Anti-Aging Products Market Size, Share, Trends, Industry Analysis Report

By Product, By Application (Anti-Wrinkle Treatment, Anti-Pigmentation, Skin Resurfacing, and Other Applications), By Distribution Channel, and By Region- Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6336

- Base Year: 2024

- Historical Data: 2020-2023

Overview

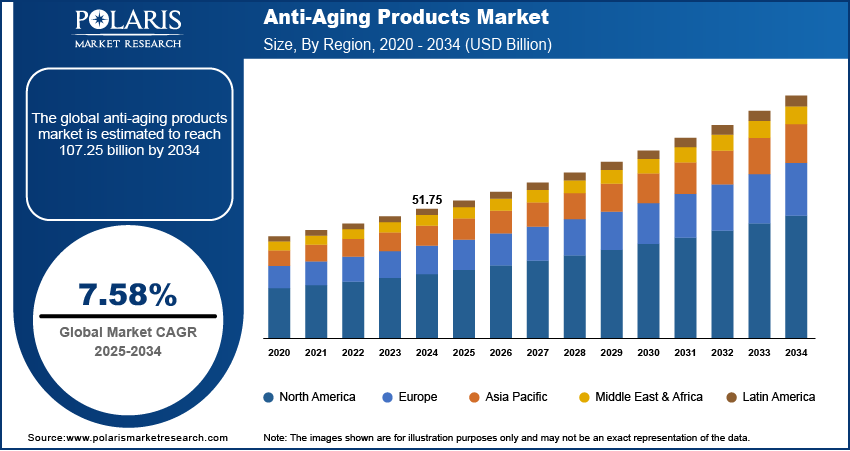

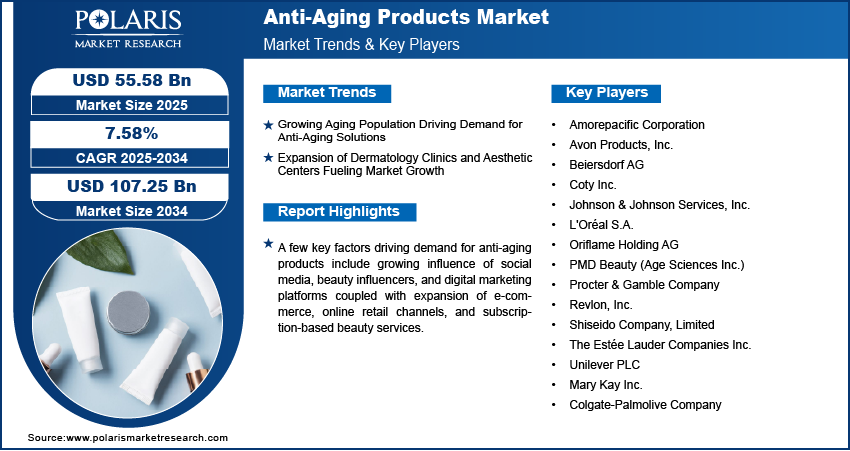

The global anti-aging products market size was valued at USD 51.75 in 2024, growing at a CAGR of 7.58% from 2025 to 2034. Key factors driving demand for anti-aging products include growing aging population driving demand for anti-aging solutions coupled with expansion of dermatology clinics and aesthetic centers.

Key Insights

- The facial serum segment dominated the market share in 2024.

- The skin resurfacing segment is projected to grow at a rapid pace in the coming years, driven by accelerating acceptance of chemical peels, exfoliators, and regenerative skincare products for uneven skin texture, acne marks, and dullness due to aging.

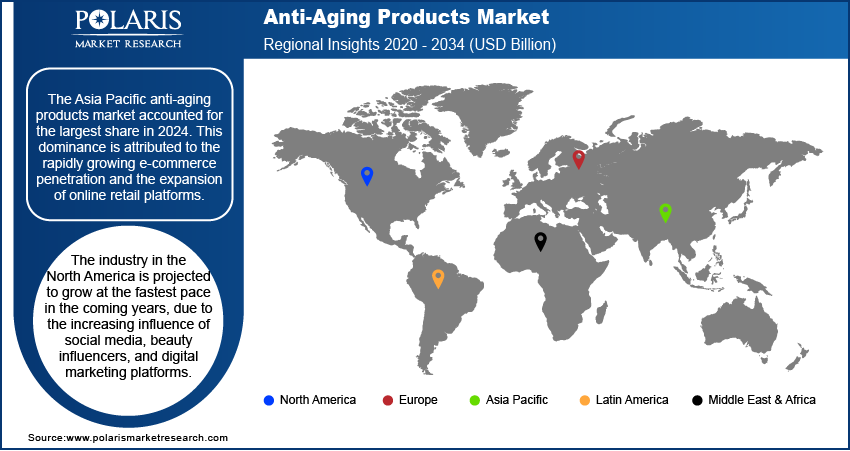

- The Asia Pacific anti-aging products market dominated the global market share in 2024.

- South Korea anti-aging products market is growing, fueled by the growth of the K-beauty industry and rising global recognition of South Korean skincare innovations.

- The market in North America is projected to grow at a fast pace from 2025-2034, due to the increasing influence of social media, beauty influencers, and digital marketing platforms.

- The market in the U.S. is growing, attributed to the rising advancements in biotechnology, including peptide-based and stem cell-derived formulations designed to deliver targeted skin rejuvenation

Industry Dynamics

- Increasing population of elderly people is propelling demand for anti-aging products. Increasing life expectancy, aging demography, and greater awareness of age-related skin conditions such as wrinkles, fine lines, and pigmentation are driving strong demand for new anti-aging solutions.

- Increase in dermatology clinics and beauty centers is propelling market growth. Convenient access to professional treatments, along with heightened consumer awareness to invest in skin rejuvenation treatments, is increasing the adoption of topical and device-based solutions.

- DNA-based skincare and genomics is a major opportunity. Personalized products created by genetic profiling and DNA analysis are facilitating extremely targeted anti-aging treatments, opening up new avenues for innovation and high-end launches.

- Premium anti-aging solutions are still too expensive to hold back market growth. Specialist serums, biotechnology-inspired formulations, and professional treatments are too costly for middle-income consumers, forestalling large-scale take-up despite increasing consumer demand.

Market Statistics

- 2024 Market Size: USD 51.75 Billion

- 2034 Projected Market Size: USD 107.25 Billion

- CAGR (2025–2034): 7.58%

- Asia Pacific: Largest Market Share

The global anti-aging products market includes a wide range of high-value skincare solutions, including facial serums, creams, lotions, eye care products, and dietary supplements, supported by advanced biotechnology, peptide-based formulations, and regenerative ingredients. Widely used for wrinkle reduction, pigmentation control, skin hydration, and improving elasticity, anti-aging products play a pivotal role in promoting preventive skincare, wellness, and cosmetic innovation. Rising consumer demand for high-end, clinically proven, and science-based products is fueling market growth. Biotechnology, precision delivery systems, and targeted formulations' technological developments are improving product efficacy, safety, and user satisfaction.

Technological advancements in biotechnology, delivery and formulation systems are making products more effective, convenient to use and safer. Social media, vloggers and online media are boosting the market growth for anti-aging products. Consumers are witnessing product launches, tutorials and recommendations that are personalized, and they are demanding high-performance creams, serums and supplements that provide visible anti-aging outcomes. This is raising brand awareness and compelling consumers to experiment with premium and technologically superior anti-aging products.

Online beauty services, subscription-based, online retail and e-commerce is driving the market growth. Customers have access to search for and buy skincare treatments online and subscription models make high-end treatments accessible at low cost. For instance, in December 2024, BeautyRightBack (BRB) introduced a subscription program fueled by AI that offered unlimited beauty treatments at a fixed fee. This program made premium anti-aging treatments affordable for consumers. The service supports business for salons and yields new sources of revenue, encouraging the use of digital innovation for business expansion.

Drivers & Opportunities

Growing Aging Population Driving Demand for Anti-Aging Solutions: Aging global population is fueling demand for anti-aging products that meet the needs of skin aging, wrinkles, and loss of firmness. Based on a United Nations report, the aged population of 65 years and older is expected to reach 2.2 billion by the late 2070s. This growth reflects the long-term prospects for skincare products addressing healthy skin and a youthful appearance. This demographic transition is compelling consumers to spend on creams, serums, supplements, and treatments developed specifically for age-related skin issues.

Expansion of Dermatology Clinics and Aesthetic Centers Fueling Market Growth: The increasing number of dermatology and aesthetic care centres is driving the adoption of professional-level anti-aging procedures and products. As per the Dubai World Dermatology and Laser Conference & Exhibition report, the world dermatology market is expected to grow to around USD 3.14 billion by 2032 at a compound annual growth rate (CAGR) of 7.03% from 2023-2032. This growth is growing access to specialized anti-aging treatments, innovative formulations, and clinical skincare solutions globally.

Segmental Insights

By Product

Based on product, the anti-aging products market is categorized into facial serums, moisturizers, creams & lotions, eye care products, facial cleansers & exfoliators, facial masks & peels, sunscreens & sun protection, and others. The facial serum segment accounted for the highest share in 2024 owing to high consumer demand for concentrated products that offer enhanced benefits like hydration, stimulation of collagen, and wrinkle reduction. Higher-end serums with bioactive peptides, retinoids, and hyaluronic acid are popular due to their penetrative capabilities into deeper layers of the skin and the provision of visible anti-aging outcomes.

Sunscreen & sun protection is anticipated to be the fastest-growing segment in the forecast period, driven by growing awareness of photoaging, preventive skincare, and recommendations from dermatologists for daily UV protection. Increasing need for multifunctional sunscreens that have antioxidant, anti-pollution, and moisturizing properties is also promoting adoption across different age groups.

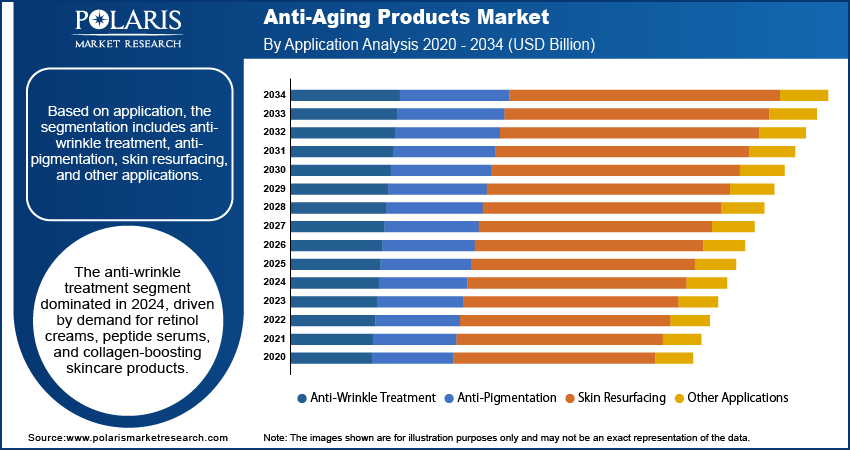

By Application

Based on application, the market is segmented into anti-wrinkle treatment, anti-pigmentation, skin resurfacing, and other applications. The market for the anti-wrinkle treatment led in 2024 due to the growing demand for retinol creams, peptide serums, and collagen-supporting products to reduce the appearance of fine lines and to improve skin elasticity.

Skin resurfacing segment is expected to register the highest growth over the forecast period, due to the growing use of chemical peels, exfoliators, and regenerative skincare products aimed at hyperpigmentation, acne scars, and age spots.

By Distribution Channel

Based on distribution channel, the market is divided into supermarkets & hypermarkets, pharmacies & drugstores, specialty beauty stores, online retail, and others. The online retail segment held the largest share in 2024, driven by the sharp rise of digital retail platforms, brand sites, and subscription-based beauty services. Convenience, bespoke guidance, and accessibility to a vast array of premium brands are major drivers of online uptake.

The specialty beauty store segment is growing at a rapid rate over the forecast period with consumers increasingly looking for professional advice, experiential shopping, and access to high-end products in branded stores. Growing chains of specialist retailers like Sephora and Ulta Beauty are expanding offline channels while complementing omnichannel initiatives of major players.

Regional Analysis

The Asia Pacific market accounted for a significant share in 2024, led by fast-growing e-commerce penetration and growth in online retail platforms that are enhancing product accessibility to consumers in urban and semi-urban areas. Increasing urbanization, in addition to increasing middle-class consumers with higher disposable incomes and an increasing demand for beauty and personal care, is further driving adoption of premium and technologically sophisticated anti-aging treatments. Moreover, raising awareness regarding skincare habits, preventive beauty, and lifestyle driven by wellness in nations like China, India, and Southeast Asia is driving overall market expansion.

South Korea Anti-Aging Products Market

South Korea held a prominent position within the region, due to the development of the K-beauty market and increasing global awareness of South Korean skincare. Domestic demand and foreign demand for K-beauty products are driving the market. Based on the Ministry of Food and Drug Safety, South Korea's cosmetics exports totaled a record USD 10.2 billion in 2024 and became the world's third-largest cosmetics exporter following France (USD 23.3 billion) and the U.S. (USD 11.2 billion), indicating robust domestic production and international competitiveness.

North America Anti-Aging Products Market

The North American market is growing at a fast pace, driven by the growing influence of social media, beauty bloggers, and online marketing channels that heavily impact consumer purchasing trends. The growth of dermatology clinics, aesthetic centers, and professional-quality treatment centers is driving the use of sophisticated anti-aging products. Moreover, growing consumer awareness of skincare performance, preventive treatments, and value product alternatives is driving market penetration in urban and suburban markets, with consumers having a strong affinity for high-performance, science-based formulations.

U.S. Anti-Aging Products Market

The U.S. dominated the North American market, driven by increasing advances in biotechnology, such as peptide-based and stem cell-derived products created to provide targeted skin rejuvenation. For instance, in May 2025, Beauty-Stem Biomedical introduced Miracle-48, a new generation of regenerative skincare with biotechnology and precision microsphere delivery. Its 10 million microspheres and 800 million active factors per milliliter formulation deliver 48 rejuvenating ingredients to renew and restore skin at the cellular level. These advances are pushing the demand for science-based, high-performance anti-aging products in the country.

Europe Anti-Aging Products Market

The Europe market held a substantial share in 2024, driven by strong consumer shift for clean-label, green, and sustainable anti-aging products that epitomize health-oriented and green lifestyles. Increasing dermatological research and clinical trials and the launch of new formulation offerings addressing wrinkles, pigmentation, and skin firmness loss are driving adoption in leading nations such as Germany, France, and the UK. Also, rising R&D spending by leading skincare companies and use of technologically advanced active ingredients in products are further enhancing the growth in the European anti-aging products market.

Key Players & Competitive Analysis

The anti-aging beauty market globally is competitive, with market leaders The Estée Lauder Companies Inc., L'Oréal S.A., and Procter & Gamble Company leading the way in revolutionary products, integration of biotechnology, and increased product portfolios in skincare, serums, creams, and supplements. The Estée Lauder Companies Inc. continues to innovate with peptide-based serums, retinol technology, and AI-powered personalization aids, while L'Oréal S.A. utilizes its vast R&D strength to introduce clinically tested anti-aging products in premium and mass segments. Procter & Gamble Company enhances its market leadership by virtue of its Olay brand, emphasizing dermatologist-endorsed products for wrinkle diminishing, moisturizing, and support for skin barrier.

The market is witnessing high uptake of multifunctional and biotech-formulated products aimed at wrinkles, pigmentation, skin elasticity, and overall rejuvenation, driven by increasing consumer demand for preventive skincare and scientifically proven efficacy. Firms are investing more in research collaborations, peptide and exosome-reliant innovations, and precision delivery technologies to maximize product differentiation and performance. Strategic partnerships with dermatologists, biotech companies, and online beauty platforms are broadening consumer interactions, and ongoing product innovation in clean-label, regenerative, and microbiome-centered formulations is defining the future of anti-aging solutions globally.

Prominent players in the market for anti-aging products are Amorepacific Corporation, Avon Products, Inc., Beiersdorf AG, Colgate-Palmolive Company, Coty Inc., Johnson & Johnson Services, Inc., L'Oréal S.A., Mary Kay Inc., Oriflame Holding AG, PMD Beauty (Age Sciences Inc.), Procter & Gamble Company, Revlon, Inc., Shiseido Company, Limited, The Estée Lauder Companies Inc., and Unilever PLC.

Key Players

- Amorepacific Corporation

- Avon Products, Inc.

- Beiersdorf AG

- Coty Inc.

- Johnson & Johnson Services, Inc.

- L'Oréal S.A.

- Oriflame Holding AG

- PMD Beauty (Age Sciences Inc.)

- Procter & Gamble Company

- Revlon, Inc.

- Shiseido Company, Limited

- The Estée Lauder Companies Inc.

- Unilever PLC

- Mary Kay Inc.

- Colgate-Palmolive Company

Anti-Aging Products Industry Developments

In February 2025, Estée Lauder Companies (ELC) collaborated with Serpin Pharma to create advanced skincare ingredients with longevity as a prime focus. Serpin Pharma is known for its scientific proficiency in anti-inflammatory studies, particularly in Serine Protease Inhibitors, a family of proteins that assist the body in healing inflamed cells.

In February 2025, NIVEA MEN introduced its Age Defense skin care range, addressing visible ageing signs like wrinkles, dryness, uneven texture, dullness, and loss of firmness. The range is infused with Thiamidol and Hyaluronic Acid for effective results within a simplified routine.

Anti-Aging Products Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Facial Serum

- Moisturizer, Creams, & Lotions

- Eye Care Products

- Facial Cleanser & Exfoliators

- Facial Masks & Peels

- Sunscreen & Sun Protection

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Anti-Wrinkle Treatment

- Anti-Pigmentation

- Skin Resurfacing

- Other Applications

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Supermarkets & Hypermarkets

- Pharmacies & Drugstores

- Specialty Beauty Stores

- Online Retail

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Anti-Aging Products Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 51.75 Billion |

|

Market Size in 2025 |

USD 55.58 Billion |

|

Revenue Forecast by 2034 |

USD 107.25 Billion |

|

CAGR |

7.58% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 51.75 billion in 2024 and is projected to grow to USD 107.25 billion by 2034.

The global market is projected to register a CAGR of 7.58% during the forecast period.

Asia Pacific dominated the market in 2024.

A few of the key players in the market are Amorepacific Corporation, Avon Products, Inc., Beiersdorf AG, Colgate-Palmolive Company, Coty Inc., Johnson & Johnson Services, Inc., L'Oréal S.A., Mary Kay Inc., Oriflame Holding AG, PMD Beauty (Age Sciences Inc.), Procter & Gamble Company, Revlon, Inc., Shiseido Company, Limited, The Estée Lauder Companies Inc., and Unilever PLC.

The facial serum segment dominated the market revenue share in 2024, driven by strong consumer preference for concentrated formulations that provide targeted benefits such as hydration, collagen stimulation, and wrinkle reduction.

The skin resurfacing segment is projected to witness the fastest growth during the forecast period, fueled by increased adoption of chemical peels, exfoliators, and regenerative skincare solutions targeting uneven skin texture, acne scars, and age-related dullness.