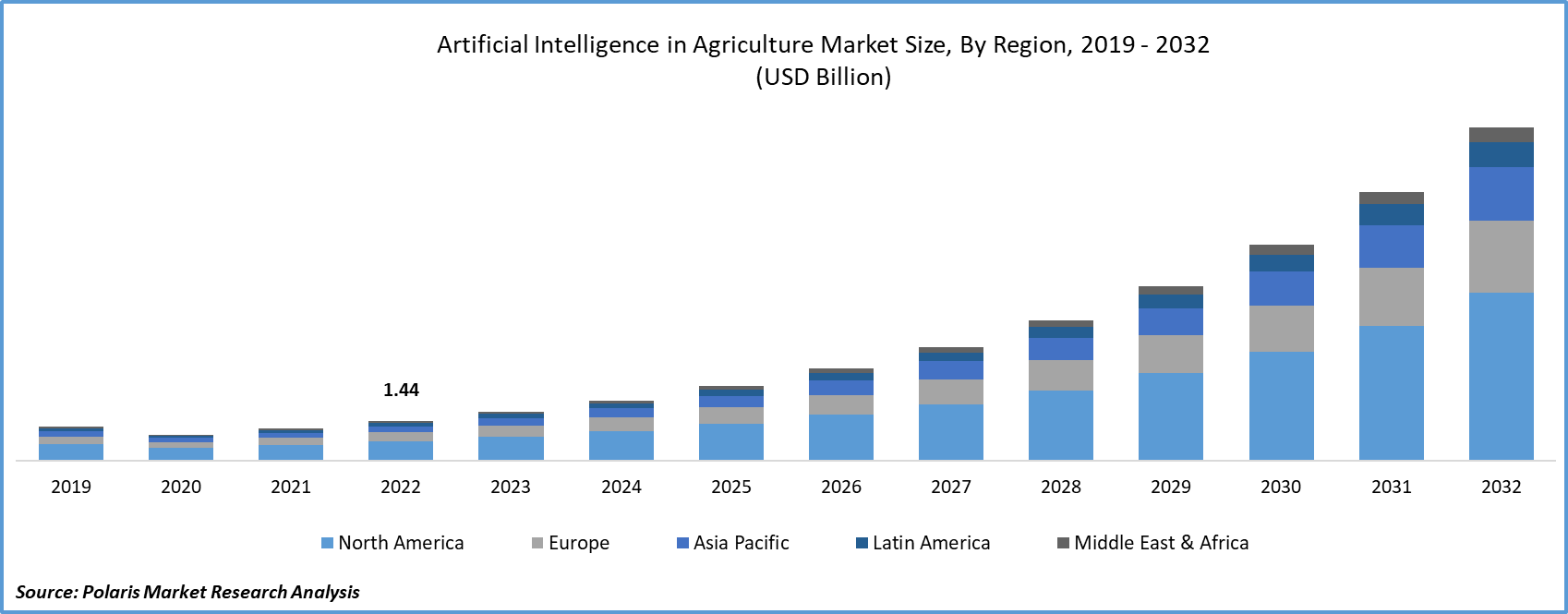

The global artificial intelligence in agriculture market size and share was valued at USD 1.77 billion in 2023 and is expected to grow at a CAGR of 23.67% during the forecast period.

Artificial Intelligence (AI) has become a game-changing influence in the agricultural industry, fundamentally reshaping the methods employed in farming and its associated processes. The adoption of AI tools, including machine learning, computer vision, and data analytics, is instrumental in surmounting these challenges and unleashing the complete capabilities of agriculture. AI's role in agriculture extends beyond traditional farming techniques, empowering farmers and those involved in agriculture to harness data-driven insights and intelligent choices to elevate productivity, streamline resource deployment, and tackle a range of agronomic concerns.

Product innovations, technological advancements, and the introduction of regulatory policies have been detailed in the report to enable businesses to make more informed decisions. Furthermore, the impact of the COVID-19 pandemic on the Artificial Intelligence in Agriculture Market demand has been examined in the study. The report is a must-read for anyone looking to develop effective strategies and stay ahead of the curve.

The process of agriculture includes several activities. They include soil preparation, sowing of seeds, fertilizer application, irrigation, weed protection, harvesting and storage. All of these steps need extensive preparation and consideration of several things. Also, some steps are labor-intensive and necessitate a large number of laborers. As such, managing these activities using traditional methods can be both hectic and time-consuming. Artificial Intelligence (AI) has the potential to address several challenges associated with conventional farming methods.

Artificial Intelligence (AI) has numerous applications in the agriculture sector. It can be used to analyze weather conditions using weather forecasting to determine which crops to grow. Another application of AI in agriculture is in soil and crop health monitoring systems to detect nutrient deficiency in soil. Industry players in the artificial intelligence in agriculture market have developed tools and apps that help farmers perform correct and regulated farming by providing advice on several aspects like crop management, optimum planting, insect assaults, and nutrition management.

To Understand More About this Research: Request a Free Sample Report

The incorporation of AI into agriculture facilitates the gathering and scrutiny of extensive data from a variety of origins, including weather patterns, soil quality, crop well-being, and historical farming records. Through the analysis and interpretation of this information, AI systems can supply valuable insights to farmers, empowering them to make informed choices for yield enhancement, waste reduction, and reduced environmental repercussions. A major advantage of AI in agriculture lies in the automation of repetitive chores through the employment of intelligent machinery and robotics. These innovations alleviate labor scarcities and permit farmers to concentrate on more advanced strategic planning and management tasks.

AI-driven agricultural technologies enable the implementation of precision farming methods, enabling tailored treatment for each crop and even individual plants according to their unique requirements. This precision guarantees the efficient utilization of resources, a reduction in chemical inputs, and the promotion of sustainable agricultural practices. The AI market in agriculture is being propelled by various factors, including a growing population, rising food demand, technological progress, data-centric decision-making, advances in robotics and drone technology, expanding government initiatives, increased investment in AgTech startups, and the heightened adoption of AI in crop monitoring.

The report provides information on artificial intelligence in agriculture market revenue and sales at the global, national, and regional levels. Besides, it includes a detailed segmentation of the market, primarily based on types, applications, end-uses, and regions. The segmentation helps businesses and stakeholders plan their products, finances, and business strategies by considering the upcoming development rate for every segment.

Industry Dynamics

Growth Drivers

Rising Population and Increased Food Requirements Facilitate Market Growth

The world's population continues to expand, leading to a greater need for food production. AI technologies in agriculture empower farmers to enhance crop yields and optimize resource utilization to meet the growing food demands sustainably. As of mid-November 2022, the global population stood at 8.0 billion people. Projections indicate that the global population will increase by approximately 2 billion people in the next three decades, growing from the current 8 billion to 9.7 billion by 2050. This demographic upswing intensifies the demand for increased crop productivity, and AI offers various means to enhance the efficiency of agricultural operations. Consequently, the population's growth and the escalating food requirements are anticipated to drive artificial intelligence in agriculture market expansion in the forecast period.

Report Segmentation

The market is primarily segmented based on technology, application, component, and region.

|

By Technology |

By Component |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Technology Analysis

The Predictive Analytics Segment Held the Largest Revenue Share in 2022

In 2022, Predictive analytics, a facet of AI, employs historical data, machine learning algorithms, and statistical methods to forecast forthcoming events or results. In the agricultural domain, predictive analytics is gaining prominence as it aids farmers in fine-tuning their operations, informed decision-making, and risk management. These models scrutinize past data encompassing crop yields, weather patterns, soil quality, and other pertinent variables in the quest for insights.

Moreover, predictive analytics can be harnessed to monitor and evaluate data from diverse origins, including weather patterns, crop health information, and pest populations. Identifying early indicators of potential pest or disease outbreaks empowers farmers to safeguard their crops proactively, diminishing the necessity for excessive pesticide application. Consequently, these applications are anticipated to drive market expansion.

By Component Analysis

The Software Segment Accounted for the Highest Market Share During the Forecast Period

One of the primary catalysts propelling the expansion of AI software in the agricultural market is its ease of integration with farming machinery, leading to cost savings in labor and real-time data collection. The vast volume of data stored in the cloud, combined with analytical tools, empowers farmers to oversee every facet of farming comprehensively. This software significantly enhances the farmer's capacity to adapt to changing demands.

For instance, NTT DOCOMO, a major telecommunications company in Japan, introduced the 'Farm Assist' application in April 2022. This application aggregates data from sensors installed on farms through access points connected to the company's cloud, allowing users to monitor and manage farm conditions via smartphones and PCs. Such innovations are poised to fuel market growth throughout the projected period strongly.

By Application Analysis

The Precision Farming Segment Held the Largest Revenue Share in 2022

Several key factors are driving the growth of this market, including enhanced water efficiency, reduced usage of fertilizers and pesticides, and the real-time collection of a variety of crop characteristics. Cutting-edge technologies like IoT, machine learning, advanced sensors, and big data analytics are pivotal in identifying soil nutrient levels, significantly contributing to the enhancement of agricultural productivity and the preservation of soil health. This empowers farmers to precisely apply the necessary nutrients to specific areas based on the data acquired. The global adoption of these modern agricultural practices is being spurred by several external factors, such as a burgeoning population, heightened food demand, and the impact of climate change.

For instance, in March 2022, John Deere introduced a system equipped with machine learning-enabled cameras that adjust sensitivity based on weed size, enabling precise weed spraying exclusively in fallow areas. Innovations of this kind are expected to drive growth in this segment.

Regional Insights

North America Dominated the Largest Market in 2022

In North America, the agricultural sector is wholeheartedly embracing AI technology to amplify productivity, optimize resource management, and refine decision-making processes. The region boasts a range of AI applications in agriculture, spanning precision farming, remote sensing, crop monitoring, predictive analytics, and automated farming systems. Leveraging this technology, farmers can enhance crop yields, economize expenses, mitigate risks, and base their choices on well-informed, data-driven insights.

Furthermore, North American governments are actively rolling out supportive policies and initiatives in response to the burgeoning potential of AI in agriculture. These measures encompass financial incentives, research grants, and legislative frameworks designed to encourage the adoption and advancement of AI in the agricultural sector. They not only facilitate the development of resilient and sustainable farming practices but also foster a favorable environment for the expansion of the AI industry.

For instance, In January 2023, a collaboration between the United States and the European Union, facilitated by artificial intelligence (AI) technology, was established to improve various sectors, including agriculture, climate forecasting, emergency response, and the electrical grid. This partnership involves joint efforts by the White House, representing the United States, and the European Commission, comprising the 27-member European Union. Consequently, this initiative is poised to stimulate market growth within the region.

The Asia Pacific region is expected to show the highest CAGR during the forecast period. Several factors, including population growth, the impact of climate change, and concerns over water scarcity, fuel this growth. The increased use of automation, together with technological advancements such as AI and ML, along with a decline in soil quality, are all contributing to the expansion of the AI Agriculture market in this region. Besides, the "Global Action on Green Development of Special Agricultural Products: One Country One Priority Product (OCOP) in Asia and the Pacific" initiative, launched by the Food and Agriculture Organization of the United Nations (FAO) in May 2022, mandates the active participation of regional countries in creating sustainable value chains and promoting their unique agricultural products on the global stage. These changes are expected to boost market growth further.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- AgEagle Aerial Systems Inc.

- aWhere Inc.

- Deere & Company

- Descartes Labs, Inc.

- ec2ce

- GAMAYA

- Granular, Inc.

- IBM Corporation

- Microsoft

- PrecisionHawk

- Prospera Technologies

- Taranis

- The Climate Corporation

- Tule Technologies Inc.

- weLLgo Medical Products GmbH

- VineView

Recent Developments

- In June 2023, Carbon Robotics' LaserWeederTM, a trailblazer in AI-driven robotics, was recognized as the Best AI-based Agricultural Solution at the sixth annual AI Breakthrough Awards, presented by AI Breakthrough. LaserWeederTM is the sole laser weeding robot currently available in the market and has successfully eliminated over one billion weeds. It accomplishes highly precise weed control through the integration of potent AI deep learning technologies, lasers, computer vision, and robotic systems.

- In November 2022, DJI Agriculture unveiled the Mavic 3 Multispectral, equipped with a multispectral imaging system, catering to a broad spectrum of application scenarios in precision agriculture and environmental monitoring. This technology swiftly captures crop growth data, facilitating more efficient crop production while reducing expenses and increasing income for farmers globally.

- In October 2022, Microsoft made an announcement regarding the open sourcing of FarmVibes by Microsoft Research. FarmVibes is a collection of AI technologies and machine learning algorithms designed for the advancement of sustainable agriculture. This AI encompasses methods for integrating diverse types of spatiotemporal and geographical data, including weather data, satellite imagery, and drone data.

Artificial Intelligence in Agriculture Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2.18 billion |

|

Revenue Forecast in 2032 |

USD 11.96 billion |

|

CAGR |

23.67% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Technology, By Application, By Component, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Seeking a more personalized report that meets your specific business needs? At Polaris Market Research, we’ll customize the research report for you. Our custom research will comprehensively cover business data and information you need to make strategic decisions and stay ahead of the curve.

Explore the landscape of artificial intelligence in agriculture in 2024 through detailed market share, size, and revenue growth rate statistics meticulously organized by Polaris Market Research Industry Reports. This expansive analysis goes beyond the present, offering a forward-looking market forecast till 2032, coupled with a perceptive historical overview. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Bio Implants Market Size, Share 2024 Research Report

Medical Devices Market Size, Share 2024 Research Report

Patient Handling Equipment Market Size, Share 2024 Research Report

Ultrasound Probe Cover Market Size, Share 2024 Research Report

Infection Control Market Size, Share 2024 Research Report